In this digital age, in which screens are the norm The appeal of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply adding an individual touch to the home, printables for free are now an essential source. In this article, we'll take a dive through the vast world of "What Is Income Tax Section 80ddb," exploring what they are, where you can find them, and how they can improve various aspects of your life.

Get Latest What Is Income Tax Section 80ddb Below

What Is Income Tax Section 80ddb

What Is Income Tax Section 80ddb - What Is Income Tax Section 80ddb, Income Tax Section 80ddb In Hindi, Income Tax Section 80ddb Limit, Income Tax Section 80ddb Pdf, Income Tax Section 80ddb Form Download, Income Tax Section 80ddb Rule 11dd, What Is 80ddb In Income Tax, What Is Section 80ddb

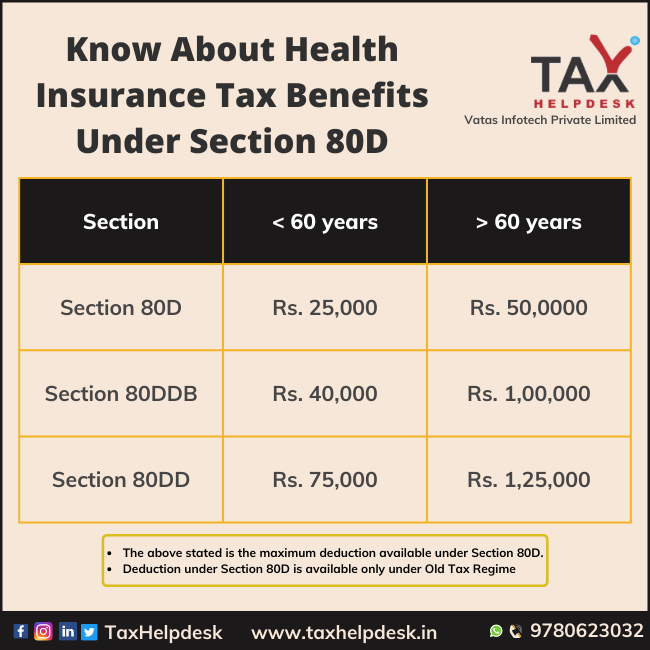

Under Section 80DDB of the Income Tax Act of 1961 tax payers suffering from specified diseases may claim an exemption from taxes This exemption is based on the expenses incurred to treat the disease

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s disease AIDS and chronic renal failure

Printables for free cover a broad assortment of printable materials that are accessible online for free cost. They are available in numerous forms, like worksheets templates, coloring pages, and much more. The great thing about What Is Income Tax Section 80ddb is their flexibility and accessibility.

More of What Is Income Tax Section 80ddb

Section 80DDB Diseases Covered Certificate Deductions Masters India

Section 80DDB Diseases Covered Certificate Deductions Masters India

Learn how to claim tax deduction for medical expenses for treatment of specified diseases under Section 80DDB Find out the eligible ailments the amount of deduction and the conditions for insurance or reimbursement

Learn how to claim deductions under Section 80DDB of the Income Tax Act for expenses incurred on treatment of specified diseases Find out the eligibility limit documents and prescription requirements for this tax benefit

What Is Income Tax Section 80ddb have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Individualization The Customization feature lets you tailor printing templates to your own specific requirements for invitations, whether that's creating them as well as organizing your calendar, or even decorating your house.

-

Educational Value: Printables for education that are free offer a wide range of educational content for learners of all ages, which makes them a vital tool for parents and educators.

-

It's easy: immediate access many designs and templates reduces time and effort.

Where to Find more What Is Income Tax Section 80ddb

Section 80DDB In Tamil Treatment For Specific Diseases In Tamil

Section 80DDB In Tamil Treatment For Specific Diseases In Tamil

Learn how to claim a tax deduction for medical expenses of dependents suffering from specified diseases under Section 80DDB of the Income Tax Act 1961 Find out the eligibility criteria deduction amount documents required and

Learn how to claim a tax deduction for medical expenses incurred for neurological cancer AIDS dementia and other diseases under section 80DDB of the Income Tax Act Find out the eligibility limit calculation

If we've already piqued your curiosity about What Is Income Tax Section 80ddb Let's see where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in What Is Income Tax Section 80ddb for different purposes.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- It is ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- These blogs cover a broad range of topics, including DIY projects to party planning.

Maximizing What Is Income Tax Section 80ddb

Here are some fresh ways that you can make use of What Is Income Tax Section 80ddb:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print worksheets that are free to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

What Is Income Tax Section 80ddb are a treasure trove of useful and creative resources that can meet the needs of a variety of people and interest. Their accessibility and versatility make them a valuable addition to each day life. Explore the wide world of What Is Income Tax Section 80ddb now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes they are! You can download and print these tools for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It's contingent upon the specific rules of usage. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Do you have any copyright rights issues with What Is Income Tax Section 80ddb?

- Some printables may have restrictions concerning their use. Be sure to read the terms and conditions offered by the creator.

-

How can I print printables for free?

- Print them at home with a printer or visit the local print shop for top quality prints.

-

What program must I use to open printables at no cost?

- The majority of PDF documents are provided with PDF formats, which is open with no cost programs like Adobe Reader.

Section 80DDB Deductions For Specified Diseases And Ailments

Anything To Everything Income Tax Guide For Individuals Including

Check more sample of What Is Income Tax Section 80ddb below

Section 80DDB Of The Income Tax Act Deduction For Medical Treatment

SECTION 80DDB DEDUCTION FOR EXPENSES ON SPECIFIED DISEASES INCOME

Preventive Check Up 80d Wkcn

Section 244A Eligibility And TDS Applicable

Section 80DDB Of Income Tax Limit Diseases Deduction

Deduction Under Chapter 6A Of Income Tax Act Section 80D 80DD

https://tax2win.in/guide/section-80ddb

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s disease AIDS and chronic renal failure

https://www.taxbuddy.com/blog/80ddb-deduction

Learn about Section 80DDB of the Income Tax Act which provides relief to taxpayers for medical expenses on serious illnesses Find out the diseases covered eligibility criteria deduction limits and required documentation for claiming this deduction

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s disease AIDS and chronic renal failure

Learn about Section 80DDB of the Income Tax Act which provides relief to taxpayers for medical expenses on serious illnesses Find out the diseases covered eligibility criteria deduction limits and required documentation for claiming this deduction

Section 244A Eligibility And TDS Applicable

SECTION 80DDB DEDUCTION FOR EXPENSES ON SPECIFIED DISEASES INCOME

Section 80DDB Of Income Tax Limit Diseases Deduction

Deduction Under Chapter 6A Of Income Tax Act Section 80D 80DD

Section 80DDB Tax Deduction For Critical Illness Medical Expense

Section 80DDB Of Income Tax Act Understanding Eligibility Specified

Section 80DDB Of Income Tax Act Understanding Eligibility Specified

Section 80DDB Of Income Tax Act 2023 Guide InstaFiling