In this digital age, with screens dominating our lives yet the appeal of tangible printed products hasn't decreased. If it's to aid in education, creative projects, or simply adding an extra personal touch to your space, Tax Deduction On Interest Earned are now an essential source. The following article is a take a dive into the sphere of "Tax Deduction On Interest Earned," exploring the benefits of them, where to get them, as well as how they can enhance various aspects of your life.

Get Latest Tax Deduction On Interest Earned Below

Tax Deduction On Interest Earned

Tax Deduction On Interest Earned - Tax Deduction On Interest Earned, Tax Exemption On Interest Earned, Tax Deduction On Interest Income, Tax Deductions On Interest Payments, Withholding Tax On Interest Earned, Tax Exemption On Interest Income, Tax Relief On Interest Payments, Tax Rebate On Interest Income For Senior Citizens, Tax Credit On Interest From Mortgage, Tax Relief On Interest Income

Interest is an amount you pay for the use of borrowed money Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction

Tax on FD Interest All interest income from fixed deposits is taxable Know how to calculate income tax on FD interest when to pay it and how TDS and FD taxation works for senior citizens File Now

The Tax Deduction On Interest Earned are a huge assortment of printable documents that can be downloaded online at no cost. They are available in a variety of designs, including worksheets templates, coloring pages and more. The great thing about Tax Deduction On Interest Earned is in their variety and accessibility.

More of Tax Deduction On Interest Earned

Deduction On Interest On Loan Higher Education 80E

Deduction On Interest On Loan Higher Education 80E

You earn 16 000 of wages and get 200 interest on your savings Your Personal Allowance is 12 570 It s used up by the first 12 570 of your wages The remaining 3 430 of your wages

Example calculation So if you earn 14 000 a year from a part time job and 5 000 in interest from savings this is how you would be taxed in 2024 25 0 on the first 12 570 income from your job 0 20 income tax on the remaining 1 430 from your wages 14 000 less the 12 570 personal tax allowance 286

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Personalization They can make the design to meet your needs for invitations, whether that's creating them, organizing your schedule, or even decorating your house.

-

Educational Impact: Education-related printables at no charge offer a wide range of educational content for learners of all ages, making them a great tool for parents and educators.

-

An easy way to access HTML0: Quick access to many designs and templates can save you time and energy.

