In this age of electronic devices, where screens have become the dominant feature of our lives and the appeal of physical printed materials isn't diminishing. It doesn't matter if it's for educational reasons for creative projects, simply adding a personal touch to your space, Tax Deduction For Work From Home are now an essential resource. The following article is a dive into the world of "Tax Deduction For Work From Home," exploring the benefits of them, where to find them and the ways that they can benefit different aspects of your lives.

Get Latest Tax Deduction For Work From Home Below

Tax Deduction For Work From Home

Tax Deduction For Work From Home - Tax Deduction For Work From Home, Tax Deduction For Work From Home Expenses, Tax Deduction For Work From Home 2022, Tax Deductions For Work From Home Employees, Tax Relief For Work From Home, Tax Deduction For Working From Home 2023, Tax Deduction Rent Work From Home, Tax Deductions For Those Who Work From Home, Tax Deduction For Working Away From Home, Can You Get Tax Deduction For Working From Home

You can make the following deductions in your tax assessment How and when can I get deductions Deductions for 2023 You receive your personal pre completed tax return by the end of April File deductions on your tax return before its due date

If you work from your own home or have rented a separate workspace you can deduct the expenses A workspace deduction is included in the expenses for the production of income If you have wage income you will automatically receive a 750 deduction The Tax Administration makes the deduction on your behalf

Tax Deduction For Work From Home offer a wide range of printable, free documents that can be downloaded online at no cost. These printables come in different kinds, including worksheets templates, coloring pages, and many more. The benefit of Tax Deduction For Work From Home is their versatility and accessibility.

