In a world in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. For educational purposes such as creative projects or simply to add a personal touch to your area, Where Do You Put Union Dues On Tax Return have become a valuable resource. Through this post, we'll take a dive into the sphere of "Where Do You Put Union Dues On Tax Return," exploring the benefits of them, where to locate them, and how they can enhance various aspects of your life.

Get Latest Where Do You Put Union Dues On Tax Return Below

Where Do You Put Union Dues On Tax Return

Where Do You Put Union Dues On Tax Return -

You can deduct dues and initiation fees you pay for union membership These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized

If you re a member of a union you may be eligible for a tax break on your union dues By deducting your dues on Schedule C you can maximize your tax refunds To claim this deduction you must be an eligible individual

Where Do You Put Union Dues On Tax Return cover a large selection of printable and downloadable resources available online for download at no cost. These resources come in many types, such as worksheets templates, coloring pages and more. One of the advantages of Where Do You Put Union Dues On Tax Return is in their variety and accessibility.

More of Where Do You Put Union Dues On Tax Return

Tax Deduction For Union Dues Included In The Budget Plan Ballotpedia News

Tax Deduction For Union Dues Included In The Budget Plan Ballotpedia News

If you re self employed you can deduct union dues as a business expense However most employees can no longer deduct union dues on their federal tax return in tax years 2018

Where to write off your union dues There are a few places on Schedule C where you can report them Line 17 under Legal and professional services Line 8 under Advertising if you paid for membership specifically

Where Do You Put Union Dues On Tax Return have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Modifications: There is the possibility of tailoring print-ready templates to your specific requirements such as designing invitations and schedules, or even decorating your home.

-

Educational value: Printables for education that are free are designed to appeal to students of all ages, which makes the perfect device for teachers and parents.

-

Affordability: Instant access to many designs and templates helps save time and effort.

Where to Find more Where Do You Put Union Dues On Tax Return

Can You Deduct Union Dues On Your Federal Income Tax Return The

Can You Deduct Union Dues On Your Federal Income Tax Return The

Under current federal law union dues are generally not deductible However there are a few exceptions and if your union dues meet one of them you are in luck

To claim your union dues deduction simply report the amount you paid in union dues on Schedule 1 of your tax return Form 1040 You ll list it under Adjustments to Income as a

We hope we've stimulated your interest in printables for free We'll take a look around to see where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Where Do You Put Union Dues On Tax Return for all goals.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets with flashcards and other teaching tools.

- It is ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- The blogs are a vast spectrum of interests, from DIY projects to party planning.

Maximizing Where Do You Put Union Dues On Tax Return

Here are some ways that you can make use of Where Do You Put Union Dues On Tax Return:

1. Home Decor

- Print and frame stunning art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home or in the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Where Do You Put Union Dues On Tax Return are an abundance of fun and practical tools catering to different needs and interest. Their accessibility and versatility make they a beneficial addition to any professional or personal life. Explore the many options of Where Do You Put Union Dues On Tax Return today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes you can! You can download and print these materials for free.

-

Does it allow me to use free printouts for commercial usage?

- It's dependent on the particular conditions of use. Always consult the author's guidelines before using their printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables could be restricted on their use. Be sure to check the terms and conditions provided by the designer.

-

How do I print printables for free?

- Print them at home using the printer, or go to any local print store for superior prints.

-

What program do I need in order to open printables free of charge?

- Most printables come in the format of PDF, which can be opened with free software such as Adobe Reader.

