In this age of electronic devices, where screens rule our lives The appeal of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons project ideas, artistic or just adding the personal touch to your home, printables for free are a great resource. In this article, we'll dive into the world "Cghs Contribution Rebate In Income Tax," exploring their purpose, where to get them, as well as what they can do to improve different aspects of your life.

Get Latest Cghs Contribution Rebate In Income Tax Below

Cghs Contribution Rebate In Income Tax

Cghs Contribution Rebate In Income Tax - Cghs Contribution Rebate In Income Tax, Is Cghs Contribution Taxable, Income Tax Deduction For Cghs Contribution, Income Tax Rebate On Cghs Subscription, Cghs Deduction Amount

The amount of contribution made to the CGHS qualifies for deduction under section 80D of the Indian Income Tax Act The maximum deductible amount stands at Rs 25 000 in a financial year

The Central Government Health Scheme CGHS provides comprehensive medical care to the employees of the Central Government and pensioners enrolled under the CGHS

The Cghs Contribution Rebate In Income Tax are a huge variety of printable, downloadable materials online, at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages and much more. One of the advantages of Cghs Contribution Rebate In Income Tax lies in their versatility and accessibility.

More of Cghs Contribution Rebate In Income Tax

Vote Oriana Oriana Ngabirano Powered By Donorbox

Vote Oriana Oriana Ngabirano Powered By Donorbox

My question is Refund of one time contribution made to became member of CGHS is Considered as income

Presenting the Union Budget in the Lok Sabha today the Finance Minister Shri P Chidambaram said that contributions made to CGHS are eligible for deduction under

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Customization: This allows you to modify print-ready templates to your specific requirements whether it's making invitations planning your schedule or decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free can be used by students of all ages, which makes them a vital aid for parents as well as educators.

-

Accessibility: instant access numerous designs and templates helps save time and effort.

Where to Find more Cghs Contribution Rebate In Income Tax

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Section 80D Income Tax Deduction for Medical Insurance Deduction under section 80D is available if the following conditions are satisfied 1 The taxpayer is an

Deduction U s 80D of the Income Tax Act 1961 in respect of Medical Insurance Premium Mediclaim paid to keep in force insurance by individual either on his own health or on the health of spouse parents and

Now that we've piqued your curiosity about Cghs Contribution Rebate In Income Tax we'll explore the places you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of motives.

- Explore categories like furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Perfect for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a broad selection of subjects, starting from DIY projects to party planning.

Maximizing Cghs Contribution Rebate In Income Tax

Here are some innovative ways create the maximum value of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Utilize free printable worksheets for reinforcement of learning at home for the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Cghs Contribution Rebate In Income Tax are a treasure trove of useful and creative resources which cater to a wide range of needs and preferences. Their accessibility and versatility make them a valuable addition to your professional and personal life. Explore the many options of Cghs Contribution Rebate In Income Tax today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes they are! You can print and download these files for free.

-

Are there any free printables for commercial uses?

- It's contingent upon the specific terms of use. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables could be restricted concerning their use. Make sure you read the terms and condition of use as provided by the creator.

-

How do I print Cghs Contribution Rebate In Income Tax?

- Print them at home with either a printer at home or in the local print shop for better quality prints.

-

What software will I need to access printables free of charge?

- The majority of printables are in the PDF format, and is open with no cost programs like Adobe Reader.

