In the digital age, where screens dominate our lives yet the appeal of tangible printed materials isn't diminishing. Whatever the reason, whether for education, creative projects, or just adding an extra personal touch to your space, Cghs Deduction Rates are now an essential resource. For this piece, we'll take a dive to the depths of "Cghs Deduction Rates," exploring the different types of printables, where to find them and how they can improve various aspects of your life.

Get Latest Cghs Deduction Rates Below

Cghs Deduction Rates

Cghs Deduction Rates - Cghs Deduction Rates, Cghs Contribution Rates List, Cghs Deduction Amount, Cghs Deduction Rate List, Cghs Deduction Rules

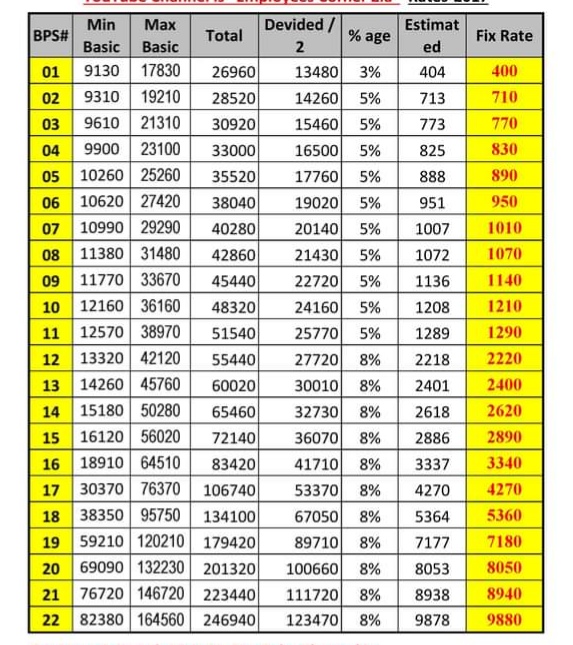

The entitlement for CGHS wards for Central Government Employees and Pensioners 2023 has been revised The General Ward Entitlement is applicable to individuals with a Basic Pay of up to Rs 36500

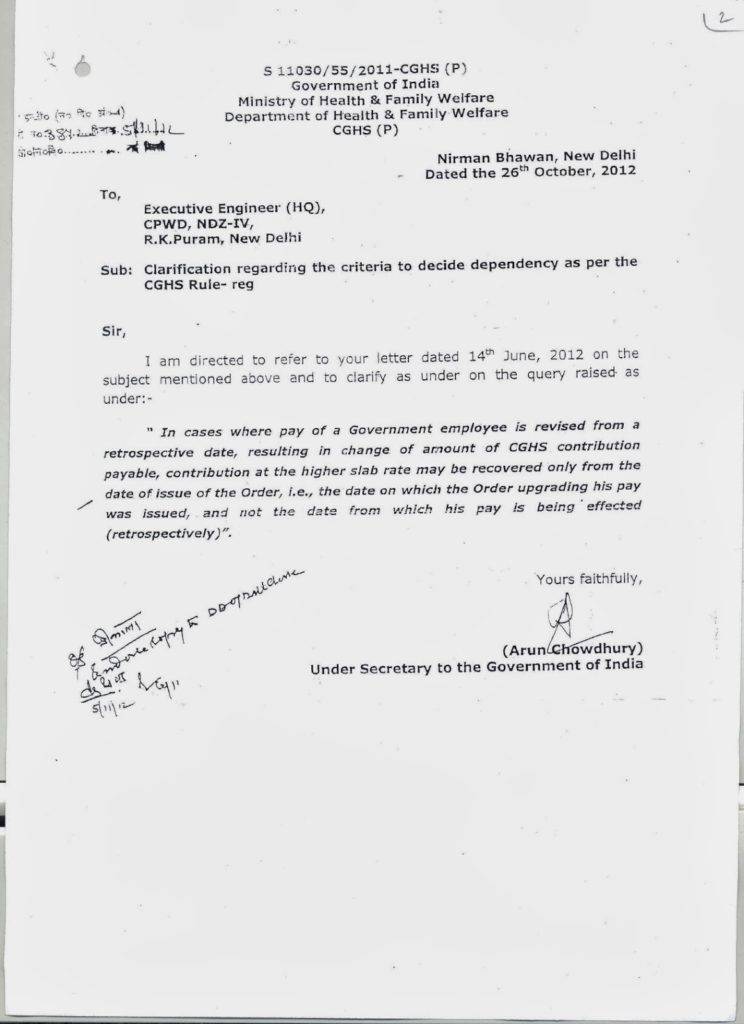

Subject Revision of rates of subscription under Central Government Health Scheme due to revision of pay and allowances of Central Government employees and revision of pension

Cghs Deduction Rates include a broad variety of printable, downloadable documents that can be downloaded online at no cost. They are available in numerous formats, such as worksheets, templates, coloring pages, and many more. The great thing about Cghs Deduction Rates is their versatility and accessibility.

