In this digital age, where screens dominate our lives The appeal of tangible printed material hasn't diminished. Whatever the reason, whether for education for creative projects, just adding an extra personal touch to your space, Tax Refund Processing Time are now a useful resource. For this piece, we'll dive into the world "Tax Refund Processing Time," exploring what they are, where to locate them, and how they can add value to various aspects of your lives.

Get Latest Tax Refund Processing Time Below

Tax Refund Processing Time

Tax Refund Processing Time - Tax Refund Processing Time, Tax Refund Processing Time 2022, Tax Refund Processing Time Reddit, State Refund Processing Time, Tax Refund Turnaround Time 2023, Tax Refund Approval Time, Tax Refund Waiting Time, Tax Rebate Processing Time, Tax Refund Waiting Time Uk, Income Tax Refund Processing Time

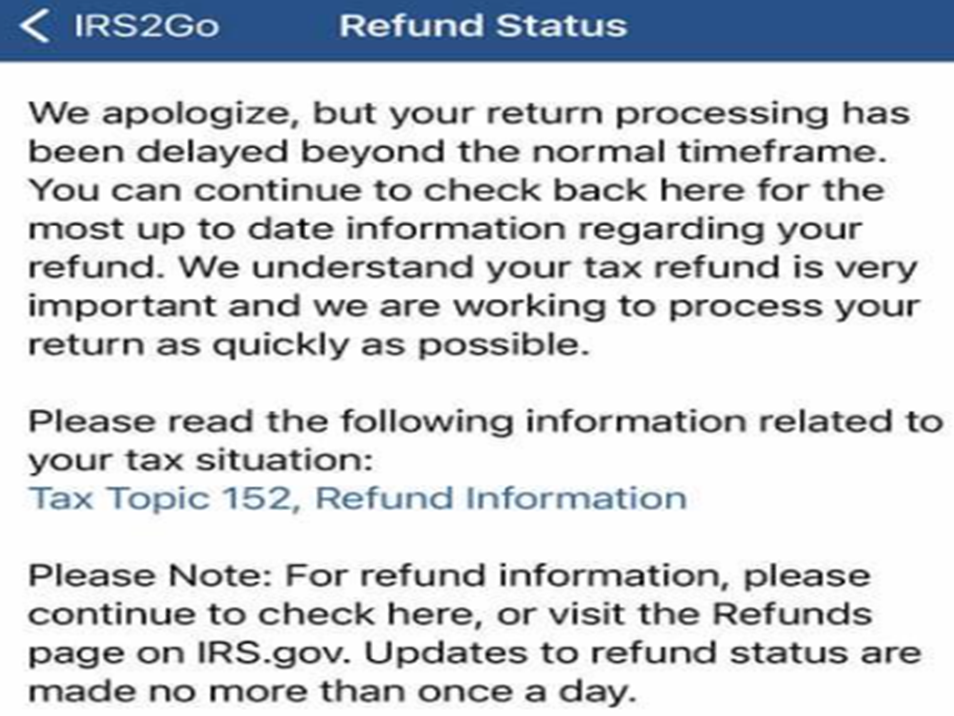

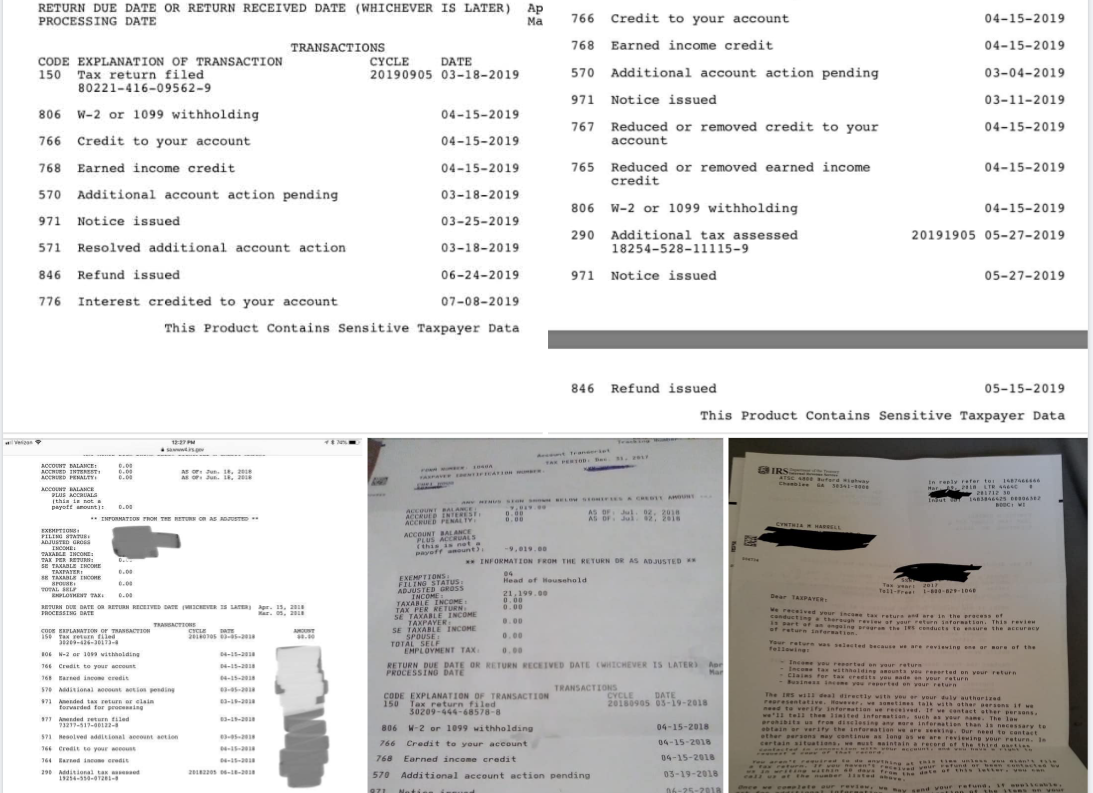

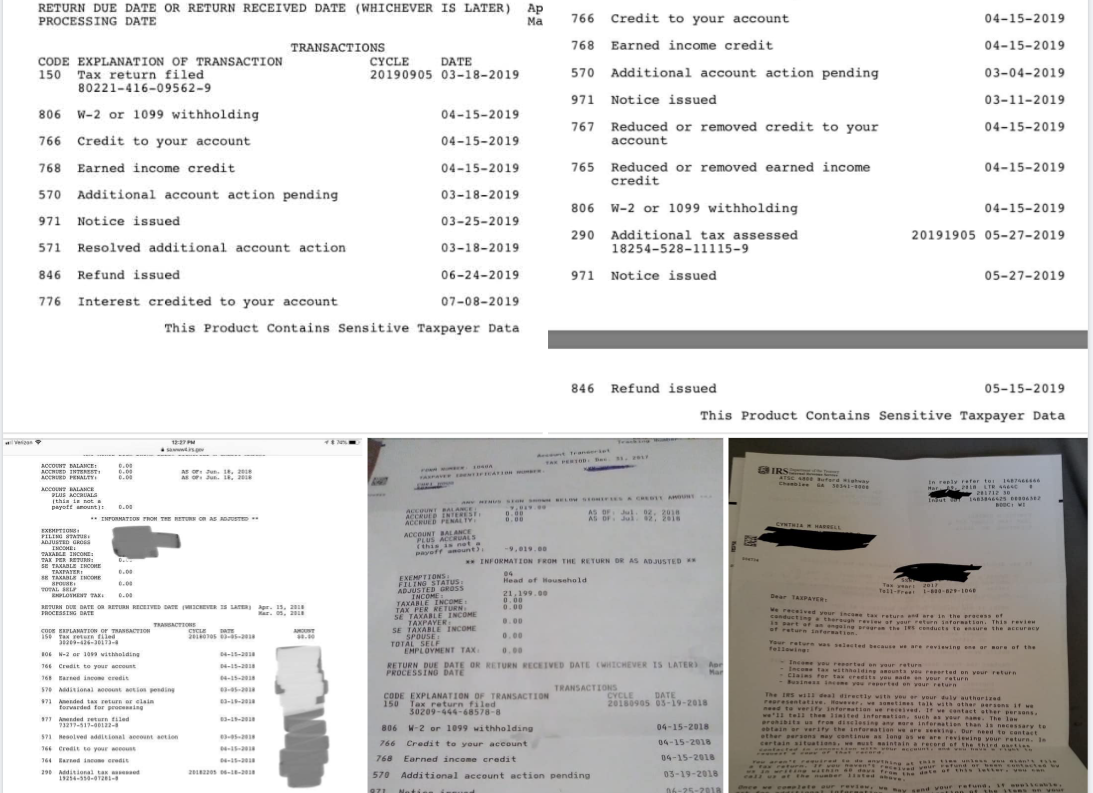

More than 90 percent of tax refunds are issued by the IRS in less than 21 days according to the IRS However the exact timing of receiving your refund depends on a range of factors and in

Once the IRS acknowledges receipt of a return refund status information is typically available within 24 hours after receipt of a taxpayer s e filed tax year 2023 return Three to four days after receipt of an e filed tax year 2022 or 2021 return Four weeks after mailing a paper return

Printables for free cover a broad collection of printable documents that can be downloaded online at no cost. These resources come in many types, such as worksheets coloring pages, templates and much more. The great thing about Tax Refund Processing Time is their versatility and accessibility.

