In the digital age, where screens dominate our lives however, the attraction of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons, creative projects, or simply to add an individual touch to your space, Cghs Deduction Amount are now a vital source. With this guide, you'll take a dive through the vast world of "Cghs Deduction Amount," exploring the benefits of them, where to get them, as well as how they can enrich various aspects of your lives.

Get Latest Cghs Deduction Amount Below

Cghs Deduction Amount

Cghs Deduction Amount - Cghs Deduction Amount, Cghs Deduction Rate List, Cghs Deduction Rates, Cghs Deduction Rules

The maximum deduction amount is Rs 50 000 E Contribution to CGHS notified scheme Contribution to Central Govt Health Scheme CGHS or any other notified scheme is allowed to individuals for

The amount of contribution you make to the CGHS qualifies for deduction u s 80 D from the taxable income subject to a maximum of Rs 25 000 per financial year

Printables for free cover a broad range of printable, free content that can be downloaded from the internet at no cost. They are available in a variety of forms, like worksheets templates, coloring pages and more. The value of Cghs Deduction Amount lies in their versatility and accessibility.

More of Cghs Deduction Amount

Deduction Of Amount Archives Free Letters

Deduction Of Amount Archives Free Letters

HANDBOOK OF CGHS 2022 COMPILED BY C K BAPAT NC CBWAI Page 5 Civilian employees of Defence paid from Defence Service Estimates Child drawing pension on

22 rowsThe amount of contribution made to the CGHS qualifies for deduction under section 80D of the Indian Income Tax Act The maximum deductible amount stands at

Cghs Deduction Amount have risen to immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Flexible: They can make the templates to meet your individual needs, whether it's designing invitations or arranging your schedule or even decorating your home.

-

Educational Value Free educational printables provide for students from all ages, making them a great tool for teachers and parents.

-

Easy to use: Instant access to the vast array of design and templates reduces time and effort.

Where to Find more Cghs Deduction Amount

Standard Deduction For Tax Calculation Available On The Gross Salary

Standard Deduction For Tax Calculation Available On The Gross Salary

Pensioner beneficiaries who have already obtained CGHS card w th life time validity by paying a lump sum amount equivalent to 10 years contribution not be required to pay

Central govt employees pensioners The rates of the Central Government Health Scheme CGHS for general surgery have been revised What are new charges

After we've peaked your interest in printables for free Let's see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Cghs Deduction Amount suitable for many reasons.

- Explore categories such as the home, decor, craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free with flashcards and other teaching tools.

- Ideal for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- These blogs cover a wide spectrum of interests, all the way from DIY projects to party planning.

Maximizing Cghs Deduction Amount

Here are some fresh ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Cghs Deduction Amount are an abundance of practical and imaginative resources which cater to a wide range of needs and pursuits. Their accessibility and flexibility make them a valuable addition to both professional and personal life. Explore the vast collection of Cghs Deduction Amount today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Cghs Deduction Amount really for free?

- Yes you can! You can print and download these documents for free.

-

Can I use free printables for commercial use?

- It depends on the specific terms of use. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with Cghs Deduction Amount?

- Some printables may contain restrictions in use. Check the terms and regulations provided by the creator.

-

How do I print Cghs Deduction Amount?

- You can print them at home using printing equipment or visit a local print shop to purchase superior prints.

-

What program do I need to run printables at no cost?

- The majority of printed documents are as PDF files, which is open with no cost software, such as Adobe Reader.

Waiver Of CGHS Card Fees For Retired Government Employees Rajya Sabha QA

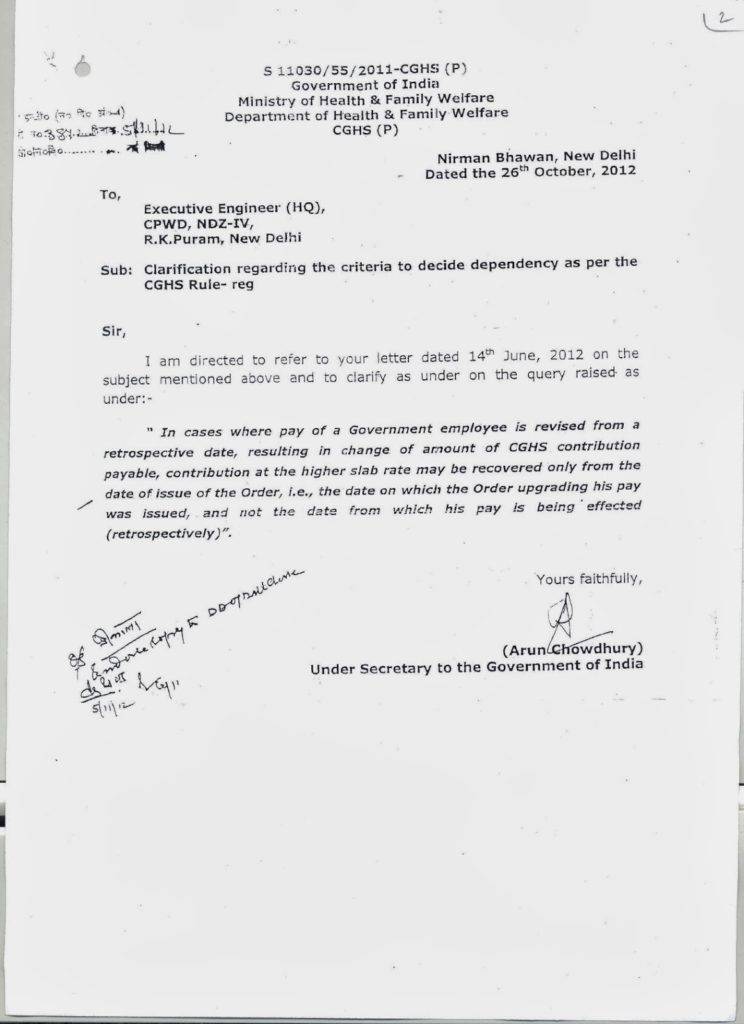

Deduction Of CGHS Contribution On Change Of Grade Pay By Virtue Of

Check more sample of Cghs Deduction Amount below

Reducing Taxes On Severance Pay Increase In Deduction Amount By

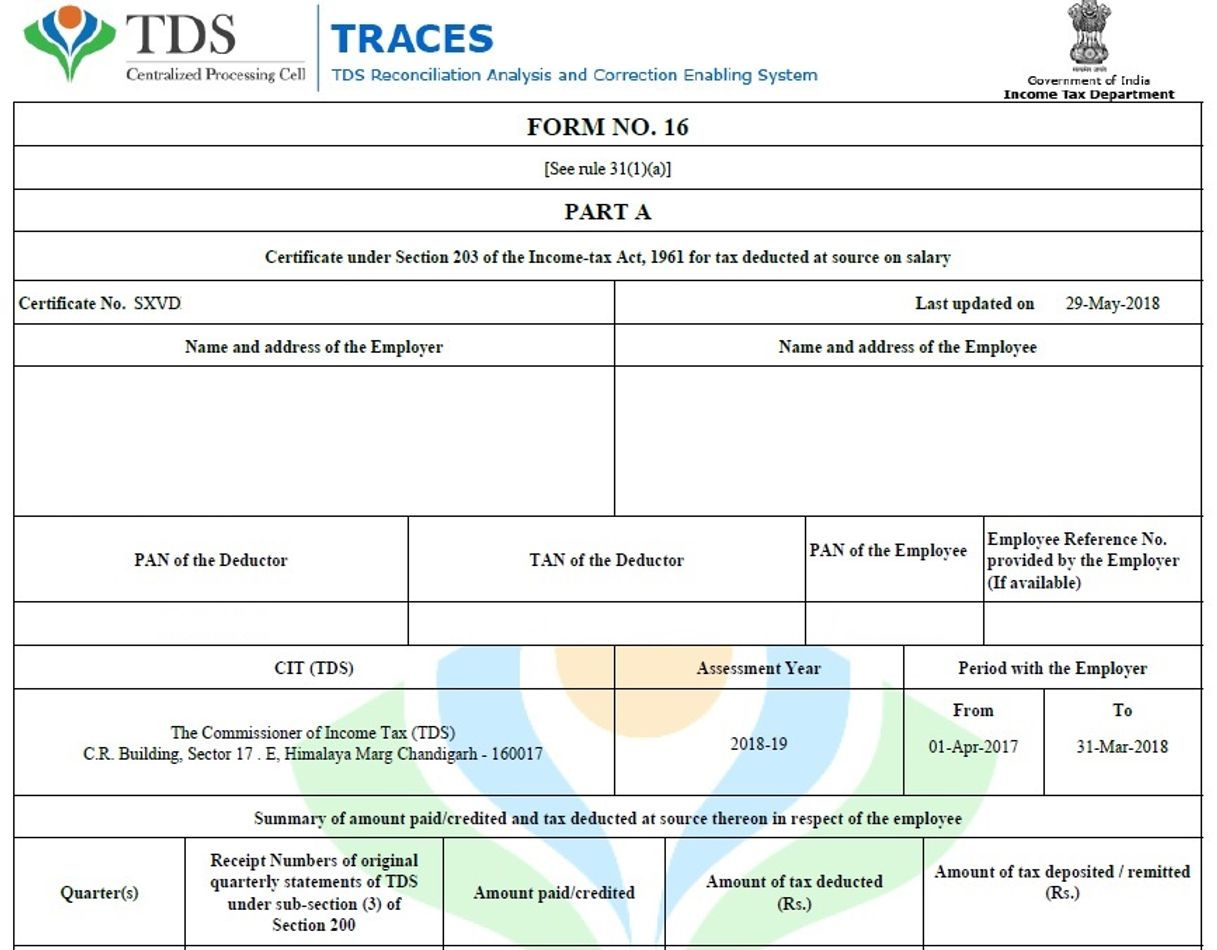

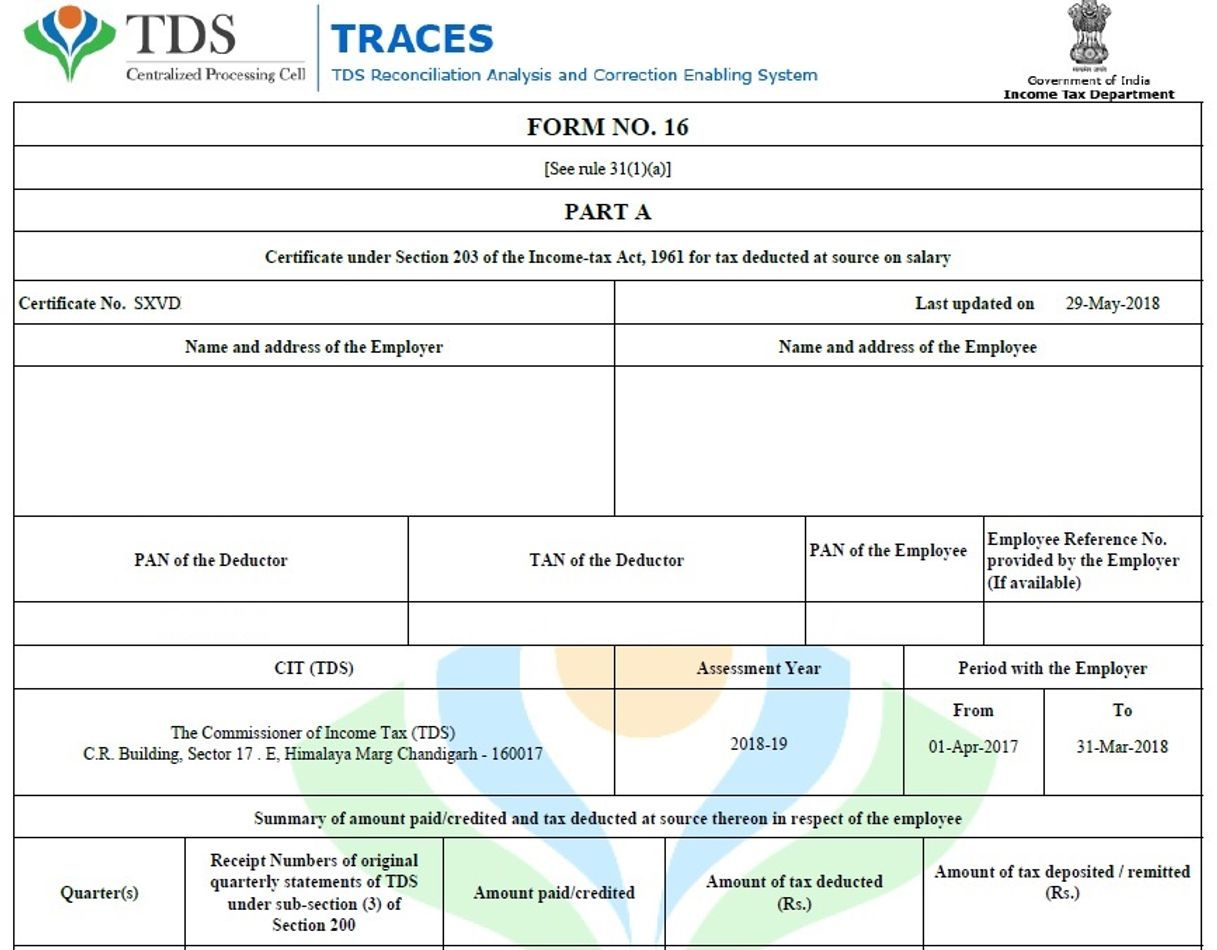

Providing Form 16 To All Pensioners And Family Pensioners CPAO

Difficulties Of CGHS Beneficiaries Due To Withdrawal Of Empanelment And

DOP PW Deduction Of Commuted Pension From The Pension Revised In

What Is The Standard Federal Tax Deduction Ericvisser