More of Cghs Deduction Rates

CGHS Rates For 21 Treatment Procedures Investigations In Continuation

CGHS Rates For 21 Treatment Procedures Investigations In Continuation

Here are the latest CGHS rates and packages for the Central Government employees and pensioners Consultation fee for CGHS beneficiaries 1 For OPD

HANDBOOK which can be accessed by all the CGHS members offline and in readable fonts This handbook can be downloaded on their Laptop Mobile and saved in documents for

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Individualization We can customize printables to fit your particular needs in designing invitations to organize your schedule or even decorating your home.

-

Educational Use: Downloads of educational content for free cater to learners of all ages, which makes the perfect tool for teachers and parents.

-

Accessibility: Access to the vast array of design and templates reduces time and effort.

Where to Find more Cghs Deduction Rates

General Provident Rules Info Ghar G P Fund

General Provident Rules Info Ghar G P Fund

The Central Government Health Scheme CGHS provides comprehensive medical care to the employees of the Central Government and pensioners enrolled under the CGHS

There is no linkage between CGHS subscription and ward entitlement Therefore all CGHS beneficiaries Serving Pensioners who are eligible for upgradation of the ward entitlement according to the revised basic pay slabs as mentioned in OM dated 28 10 2022 may apply for fresh CGHS card

After we've peaked your interest in printables for free and other printables, let's discover where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Cghs Deduction Rates for various reasons.

- Explore categories such as interior decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- Ideal for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a broad spectrum of interests, from DIY projects to party planning.

Maximizing Cghs Deduction Rates

Here are some creative ways how you could make the most use of Cghs Deduction Rates:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Cghs Deduction Rates are a treasure trove of practical and innovative resources for a variety of needs and interest. Their availability and versatility make them a valuable addition to both professional and personal life. Explore the plethora of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes, they are! You can download and print these tools for free.

-

Can I download free printables for commercial purposes?

- It's determined by the specific conditions of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables may contain restrictions regarding usage. Check the terms and condition of use as provided by the designer.

-

How can I print Cghs Deduction Rates?

- You can print them at home using either a printer or go to a local print shop to purchase more high-quality prints.

-

What program do I need in order to open printables that are free?

- Many printables are offered in PDF format. They can be opened with free programs like Adobe Reader.

