In the age of digital, in which screens are the norm it's no wonder that the appeal of tangible, printed materials hasn't diminished. No matter whether it's for educational uses project ideas, artistic or just adding the personal touch to your home, printables for free are a great resource. Here, we'll take a dive into the world "What Energy Efficient Improvements Are Tax Deductible," exploring what they are, where to find them, and how they can improve various aspects of your life.

Get Latest What Energy Efficient Improvements Are Tax Deductible Below

What Energy Efficient Improvements Are Tax Deductible

What Energy Efficient Improvements Are Tax Deductible - What Energy Efficient Improvements Are Tax Deductible, What Energy Efficient Improvements Are Tax Deductible In 2022, What Energy Efficient Home Improvements Are Tax Deductible, What Energy Efficient Items Are Tax Deductible, What Home Energy Improvements Are Tax Deductible

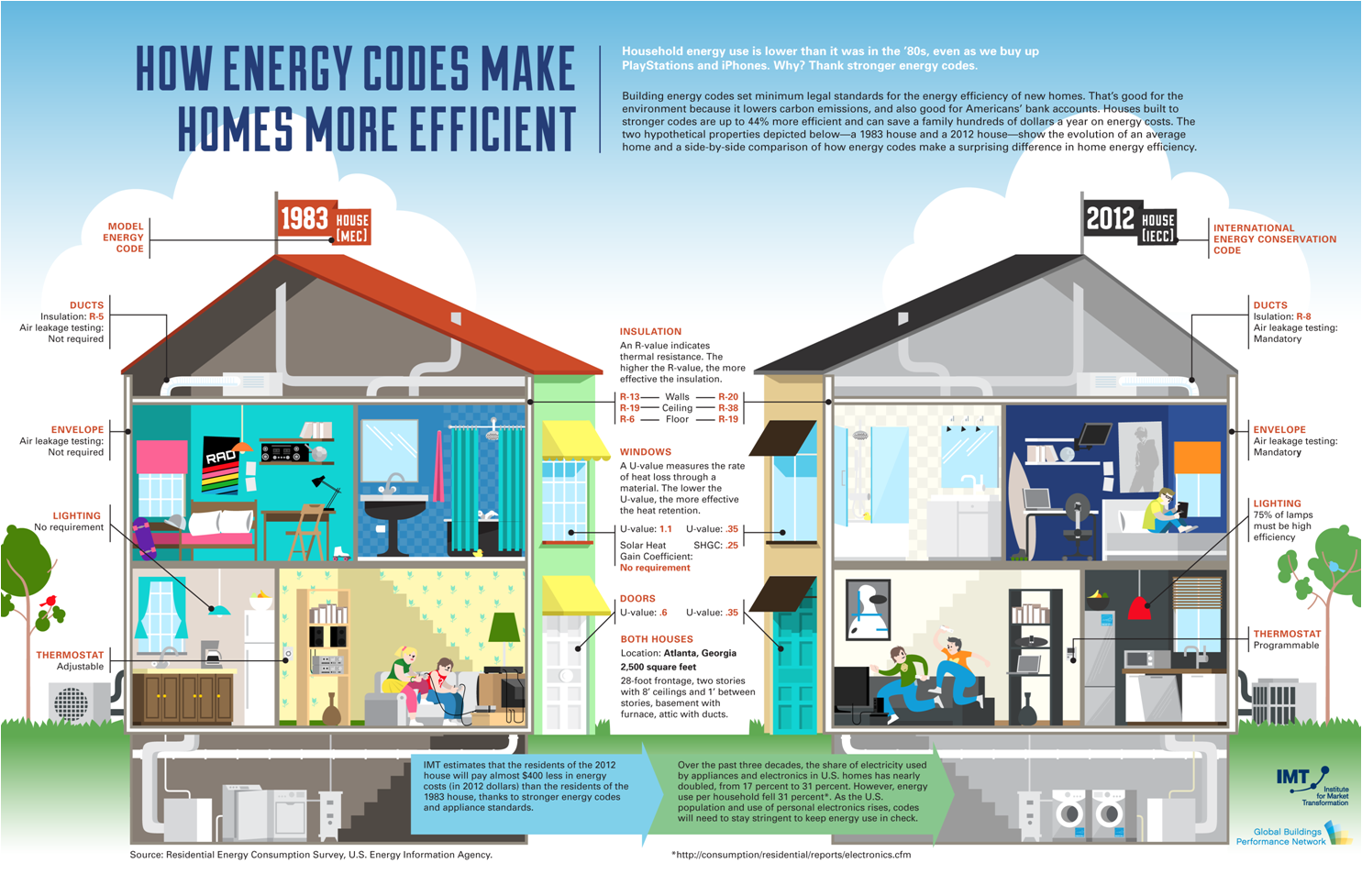

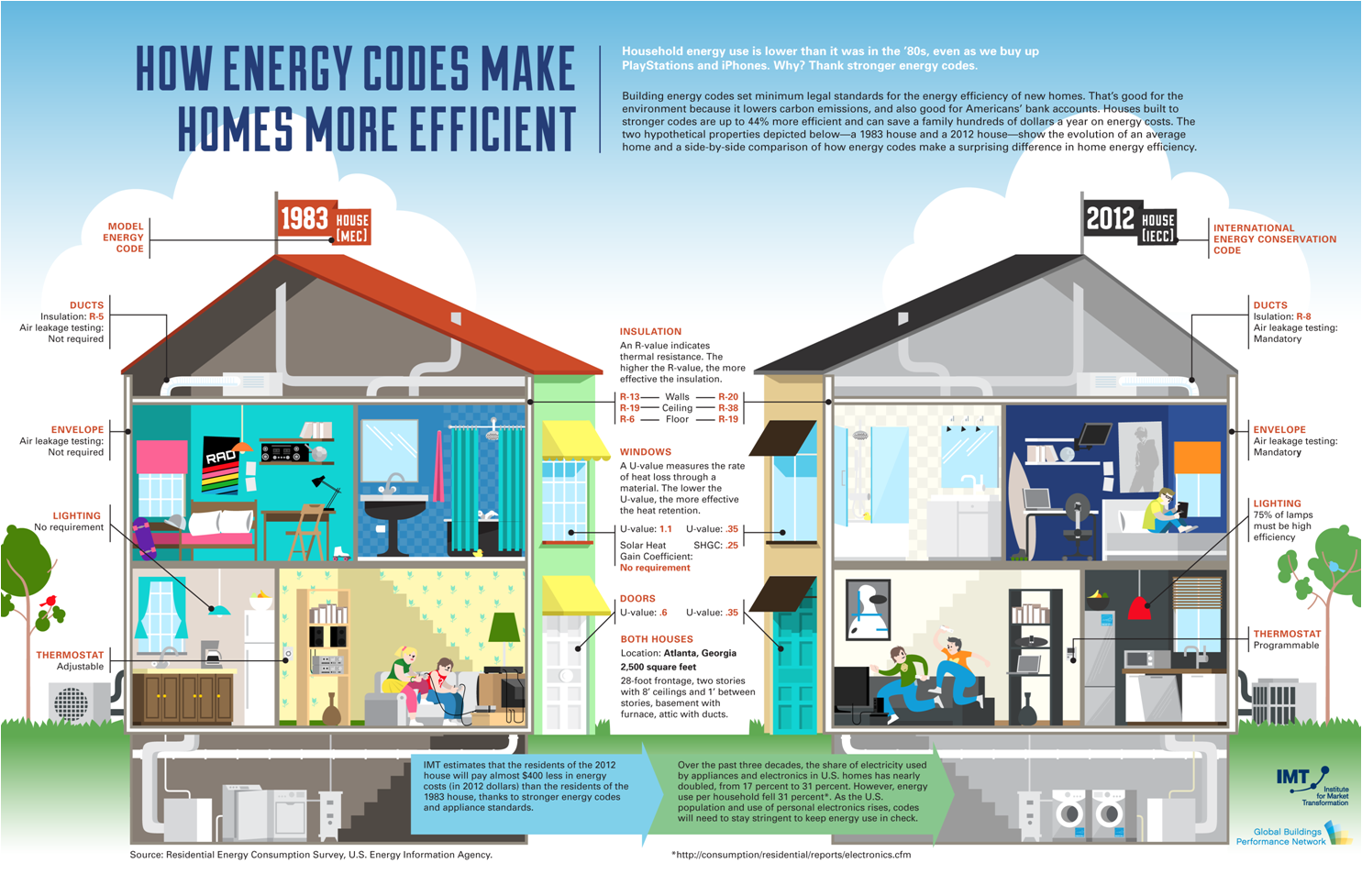

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022 Energy Efficient Upgrades That Qualify for Federal Tax

10 Energy Related Home Improvements You Can Make Today Federal Tax Credit for Solar Energy Are Energy Efficient Appliances Tax Deductible Federal Tax Deductions for Home Renovation Home Improvements and Your Taxes

What Energy Efficient Improvements Are Tax Deductible provide a diverse assortment of printable, downloadable items that are available online at no cost. These materials come in a variety of forms, like worksheets coloring pages, templates and many more. The benefit of What Energy Efficient Improvements Are Tax Deductible lies in their versatility and accessibility.

