In this day and age where screens rule our lives The appeal of tangible printed products hasn't decreased. Whatever the reason, whether for education as well as creative projects or just adding a personal touch to your home, printables for free are now an essential source. This article will take a dive through the vast world of "Tax Exemption On Education Loan 80e," exploring the benefits of them, where to get them, as well as the ways that they can benefit different aspects of your daily life.

Get Latest Tax Exemption On Education Loan 80e Below

Tax Exemption On Education Loan 80e

Tax Exemption On Education Loan 80e - Tax Exemption On Education Loan 80e, Can I Get Tax Benefit On Education Loan, Education Loan Tax Exemption Limit, Can Education Loan Be Used For Tax Exemption, Is Education Loan Interest Tax Deductible, Education Loan Tax Exemption Example

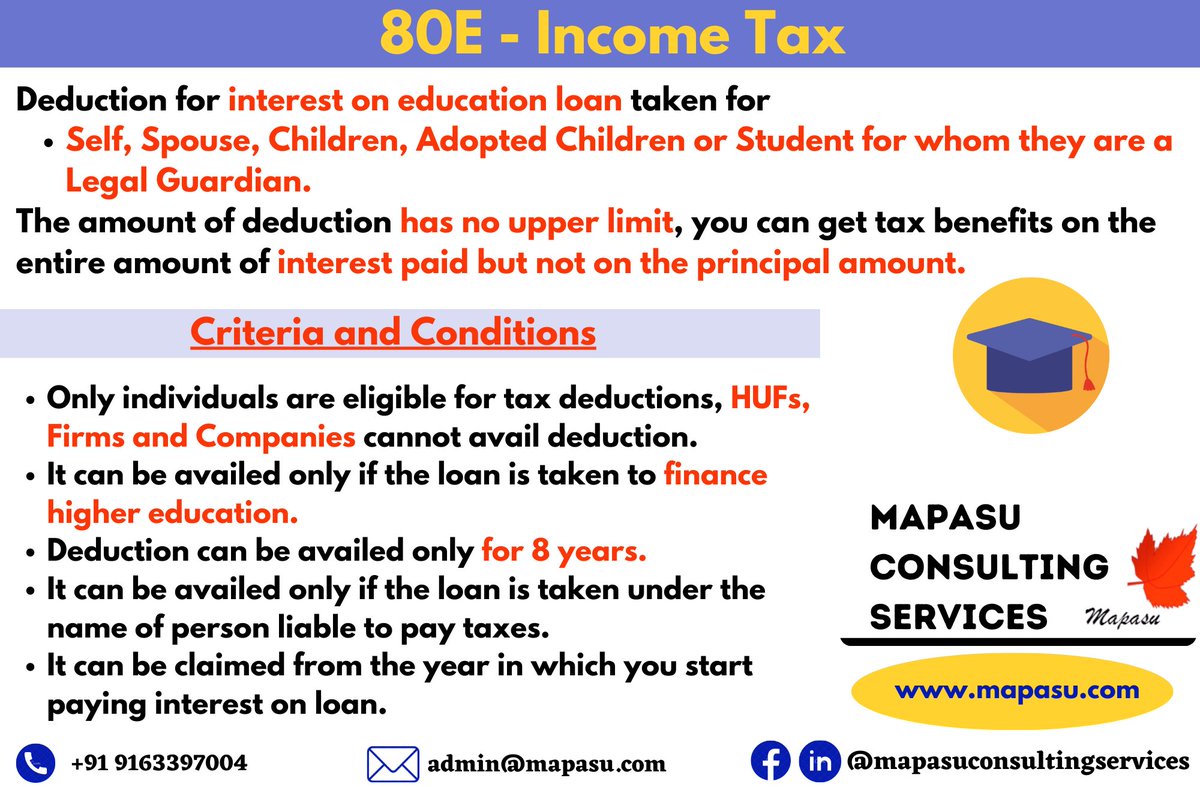

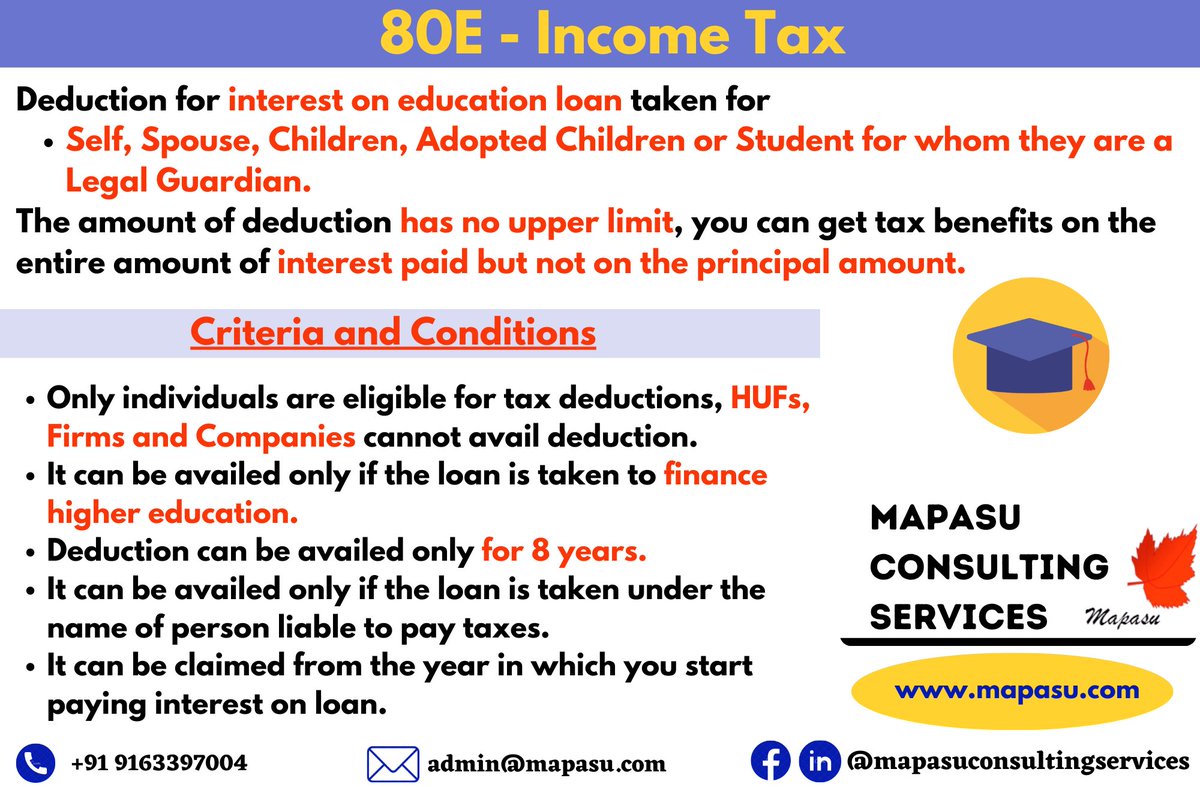

Section 80E of the Income Tax Act allows a tax deduction on the interest paid on education loans for higher studies Section 80E deduction helps to reduce the financial burden

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

Tax Exemption On Education Loan 80e cover a large variety of printable, downloadable resources available online for download at no cost. They are available in a variety of forms, like worksheets coloring pages, templates and more. The value of Tax Exemption On Education Loan 80e is in their versatility and accessibility.

More of Tax Exemption On Education Loan 80e

Deduction U s 80E For Education Loan Taxontips

Deduction U s 80E For Education Loan Taxontips

You can save up to 10 times more tax if you take up an education loan to fund your education than using your own funds An education loan income tax exemption can be claimed either by

Section 80E Deduction for Interest on education Loan Have you taken an education loan to support higher studies of yourself or of your spouse Children or for the

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization: You can tailor printables to fit your particular needs for invitations, whether that's creating them for your guests, organizing your schedule or decorating your home.

-

Educational Worth: The free educational worksheets can be used by students from all ages, making them an invaluable device for teachers and parents.

-

Easy to use: Quick access to various designs and templates cuts down on time and efforts.

Where to Find more Tax Exemption On Education Loan 80e

A Detailed Analysis Of Section 80E Tax Exemption On Education Loan

A Detailed Analysis Of Section 80E Tax Exemption On Education Loan

Other than giving an opportunity for better education it also gives you tax deduction under sec 80E of Indian Income Tax Act once you start earning This post covers all the questions you might have regarding tax

Tax Benefits Associated with Section 80E An individual who has availed a loan for higher education can enjoy various tax benefits as per the provisions of the Income Tax Act Suppose

