In this age of technology, when screens dominate our lives, the charm of tangible printed materials isn't diminishing. No matter whether it's for educational uses such as creative projects or simply adding the personal touch to your space, Tax Deduction Student Loan Cosigner have become an invaluable resource. Through this post, we'll take a dive in the world of "Tax Deduction Student Loan Cosigner," exploring their purpose, where they can be found, and how they can enhance various aspects of your daily life.

Get Latest Tax Deduction Student Loan Cosigner Below

Tax Deduction Student Loan Cosigner

Tax Deduction Student Loan Cosigner - Tax Deduction Student Loan Cosigner, Student Loan Interest Cosigner Tax Deduction, Can A Cosigner Claim Student Loan Interest, Can You Claim Student Loans On Taxes

To calculate your interest deduction you take the total amount you paid in student loan interest for the tax year from January 1 to December 31 for most people

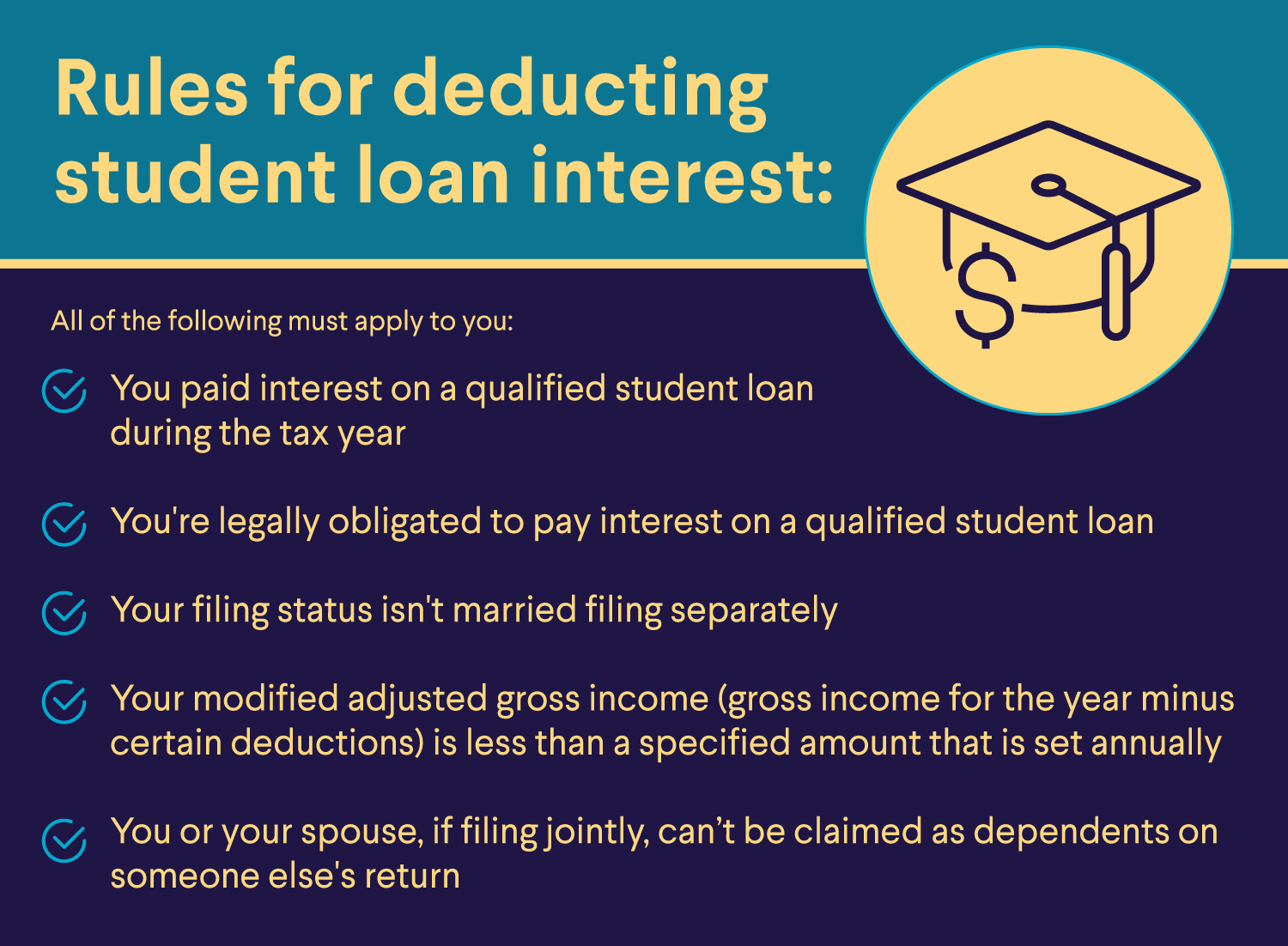

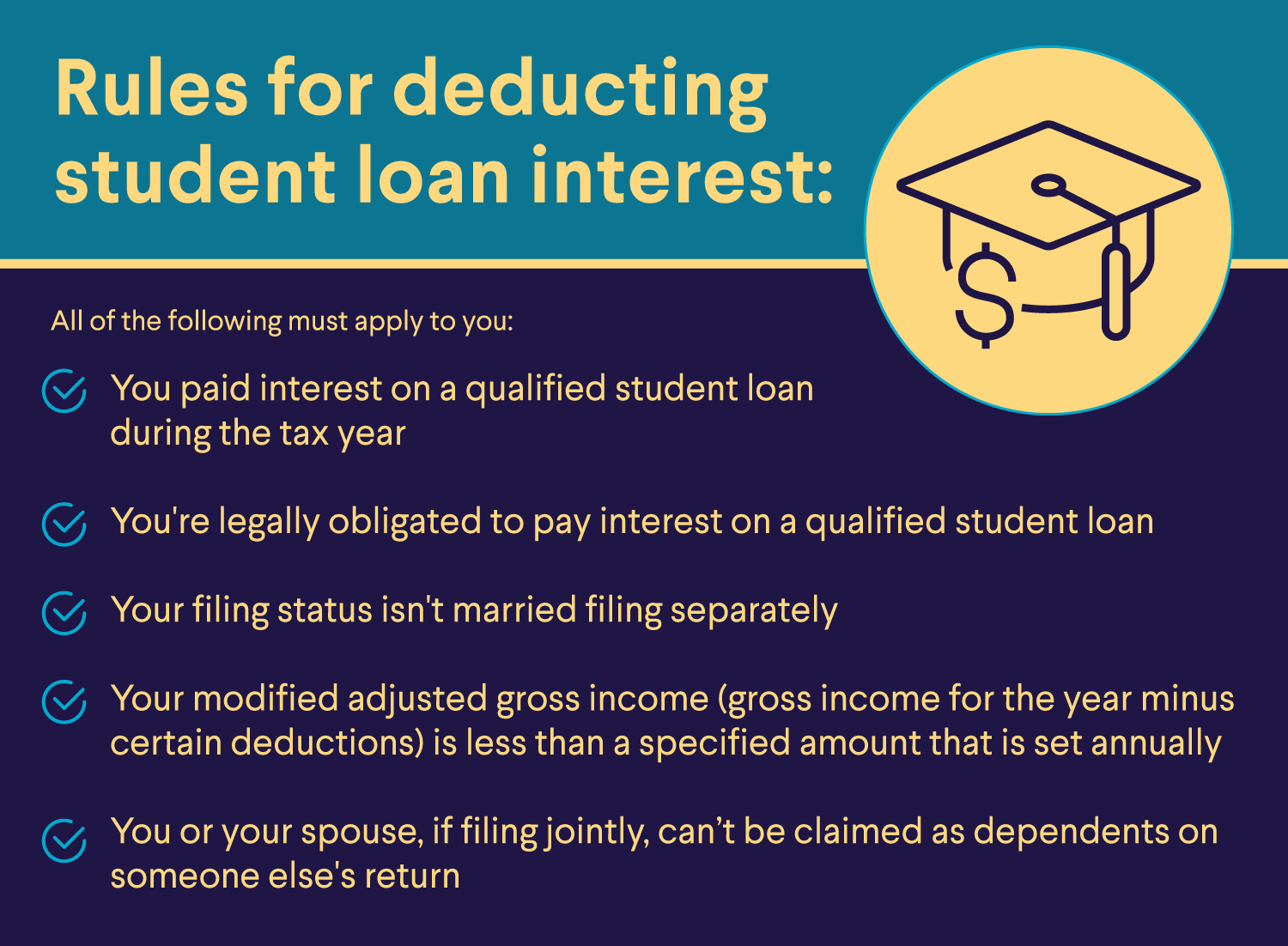

You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on

Tax Deduction Student Loan Cosigner cover a large assortment of printable items that are available online at no cost. These materials come in a variety of types, like worksheets, coloring pages, templates and much more. The benefit of Tax Deduction Student Loan Cosigner lies in their versatility as well as accessibility.

