In this digital age, with screens dominating our lives, the charm of tangible, printed materials hasn't diminished. Be it for educational use in creative or artistic projects, or simply to add personal touches to your home, printables for free are now a useful source. The following article is a dive through the vast world of "What Is 80d In Itr," exploring the benefits of them, where to get them, as well as ways they can help you improve many aspects of your daily life.

Get Latest What Is 80d In Itr Below

What Is 80d In Itr

What Is 80d In Itr - What Is 80d In Itr, What Is 80d In Income Tax Return, What Is 80d In Income Tax, How To Fill 80d In Itr, What Is 80c And 80d In Income Tax

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are satisfied a The medical expenditure must be incurred either on self spouse or dependent children or and parents

Section 80D of the Income Tax Act 1961 was introduced to promote health planning Under this section taxpayers can claim deductions and tax benefits under health insurance premiums Section 80D provides a deduction for expenditure on the Medical insurance premium Contribution to CGHS Central Govt Health Scheme notified scheme

The What Is 80d In Itr are a huge variety of printable, downloadable materials online, at no cost. These resources come in various designs, including worksheets coloring pages, templates and much more. The beauty of What Is 80d In Itr lies in their versatility and accessibility.

More of What Is 80d In Itr

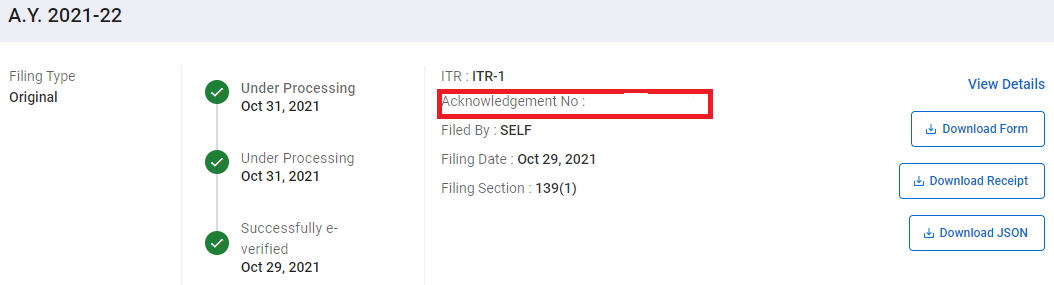

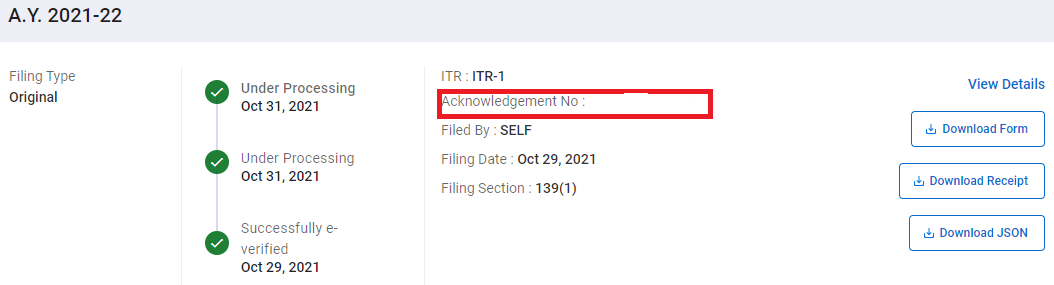

What Is Acknowledgment Number In ITR Income Tax Return Understand

What Is Acknowledgment Number In ITR Income Tax Return Understand

Section 80D is a facility introduced in the Income Tax Act to allow taxpayers to claim a deduction for medical insurance premium paid Claiming a deduction under this section reduces the tax burden of individuals by allowing a claim of deduction for up to Rs 25 000 per year for medical insurance premium

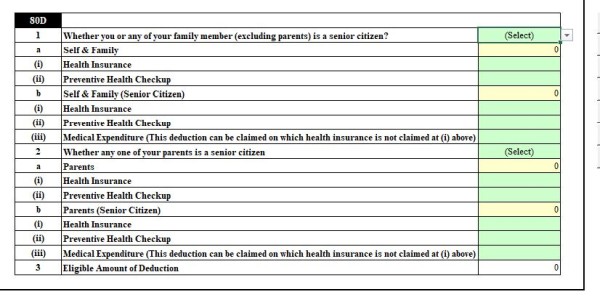

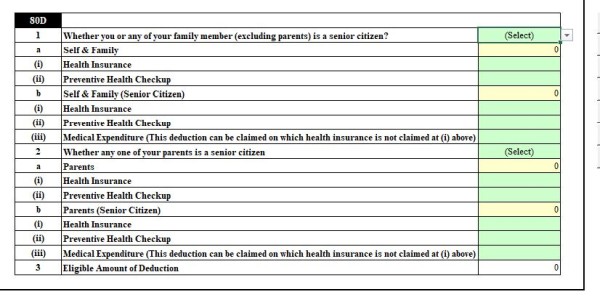

Fill Schedule 80D in ITR Firstly let us understand the eligibility for health insurance premiums paid under Section 80D of the Income Tax Act Taxpayers below 60 years old can claim deductions of up to INR 25 000 annually Senior citizens can claim a maximum deduction of INR 50 000 each year

What Is 80d In Itr have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Flexible: Your HTML0 customization options allow you to customize the design to meet your needs for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your house.

