In this day and age with screens dominating our lives however, the attraction of tangible printed items hasn't gone away. If it's to aid in education in creative or artistic projects, or simply to add personal touches to your area, Tax Rebate On Donations To Charity India are now a vital resource. We'll take a dive through the vast world of "Tax Rebate On Donations To Charity India," exploring their purpose, where to locate them, and how they can be used to enhance different aspects of your life.

Get Latest Tax Rebate On Donations To Charity India Below

Tax Rebate On Donations To Charity India

Tax Rebate On Donations To Charity India - Tax Benefit On Donations To Charity In India, Can You Claim Tax On Charity Donations, Can You Get Tax Relief On Charity Donations, Are Any Charitable Donations Tax Deductible, How To Get A Tax Deduction For Charitable Donations

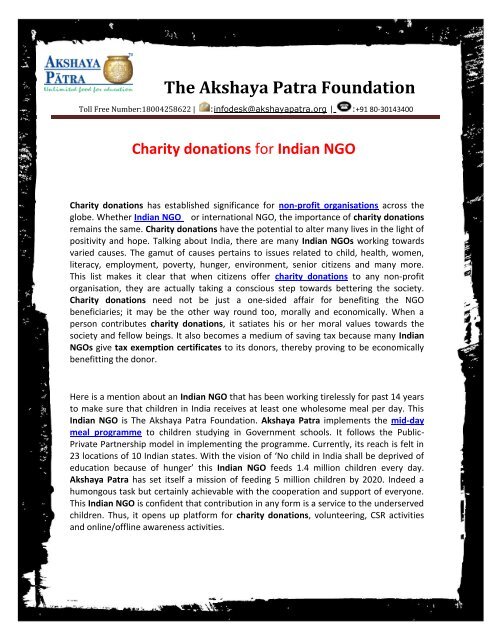

Web Donations above 500 to Akshaya Patra will be eligible for a 50 deduction from one s taxable income under Section 80G of the Income Tax Act By contributing to Akshaya

Web 28 d 233 c 2020 nbsp 0183 32 A donor can claim 50 or 100 amount donated to the charity depending on the institution the donation was made to How much of the amount donated can be claimed as a deduction and whether with

The Tax Rebate On Donations To Charity India are a huge assortment of printable, downloadable resources available online for download at no cost. These printables come in different forms, including worksheets, templates, coloring pages and more. The beauty of Tax Rebate On Donations To Charity India is their versatility and accessibility.

More of Tax Rebate On Donations To Charity India

Oxfam Tax Rebate A5 4 Page Leaflet Outside Pages Digital Charity Lab

Oxfam Tax Rebate A5 4 Page Leaflet Outside Pages Digital Charity Lab

Web Deduction in respect of donations to certain funds charitable institutions etc 80G 1 In computing the total income of an assessee there shall be deducted in accordance with

Web This section offers tax deductions on donations made to certain funds or charities An amount donated by an individual to an eligible charity can be claimed as a tax deduction

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Personalization You can tailor designs to suit your personal needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value Education-related printables at no charge are designed to appeal to students of all ages, which makes these printables a powerful resource for educators and parents.

-

Convenience: Fast access many designs and templates, which saves time as well as effort.