Where to Find more Tax Deduction On Interest Earned

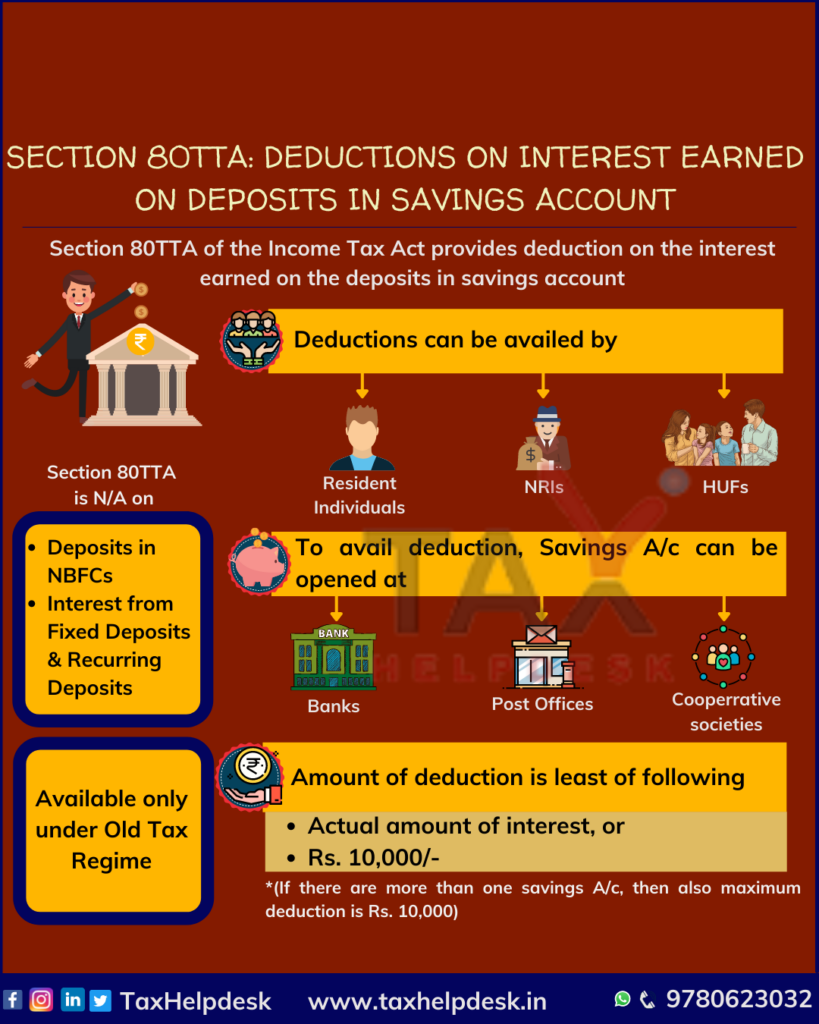

Deductions On Interest On Deposits In Savings Account Section 80TTA

Deductions On Interest On Deposits In Savings Account Section 80TTA

What is section 80TTA Section 80TTA of the Income Tax Act 1961 provides a deduction on the interest earned on your savings account with a bank cooperative society or post office up to Rs 10 000 No deduction for

Section 80TTA of Income Tax Act provides up to Rs 10 000 deduction on such interest Available to Individuals HUF and NRIs only on NRO savings accounts Deduction for interest earned from savings accounts with banks co op societies or post offices

Since we've got your curiosity about Tax Deduction On Interest Earned, let's explore where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of objectives.

- Explore categories like decorating your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- The blogs are a vast range of interests, starting from DIY projects to planning a party.

Maximizing Tax Deduction On Interest Earned

Here are some unique ways for you to get the best of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets to reinforce learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Tax Deduction On Interest Earned are an abundance of innovative and useful resources that satisfy a wide range of requirements and desires. Their accessibility and versatility make them an essential part of both professional and personal lives. Explore the vast collection of Tax Deduction On Interest Earned today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes they are! You can download and print these materials for free.

-

Does it allow me to use free printouts for commercial usage?

- It's all dependent on the conditions of use. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright violations with Tax Deduction On Interest Earned?

- Some printables may contain restrictions in use. Check these terms and conditions as set out by the designer.

-

How can I print printables for free?

- Print them at home with your printer or visit a local print shop for the highest quality prints.

-

What software do I need to run printables at no cost?

- Most PDF-based printables are available in PDF format. They can be opened using free software, such as Adobe Reader.

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

Advantages Of Tax On Different Types Of Loans

Check more sample of Tax Deduction On Interest Earned below

Section 80P 2 d Deduction Not Eligible On Interest Earned On

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

80TTB Tax Deduction Under Section 80TTB For Senior Citizens

Deduction On Electrical Vehicle For Interest Paid On Loan

Deductions On Interest Earned By Senior Citizens Section 80TTB

Section 80EE And 80EEA Interest On Housing Loan Deduction

https://cleartax.in/s/income-tax-on-fixed-deposit-interest

Tax on FD Interest All interest income from fixed deposits is taxable Know how to calculate income tax on FD interest when to pay it and how TDS and FD taxation works for senior citizens File Now

https://www.investopedia.com/terms/t/tax-deductible-interest.asp

Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types of interest

Tax on FD Interest All interest income from fixed deposits is taxable Know how to calculate income tax on FD interest when to pay it and how TDS and FD taxation works for senior citizens File Now

Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types of interest

Deduction On Electrical Vehicle For Interest Paid On Loan

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Deductions On Interest Earned By Senior Citizens Section 80TTB

Section 80EE And 80EEA Interest On Housing Loan Deduction

If You Are A Senior Citizen Claim Deduction Of Rs 50 000 On Interest

Tax Deduction On Interest Income Earned On Savings By Senior Citizens

Tax Deduction On Interest Income Earned On Savings By Senior Citizens

Section 80TTB AY 2021 22 Deduction On Interest Income For Senior