-

Educational Impact: Education-related printables at no charge offer a wide range of educational content for learners of all ages. This makes them a valuable source for educators and parents.

-

Accessibility: Fast access a plethora of designs and templates helps save time and effort.

Where to Find more What Is 80d In Itr

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

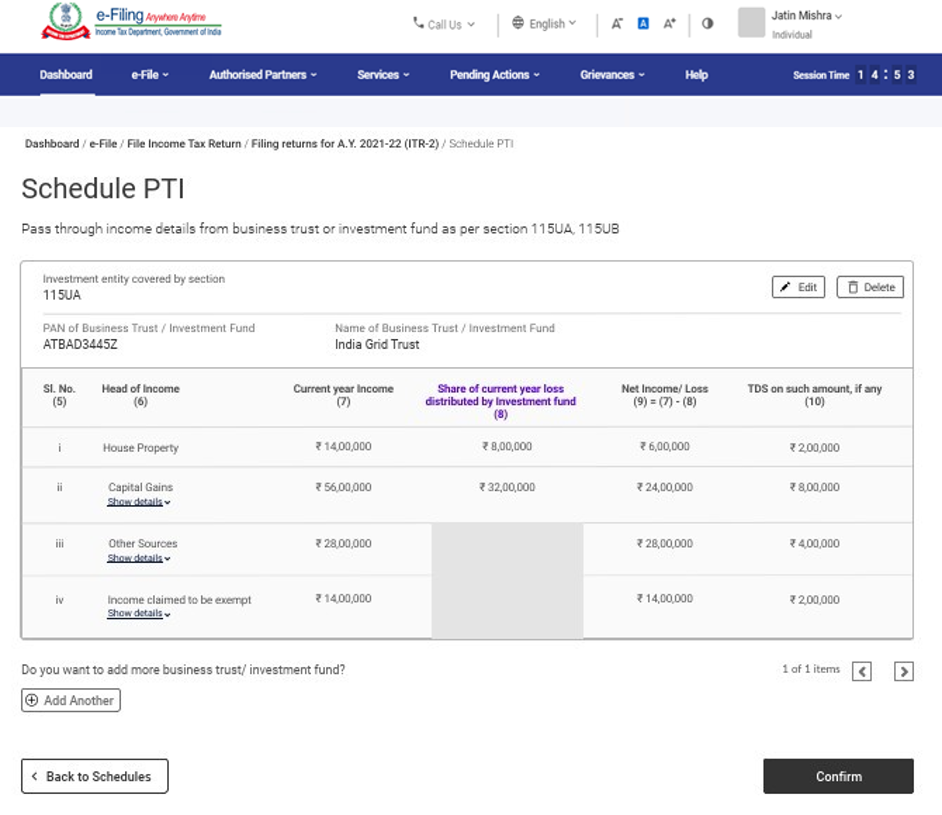

Understanding Section 80D What is Section 80D Who Can Avail Benefits under Section 80D Budget 2023 Impact Increased Deduction Limits Separate Deductions for Parents Inclusion of Preventive Health Checkups The Importance of Filing ITR How to Maximize Your Benefits Choose the Right Health Insurance Plan Keep Documentation in Order

What is Deduction under section 80D Section 80D of the Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the amount paid towards medical insurance premiums medical expenditures and preventive health checkups in a financial year

Since we've got your interest in printables for free Let's look into where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of applications.

- Explore categories such as furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs are a vast spectrum of interests, all the way from DIY projects to party planning.

Maximizing What Is 80d In Itr

Here are some inventive ways to make the most use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Utilize free printable worksheets to reinforce learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

What Is 80d In Itr are an abundance of practical and imaginative resources that meet a variety of needs and preferences. Their accessibility and versatility make these printables a useful addition to any professional or personal life. Explore the many options of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes they are! You can print and download these items for free.

-

Does it allow me to use free printables to make commercial products?

- It's dependent on the particular terms of use. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns when using What Is 80d In Itr?

- Some printables may have restrictions regarding their use. You should read the terms and conditions set forth by the creator.

-

How can I print printables for free?

- Print them at home using your printer or visit a local print shop for better quality prints.

-

What software do I need to open printables that are free?