Where to Find more Tax Rebate On Donations To Charity India

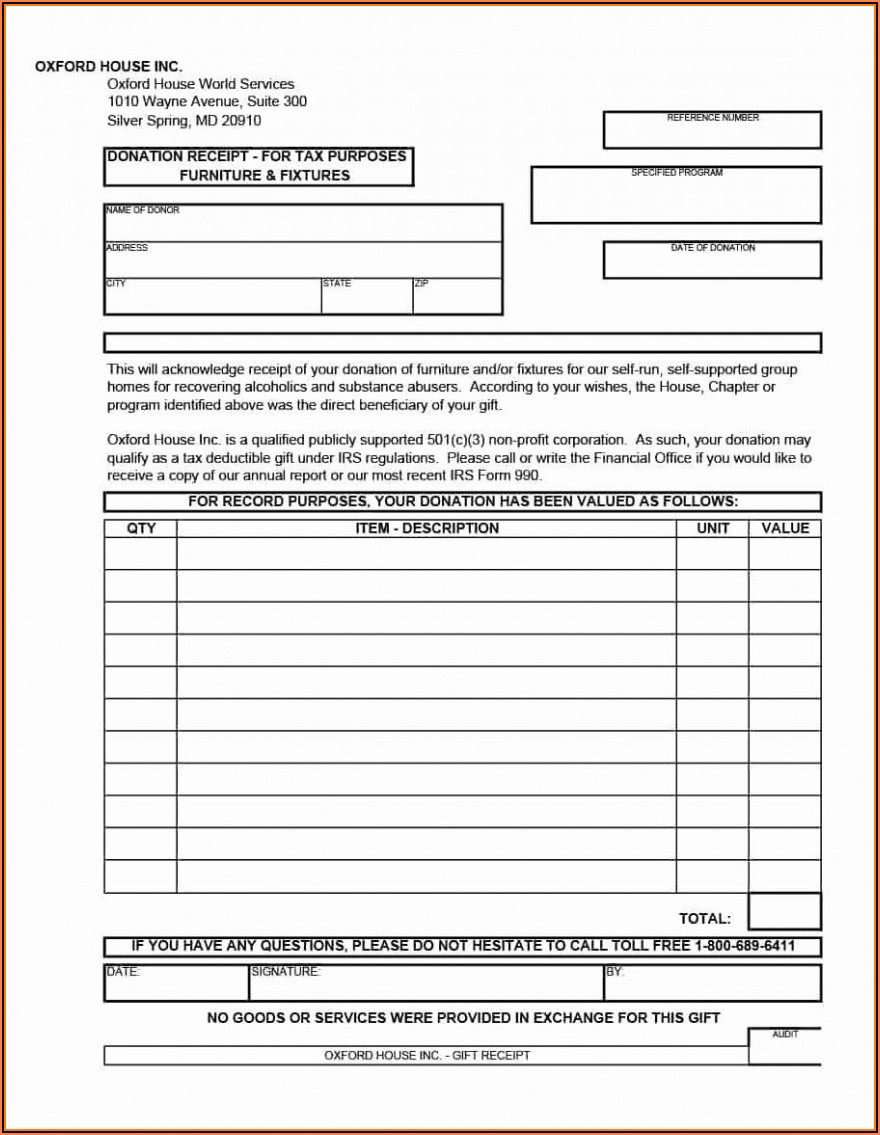

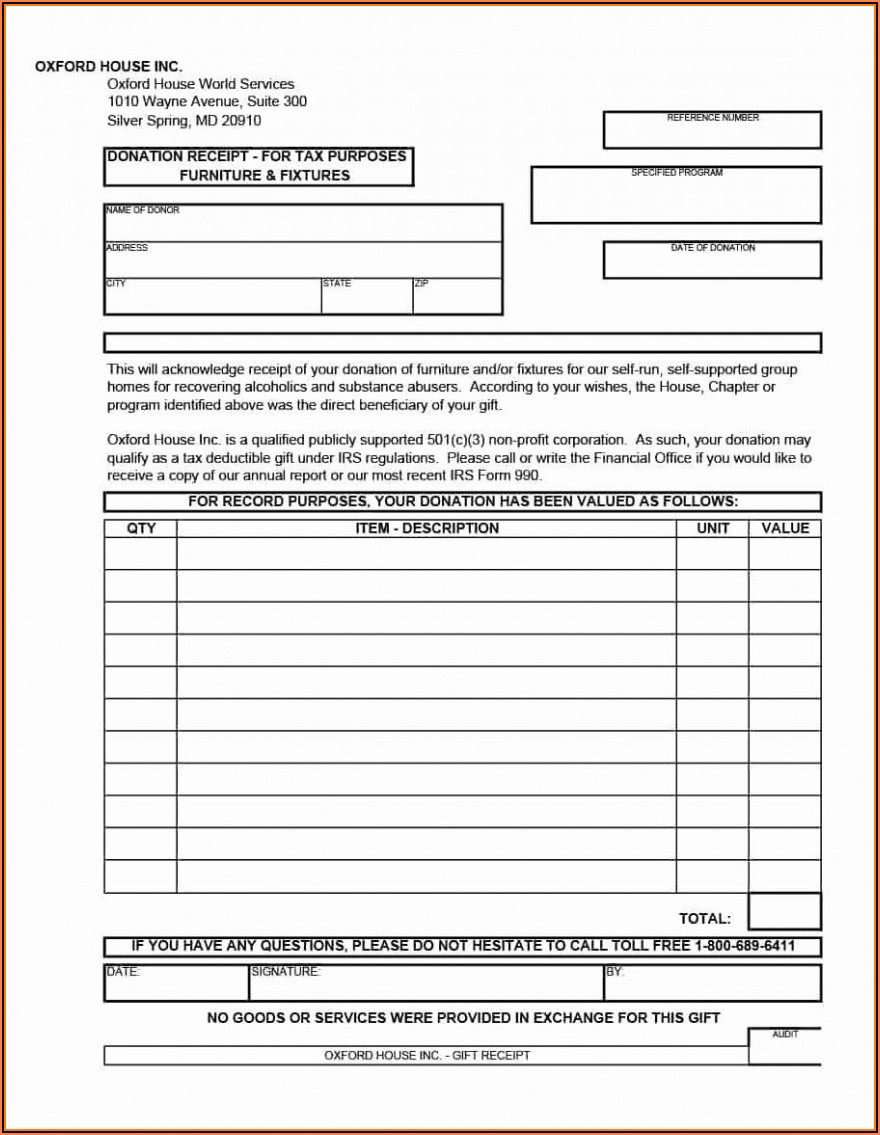

15 Donation Receipt Template Samples Templates Assistant

15 Donation Receipt Template Samples Templates Assistant

Web 23 sept 2021 nbsp 0183 32 Deduction allowed shall be 100 or 50 of the amount donated if donation has been given to any of the below mentioned institutions or funds Deduction allowed

Web WIRC of The Institute of Chartered Accountants of India 26th May 2021 Recent developments in Charity Taxation 2 Synopsis 5 27 2021 Brief background of relevant

If we've already piqued your interest in printables for free we'll explore the places you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Tax Rebate On Donations To Charity India designed for a variety motives.

- Explore categories such as interior decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free as well as flashcards and other learning tools.

- The perfect resource for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- These blogs cover a wide range of interests, starting from DIY projects to party planning.

Maximizing Tax Rebate On Donations To Charity India

Here are some ways ensure you get the very most use of Tax Rebate On Donations To Charity India:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home or in the classroom.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Rebate On Donations To Charity India are a treasure trove of practical and innovative resources that satisfy a wide range of requirements and needs and. Their accessibility and flexibility make them a valuable addition to both professional and personal lives. Explore the endless world of Tax Rebate On Donations To Charity India today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes they are! You can download and print these resources at no cost.

-

Do I have the right to use free printables in commercial projects?

- It's determined by the specific conditions of use. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables might have limitations in their usage. Check these terms and conditions as set out by the author.

-

How do I print Tax Rebate On Donations To Charity India?

- Print them at home using an printer, or go to an in-store print shop to get superior prints.

-

What software do I require to open printables at no cost?

- A majority of printed materials are in PDF format, which is open with no cost software, such as Adobe Reader.

Campaign Gallery Oxfam Tax Rebate Letter From January 2017 Digital

How To Claim Charitable Donations Charity Zakat Tax Credits How

Check more sample of Tax Rebate On Donations To Charity India below

Tax Rebate On Donation Sewa Bharti Malwa

How To Maximize Your Charity Tax Deductible Donation WealthFit

Donation Tax Calculator Giving NUS Yong Loo Lin School Of Medicine

Printable Tax Deduction Form For Donations Printable Forms Free Online

Online Step To Download 80G Receipt For Donation Made To PM Cares Fund

Updated PN Says Tax Rebate For Community Chest Fund Discriminates

https://serudsindia.org/tax-benefits-charity-in…

Web 28 d 233 c 2020 nbsp 0183 32 A donor can claim 50 or 100 amount donated to the charity depending on the institution the donation was made to How much of the amount donated can be claimed as a deduction and whether with

https://tax2win.in/guide/80g-deduction-donations-to-charitable-institutions

Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals

Web 28 d 233 c 2020 nbsp 0183 32 A donor can claim 50 or 100 amount donated to the charity depending on the institution the donation was made to How much of the amount donated can be claimed as a deduction and whether with

Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals

Printable Tax Deduction Form For Donations Printable Forms Free Online

How To Maximize Your Charity Tax Deductible Donation WealthFit

Online Step To Download 80G Receipt For Donation Made To PM Cares Fund

Updated PN Says Tax Rebate For Community Chest Fund Discriminates

Charity Donations For Indian NGO

Trick Of The Trade How Sadhguru s Isha Foundation Evades Paying Taxes

Trick Of The Trade How Sadhguru s Isha Foundation Evades Paying Taxes

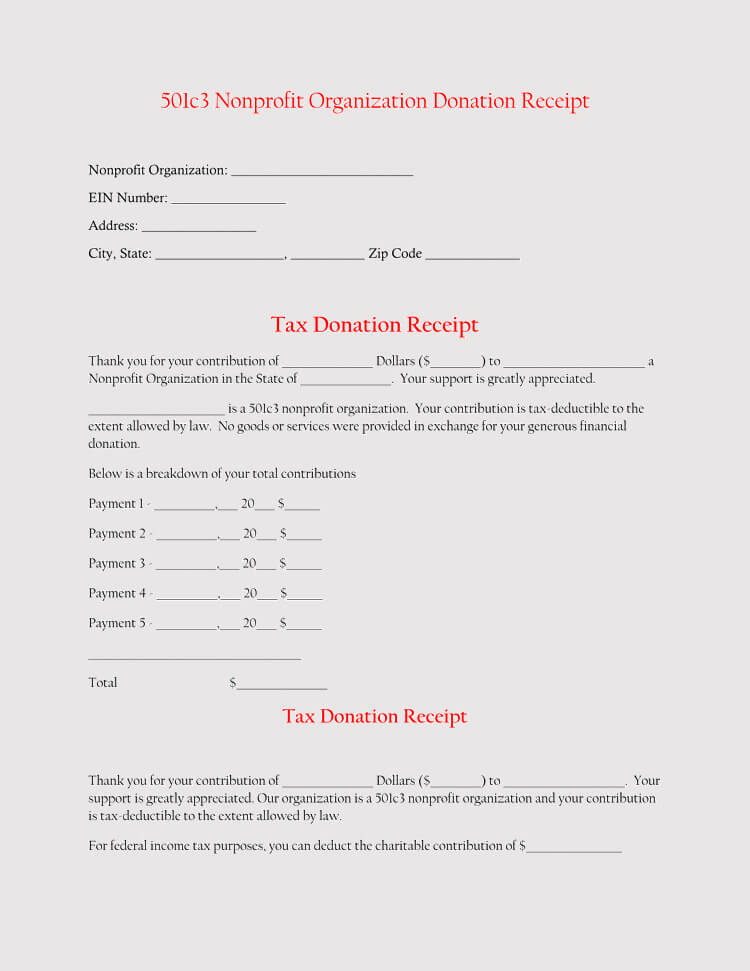

501c3 Donation Receipt Template Addictionary Download 501c3 Donation