More of Tax Refund Processing Time

Alert Taxpayers IT Department Plans To Reduce Income Tax Refund

Alert Taxpayers IT Department Plans To Reduce Income Tax Refund

Most taxpayers receive their refunds within 21 days of filing The IRS says they issue 90 of refunds in that time frame If you choose to have your refund deposited directly into your account you may have to wait five days before you can gain access to it

The IRS says the vast majority of refunds are sent within 21 calendar days of filing That means if you wait until April 18 the last day to file your 2022 tax return without asking for an

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Flexible: We can customize the templates to meet your individual needs for invitations, whether that's creating them, organizing your schedule, or decorating your home.

-

Educational Value Printing educational materials for no cost cater to learners from all ages, making them a great tool for parents and educators.

-

It's easy: Quick access to an array of designs and templates can save you time and energy.

Where to Find more Tax Refund Processing Time

Income Tax Refund Govt Plans To Reduce Refund Processing Time Check

Income Tax Refund Govt Plans To Reduce Refund Processing Time Check

Usually the IRS says to allow 4 weeks before checking the status of your refund and that refund processing can take 6 to 8 weeks from the date the IRS receives your return Tax Refund Processing

The IRS says if you file early and electronically you ll typically receive your tax refund within 21 days after filing However if you file a paper tax return expect delays The IRS warns

Now that we've ignited your interest in printables for free Let's see where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection and Tax Refund Processing Time for a variety motives.

- Explore categories like decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- Ideal for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a broad range of topics, including DIY projects to planning a party.

Maximizing Tax Refund Processing Time

Here are some ways create the maximum value of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Utilize free printable worksheets to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Tax Refund Processing Time are an abundance of fun and practical tools for a variety of needs and desires. Their accessibility and flexibility make them a wonderful addition to both professional and personal life. Explore the plethora that is Tax Refund Processing Time today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes they are! You can print and download these free resources for no cost.

-

Can I download free printables to make commercial products?

- It's all dependent on the rules of usage. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may contain restrictions regarding usage. Make sure you read the terms and conditions offered by the designer.

-

How do I print Tax Refund Processing Time?

- You can print them at home using an printer, or go to an area print shop for higher quality prints.

-

What software is required to open printables that are free?

- Most printables come in PDF format. They is open with no cost software such as Adobe Reader.

Processing My Tax Refund YouTube

Tax Refund Still Processing Get Refund Faster Unemployment Refund

Check more sample of Tax Refund Processing Time below

IRS Refund processing schedule aving To Invest

ERC Refund Processing Time What To Expect YouTube

Image 16 aving To Invest

Tax Return Tips Can Speed Refund Processing And Help Prevent Theft Of

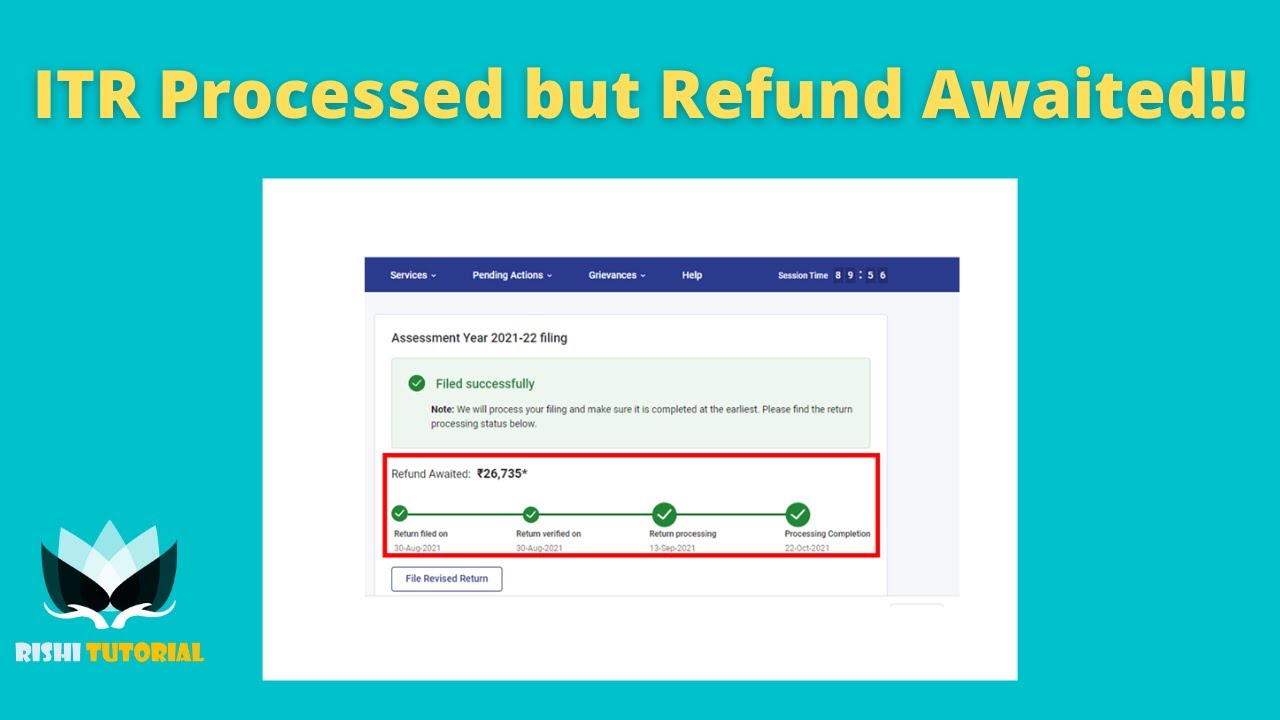

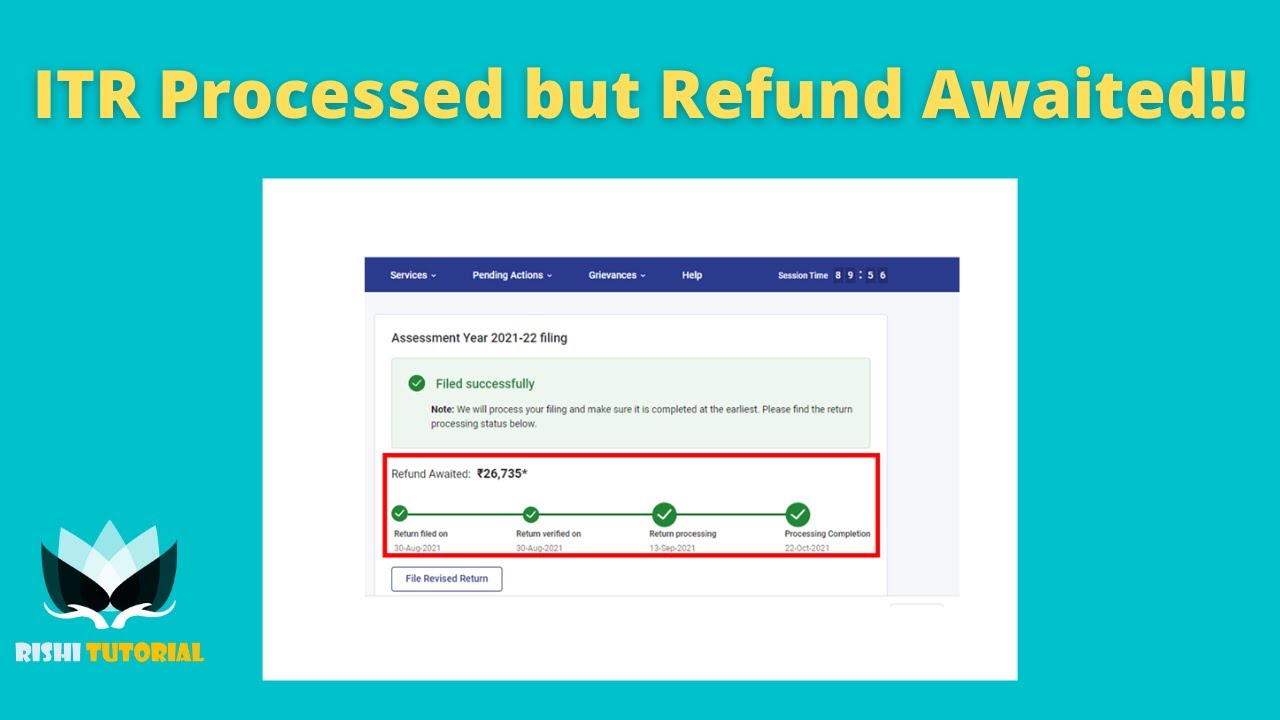

ITR PROCESSED BUT REFUND AWAITED HOW TO RESPONSE CPC REFUND STATUS

Why Is My Tax Refund Still Processing 2020 YouTube

https://www.irs.gov/newsroom/tax-time-guide-irs...

Once the IRS acknowledges receipt of a return refund status information is typically available within 24 hours after receipt of a taxpayer s e filed tax year 2023 return Three to four days after receipt of an e filed tax year 2022 or 2021 return Four weeks after mailing a paper return

https://www.irs.gov/help/processing-status-for-tax-forms

Electronically filed Form 1040 returns are generally processed within 21 days We re currently processing paper returns received during the months below Form 1040 series Original April 2024 Amended March 2024 This does not include those that require error correction or other special handling

Once the IRS acknowledges receipt of a return refund status information is typically available within 24 hours after receipt of a taxpayer s e filed tax year 2023 return Three to four days after receipt of an e filed tax year 2022 or 2021 return Four weeks after mailing a paper return

Electronically filed Form 1040 returns are generally processed within 21 days We re currently processing paper returns received during the months below Form 1040 series Original April 2024 Amended March 2024 This does not include those that require error correction or other special handling

Tax Return Tips Can Speed Refund Processing And Help Prevent Theft Of

ERC Refund Processing Time What To Expect YouTube

ITR PROCESSED BUT REFUND AWAITED HOW TO RESPONSE CPC REFUND STATUS

Why Is My Tax Refund Still Processing 2020 YouTube

Customers Experiencing Lengthy ERC Refund Processing Windes

Image 3 aving To Invest

Image 3 aving To Invest

Where s My Refund Gallagher Gatewood