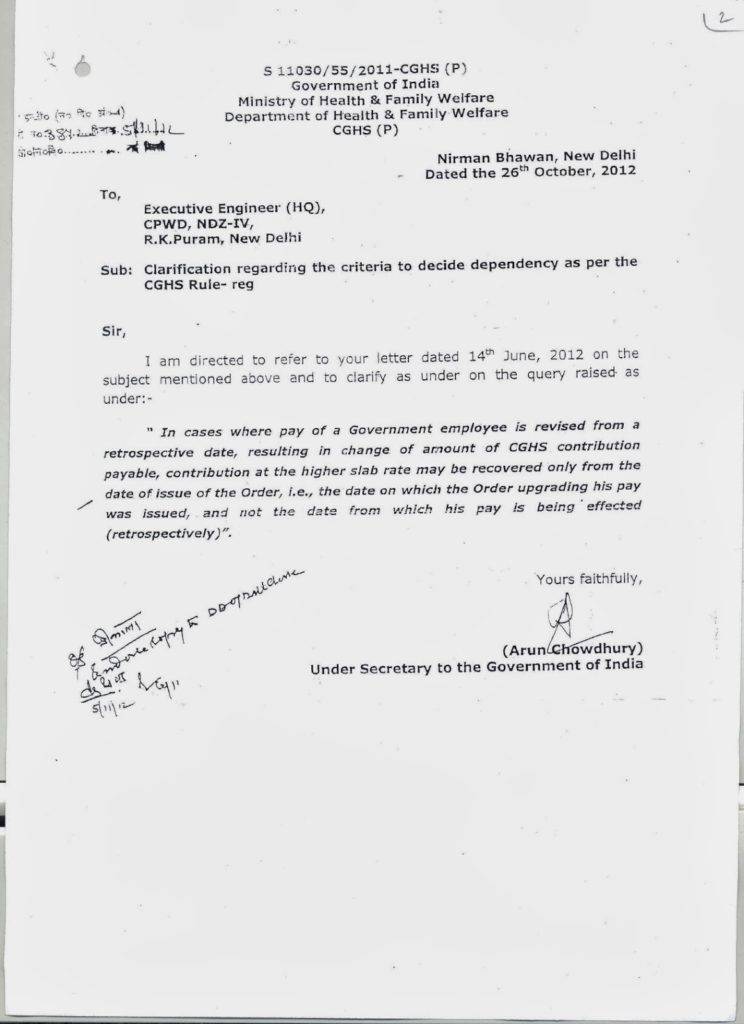

CGHS Yearly Contribution Deposited By Retired Employees Clarification

Deduction Of CGHS Contribution On Change Of Grade Pay By Virtue Of

Check more sample of Cghs Contribution Rebate In Income Tax below

Breathtaking Income Tax Calculation Statement Two Types Of Financial

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

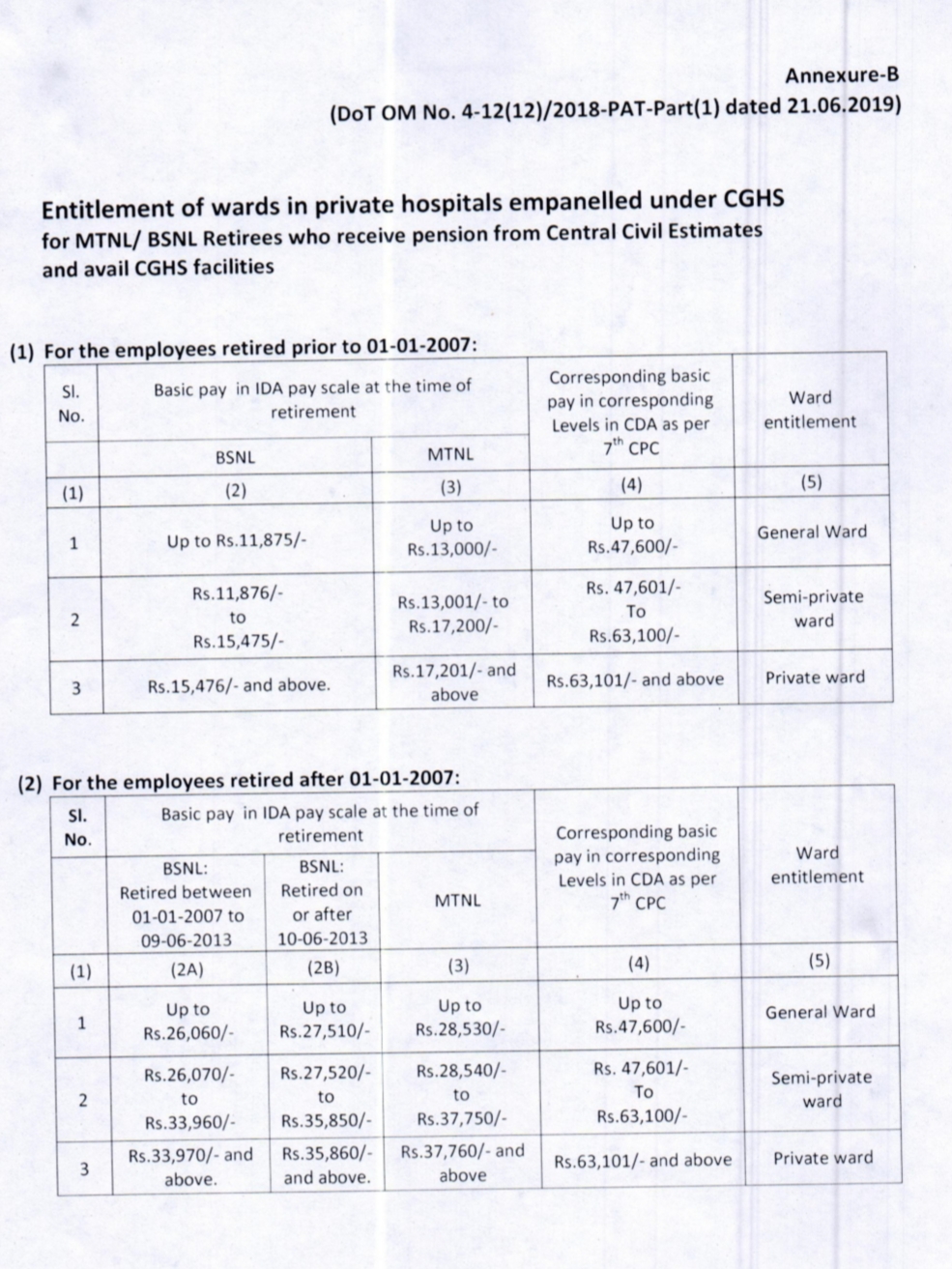

CGHS Facilities To The Retired BSNL MTNL Employees Who Are In Receipt

How To Deal With An Income Tax Notice Wealthzi

CGHS Application CGHS Contribution CGHS Card Loss CGHS Card

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

https://cleartax.in/s/central-government-health-scheme

The Central Government Health Scheme CGHS provides comprehensive medical care to the employees of the Central Government and pensioners enrolled under the CGHS

https://tax2win.in/guide/section-80d-ded…

Section 80D of the Income Tax Act allows individuals or HUF to claim a deduction for medical insurance premiums paid in a financial year Section 80D provides a deduction for expenditure on the Medical insurance

The Central Government Health Scheme CGHS provides comprehensive medical care to the employees of the Central Government and pensioners enrolled under the CGHS

Section 80D of the Income Tax Act allows individuals or HUF to claim a deduction for medical insurance premiums paid in a financial year Section 80D provides a deduction for expenditure on the Medical insurance

How To Deal With An Income Tax Notice Wealthzi

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

CGHS Application CGHS Contribution CGHS Card Loss CGHS Card

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

CGHS Annual Contribution Of KVS Pensioners

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates