In the age of digital, where screens dominate our lives The appeal of tangible printed products hasn't decreased. In the case of educational materials as well as creative projects or just adding an extra personal touch to your space, Tax Saving On Education Loan have become an invaluable resource. Here, we'll dive deep into the realm of "Tax Saving On Education Loan," exploring the different types of printables, where to locate them, and how they can improve various aspects of your life.

Get Latest Tax Saving On Education Loan Below

Tax Saving On Education Loan

Tax Saving On Education Loan - Tax Saving On Education Loan, Tax Saving On Student Loan, Tax Benefit On Student Loan, Tax Benefit On Child Education Loan, Tax Benefit On Higher Education Loan, Can We Save Tax On Education Loan, Does Education Loan Save Income Tax, How Much Tax Can Be Saved On Education Loan, Is Education Loan Interest Tax Deductible, Can I Get Tax Benefit On Education Loan

To qualify you must be enrolled for at least one academic period at least half time each year The credit covers 100 of the first

To claim the full student loan interest write off your MAGI must be below 70 000 140 000 if you file a joint return with your spouse If your income is between

The Tax Saving On Education Loan are a huge range of downloadable, printable documents that can be downloaded online at no cost. The resources are offered in a variety formats, such as worksheets, coloring pages, templates and more. One of the advantages of Tax Saving On Education Loan lies in their versatility as well as accessibility.

More of Tax Saving On Education Loan

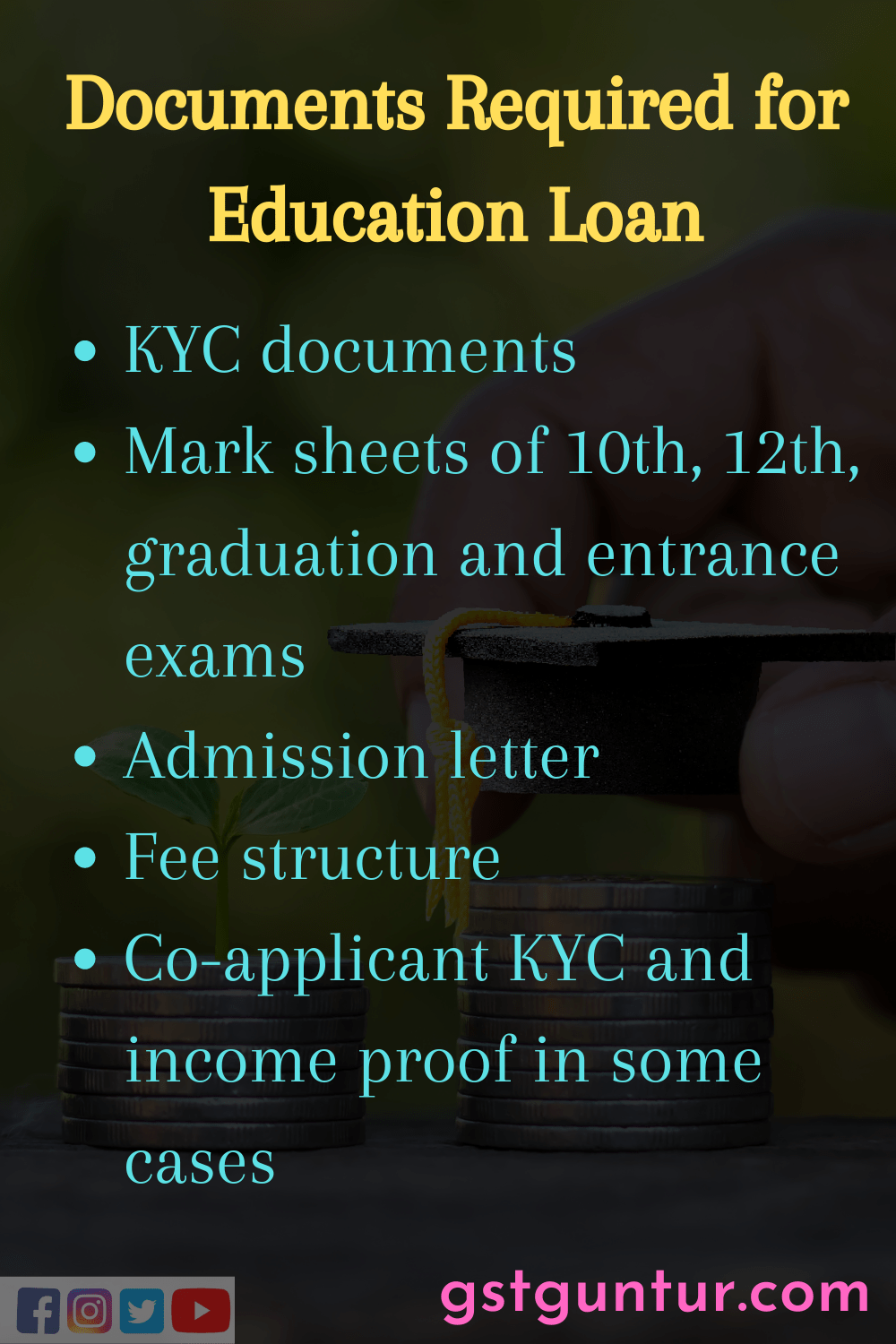

Features And Tax Benefit Of Education Loan In India Student Loans

Features And Tax Benefit Of Education Loan In India Student Loans

Tax free educational assistance For tax free educational assistance received in 2023 reduce the qualified educational expenses for each academic period by the amount of tax free educational assistance

Suppose your gross total income is 10 00 000 and during the year you have repaid interest of 200 000 on an education loan This entire amount of interest

Tax Saving On Education Loan have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: They can make printed materials to meet your requirements such as designing invitations making your schedule, or even decorating your home.

-

Educational Use: These Tax Saving On Education Loan cater to learners of all ages. This makes these printables a powerful resource for educators and parents.

-

Convenience: Access to a myriad of designs as well as templates reduces time and effort.

Where to Find more Tax Saving On Education Loan

Ultimate Guide On Education Loan Eligibility Interest Rates

Ultimate Guide On Education Loan Eligibility Interest Rates

An education loan helps you not only finance your higher studies but it can save you a lot of tax as well If you have taken an education loan and are repaying the same then the interest paid on

An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero

We've now piqued your interest in Tax Saving On Education Loan Let's look into where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection with Tax Saving On Education Loan for all purposes.

- Explore categories such as decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free or flashcards as well as learning materials.

- This is a great resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- These blogs cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Tax Saving On Education Loan

Here are some ideas in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home for the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Tax Saving On Education Loan are an abundance of innovative and useful resources that cater to various needs and interests. Their accessibility and versatility make them an essential part of any professional or personal life. Explore the wide world of Tax Saving On Education Loan today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes they are! You can print and download these tools for free.

-

Can I use free templates for commercial use?

- It's dependent on the particular usage guidelines. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues in Tax Saving On Education Loan?

- Some printables may have restrictions regarding their use. Be sure to review the terms of service and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home with printing equipment or visit the local print shop for the highest quality prints.

-

What software do I require to open Tax Saving On Education Loan?

- The majority of printed documents are in PDF format. They can be opened with free software, such as Adobe Reader.

Home Loan Tax Benefits Interest On Home Loan Section 24 And

Importance And Benefits Of Tax Saving

Check more sample of Tax Saving On Education Loan below

HOME LOAN INTEREST CERTIFICATE For FY 2021 22 PDF Loans Interest

How Useful Are Your Tax Saving Investments Other Than Saving Tax

Tax Savings Options That You Should Know

What Is The Difference Between Tax free Bonds And Tax saving Bonds

As The Financial Year Is Coming To An End Tax Saving Investments Become

Standard Deduction For Salaried Employees Impact Of Standard

https://www.forbes.com/advisor/taxes/student-loan-interest-tax-deduction

To claim the full student loan interest write off your MAGI must be below 70 000 140 000 if you file a joint return with your spouse If your income is between

https://learn.quicko.com/section-80e-deduction-for...