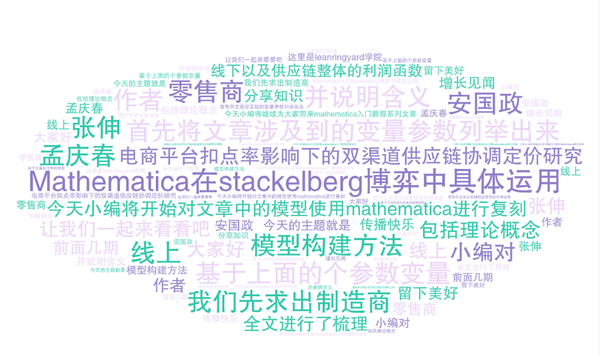

16 Mathematica Stackelberg 4

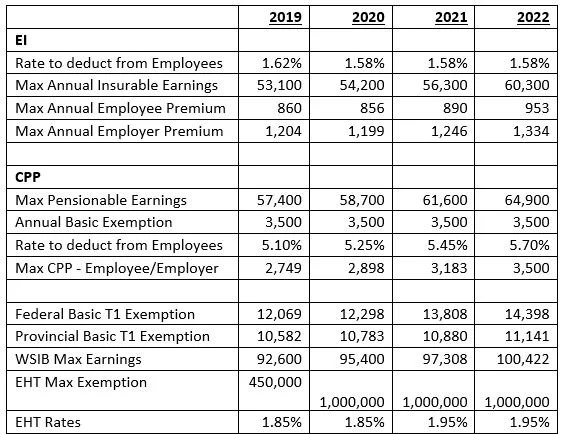

Payroll Deduction Rates Hicks MacPherson Iatonna Driedger LLP

Check more sample of Cghs Deduction Rates below

New GP Fund Deduction Rates 2022 By The Finance Department Teacher

Payroll Tax Deduction Rates Will Rise In 2018 HRWatchdog

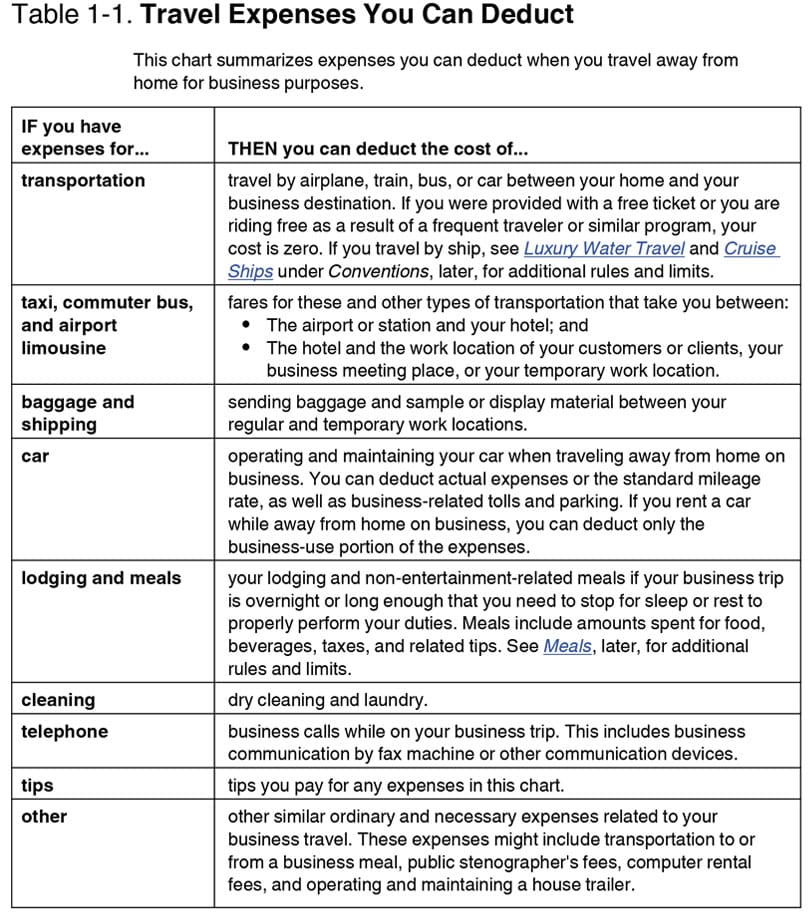

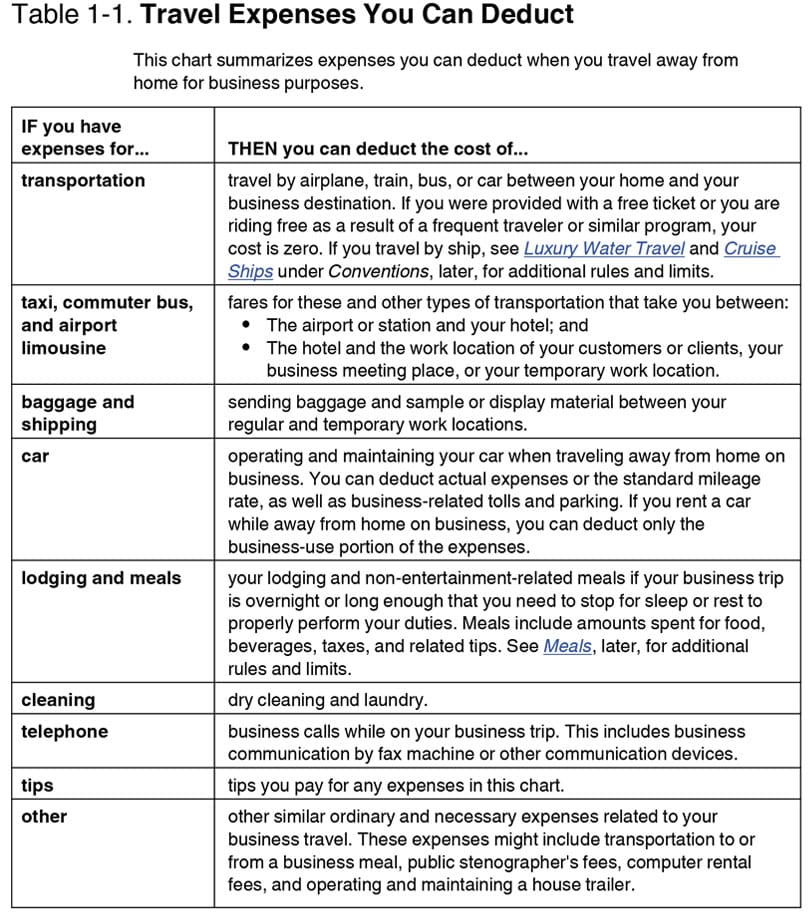

2019 IRS Mileage Deduction Rates

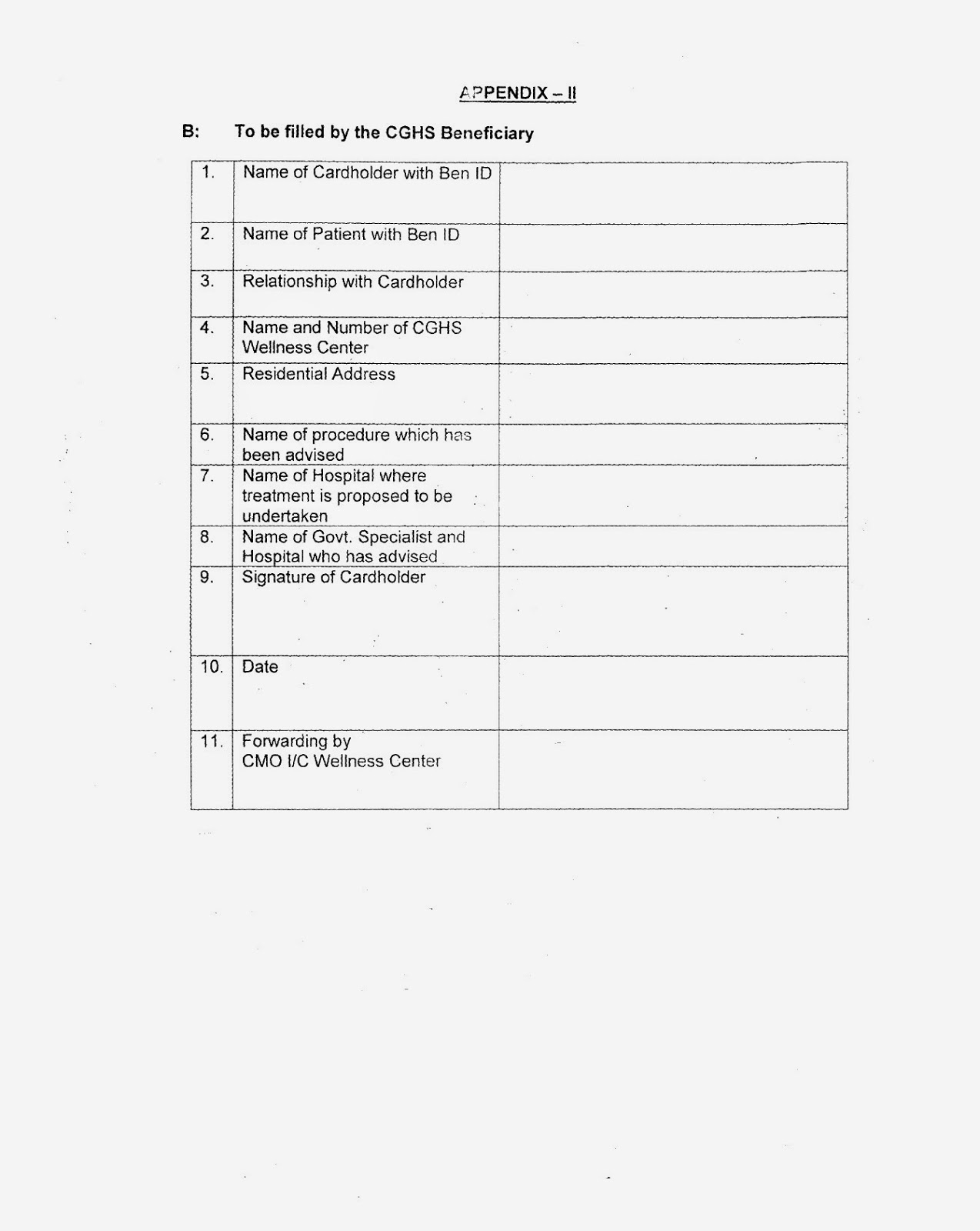

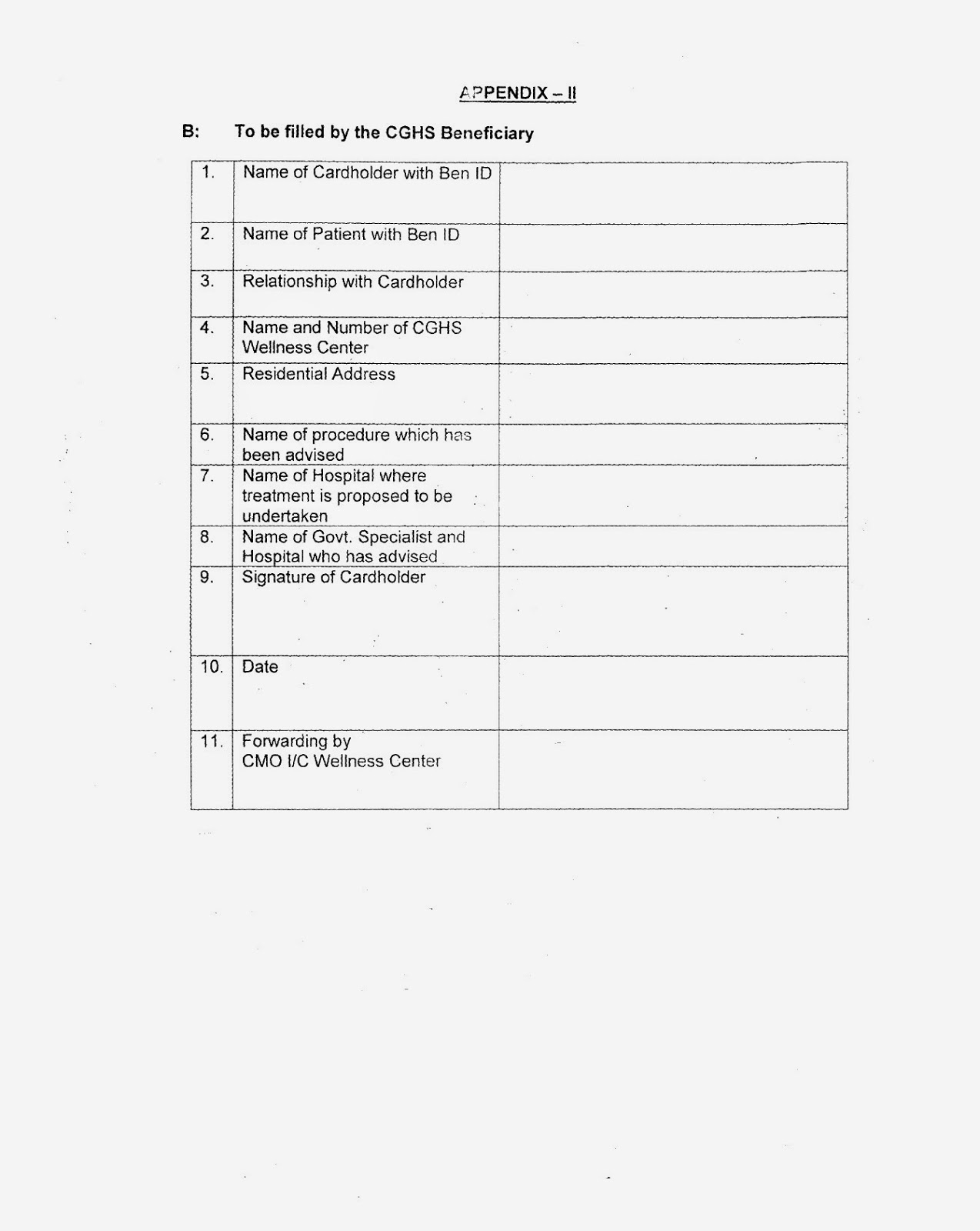

Guidelines And Ceiling Rates For Permission Reimbursement For Bariatric

Income Tax Calculation Example 9 For Salary Employees 2023 24

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

https://dot.gov.in/sites/default/files/Circular No...

Subject Revision of rates of subscription under Central Government Health Scheme due to revision of pay and allowances of Central Government employees and revision of pension

https://mowr.nic.in/core/Circulars/2024/GA_27-06...

The applications shall be accompanied with payment of CGHS Contribution on Bharat Kosh along with the Challan generated from Bharatkosh as proof of payment The contribution

Subject Revision of rates of subscription under Central Government Health Scheme due to revision of pay and allowances of Central Government employees and revision of pension

The applications shall be accompanied with payment of CGHS Contribution on Bharat Kosh along with the Challan generated from Bharatkosh as proof of payment The contribution

Guidelines And Ceiling Rates For Permission Reimbursement For Bariatric

Payroll Tax Deduction Rates Will Rise In 2018 HRWatchdog

Income Tax Calculation Example 9 For Salary Employees 2023 24

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Punjab GP Fund Deduction Rates 2022 Parho Pakistan

What Are The Standard Mileage Deduction Rates Rules GOFAR

What Are The Standard Mileage Deduction Rates Rules GOFAR

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More Gambaran