More of Tax Deduction Student Loan Cosigner

Mortgage Interest Tax Deduction 2020 Calculator JunaidKaleah

Mortgage Interest Tax Deduction 2020 Calculator JunaidKaleah

This interview will help you determine if you can deduct the interest you paid on a student or educational loan Information you ll need Filing status Basic income

Student loan interest deduction You can t deduct as interest on a student loan any interest paid by your employer after March 27 2000 and before January 1 2026 under an educational assistance program See chapter

Tax Deduction Student Loan Cosigner have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization: We can customize printables to your specific needs such as designing invitations planning your schedule or decorating your home.

-

Educational Impact: Downloads of educational content for free can be used by students from all ages, making the perfect resource for educators and parents.

-

An easy way to access HTML0: The instant accessibility to many designs and templates saves time and effort.

Where to Find more Tax Deduction Student Loan Cosigner

Everything You Need To Know About Becoming A Student Loan Cosigner

Everything You Need To Know About Becoming A Student Loan Cosigner

For the 2021 tax year the max student loan interest deduction 2 500 or the amount you paid in interest for the year for a qualifying student loan whichever is less But in true

The student loan interest deduction allows you to deduct up to 2 500 from your taxes By Ryan Lane Updated Mar 4 2024 Edited by Des Toups Many or all of

Now that we've ignited your interest in Tax Deduction Student Loan Cosigner Let's take a look at where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety in Tax Deduction Student Loan Cosigner for different applications.

- Explore categories such as decorations for the home, education and management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free or flashcards as well as learning materials.

- Perfect for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs are a vast range of interests, from DIY projects to planning a party.

Maximizing Tax Deduction Student Loan Cosigner

Here are some ideas how you could make the most use of Tax Deduction Student Loan Cosigner:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use free printable worksheets to build your knowledge at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Deduction Student Loan Cosigner are an abundance of creative and practical resources that cater to various needs and preferences. Their availability and versatility make these printables a useful addition to both personal and professional life. Explore the vast world of Tax Deduction Student Loan Cosigner to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes they are! You can download and print these materials for free.

-

Can I use the free printables in commercial projects?

- It's determined by the specific rules of usage. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright rights issues with Tax Deduction Student Loan Cosigner?

- Some printables could have limitations regarding usage. Make sure you read the conditions and terms of use provided by the creator.

-

How can I print printables for free?

- You can print them at home with a printer or visit an area print shop for top quality prints.

-

What program do I require to view printables that are free?

- The majority of printed documents are in the PDF format, and can be opened with free programs like Adobe Reader.

What Rights Does A Student Loan Cosigner Have Debt

San Diego Injury Law Center Student Loans Without Cosigner Student

Check more sample of Tax Deduction Student Loan Cosigner below

Student Loan Interest Deduction Are You Eligible LendEDU

How To Claim The Student Loan Interest Deduction Tomcaligist

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

Adding A Cosigner To A Student Loan Has Become Common Practice After

Section 179 Tax Deduction

What s The Difference Between A Loan Cosigner And A Guarantor

https://www.irs.gov/taxtopics/tc456

You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on

https://www.forbes.com/advisor/taxes/student-loan...

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a

You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a

Adding A Cosigner To A Student Loan Has Become Common Practice After

How To Claim The Student Loan Interest Deduction Tomcaligist

Section 179 Tax Deduction

What s The Difference Between A Loan Cosigner And A Guarantor

Co Signer Agreement Pdf Doc Template PdfFiller

When Should You Pay For Help With Your Student Loan Debt Student

When Should You Pay For Help With Your Student Loan Debt Student

2024 Student Loan Interest Federal Income Tax Deduction Calculator