In the age of digital, where screens dominate our lives The appeal of tangible printed materials isn't diminishing. No matter whether it's for educational uses or creative projects, or simply adding an individual touch to the space, Cis Tax Rebate Hmrc are now an essential source. In this article, we'll take a dive into the sphere of "Cis Tax Rebate Hmrc," exploring their purpose, where to find them, and how they can add value to various aspects of your life.

Get Latest Cis Tax Rebate Hmrc Below

Cis Tax Rebate Hmrc

Cis Tax Rebate Hmrc - Cis Tax Rebate Hmrc, Cis Tax Return Hmrc, What Is Hmrc Tax Rebate, How Do I Claim My Cis Refund From Hmrc, Hmrc Tax Rebate Number

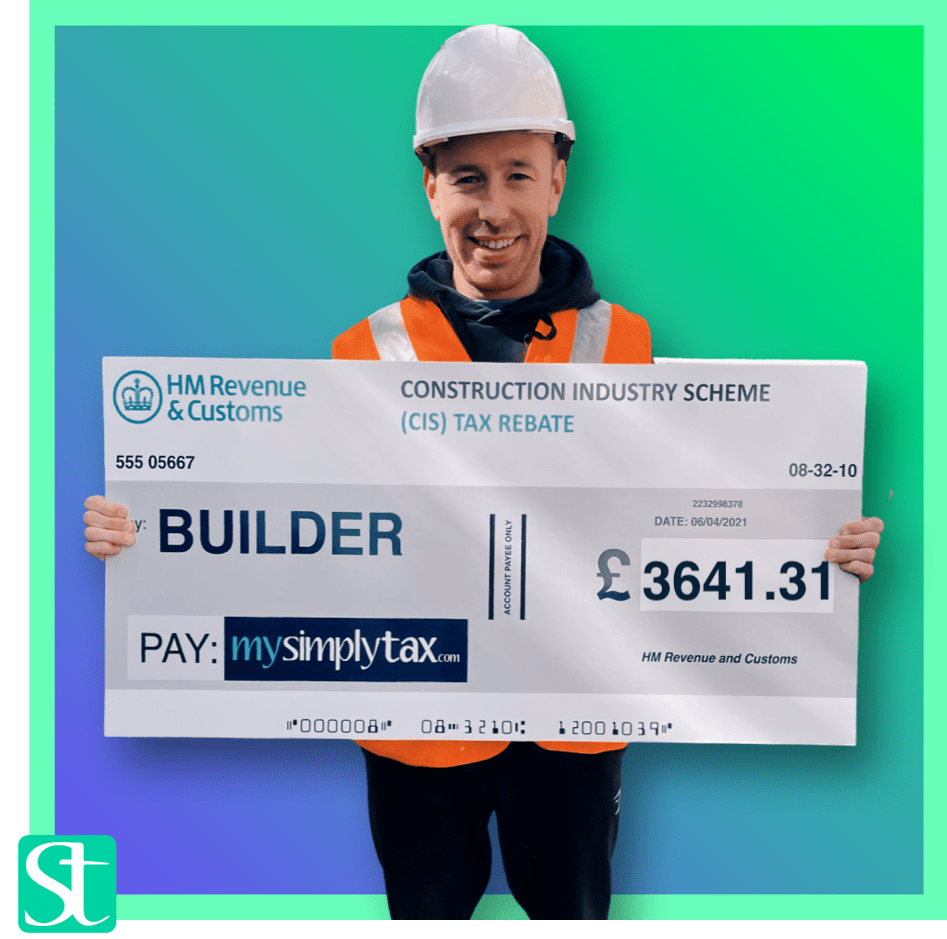

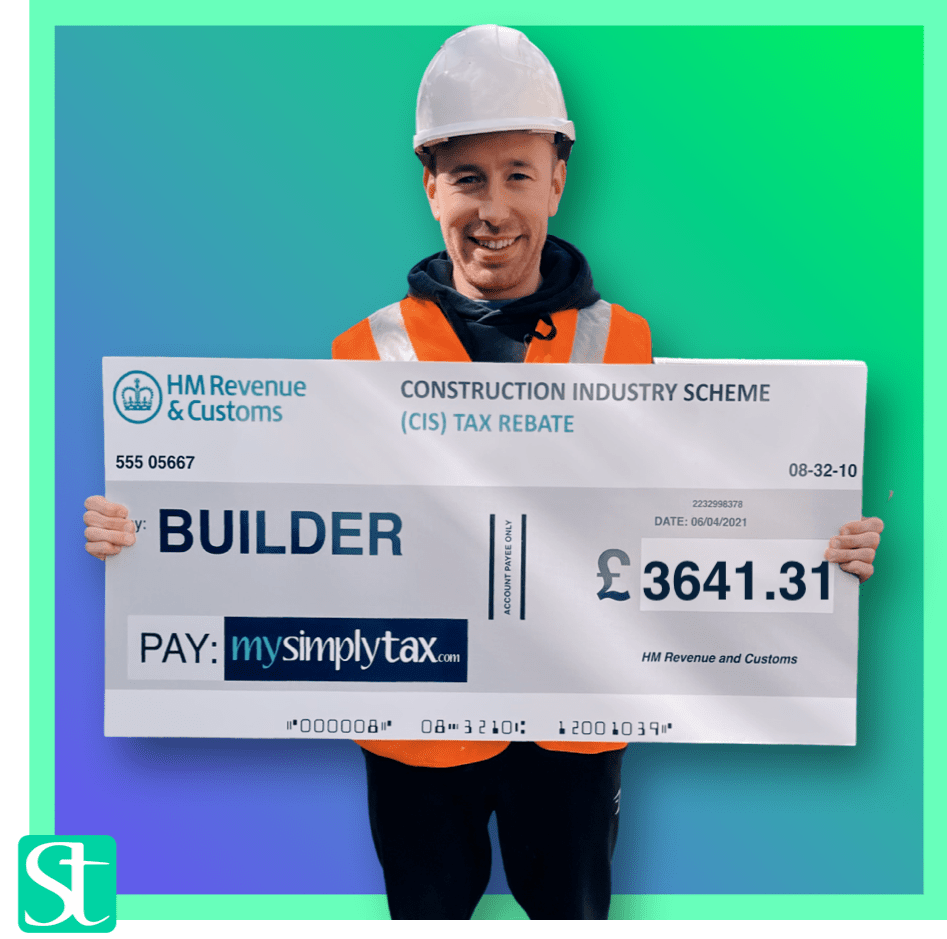

Web 4 janv 2022 nbsp 0183 32 Most CIS workers receive a tax refund rebate after they submit their Self Assessment tax return because they usually overpay towards their tax bill through CIS

Web 4 avr 2014 nbsp 0183 32 Use the Construction Industry Scheme CIS form CIS40 if you re an individual to claim repayment of subcontractor deductions during the current tax year From HM

Cis Tax Rebate Hmrc cover a large assortment of printable documents that can be downloaded online at no cost. They are available in a variety of forms, like worksheets templates, coloring pages and more. One of the advantages of Cis Tax Rebate Hmrc is in their variety and accessibility.

More of Cis Tax Rebate Hmrc

Online Income Tax Cis Tax Rebate Hmrc Tax Refund And Return Calculator

Online Income Tax Cis Tax Rebate Hmrc Tax Refund And Return Calculator

Web 6 avr 2023 nbsp 0183 32 You can find more information in HMRC s manual on GOV UK You will still be required to file your tax return for the year in which your construction industry work

Web Atthe end of the tax year once we have received the company s P35annual return any excess CIS deductions that cannot be set offmay be refunded or set against

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Modifications: You can tailor designs to suit your personal needs when it comes to designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Use: These Cis Tax Rebate Hmrc offer a wide range of educational content for learners of all ages, making these printables a powerful aid for parents as well as educators.

-

Affordability: Fast access numerous designs and templates helps save time and effort.

Where to Find more Cis Tax Rebate Hmrc

CIS Tax Rebates Verulams

CIS Tax Rebates Verulams

Web What is the CIS rebate The 20 deduction usually works out as more than you owe in tax so subcontractors can claim back a CIS tax rebate from HMRC in the April of the following tax year For most CIS construction

Web 9 f 233 vr 2023 nbsp 0183 32 If you re a self employed contractor in the construction industry you must register for CIS a HMRC scheme that determines how workers in the construction

We've now piqued your interest in Cis Tax Rebate Hmrc Let's find out where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection in Cis Tax Rebate Hmrc for different objectives.

