In this digital age, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. Be it for educational use as well as creative projects or just adding the personal touch to your home, printables for free have proven to be a valuable resource. With this guide, you'll take a dive in the world of "Tax Rebate Deceased Taxpayer," exploring their purpose, where they are available, and the ways that they can benefit different aspects of your life.

Get Latest Tax Rebate Deceased Taxpayer Below

Tax Rebate Deceased Taxpayer

Tax Rebate Deceased Taxpayer - Tax Rebate Deceased Taxpayer, Tax Return Deceased Person, Tax Refund Deceased Person, Tax Return Deceased Person Canada, Tax Refund For Deceased Taxpayer, Tax Rebate For Deceased Person, How Do I Claim Tax Back For A Deceased Person, Can You Claim Tax Back For A Deceased Person, Can A Deceased Person Receive A Tax Refund

Web If the taxpayer died in 2021 meets the other requirements but did not receive the full amount of EIP 3 they are eligible for the Recovery Rebate Credit on their 2021 tax

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Tax Rebate Deceased Taxpayer encompass a wide selection of printable and downloadable materials that are accessible online for free cost. They come in many formats, such as worksheets, templates, coloring pages and much more. The beauty of Tax Rebate Deceased Taxpayer is in their versatility and accessibility.

More of Tax Rebate Deceased Taxpayer

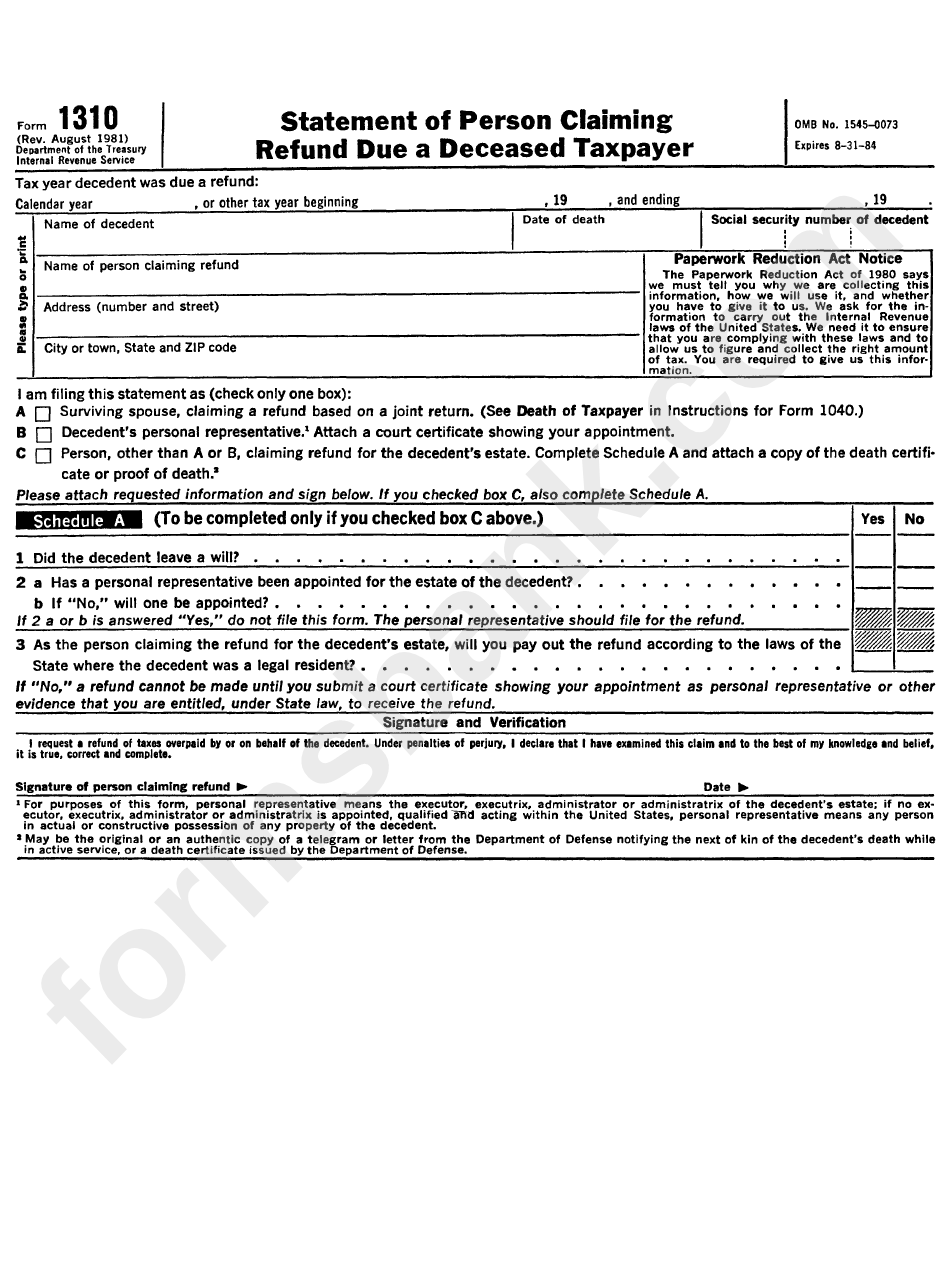

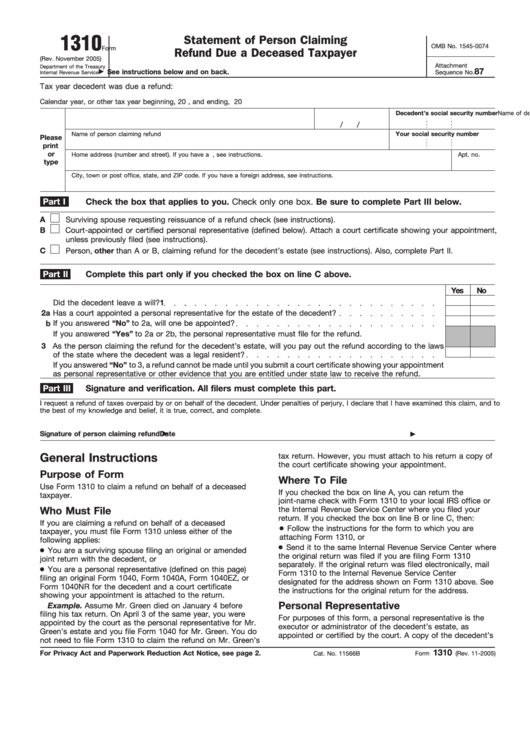

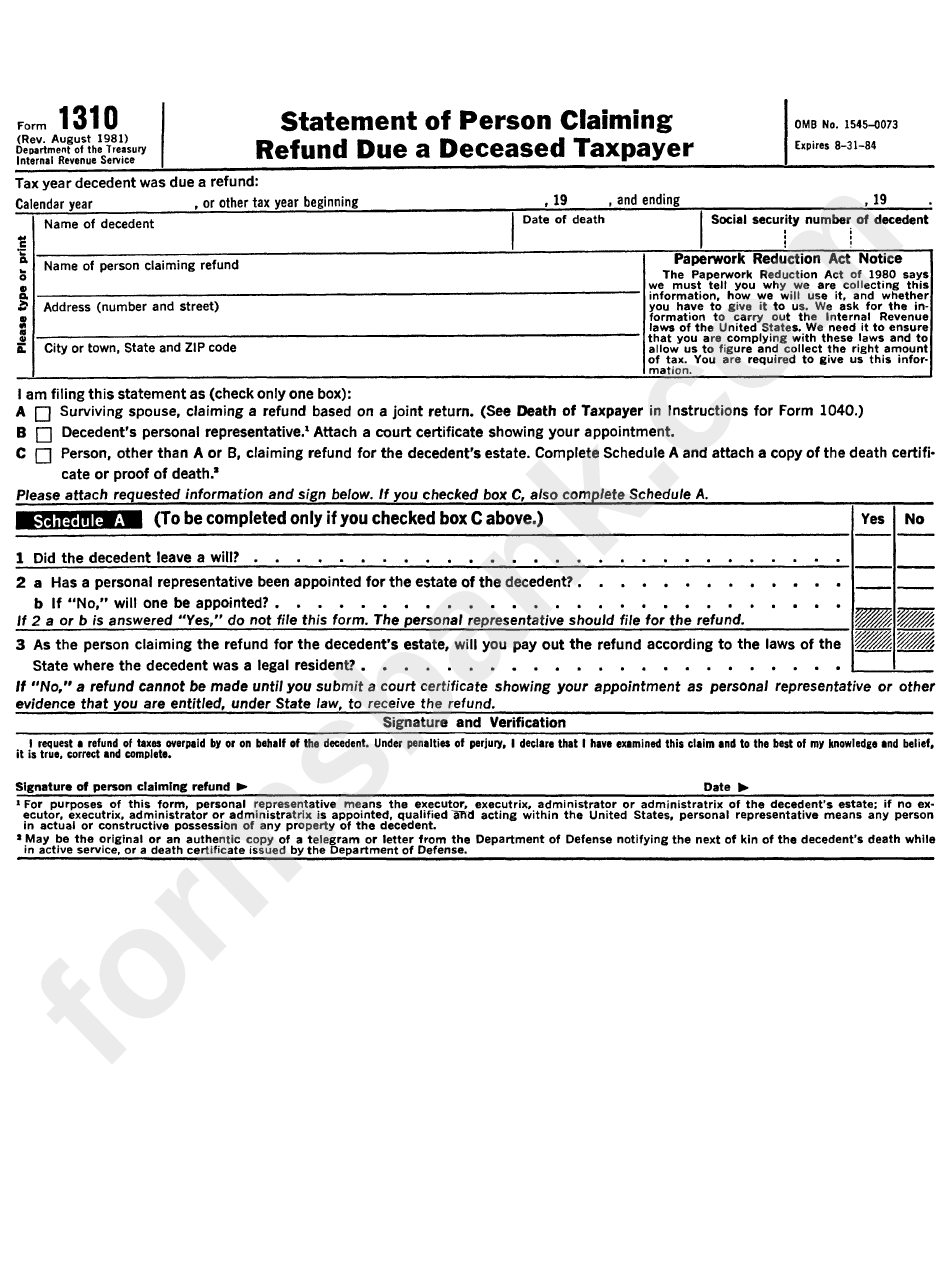

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer

Web Les ayant droits du d 233 funt h 233 ritiers conjoint ne sont plus tenus de se rendre au centre des imp 244 ts dans les 6 mois qui suivent le d 233 c 232 s Il leur suffit de remplir une d 233 claration

Web 8 mars 2021 nbsp 0183 32 Recovery Rebate Credit for a deceased taxpayer 03 08 2021 12 30 PM I have had several returns this year where one spouse passed away in 2020 and where

The Tax Rebate Deceased Taxpayer have gained huge popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Individualization We can customize designs to suit your personal needs whether you're designing invitations and schedules, or even decorating your home.

-

Educational Benefits: Downloads of educational content for free provide for students of all ages, making them an essential device for teachers and parents.

-

An easy way to access HTML0: You have instant access an array of designs and templates will save you time and effort.