More of Tax Deduction For Work From Home

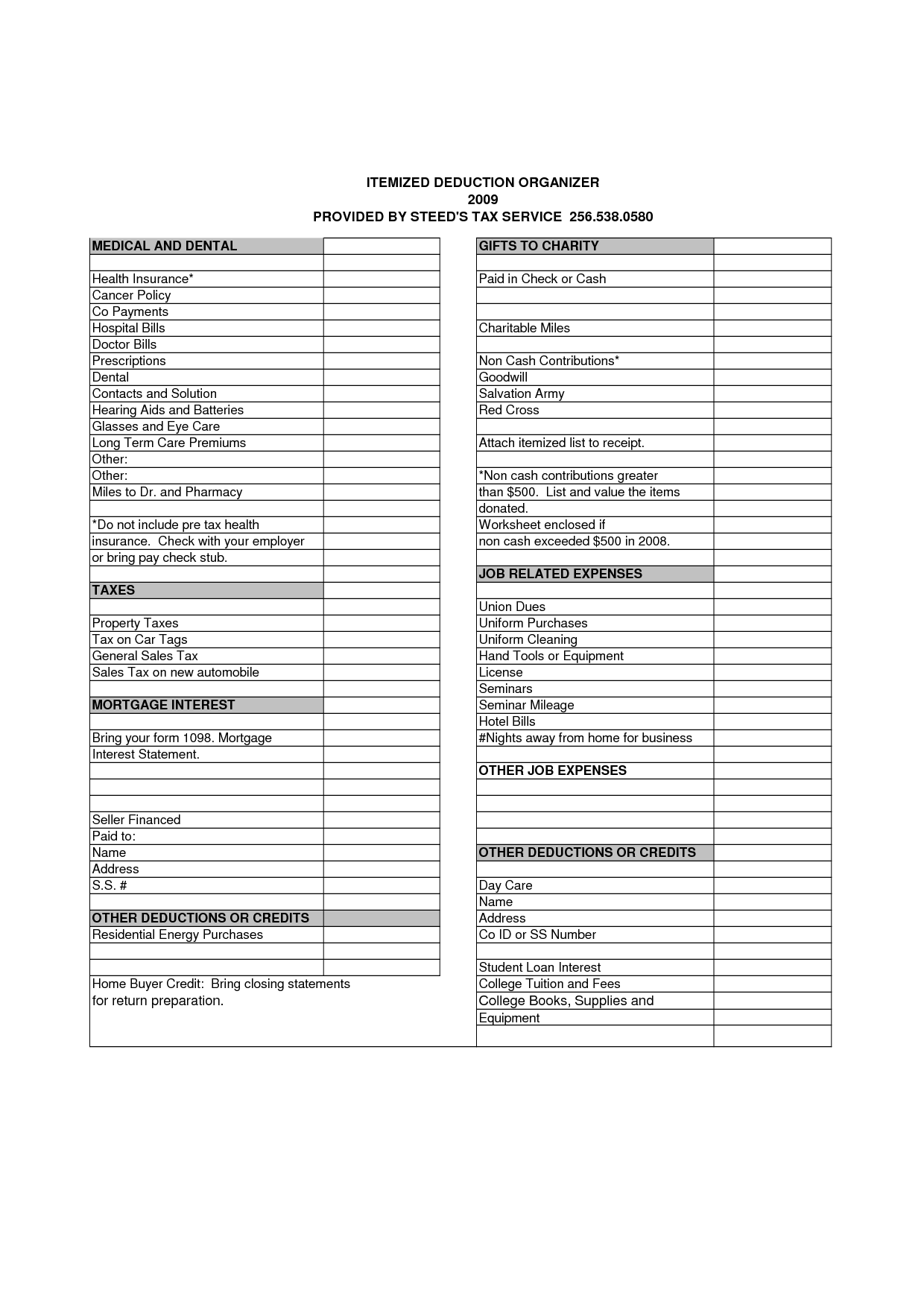

8 Tax Itemized Deduction Worksheet Worksheeto

8 Tax Itemized Deduction Worksheet Worksheeto

If you pay the 20 basic rate of tax and claim tax relief on 6 a week you would get 1 20 per week in tax relief 20 of 6 You ll usually get tax relief through a change to your tax

Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions Also work from home expenses can only be written off if they exceed 2 of adjustable gross income

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Personalization You can tailor printed materials to meet your requirements, whether it's designing invitations, organizing your schedule, or even decorating your home.

-

Education Value Free educational printables offer a wide range of educational content for learners of all ages, making them an essential device for teachers and parents.

-

The convenience of Access to various designs and templates reduces time and effort.

Where to Find more Tax Deduction For Work From Home

Tax Deductions For Businesses BUCHBINDER TUNICK CO

Tax Deductions For Businesses BUCHBINDER TUNICK CO

Work from home WFH tax deductions are business expenses that you can subtracted from revenue to lower your tax bill But these deductions almost exclusively apply to those who own their

You can claim the deduction whether you re a homeowner or a renter and you can use the deduction for any type of home where you reside a single family home an apartment a condo or a

Now that we've piqued your curiosity about Tax Deduction For Work From Home and other printables, let's discover where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Tax Deduction For Work From Home designed for a variety goals.

- Explore categories like furniture, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free including flashcards, learning materials.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- The blogs covered cover a wide spectrum of interests, including DIY projects to planning a party.

Maximizing Tax Deduction For Work From Home

Here are some ideas create the maximum value use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Tax Deduction For Work From Home are an abundance with useful and creative ideas designed to meet a range of needs and interest. Their access and versatility makes they a beneficial addition to both professional and personal life. Explore the vast array of Tax Deduction For Work From Home to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Deduction For Work From Home really free?

- Yes, they are! You can download and print the resources for free.

-

Can I make use of free printables for commercial use?

- It is contingent on the specific terms of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables may be subject to restrictions concerning their use. Make sure you read the terms and regulations provided by the creator.

-

How do I print printables for free?

- Print them at home with either a printer at home or in a local print shop to purchase premium prints.

-

What software do I need in order to open Tax Deduction For Work From Home?

- The majority of printed documents are in the format of PDF, which can be opened with free software such as Adobe Reader.

Work Clothing Tax Deduction Things You Should Know

10 2014 Itemized Deductions Worksheet Worksheeto

Check more sample of Tax Deduction For Work From Home below

Actual Or Standard Mileage Deduction For Your Work Vehicle YouTube

Deduction For Work Related Vehicle Expenses Disallowed Tradies Advantage

Business Itemized Deductions Worksheet Beautiful Business Itemized For

How To Claim A Tax Deduction For Work Clothes Sapling

A Singaporean s Guide How To Claim Income Tax Deduction For Work

How Do Tax Write Offs Work For Small Businesses Tax Walls

https://www.vero.fi/.../home-office-deduction

If you work from your own home or have rented a separate workspace you can deduct the expenses A workspace deduction is included in the expenses for the production of income If you have wage income you will automatically receive a 750 deduction The Tax Administration makes the deduction on your behalf

https://www.ramseysolutions.com/taxes/work-from...

What are work from home tax deductions or write offs We want you to get every deduction you deserve so you ll have more cash in your pocket to get out of debt save for an emergency fund and win with money So let s dig into the deets on work from home deductions Can I claim the home office tax deduction if I ve been working

If you work from your own home or have rented a separate workspace you can deduct the expenses A workspace deduction is included in the expenses for the production of income If you have wage income you will automatically receive a 750 deduction The Tax Administration makes the deduction on your behalf

What are work from home tax deductions or write offs We want you to get every deduction you deserve so you ll have more cash in your pocket to get out of debt save for an emergency fund and win with money So let s dig into the deets on work from home deductions Can I claim the home office tax deduction if I ve been working

How To Claim A Tax Deduction For Work Clothes Sapling

Deduction For Work Related Vehicle Expenses Disallowed Tradies Advantage

A Singaporean s Guide How To Claim Income Tax Deduction For Work

How Do Tax Write Offs Work For Small Businesses Tax Walls

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

Printable Itemized Deductions Worksheet

Printable Itemized Deductions Worksheet

How To Maximize Your Charity Tax Deductible Donation WealthFit