- Explore categories such as decorations for the home, education and craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Great for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs are a vast selection of subjects, starting from DIY projects to party planning.

Maximizing Cis Tax Rebate Hmrc

Here are some fresh ways of making the most of Cis Tax Rebate Hmrc:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets to build your knowledge at home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Cis Tax Rebate Hmrc are an abundance of innovative and useful resources catering to different needs and interests. Their access and versatility makes they a beneficial addition to the professional and personal lives of both. Explore the plethora that is Cis Tax Rebate Hmrc today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I make use of free printables in commercial projects?

- It's determined by the specific rules of usage. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues in Cis Tax Rebate Hmrc?

- Some printables may come with restrictions on usage. Be sure to review the terms and conditions provided by the author.

-

How do I print printables for free?

- Print them at home with printing equipment or visit a local print shop to purchase top quality prints.

-

What software do I need to open printables free of charge?

- The majority of printed documents are in the format PDF. This can be opened using free software, such as Adobe Reader.

CIS Help And User Guide Sage 200 Sicon Ltd

![]()

Cash Declaration HM Revenue Customs Hmrc Gov Fill Out Sign

Check more sample of Cis Tax Rebate Hmrc below

Hmrc Tax Return Self Assessment Form Printable Rebate Form

Tool Tax Rebate HMRC How To Claim For Mechanics Trades

CIS Tax Rebate CIS Refunds CIS Tax Link Accountants London

Are You Due A Tax Rebate As A Construction Worker CIS Tax Rebates

It s Not A Tax Rebate It s An HMRC Phishing Scam IT Governance UK Blog

How To Claim and Increase Your P800 Refund Tax Rebates

https://www.gov.uk/government/publications/construction-industry...

Web 4 avr 2014 nbsp 0183 32 Use the Construction Industry Scheme CIS form CIS40 if you re an individual to claim repayment of subcontractor deductions during the current tax year From HM

https://www.gov.uk/what-is-the-construction-industry-scheme

Web Under the Construction Industry Scheme CIS contractors deduct money from a subcontractor s payments and pass it to HM Revenue and Customs HMRC The

Web 4 avr 2014 nbsp 0183 32 Use the Construction Industry Scheme CIS form CIS40 if you re an individual to claim repayment of subcontractor deductions during the current tax year From HM

Web Under the Construction Industry Scheme CIS contractors deduct money from a subcontractor s payments and pass it to HM Revenue and Customs HMRC The

Are You Due A Tax Rebate As A Construction Worker CIS Tax Rebates

Tool Tax Rebate HMRC How To Claim For Mechanics Trades

It s Not A Tax Rebate It s An HMRC Phishing Scam IT Governance UK Blog

How To Claim and Increase Your P800 Refund Tax Rebates

HMRC Tax Return Get The Information You Need

CIS Tax Return Service Norton Bridges Construction Industry Scheme

CIS Tax Return Service Norton Bridges Construction Industry Scheme

Tax In 10 ish Seconds What Is The CIS Rebate YouTube