Where to Find more Tax Rebate Deceased Taxpayer

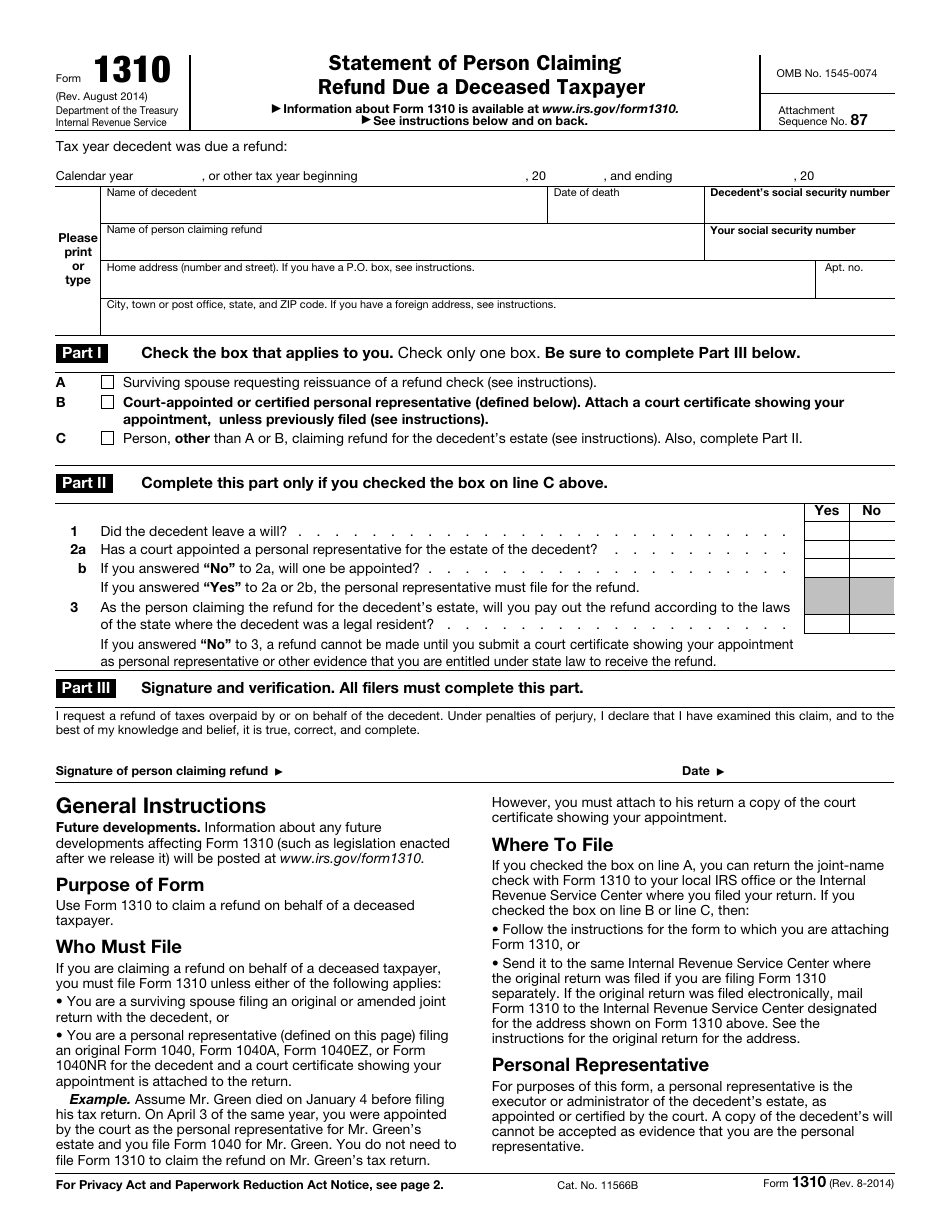

IRS Form 1310 Download Fillable PDF Or Fill Online Statement Of Person

IRS Form 1310 Download Fillable PDF Or Fill Online Statement Of Person

Web 30 ao 251 t 2023 nbsp 0183 32 File the Final Income Tax Returns of a Deceased Person In general file and prepare the final individual income tax return of a deceased person the same way you

Web 14 avr 2023 nbsp 0183 32 For decedents with 2023 date of deaths the filing threshold is 12 920 000 The Form 706 instructions for the year of the decedent s death provide the filing

Now that we've piqued your interest in printables for free we'll explore the places they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Tax Rebate Deceased Taxpayer suitable for many goals.

- Explore categories like interior decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- This is a great resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- These blogs cover a wide spectrum of interests, ranging from DIY projects to party planning.

Maximizing Tax Rebate Deceased Taxpayer

Here are some new ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or festive decorations to decorate your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Rebate Deceased Taxpayer are an abundance of practical and imaginative resources that can meet the needs of a variety of people and interests. Their accessibility and flexibility make these printables a useful addition to any professional or personal life. Explore the plethora of Tax Rebate Deceased Taxpayer to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes they are! You can download and print these documents for free.

-

Can I download free printables in commercial projects?

- It's determined by the specific rules of usage. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright issues with Tax Rebate Deceased Taxpayer?

- Certain printables might have limitations on their use. Make sure to read the terms and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home with either a printer or go to a print shop in your area for superior prints.

-

What software do I require to view printables for free?

- The majority of printables are in PDF format, which can be opened with free programs like Adobe Reader.

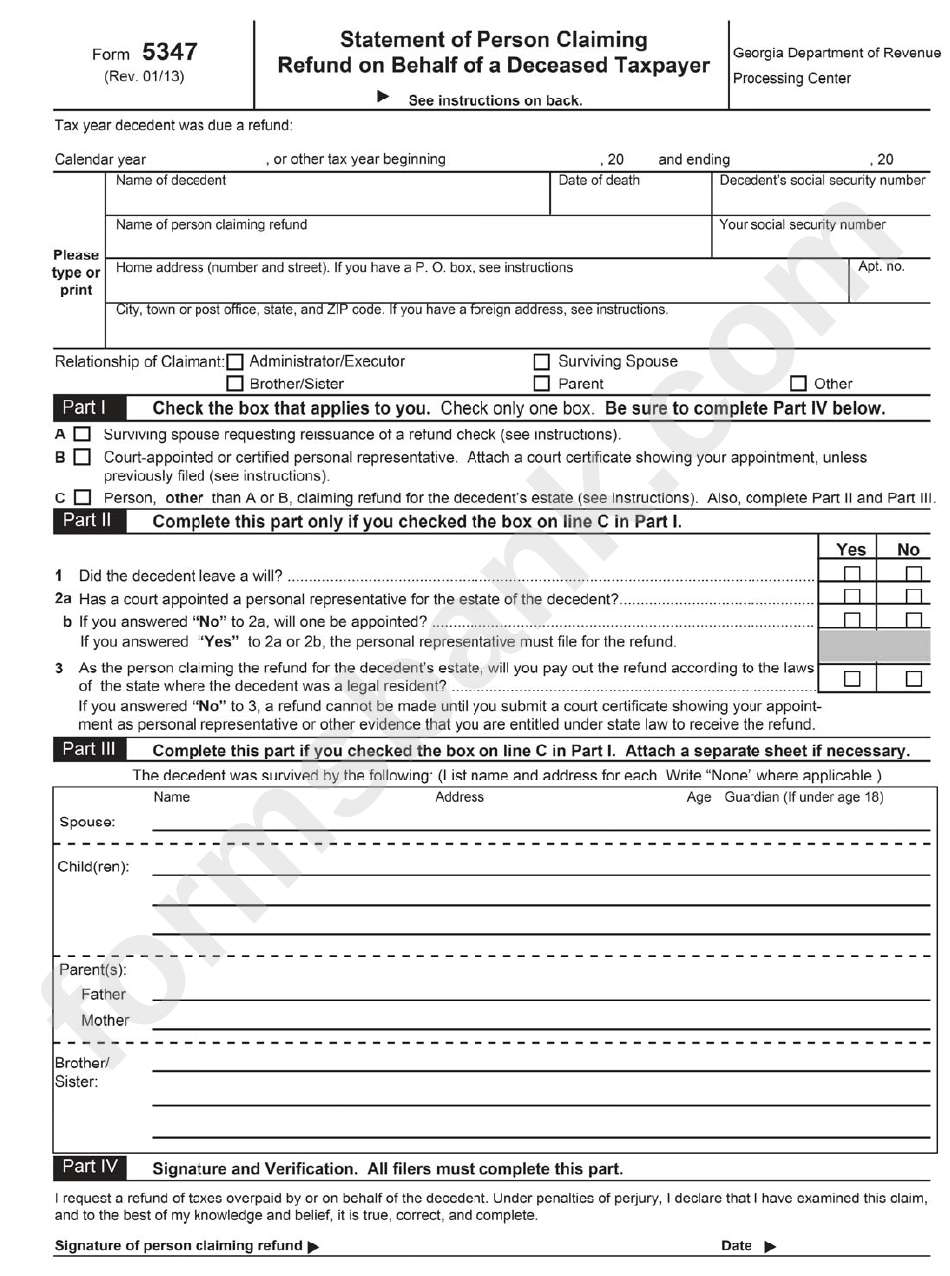

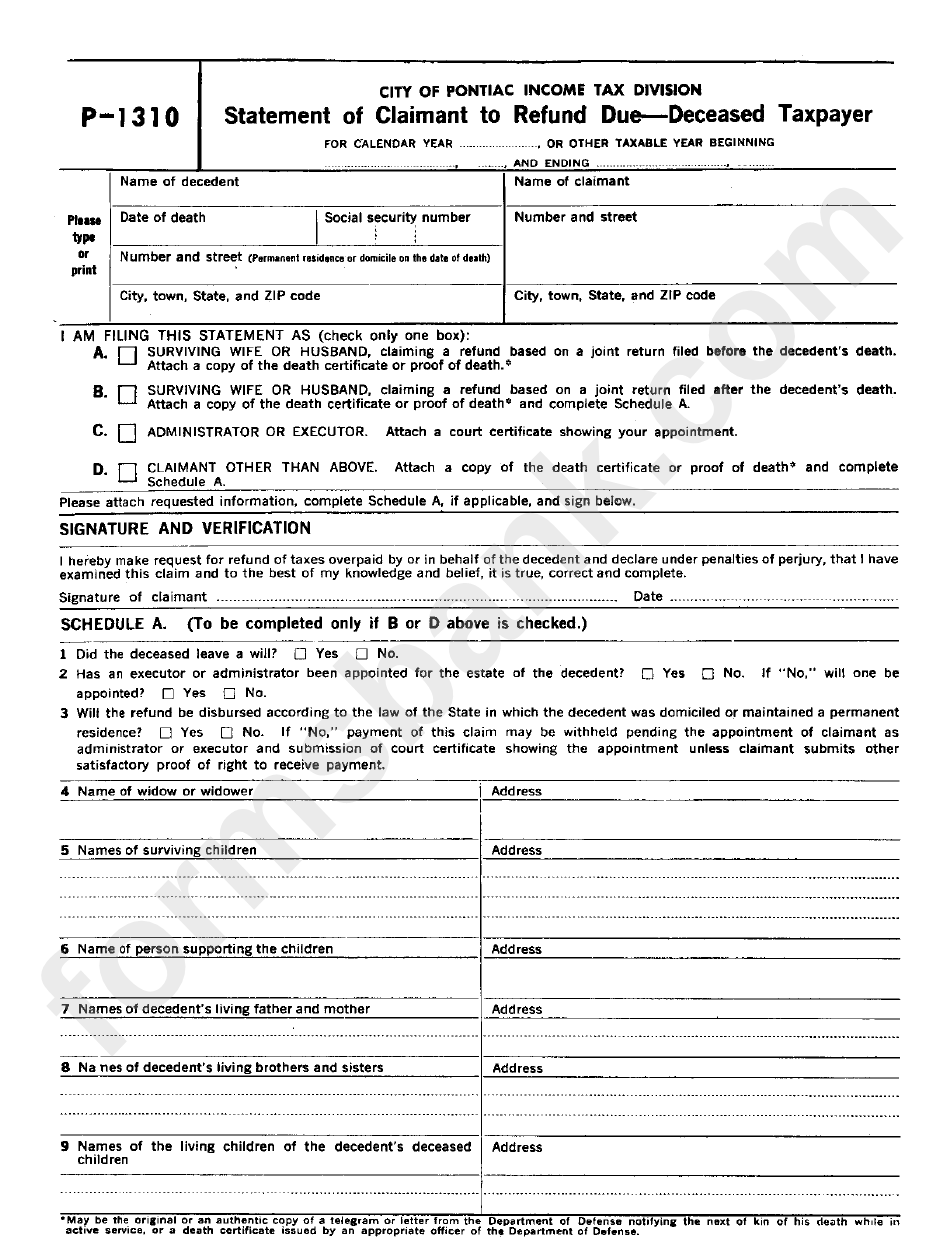

Form 5747 Statement Of Person Claiming Refund On Behalf Of A Deceased

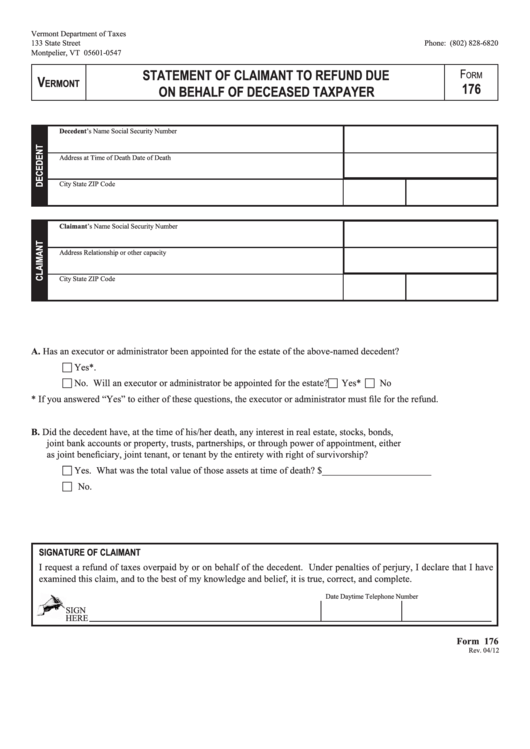

Form 176 Statement Of Claimant To Refund Due On Behalf Of Deceased

Check more sample of Tax Rebate Deceased Taxpayer below

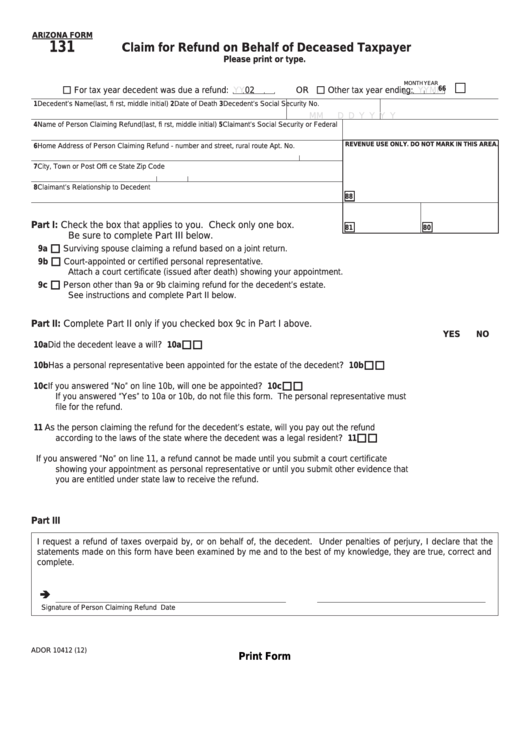

