In this age of technology, where screens have become the dominant feature of our lives yet the appeal of tangible, printed materials hasn't diminished. Whatever the reason, whether for education, creative projects, or just adding an individual touch to your home, printables for free are a great resource. This article will take a dive to the depths of "What Tax Form For Energy Credit," exploring what they are, how they are, and how they can improve various aspects of your lives.

Get Latest What Tax Form For Energy Credit Below

What Tax Form For Energy Credit

What Tax Form For Energy Credit - What Tax Form For Energy Credit, What Qualifies For Energy Tax Credit, What Is The Federal Energy Tax Credit, What Is Energy Tax Credit, Can I Claim Energy Tax Credit

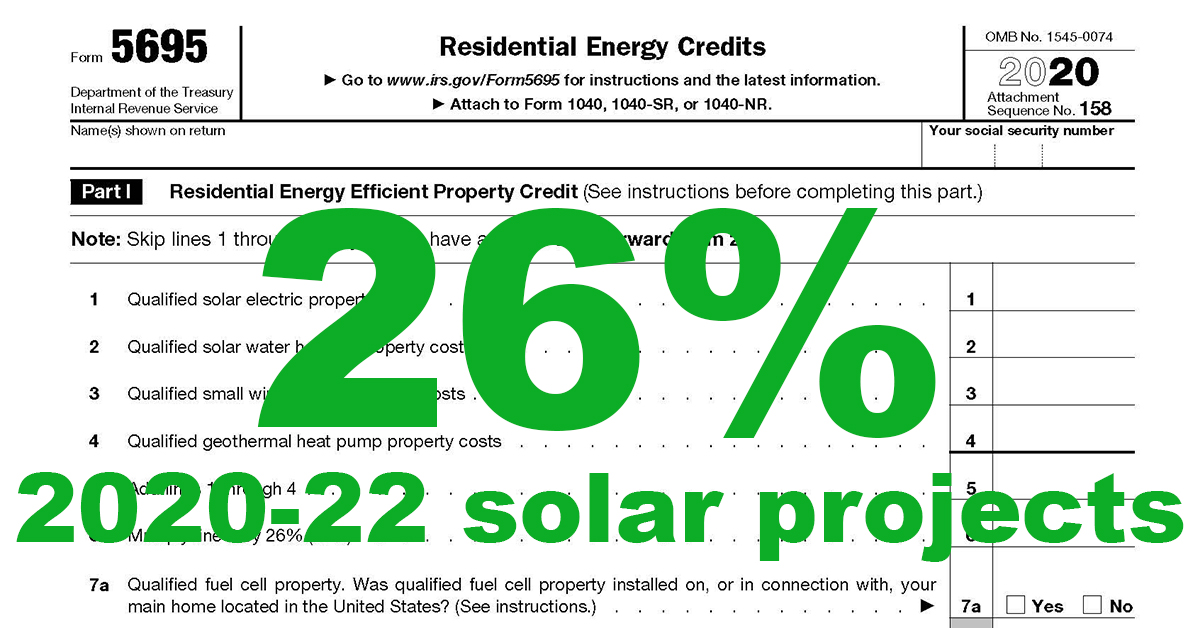

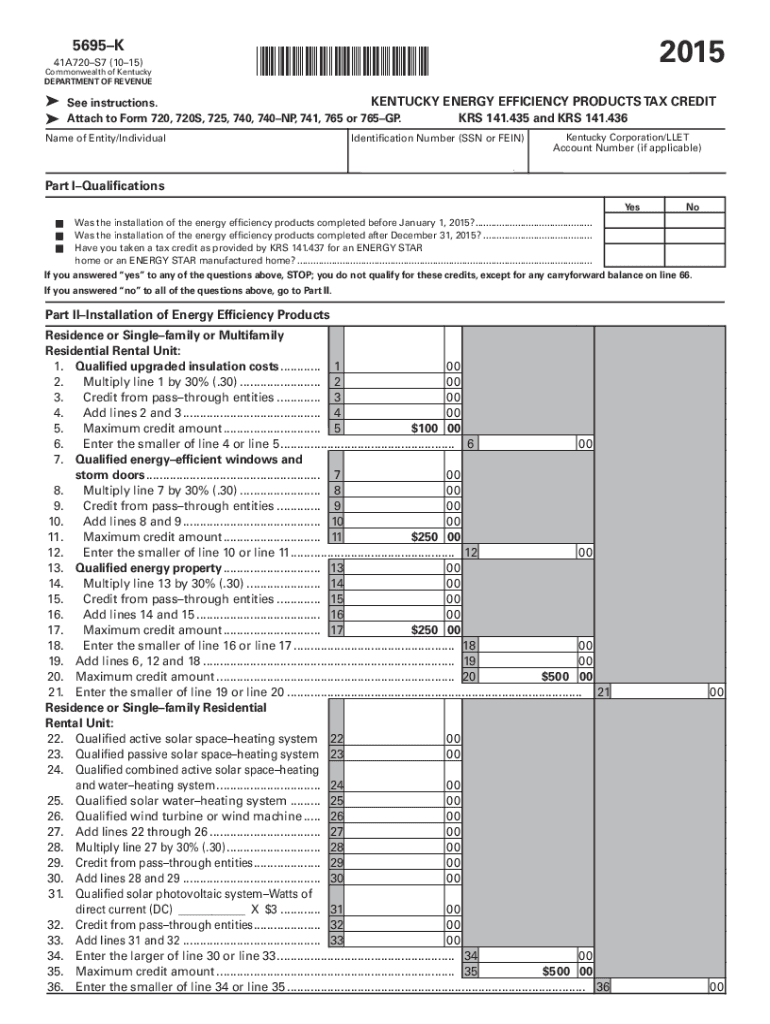

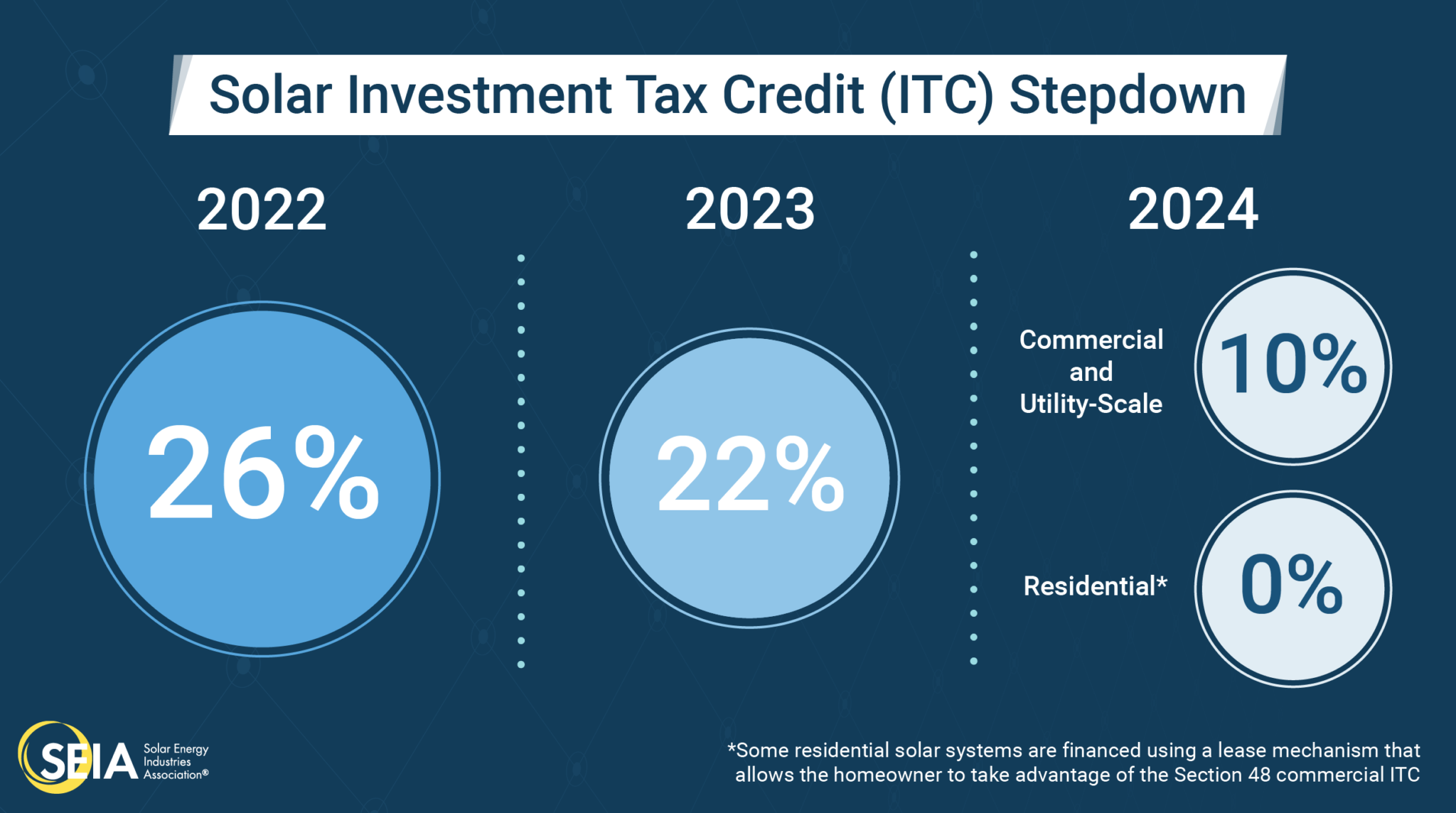

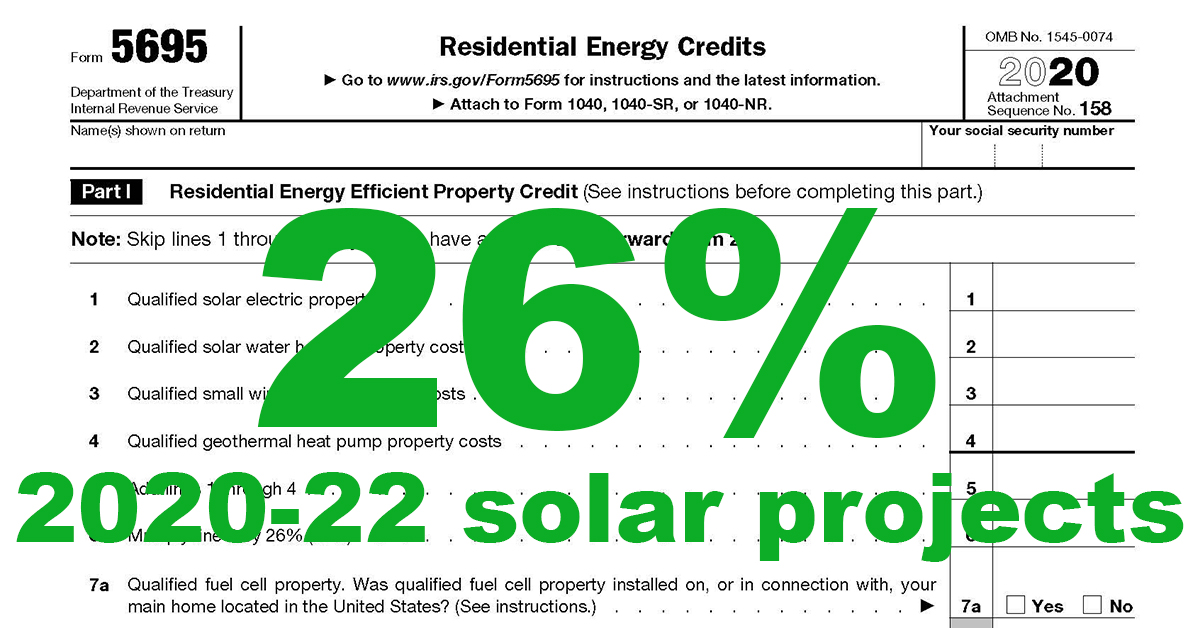

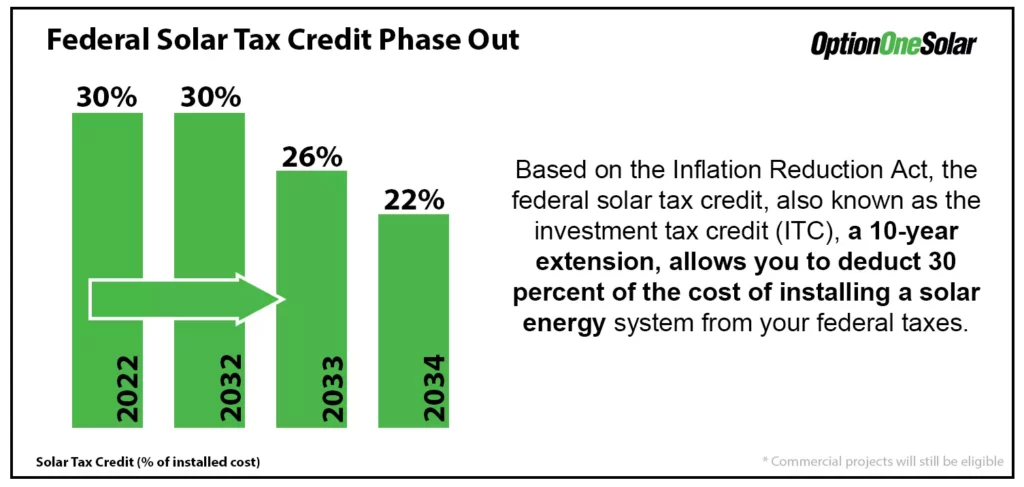

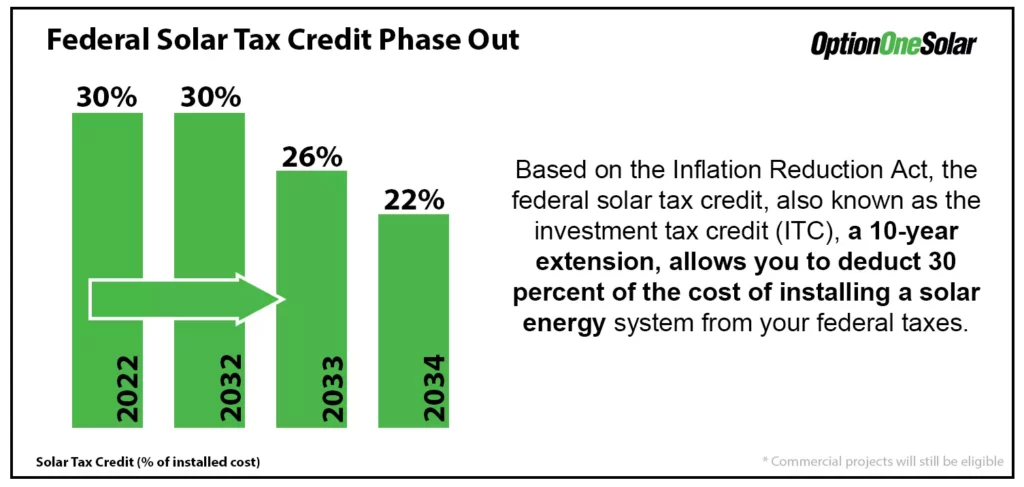

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