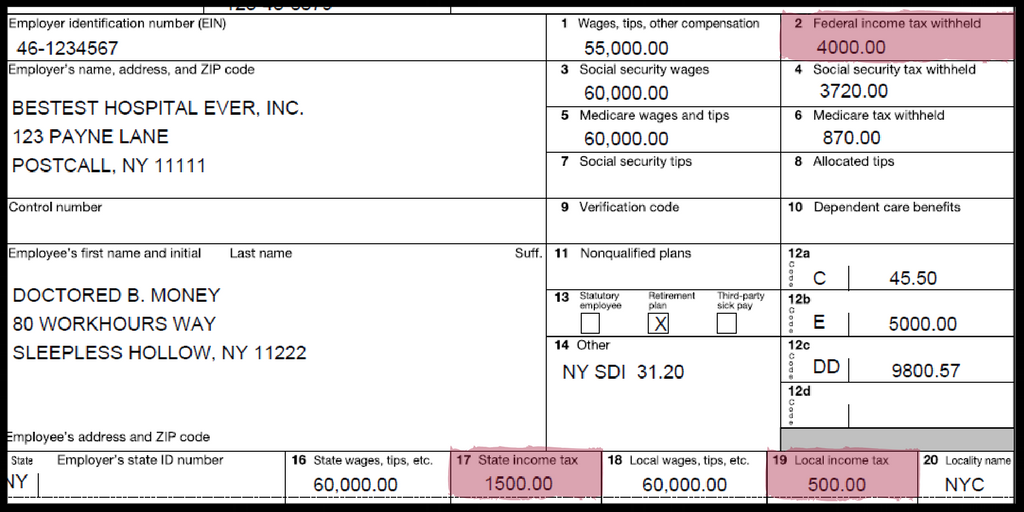

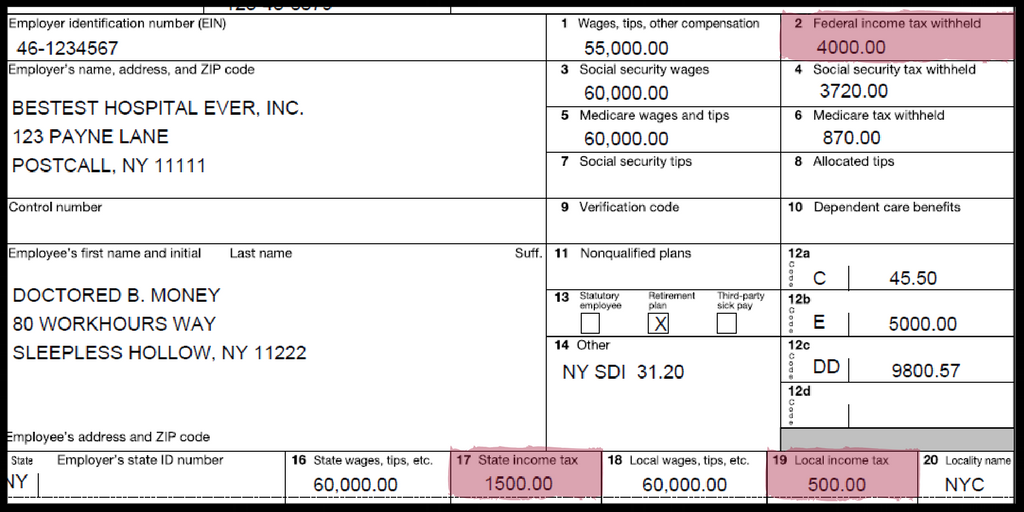

Friday Feature The W2 Catchall Box 14 Escape Technology

Pay POAM Union Dues On Our Website

Check more sample of Where Do You Put Union Dues On Tax Return below

2023 Federal Tax Brackets Are Out See Which Bracket You Fall In and

Man Denied Exemption To Union Dues On Religious Grounds After Board

Illinois Teachers Saw Union Dues Flow To Chicago Groups Politics And

How A Teachers Union Puts Its Stamp On NJ Politics NJ Spotlight News

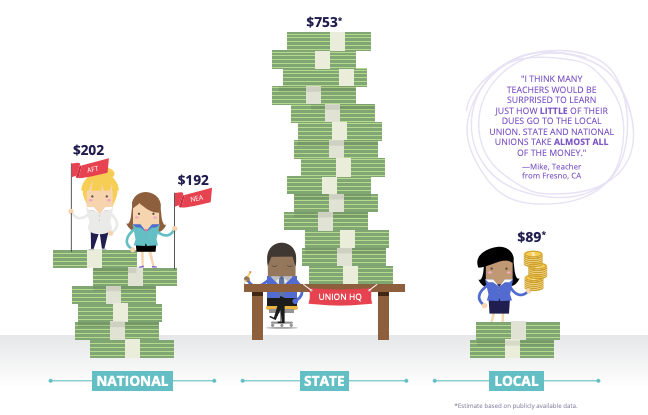

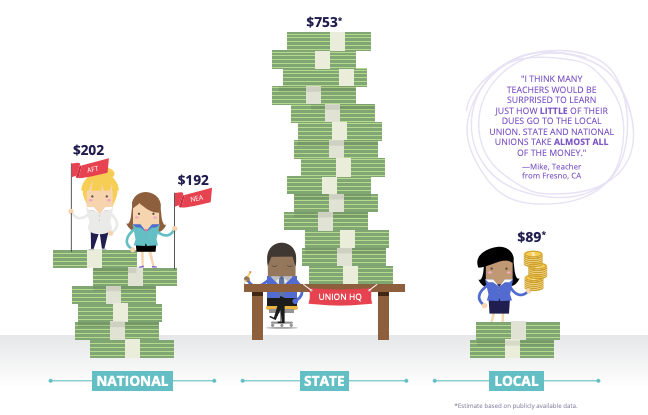

Where Do California Teacher Union Dues Go Teacher Freedom

Maxime Ausflug Damit W2 Box 14 E Gelehrter Feindlich Begleiten

https://www.irs.com › en › are-union-d…

If you re a member of a union you may be eligible for a tax break on your union dues By deducting your dues on Schedule C you can maximize your tax refunds To claim this deduction you must be an eligible individual

https://ttlc.intuit.com › community › taxes › discussion

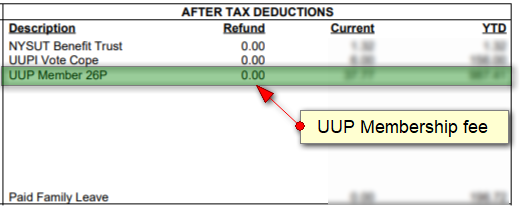

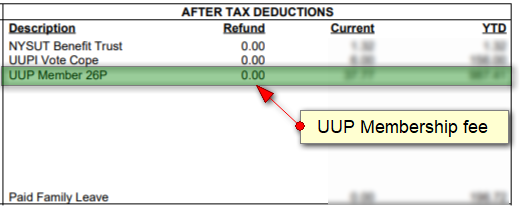

Employers disclose Union Dues paid by employees in Box 14 on Form W 2 You can deduct dues and initiation fees you pay for union membership as unreimbursed employee

If you re a member of a union you may be eligible for a tax break on your union dues By deducting your dues on Schedule C you can maximize your tax refunds To claim this deduction you must be an eligible individual

Employers disclose Union Dues paid by employees in Box 14 on Form W 2 You can deduct dues and initiation fees you pay for union membership as unreimbursed employee

How A Teachers Union Puts Its Stamp On NJ Politics NJ Spotlight News

Man Denied Exemption To Union Dues On Religious Grounds After Board

Where Do California Teacher Union Dues Go Teacher Freedom

Maxime Ausflug Damit W2 Box 14 E Gelehrter Feindlich Begleiten

IAM Union Quickly Folds In Boeing Technician s Lawsuit Over Unlawful

Deducting Union Dues On NYS Taxes UUP Buffalo Center

Deducting Union Dues On NYS Taxes UUP Buffalo Center

Tax Checklist Union Dues Moving Expenses School Supplies For