In the digital age, where screens have become the dominant feature of our lives The appeal of tangible printed materials isn't diminishing. Whatever the reason, whether for education project ideas, artistic or just adding an element of personalization to your space, What Is 80ddb Deduction In Income Tax have proven to be a valuable resource. The following article is a take a dive through the vast world of "What Is 80ddb Deduction In Income Tax," exploring their purpose, where to find them and how they can enrich various aspects of your lives.

Get Latest What Is 80ddb Deduction In Income Tax Below

What Is 80ddb Deduction In Income Tax

What Is 80ddb Deduction In Income Tax - What Is 80ddb Deduction In Income Tax, What Is 80ddb Deduction, What Is 80ddb In Income Tax, How Much Deduction Under 80ddb

1 Section 80DDB offers a beneficial tax deduction for medical expenses for treatment of specified diseases 2 Cancer dementia motor neuron diseases Parkinson s disease AIDS and chronic renal failure are among the specified ailments

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s disease AIDS and chronic renal failure This section is applicable to individual taxpayers Hindu Undivided Families HUFs and residents The

Printables for free cover a broad range of downloadable, printable items that are available online at no cost. They come in many types, such as worksheets templates, coloring pages, and many more. The great thing about What Is 80ddb Deduction In Income Tax is their flexibility and accessibility.

More of What Is 80ddb Deduction In Income Tax

What Is Provision Of Claiming Medical Expenses In Income Tax Sec 80ddb

What Is Provision Of Claiming Medical Expenses In Income Tax Sec 80ddb

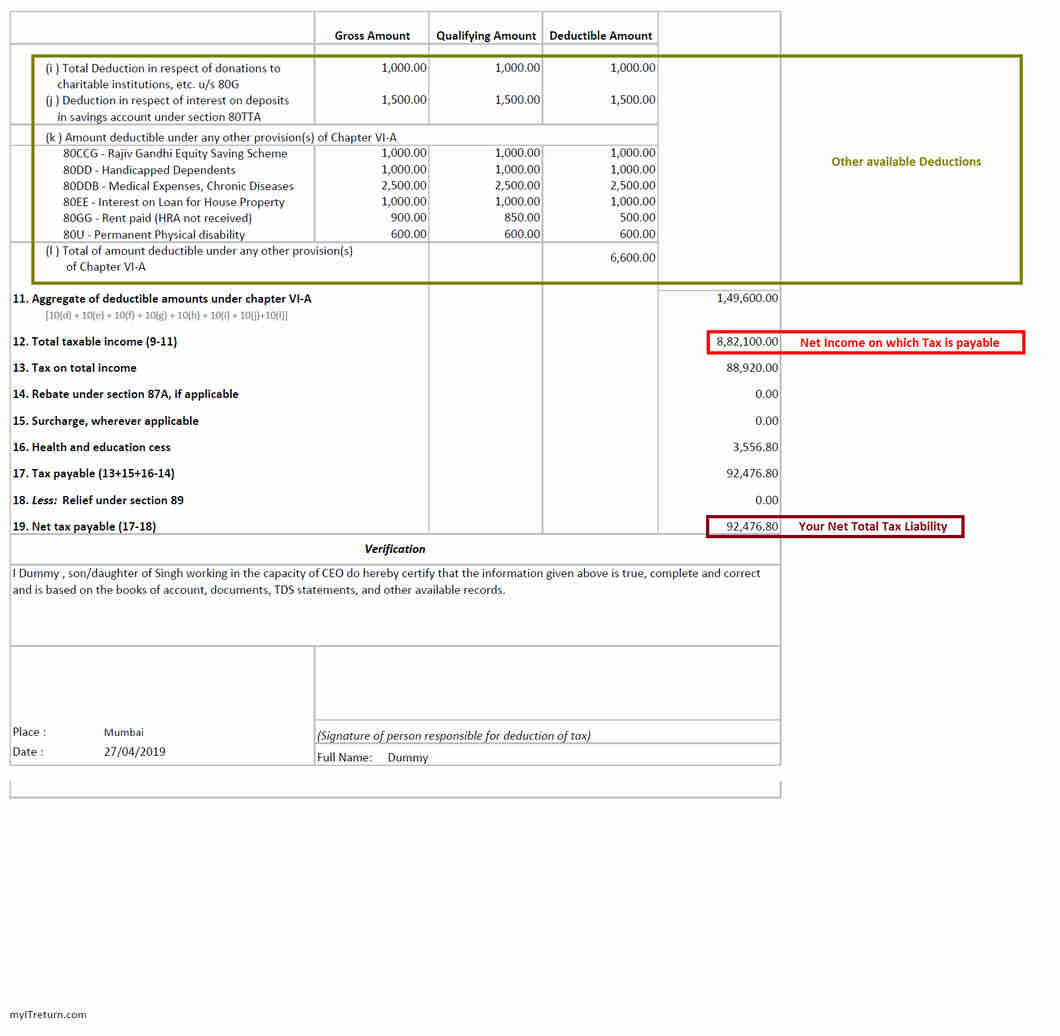

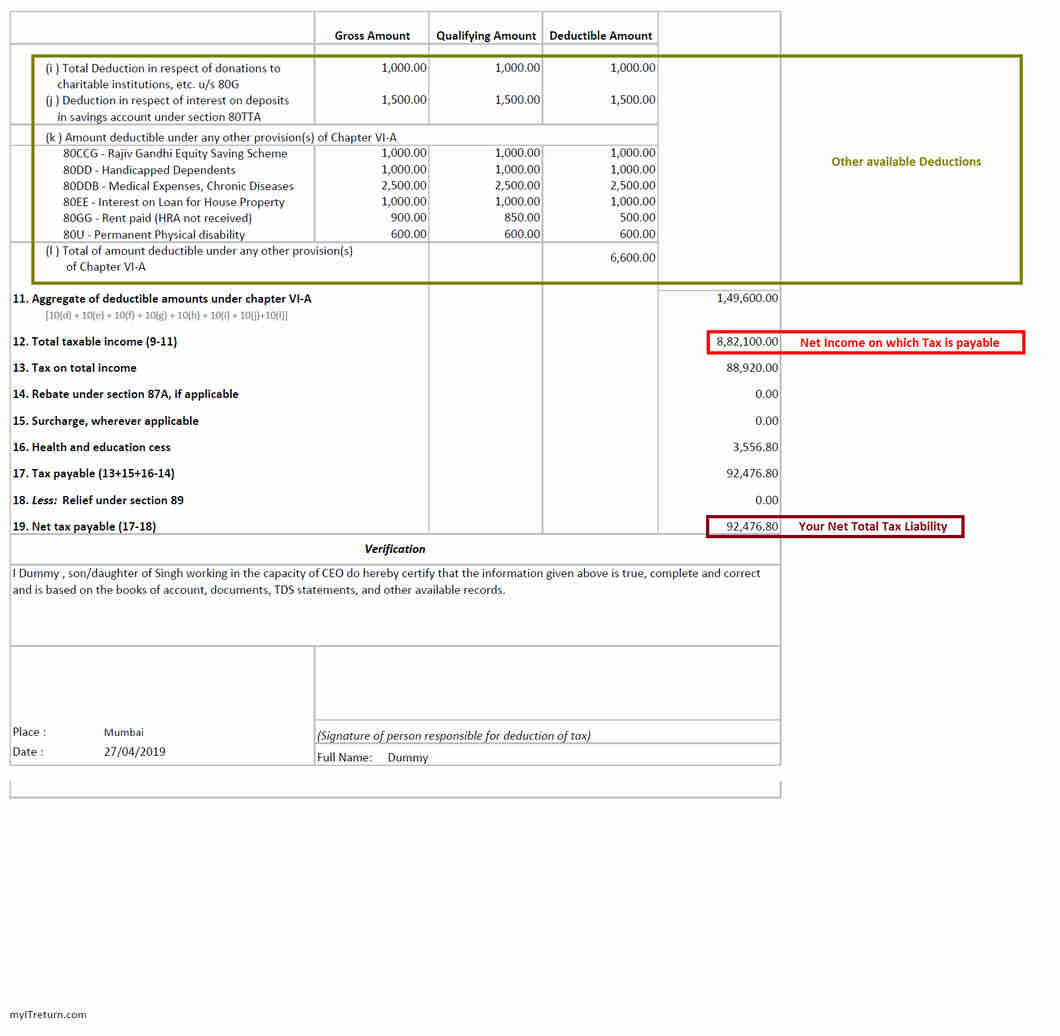

Section 80DDB provides for a deduction to Individuals and HUFs for medical expenses incurred for treatment of specified diseases or ailments and should be deducted from the Gross Total Income while computing the taxable income of the assessee

Deduction under section 80DDB of the Income Tax Act is available towards the amount actually paid for the medical treatment of the specified disease The current article explains all the provisions attached with the said deduction along with the frequently asked questions

What Is 80ddb Deduction In Income Tax have gained a lot of popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Personalization The Customization feature lets you tailor printables to fit your particular needs in designing invitations to organize your schedule or decorating your home.