Section 80D Deduction In Respect Of Health Or Medical Insurance

https://tilakmarg.com/opinion/central-government...

The amount of contribution you make to the CGHS qualifies for deduction u s 80 D from the taxable income subject to a maximum of Rs 25 000 per financial year

https://cleartax.in/s/central-government-health-scheme

Demand draft for the required amount towards the CGHS contribution Provisional card if PPO is not provided CGHS Card A CGHS card is a plastic card given

The amount of contribution you make to the CGHS qualifies for deduction u s 80 D from the taxable income subject to a maximum of Rs 25 000 per financial year

Demand draft for the required amount towards the CGHS contribution Provisional card if PPO is not provided CGHS Card A CGHS card is a plastic card given

DOP PW Deduction Of Commuted Pension From The Pension Revised In

Providing Form 16 To All Pensioners And Family Pensioners CPAO

What Is The Standard Federal Tax Deduction Ericvisser

Section 80D Deduction In Respect Of Health Or Medical Insurance

Letter Of Salary Deduction Due To Negligence Word Excel Templates

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

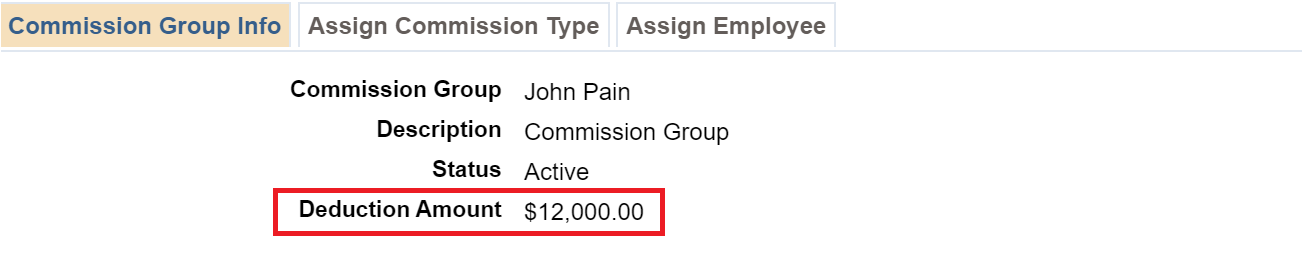

Standard Deduction In Sales Commission Sage Intacct Tips Tricks