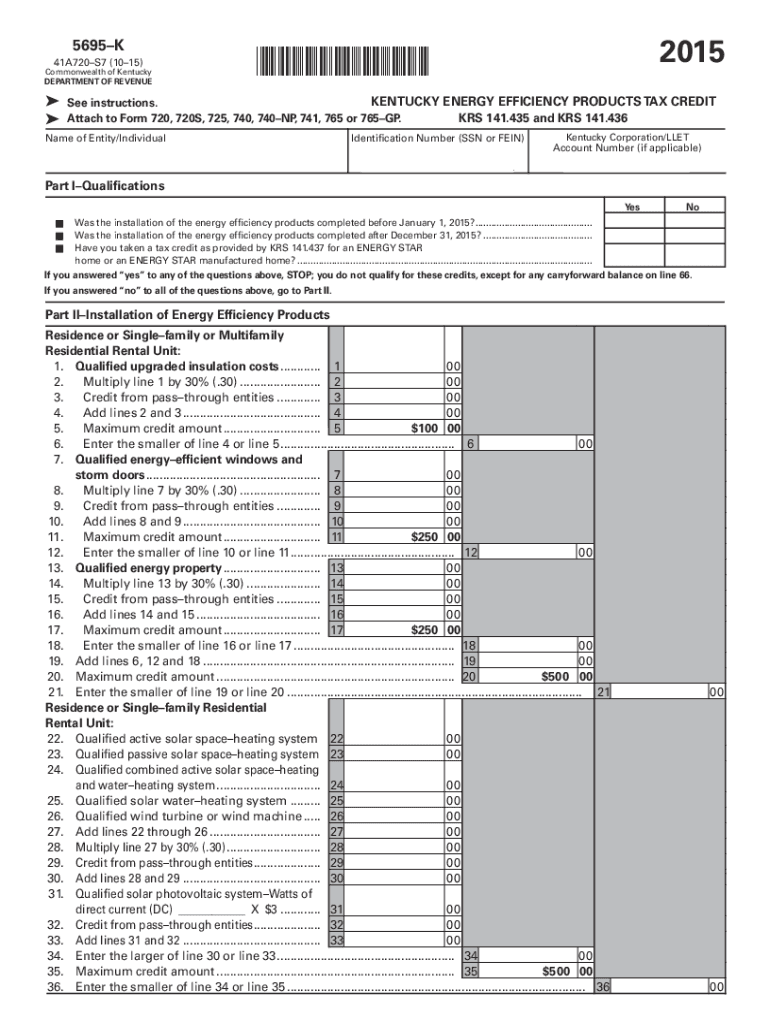

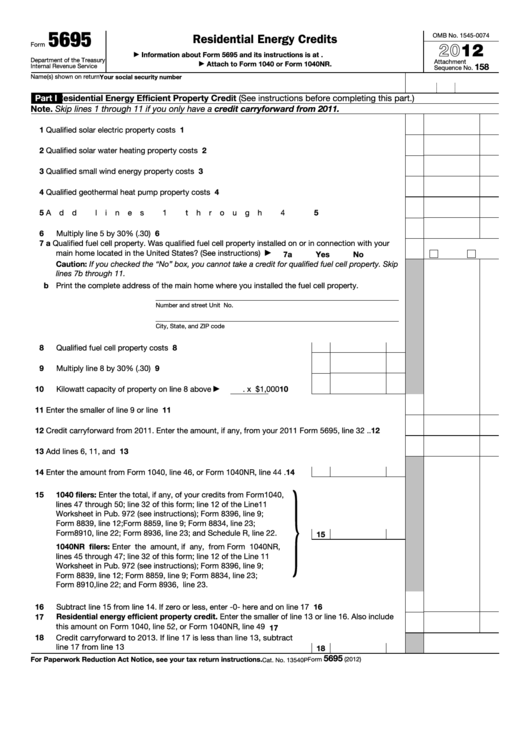

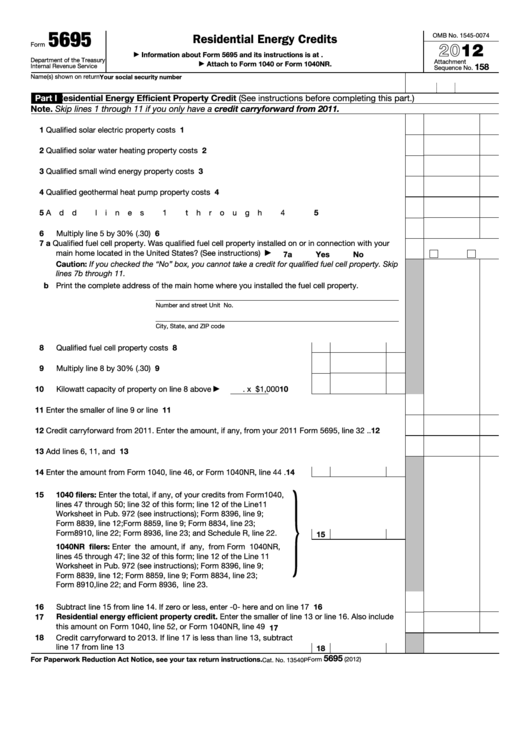

The residential energy credits are The residential clean energy credit and The energy efficient home improvement credit Also use Form 5695 to take any residential clean energy credit carryforward from 2022 Form 5695 or to carry the unused portion of the residential clean energy credit to 2024

The What Tax Form For Energy Credit are a huge assortment of printable material that is available online at no cost. The resources are offered in a variety designs, including worksheets templates, coloring pages, and more. The beauty of What Tax Form For Energy Credit is in their versatility and accessibility.

