In this day and age where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. No matter whether it's for educational uses or creative projects, or simply to add a personal touch to your home, printables for free are now a useful resource. In this article, we'll dive to the depths of "Can You Claim Education Credit If Married Filing Separately," exploring the benefits of them, where to get them, as well as how they can add value to various aspects of your life.

Get Latest Can You Claim Education Credit If Married Filing Separately Below

Can You Claim Education Credit If Married Filing Separately

Can You Claim Education Credit If Married Filing Separately - Can You Claim Education Credit If Married Filing Separately, Can I Claim Child Care Credit If Married Filing Separately

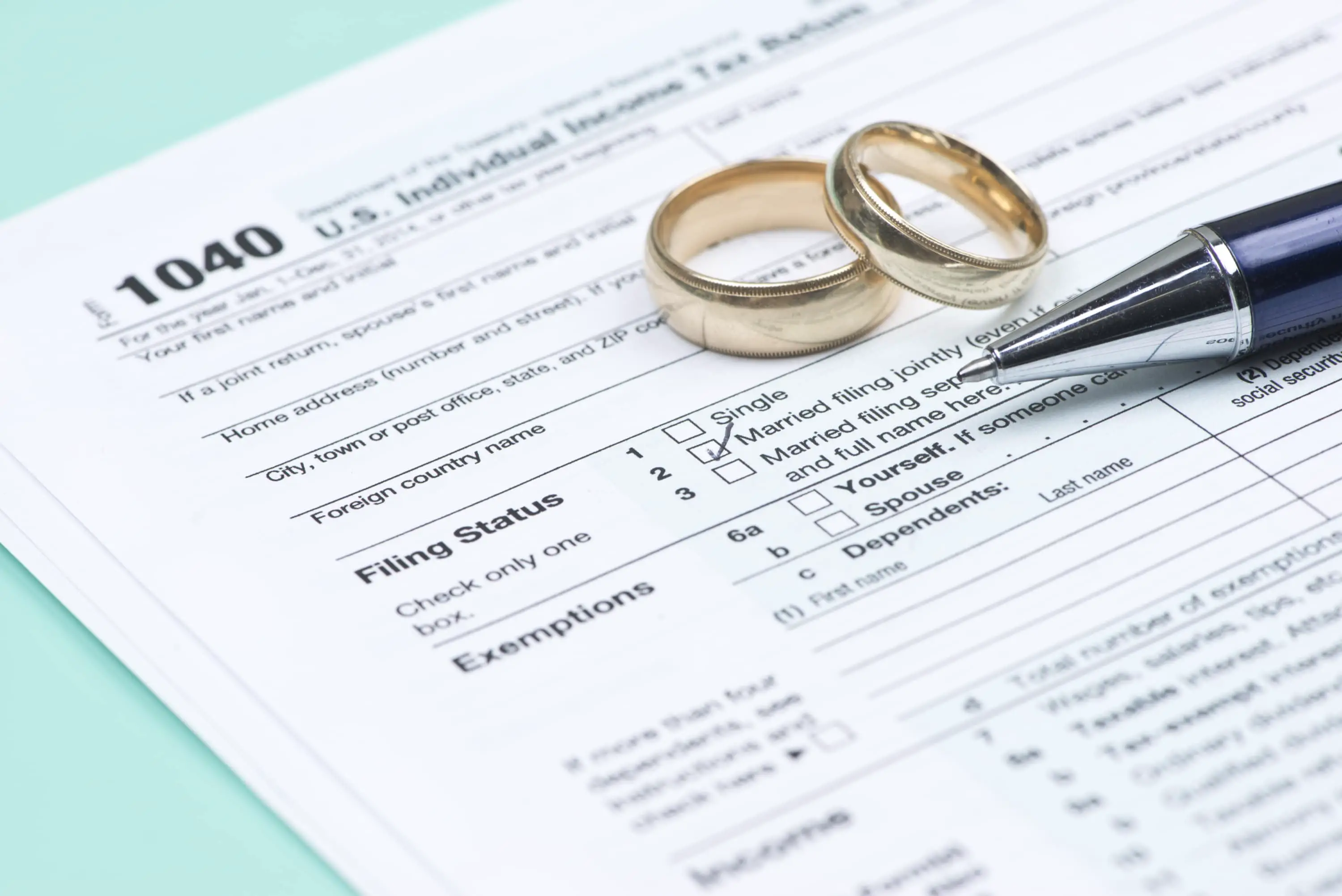

To claim an education credit verify that the following are true for the taxpayers They cannot be claimed as a dependent on someone else s tax return They are not filing as Married Filing Separately Their adjusted gross income AGI is below the limitations for their filing status

When you file as Married Filing Separately you can not claim any education credits deductions None at all Each year you can choose to file as Married Filing Separately However that may not provide the benefit that you expect and you will almost always end up paying more in tax than if you file jointly

Can You Claim Education Credit If Married Filing Separately include a broad collection of printable documents that can be downloaded online at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages and more. The great thing about Can You Claim Education Credit If Married Filing Separately is in their variety and accessibility.