Fillable Form 131 Claim For Refund On Behalf Of Deceased Taxpayer

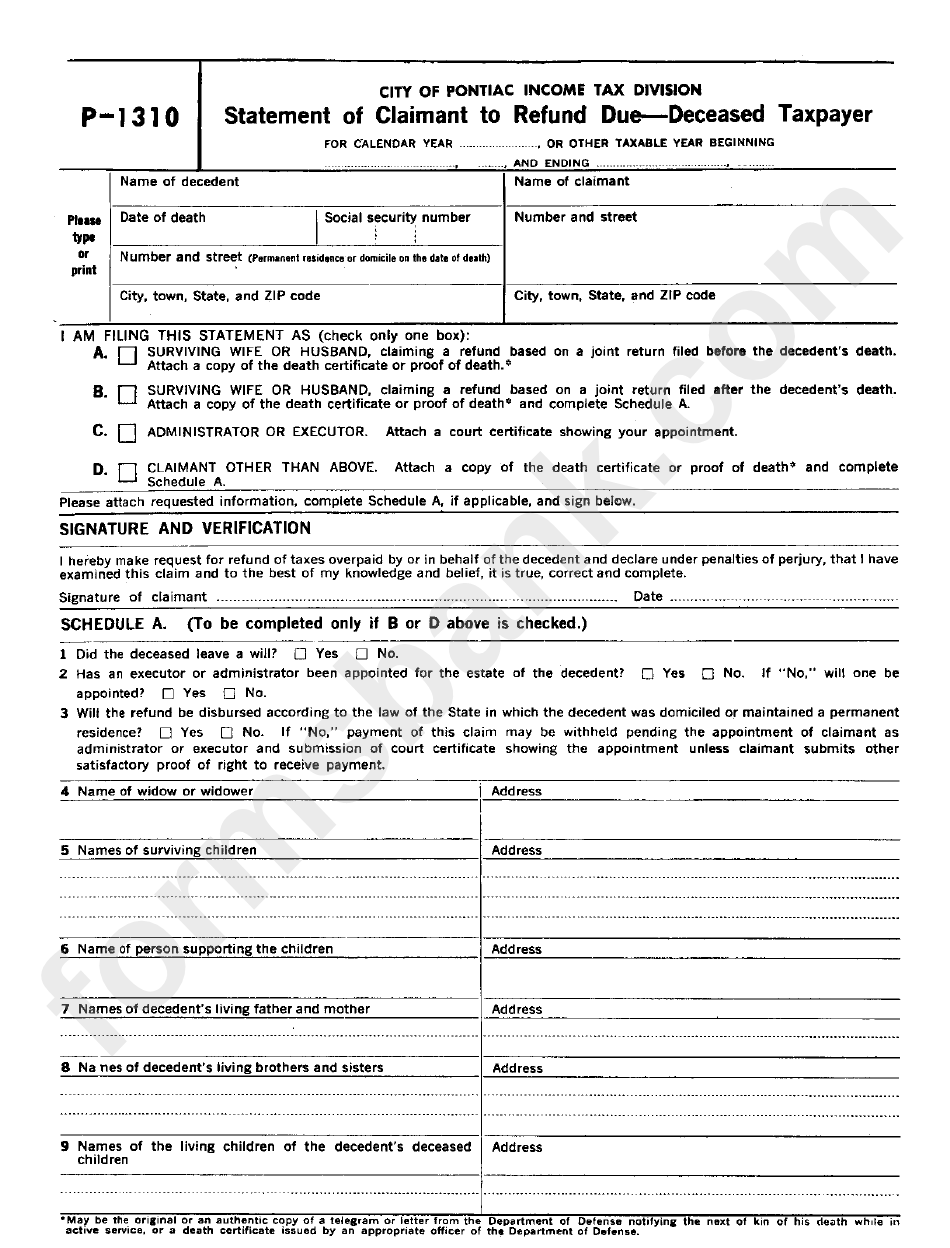

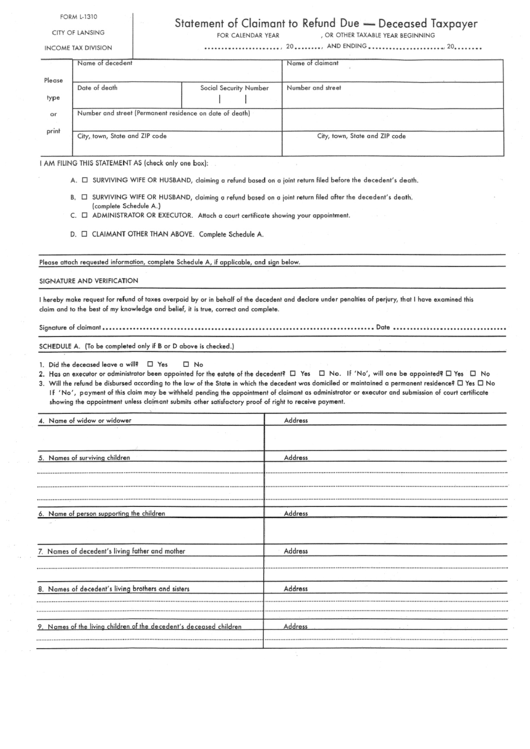

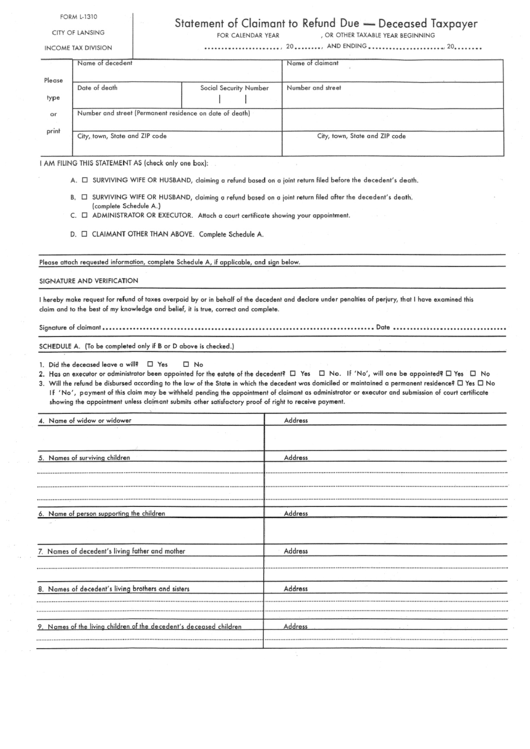

Form L 1310 Statement Of Claimant To Refund Due Deceased Taxpayer

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

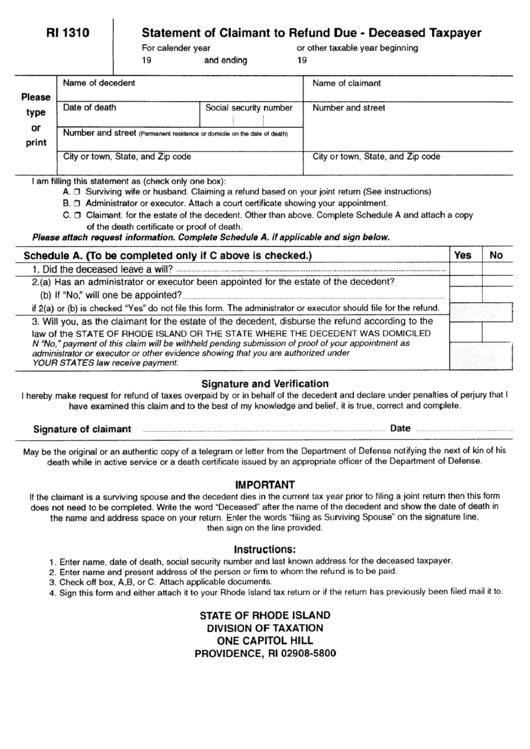

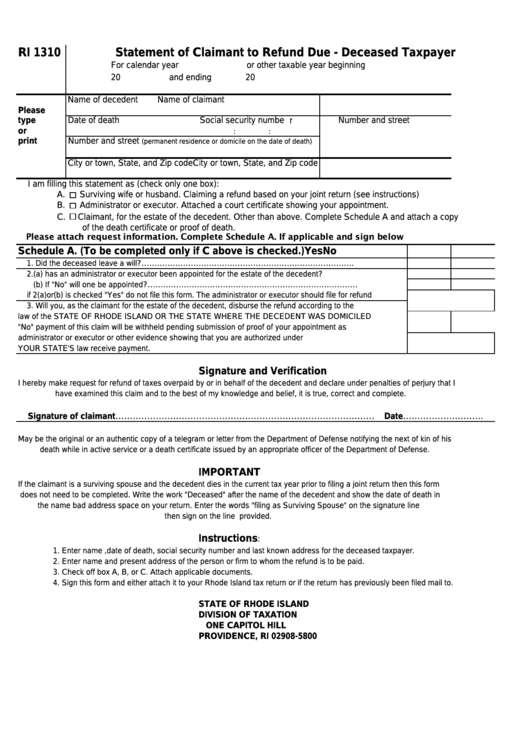

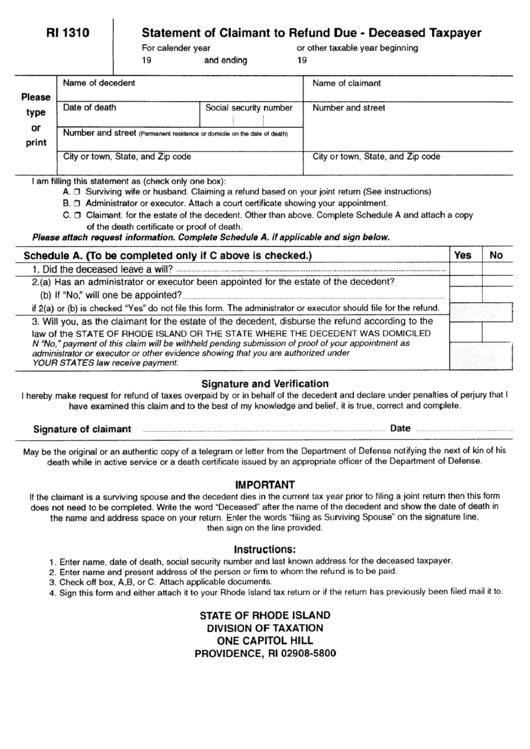

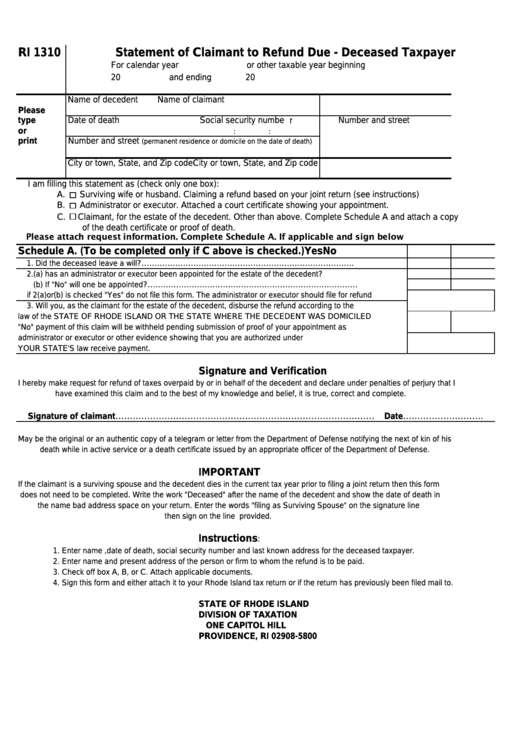

Fillable Form Ri 1310 Statement Of Claimant To Refund Due Deceased

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer

Form Ri 1310 Statement Of Claimant To Refund Due Deceased Taxpayer

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.nstp.org/article/Update Regarding Deceased Taxpayers

Web 9 mars 2021 nbsp 0183 32 In 2020 after the CARES Act and the issuance of the first Economic Impact Payment the then Secretary of the Treasury Mnuchin instructed surviving taxpayers

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 9 mars 2021 nbsp 0183 32 In 2020 after the CARES Act and the issuance of the first Economic Impact Payment the then Secretary of the Treasury Mnuchin instructed surviving taxpayers

Fillable Form Ri 1310 Statement Of Claimant To Refund Due Deceased

Form L 1310 Statement Of Claimant To Refund Due Deceased Taxpayer

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer

Form Ri 1310 Statement Of Claimant To Refund Due Deceased Taxpayer

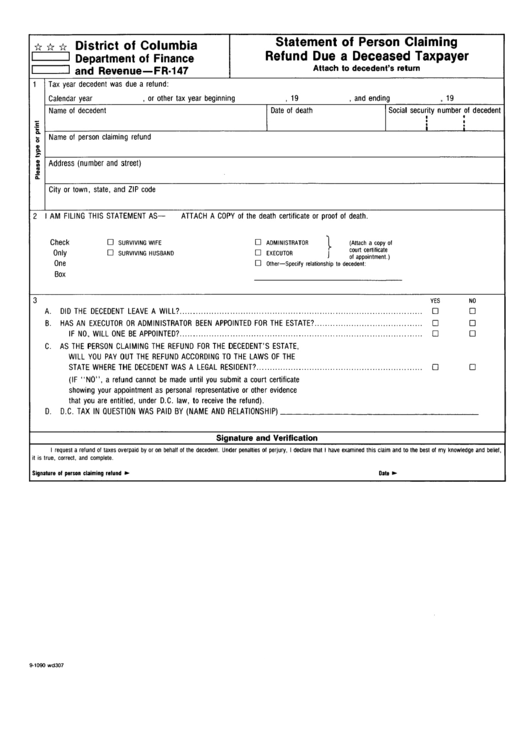

Fillable Form Fr 147 Statement Of Person Claiming Refund Due A

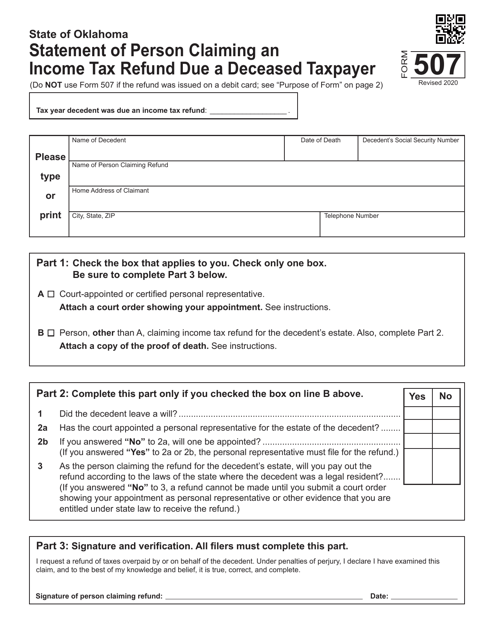

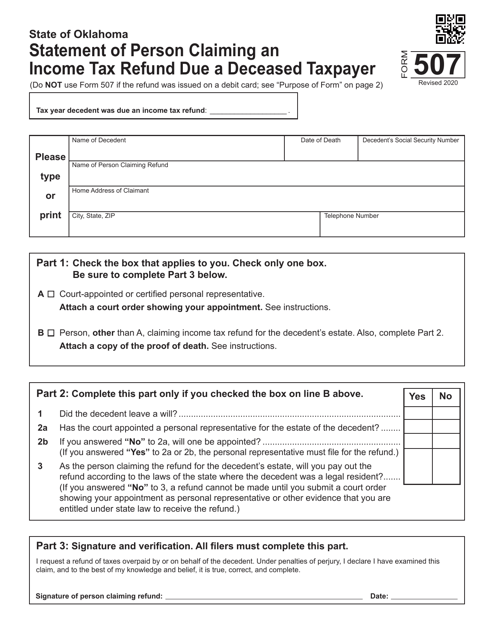

Form 507 Download Fillable PDF Or Fill Online Statement Of Person

Form 507 Download Fillable PDF Or Fill Online Statement Of Person

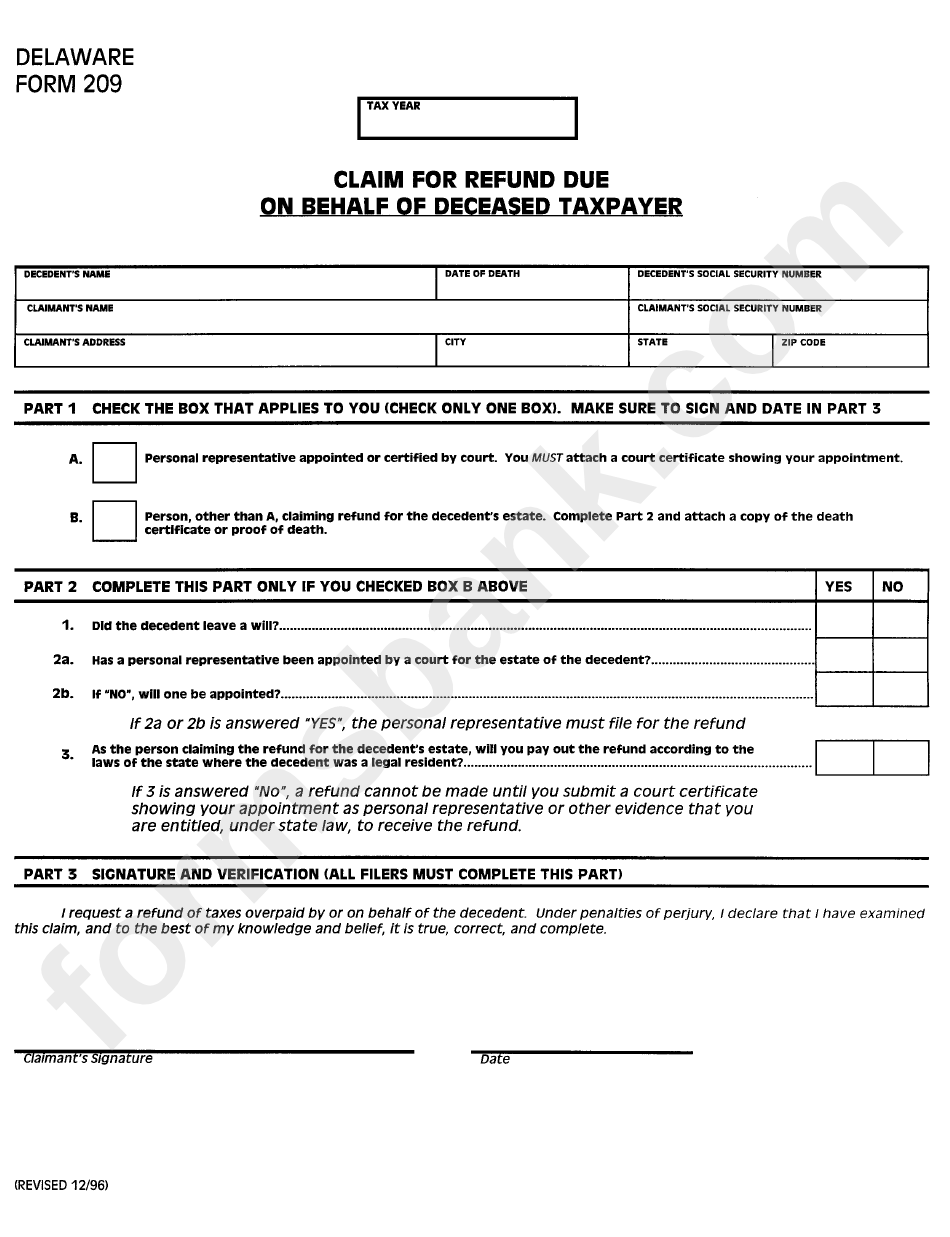

Fillable Form 209 Claim For Refund Due On Behalf Of Deceased Taxpayer