Now that we've piqued your interest in Tax Exemption On Education Loan 80e Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Tax Exemption On Education Loan 80e to suit a variety of needs.

- Explore categories such as furniture, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- The blogs are a vast selection of subjects, ranging from DIY projects to party planning.

Maximizing Tax Exemption On Education Loan 80e

Here are some inventive ways that you can make use use of Tax Exemption On Education Loan 80e:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home for the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Exemption On Education Loan 80e are a treasure trove of practical and imaginative resources catering to different needs and hobbies. Their accessibility and versatility make them an invaluable addition to both personal and professional life. Explore the vast array that is Tax Exemption On Education Loan 80e today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes you can! You can download and print these items for free.

-

Can I use free printables to make commercial products?

- It's all dependent on the conditions of use. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright issues when you download Tax Exemption On Education Loan 80e?

- Some printables may come with restrictions concerning their use. Make sure to read these terms and conditions as set out by the author.

-

How can I print printables for free?

- Print them at home using any printer or head to any local print store for higher quality prints.

-

What software must I use to open printables that are free?

- Many printables are offered in PDF format. They can be opened with free software like Adobe Reader.

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Income Tax Deduction In Case Of Higher Education Loan U s 80E YouTube

Check more sample of Tax Exemption On Education Loan 80e below

Section 80E Tax Exemption On Interest On Education Loan With Automated

Section 80E Tax Exemption On Interest On Education Loan With Automated

Tax Exemption On Loan For Abroad Education U S 80E SAG Infotech Tax

PPT Section 80E Tax Exemption On Interest On Education Loan

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

Mapasu On Twitter Income Tax Section 80E income tax

https://cleartax.in/s/section-80e-deductio…

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

https://tax2win.in/guide/sec-80e-deducti…

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education

PPT Section 80E Tax Exemption On Interest On Education Loan

Section 80E Tax Exemption On Interest On Education Loan With Automated

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

Mapasu On Twitter Income Tax Section 80E income tax

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

80E Deduction Tax Benefit Income Tax Deduction Education Loan

80E Deduction Tax Benefit Income Tax Deduction Education Loan

Optima Tax Relief Reviews Form 1023 Tax Exemption Revision