More of Can You Claim Education Credit If Married Filing Separately

Is The Married Filing Separately Tax Status Right For You

:max_bytes(150000):strip_icc()/when-should-you-file-a-seperate-return-from-your-spouse-3193041-final-f72815b10bef416db12eebc301043dc3.png)

Is The Married Filing Separately Tax Status Right For You

You can t claim the lifetime learning credit if any of the following applies Your filing status is married filing separately You re listed as a dependent on another person s tax return such as your parents Your modified adjusted gross income is above a specified amount

You can claim tax deductions and credits that would otherwise be unavailable to you if you re eligible to file as head of household rather than married filing separately Married Filing

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

The ability to customize: There is the possibility of tailoring designs to suit your personal needs be it designing invitations or arranging your schedule or even decorating your home.

-

Educational Use: The free educational worksheets can be used by students of all ages. This makes them a great device for teachers and parents.

-

An easy way to access HTML0: You have instant access numerous designs and templates cuts down on time and efforts.

Where to Find more Can You Claim Education Credit If Married Filing Separately

Married Filing Separately For Student Loans How Your Taxes Are

Married Filing Separately For Student Loans How Your Taxes Are

Your filing status is married filing separately You already claimed or deducted another higher education benefit using the same student or same expenses You or your spouse were a non resident alien for any part of the year and didn t choose to be treated as a resident alien for tax purposes

December 23 2021 Why use LendingTree Whether you re a student or the parent of a student if you paid for college you may be eligible for an education tax credit Who can claim education tax credits can depend on factors such as where you go to school your criminal history and whether you re a dependent

Now that we've piqued your curiosity about Can You Claim Education Credit If Married Filing Separately and other printables, let's discover where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection and Can You Claim Education Credit If Married Filing Separately for a variety uses.

- Explore categories like the home, decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets or flashcards as well as learning tools.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- These blogs cover a wide range of topics, from DIY projects to party planning.

Maximizing Can You Claim Education Credit If Married Filing Separately

Here are some innovative ways how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Utilize free printable worksheets to aid in learning at your home or in the classroom.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Can You Claim Education Credit If Married Filing Separately are a treasure trove of practical and imaginative resources for a variety of needs and passions. Their availability and versatility make they a beneficial addition to your professional and personal life. Explore the endless world of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Can You Claim Education Credit If Married Filing Separately truly available for download?

- Yes you can! You can download and print these items for free.

-

Does it allow me to use free printables for commercial use?

- It's based on specific terms of use. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables could be restricted on usage. Always read these terms and conditions as set out by the author.

-

How do I print Can You Claim Education Credit If Married Filing Separately?

- You can print them at home with printing equipment or visit a print shop in your area for more high-quality prints.

-

What program do I require to view printables that are free?

- The majority of printables are in PDF format, which is open with no cost programs like Adobe Reader.

Should I File Jointly Or Separately Expat US Tax

2021 Tax Brackets Irs Married Filing Jointly

Check more sample of Can You Claim Education Credit If Married Filing Separately below

Married Filing Separate And N 400 Applications CitizenPath

How To Fill Out IRS Form W 4 2020 Married Filing Jointly YouTube

Can You Claim The Employee Retention Credit MichaelTritthart

2022 Tax Brackets Married Filing Jointly Irs Printable Form

How To Fill Out W 4 Form Married Filing Jointly 2023 Printable Forms

Irs Tax Table 2022 Married Filing Jointly Latest News Update

https://ttlc.intuit.com/community/college...

When you file as Married Filing Separately you can not claim any education credits deductions None at all Each year you can choose to file as Married Filing Separately However that may not provide the benefit that you expect and you will almost always end up paying more in tax than if you file jointly

:max_bytes(150000):strip_icc()/when-should-you-file-a-seperate-return-from-your-spouse-3193041-final-f72815b10bef416db12eebc301043dc3.png?w=186)

https://www.irs.gov/instructions/i8863

The lifetime learning credit and the American opportunity credit MAGI limits are 180 000 if you re married filing jointly 90 000 if you re filing single head of household or qualifying surviving spouse See Table 1 and the instructions for line 3

When you file as Married Filing Separately you can not claim any education credits deductions None at all Each year you can choose to file as Married Filing Separately However that may not provide the benefit that you expect and you will almost always end up paying more in tax than if you file jointly

The lifetime learning credit and the American opportunity credit MAGI limits are 180 000 if you re married filing jointly 90 000 if you re filing single head of household or qualifying surviving spouse See Table 1 and the instructions for line 3

2022 Tax Brackets Married Filing Jointly Irs Printable Form

How To Fill Out IRS Form W 4 2020 Married Filing Jointly YouTube

How To Fill Out W 4 Form Married Filing Jointly 2023 Printable Forms

Irs Tax Table 2022 Married Filing Jointly Latest News Update

Sample W4 2021 Filled Out Sample W4 2021 Filled Out The W4 Form 2021

How Many Times Can You Get Education Credit Leia Aqui Can You Claim

How Many Times Can You Get Education Credit Leia Aqui Can You Claim

How To Do Your Own Taxes A Beginners Guide