More of What Energy Efficient Improvements Are Tax Deductible

Are Home Improvements Tax Deductible AppliancePartsPros Blog

Are Home Improvements Tax Deductible AppliancePartsPros Blog

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades SEE TAX

IRS updates FAQs for energy efficient home improvement and residential clean energy property credits April 17 2024 The IRS today issued frequently asked questions FAQs in Fact Sheet 2024 15 to address the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Individualization They can make printing templates to your own specific requirements when it comes to designing invitations and schedules, or even decorating your home.

-

Educational value: Downloads of educational content for free offer a wide range of educational content for learners of all ages. This makes them a useful source for educators and parents.

-

Affordability: You have instant access a plethora of designs and templates can save you time and energy.

Where to Find more What Energy Efficient Improvements Are Tax Deductible

Are Home Improvements Tax Deductible LendingTree

Are Home Improvements Tax Deductible LendingTree

Some home improvements are tax deductible such as capital improvements energy efficiency improvements and improvements related to medical care Key Takeaways Homeowners can

The maximum credit amount is 1 200 for home improvements and 2 000 for heat pumps and biomass stoves or boilers Previously the credit was capped at a 500 lifetime limit

In the event that we've stirred your interest in What Energy Efficient Improvements Are Tax Deductible Let's see where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of What Energy Efficient Improvements Are Tax Deductible for various uses.

- Explore categories such as design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs covered cover a wide array of topics, ranging everything from DIY projects to party planning.

Maximizing What Energy Efficient Improvements Are Tax Deductible

Here are some inventive ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

What Energy Efficient Improvements Are Tax Deductible are an abundance of practical and innovative resources catering to different needs and hobbies. Their accessibility and flexibility make them an invaluable addition to both professional and personal lives. Explore the vast array that is What Energy Efficient Improvements Are Tax Deductible today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Energy Efficient Improvements Are Tax Deductible really for free?

- Yes, they are! You can download and print these documents for free.

-

Can I make use of free templates for commercial use?

- It's based on specific usage guidelines. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues in What Energy Efficient Improvements Are Tax Deductible?

- Some printables may have restrictions on usage. Make sure to read the terms and conditions set forth by the creator.

-

How can I print What Energy Efficient Improvements Are Tax Deductible?

- You can print them at home with the printer, or go to a local print shop to purchase more high-quality prints.

-

What software do I require to view printables free of charge?

- A majority of printed materials are in the format of PDF, which can be opened with free software like Adobe Reader.

Energy Efficient Improvements Prime Energy Solar

Are Home Improvements Tax Deductible 2023

Check more sample of What Energy Efficient Improvements Are Tax Deductible below

What Capital Improvements Are Tax Deductible Tax Deductions Home

Are Home Improvements Tax Deductible Rayne Water

Energy Efficient Home Improvements That Offer Best ROI Land

Capital Improvements Elmer McDuffy

Energy Saving Archives Texas Home Improvement

Making Your Home Energy Efficient Is Tax Deductible Finerpoints

https://turbotax.intuit.com/tax-tips/home...

10 Energy Related Home Improvements You Can Make Today Federal Tax Credit for Solar Energy Are Energy Efficient Appliances Tax Deductible Federal Tax Deductions for Home Renovation Home Improvements and Your Taxes

https://www.irs.gov/newsroom/irs-updates...

IR 2024 113 April 17 2024 The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 to address the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements

10 Energy Related Home Improvements You Can Make Today Federal Tax Credit for Solar Energy Are Energy Efficient Appliances Tax Deductible Federal Tax Deductions for Home Renovation Home Improvements and Your Taxes

IR 2024 113 April 17 2024 The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 to address the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements

Capital Improvements Elmer McDuffy

Are Home Improvements Tax Deductible Rayne Water

Energy Saving Archives Texas Home Improvement

Making Your Home Energy Efficient Is Tax Deductible Finerpoints

North MSP frustrated By Lack Of Firms Registered To Carry Out Energy

Are Home Improvements Tax Deductible

Are Home Improvements Tax Deductible

Energy Efficient Home Improvements That Save Money