In this digital age, where screens dominate our lives, the charm of tangible printed items hasn't gone away. If it's to aid in education such as creative projects or simply adding an extra personal touch to your area, Who Can Claim Fuel Tax Credits Ato have proven to be a valuable source. Here, we'll dive into the world of "Who Can Claim Fuel Tax Credits Ato," exploring the different types of printables, where to find them, and how they can add value to various aspects of your daily life.

Get Latest Who Can Claim Fuel Tax Credits Ato Below

Who Can Claim Fuel Tax Credits Ato

Who Can Claim Fuel Tax Credits Ato - Who Can Claim Fuel Tax Credits Ato, Can I Claim The Fuel Tax Credit, Ato Fuel Tax Credits Eligibility, Is Fuel Tax Credit Taxable Income Ato

Registration for both GST and fuel tax credits is required before fuel tax credits can be claimed If already registered for GST the registration for fuel tax credits can be added by an authorised contact person

To be eligible for claiming fuel tax credits a fuel must be taxable That is fuel tax excise or customs duty must be paid on it You can use our Fuel tax credit eligibility tool to check

Printables for free include a vast assortment of printable, downloadable materials available online at no cost. They come in many forms, including worksheets, templates, coloring pages, and more. The beauty of Who Can Claim Fuel Tax Credits Ato is their versatility and accessibility.

More of Who Can Claim Fuel Tax Credits Ato

Accountancy Group Fuel Tax Credit Changes Accountancy Group

Accountancy Group Fuel Tax Credit Changes Accountancy Group

You may be able to claim credits that is get money back for fuel you use in your small business Find out if the fuel and business activities you undertake are eligible for fuel

Check fuel tax credit rates for non businesses from 1 July 2021 to 30 June 2022

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Flexible: There is the possibility of tailoring printed materials to meet your requirements when it comes to designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational value: Education-related printables at no charge are designed to appeal to students from all ages, making the perfect source for educators and parents.

-

Easy to use: Instant access to the vast array of design and templates helps save time and effort.

Where to Find more Who Can Claim Fuel Tax Credits Ato

Fuel Tax Credit Changes HTA

Fuel Tax Credit Changes HTA

In order to be eligible to claim fuel tax credits individuals and businesses have to meet specific criteria set by the ATO But first let s discuss the types of assets

No you do not need to send any documentation to the Tax Office or the Department to claim the fuel tax credit You should however have and retain adequate documentation

We've now piqued your curiosity about Who Can Claim Fuel Tax Credits Ato Let's see where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of goals.

- Explore categories such as interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free, flashcards, and learning tools.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- The blogs covered cover a wide variety of topics, everything from DIY projects to party planning.

Maximizing Who Can Claim Fuel Tax Credits Ato

Here are some unique ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities for teaching at-home for the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Who Can Claim Fuel Tax Credits Ato are a treasure trove filled with creative and practical information that can meet the needs of a variety of people and interests. Their access and versatility makes these printables a useful addition to each day life. Explore the many options of Who Can Claim Fuel Tax Credits Ato today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes they are! You can print and download these tools for free.

-

Can I use the free printables for commercial uses?

- It's all dependent on the usage guidelines. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Are there any copyright issues when you download Who Can Claim Fuel Tax Credits Ato?

- Some printables may have restrictions regarding their use. Be sure to read the conditions and terms of use provided by the author.

-

How can I print printables for free?

- You can print them at home with either a printer at home or in the local print shops for top quality prints.

-

What software do I need to run printables free of charge?

- The majority of printed documents are in the PDF format, and is open with no cost programs like Adobe Reader.

Fuel Tax Credits Banlaw

STM Accounting Group Fuel Tax Credit Changes

Check more sample of Who Can Claim Fuel Tax Credits Ato below

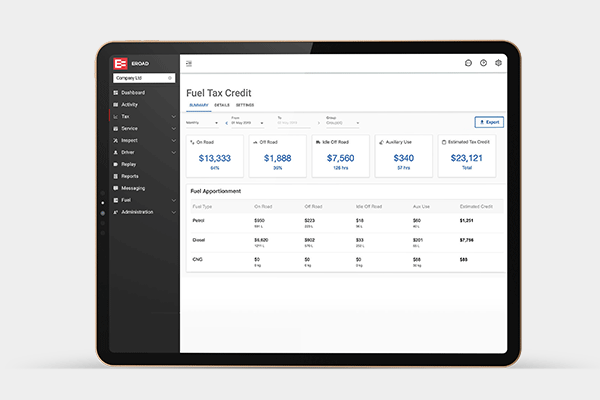

EROAD Receives ATO Class Ruling For Its Fuel Tax Credits Solution

Fuel Tax Credit Changes

Fuel Prices To Rise Following Budget End Prime Mover Magazine

Can You Claim Fuel Tax Credit Accru Melbourne

NOT COMPLYING BY SUPER LAWS CAN CAUSE DIRECTOR DISQUALIFICATION

Fuel Tax Credit Changes The Garis Group

https://www.ato.gov.au/.../eligibility/eligible-fuels

To be eligible for claiming fuel tax credits a fuel must be taxable That is fuel tax excise or customs duty must be paid on it You can use our Fuel tax credit eligibility tool to check

https://business.gov.au/finance/taxation/claim-fuel-tax-credits

You claim fuel tax credits on your BAS Before you can claim on your BAS you need to calculate your fuel tax credits To get your claim right use the fuel tax credit tools on the

To be eligible for claiming fuel tax credits a fuel must be taxable That is fuel tax excise or customs duty must be paid on it You can use our Fuel tax credit eligibility tool to check

You claim fuel tax credits on your BAS Before you can claim on your BAS you need to calculate your fuel tax credits To get your claim right use the fuel tax credit tools on the

Can You Claim Fuel Tax Credit Accru Melbourne

Fuel Tax Credit Changes

NOT COMPLYING BY SUPER LAWS CAN CAUSE DIRECTOR DISQUALIFICATION

Fuel Tax Credit Changes The Garis Group

Fuel Tax Credit Rates Reduced Howe Ford Boxer

What Vehicles Can Claim Fuel Tax Credits Leia Aqui What Qualifies As

What Vehicles Can Claim Fuel Tax Credits Leia Aqui What Qualifies As

Am I Eligible For Fuel Tax Credits Fuel Tax Assist