- Most PDF-based printables are available with PDF formats, which can be opened with free software like Adobe Reader.

Unboxing Canon 80D What s In The Box YouTube

Preventive Check Up 80d Wkcn

Check more sample of What Is 80d In Itr below

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

What Is 80D For Senior Citizens

2 Income Tax Department

80D Tax Benefits 80D Medical Expenditure And Preventive Health

Help In Schedule 80D In ITR2 Income Tax ITR

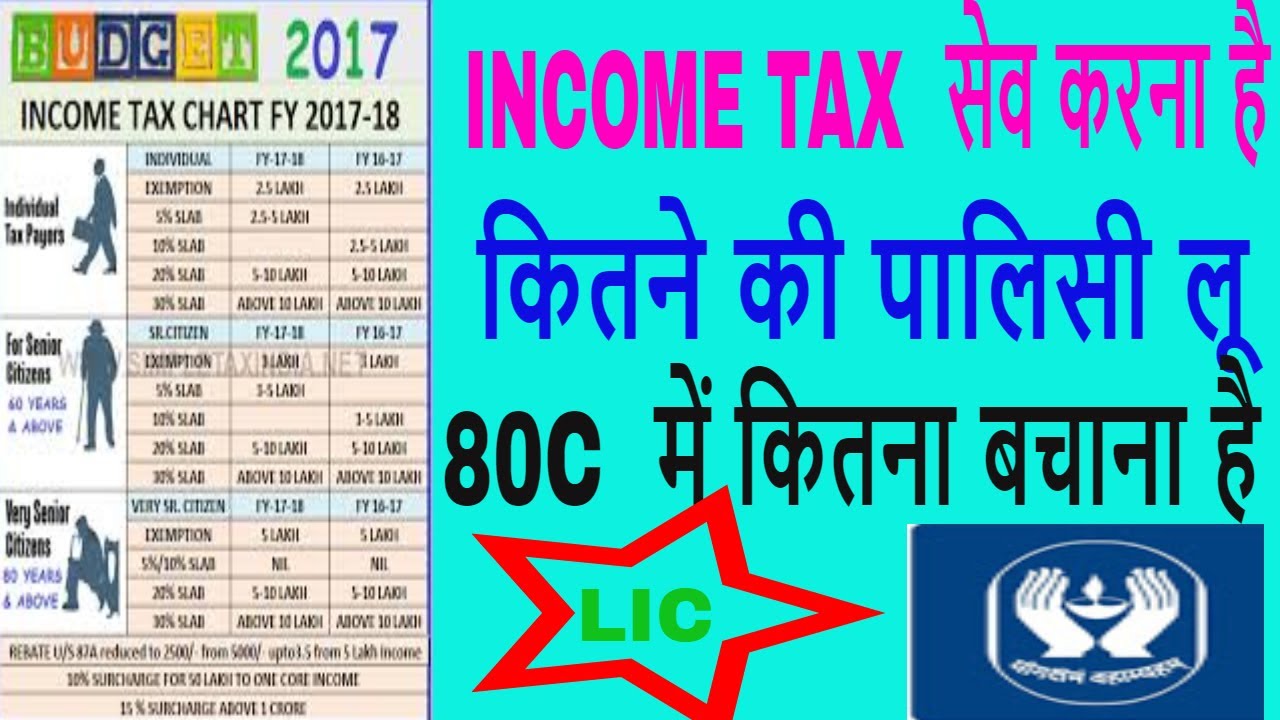

HOW TO SAVE INCOME TAX 80C 80D BY LIC NEW INCOME TAX SLAB 2018 YouTube

https://tax2win.in/guide/section-80d-deduction...

Section 80D of the Income Tax Act 1961 was introduced to promote health planning Under this section taxpayers can claim deductions and tax benefits under health insurance premiums Section 80D provides a deduction for expenditure on the Medical insurance premium Contribution to CGHS Central Govt Health Scheme notified scheme

https://m.economictimes.com/wealth/tax/you-can...

Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual has paid medical insurance premium during the year for self spouse and dependent children

Section 80D of the Income Tax Act 1961 was introduced to promote health planning Under this section taxpayers can claim deductions and tax benefits under health insurance premiums Section 80D provides a deduction for expenditure on the Medical insurance premium Contribution to CGHS Central Govt Health Scheme notified scheme

Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual has paid medical insurance premium during the year for self spouse and dependent children

80D Tax Benefits 80D Medical Expenditure And Preventive Health

What Is 80D For Senior Citizens

Help In Schedule 80D In ITR2 Income Tax ITR

HOW TO SAVE INCOME TAX 80C 80D BY LIC NEW INCOME TAX SLAB 2018 YouTube

What Is 80D In Health Insurance

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Bra Bust Size Off 69 Medpharmres