More of What Tax Form For Energy Credit

Solar Tax Credit What You Need To Know NRG Clean Power

Solar Tax Credit What You Need To Know NRG Clean Power

You must complete IRS Form 5695 if you qualify to claim the non business energy property credit or the residential energy efficient property credit TABLE OF CONTENTS Home improvement credits Nonbusiness Energy Property credit through 2022 Energy Efficient Home Improvement credit for 2023 through 2032 Click to expand

The residential energy efficient property credit best known as the residential energy credit and most commonly claimed by homeowners is claimed in Part I of Form 5695 The nonbusiness energy property credit is

What Tax Form For Energy Credit have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Individualization You can tailor print-ready templates to your specific requirements whether it's making invitations as well as organizing your calendar, or even decorating your home.

-

Educational Use: Educational printables that can be downloaded for free can be used by students from all ages, making them an invaluable tool for parents and teachers.

-

Convenience: You have instant access a plethora of designs and templates saves time and effort.

Where to Find more What Tax Form For Energy Credit

For 346PRODUCTION Www directingactors

For 346PRODUCTION Www directingactors

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but

The residential energy credits are The residential clean energy credit and The energy efficient home improvement credit Also use Form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit for 2023 Who Can Take the Credits You may be able

We've now piqued your interest in printables for free Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of What Tax Form For Energy Credit suitable for many uses.

- Explore categories like home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs are a vast array of topics, ranging including DIY projects to planning a party.

Maximizing What Tax Form For Energy Credit

Here are some creative ways create the maximum value of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Utilize free printable worksheets to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

What Tax Form For Energy Credit are a treasure trove of practical and innovative resources catering to different needs and needs and. Their availability and versatility make they a beneficial addition to your professional and personal life. Explore the vast collection of What Tax Form For Energy Credit right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Tax Form For Energy Credit really free?

- Yes, they are! You can download and print these documents for free.

-

Can I utilize free printables for commercial use?

- It is contingent on the specific usage guidelines. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns with What Tax Form For Energy Credit?

- Some printables may contain restrictions in use. Be sure to review the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home using any printer or head to an area print shop for the highest quality prints.

-

What software do I need to open printables that are free?

- Most PDF-based printables are available in PDF format, which can be opened using free software, such as Adobe Reader.

Residential Energy Efficient Property Credit Limit Worksheet

Free Printable 1040Ez Form

Check more sample of What Tax Form For Energy Credit below

How Do I Apply For The Tax Credit Tax Form For Energy Efficiency Tax

Energy Audit Data Collection Form Fill And Sign Printable Template

Client Intake Form For Energy Healing PDF Energy Medicine

Does My New Air Conditioner Qualify For Energy Credit Smart AC Solutions

Puget Sound Solar LLC

Form 5695 Fillable Printable Forms Free Online

https://www.irs.gov/instructions/i5695

The residential energy credits are The residential clean energy credit and The energy efficient home improvement credit Also use Form 5695 to take any residential clean energy credit carryforward from 2022 Form 5695 or to carry the unused portion of the residential clean energy credit to 2024

https://www.investopedia.com/terms/e/energy-tax-credit.asp

Key Takeaways An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces the total

The residential energy credits are The residential clean energy credit and The energy efficient home improvement credit Also use Form 5695 to take any residential clean energy credit carryforward from 2022 Form 5695 or to carry the unused portion of the residential clean energy credit to 2024

Key Takeaways An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces the total

Does My New Air Conditioner Qualify For Energy Credit Smart AC Solutions

Energy Audit Data Collection Form Fill And Sign Printable Template

Puget Sound Solar LLC

Form 5695 Fillable Printable Forms Free Online

What Tax Form Does A New Employee Fill Out 2023 Employeeform

Solar Panel Installation In Barstow Option One Solar

Solar Panel Installation In Barstow Option One Solar

State Of Michigan Fillable Forms Fill Out And Sign Printable PDF