Section 80E of the Income Tax Act is a tax saving provision that provides tax deductions to individuals who have taken education loans to pursue their higher

To claim the full student loan interest write off your MAGI must be below 70 000 140 000 if you file a joint return with your spouse If your income is between

Section 80E of the Income Tax Act is a tax saving provision that provides tax deductions to individuals who have taken education loans to pursue their higher

What Is The Difference Between Tax free Bonds And Tax saving Bonds

How Useful Are Your Tax Saving Investments Other Than Saving Tax

As The Financial Year Is Coming To An End Tax Saving Investments Become

Standard Deduction For Salaried Employees Impact Of Standard

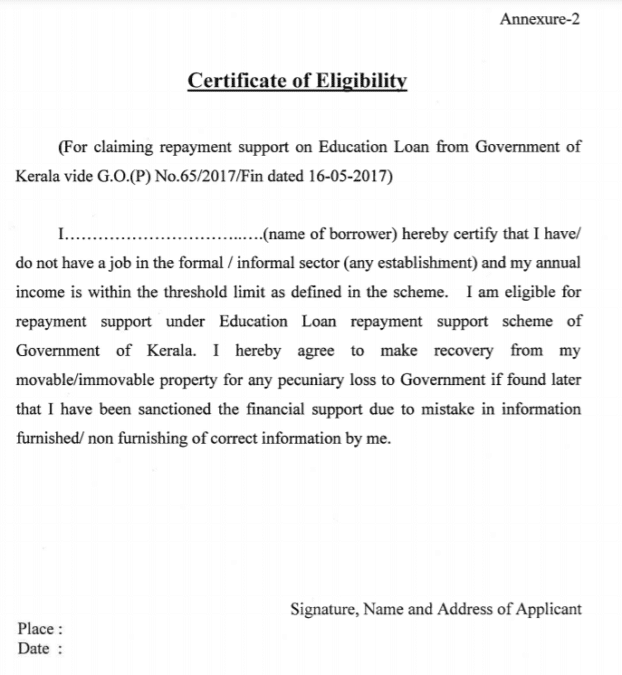

Elrs kerala gov Kerala Education Loan Repayment Scheme 2022 Online

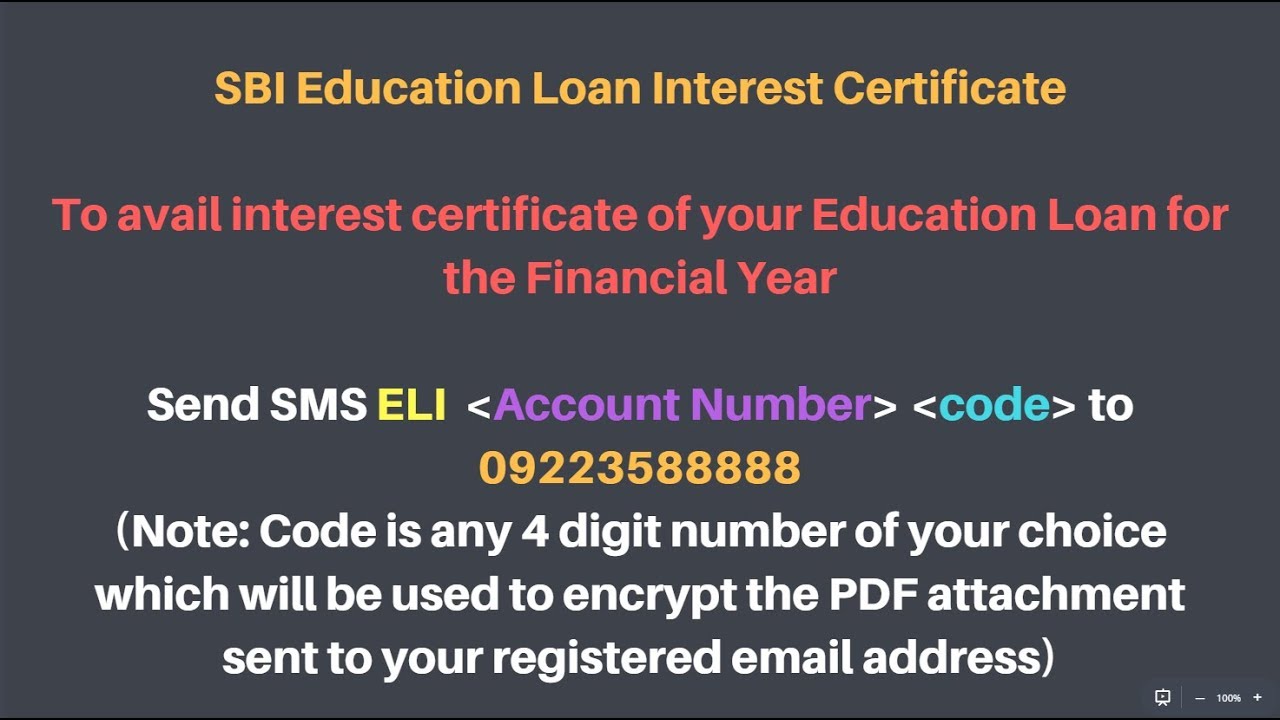

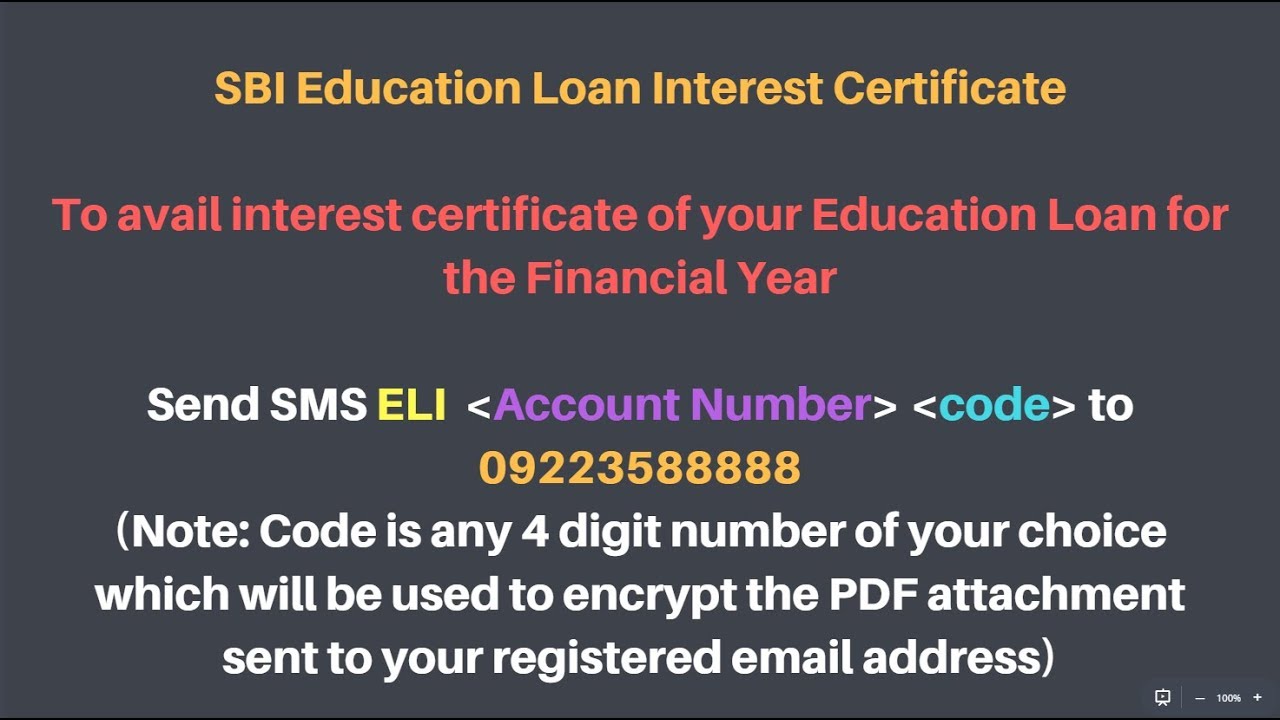

How To Download SBI Education Loan Interest Certificate Through SMS

How To Download SBI Education Loan Interest Certificate Through SMS

Best Tax Saving Investment Scheme ELSSs Wealth4india