-

Educational Worth: Education-related printables at no charge cater to learners of all ages, making them an invaluable tool for parents and educators.

-

Convenience: You have instant access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more What Is 80ddb Deduction In Income Tax

Section 80EEA Eligibility And Deduction Amount

Section 80EEA Eligibility And Deduction Amount

Section 80DDB is a section introduced in the Income Tax Act for allowing individuals suffering from specific diseases to claim a deduction from the taxable income For certain specific diseases the Government offers tax deduction to individuals and HUFs under Section 80DDB on the basis of expenses incurred for the treatment of the

Under the Section 80DDB an individual can claim for deduction up to Rs 40 000 If an individual on behalf of whom such medical expenditure is incurred is a senior citizen then one can claim

We've now piqued your interest in printables for free Let's see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of What Is 80ddb Deduction In Income Tax to suit a variety of purposes.

- Explore categories like decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free, flashcards, and learning tools.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a wide spectrum of interests, including DIY projects to party planning.

Maximizing What Is 80ddb Deduction In Income Tax

Here are some inventive ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

What Is 80ddb Deduction In Income Tax are a treasure trove of innovative and useful resources that satisfy a wide range of requirements and preferences. Their accessibility and flexibility make them a great addition to both professional and personal life. Explore the vast array of What Is 80ddb Deduction In Income Tax right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes you can! You can print and download these tools for free.

-

Can I use the free printables for commercial purposes?

- It is contingent on the specific usage guidelines. Always check the creator's guidelines before using their printables for commercial projects.

-

Are there any copyright rights issues with What Is 80ddb Deduction In Income Tax?

- Some printables may come with restrictions on usage. Be sure to read the terms and regulations provided by the author.

-

How can I print printables for free?

- You can print them at home with either a printer or go to a print shop in your area for top quality prints.

-

What software do I need in order to open What Is 80ddb Deduction In Income Tax?

- Many printables are offered in the format of PDF, which is open with no cost software like Adobe Reader.

Section 80DDB Of Income Tax Limit Diseases Deduction

80DDB Deduction Limit For AY 2021 22 New Tax Route

Check more sample of What Is 80ddb Deduction In Income Tax below

SECTION 80DDB DEDUCTION FOR EXPENSES ON SPECIFIED DISEASES INCOME

Deduction Under Section 80DD 80DDB And 80U

A Guide To Avail Tax Deduction Under Section 80DDB

Anything To Everything Income Tax Guide For Individuals Including

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

Standard Deduction In Income Tax 2022

https://tax2win.in/guide/section-80ddb

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s disease AIDS and chronic renal failure This section is applicable to individual taxpayers Hindu Undivided Families HUFs and residents The

https://www.taxbuddy.com/blog/80ddb-deduction

Under Section 80DDB of the Income Tax Act financial relief is given to the taxpayer by allowing him deduction for medical treatment of specified diseases These limits differ according to the patient s age and have been revised from time to time to adjust for an escalation in health care costs

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s disease AIDS and chronic renal failure This section is applicable to individual taxpayers Hindu Undivided Families HUFs and residents The

Under Section 80DDB of the Income Tax Act financial relief is given to the taxpayer by allowing him deduction for medical treatment of specified diseases These limits differ according to the patient s age and have been revised from time to time to adjust for an escalation in health care costs

Anything To Everything Income Tax Guide For Individuals Including

Deduction Under Section 80DD 80DDB And 80U

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

Standard Deduction In Income Tax 2022

Section 80DDB Tax Deduction For Critical Illness Medical Expense

Income Tax Deduction Section 80DDB YouTube

Income Tax Deduction Section 80DDB YouTube

Understanding 80DDB Deduction For Medical Treatment