In a world when screens dominate our lives and the appeal of physical printed material hasn't diminished. It doesn't matter if it's for educational reasons and creative work, or just adding an individual touch to the space, Corporation Tax Rebate Losses can be an excellent source. In this article, we'll take a dive in the world of "Corporation Tax Rebate Losses," exploring what they are, where they are, and how they can add value to various aspects of your daily life.

Get Latest Corporation Tax Rebate Losses Below

Corporation Tax Rebate Losses

Corporation Tax Rebate Losses - Corporation Tax Rebate Losses, Corporation Tax Refund Losses, Company Tax Return Losses Schedule, Corporation Tax Relief Capital Losses, Corporation Tax Loss Relief Carry Back, Corporation Tax Loss Relief Restriction, Corporation Tax Loss Relief Group, Corporation Tax Loss Relief Covid, Corporation Tax Loss Relief Against Capital Gains, Corporation Tax Loss Relief Claim

Web 1 f 233 vr 2021 nbsp 0183 32 Taxpayers can claim losses because of the operation of the rules of Subchapter S passing through income gains losses and deductions under Sec 1366 and exercise of the right to treat the S

Web 4 avr 2022 nbsp 0183 32 The government introduced legislation in Finance Act 2021 that provides a temporary extension to the loss carry back rules for trading losses of both corporate

Corporation Tax Rebate Losses provide a diverse variety of printable, downloadable material that is available online at no cost. They are available in a variety of kinds, including worksheets templates, coloring pages and much more. The benefit of Corporation Tax Rebate Losses is in their versatility and accessibility.

More of Corporation Tax Rebate Losses

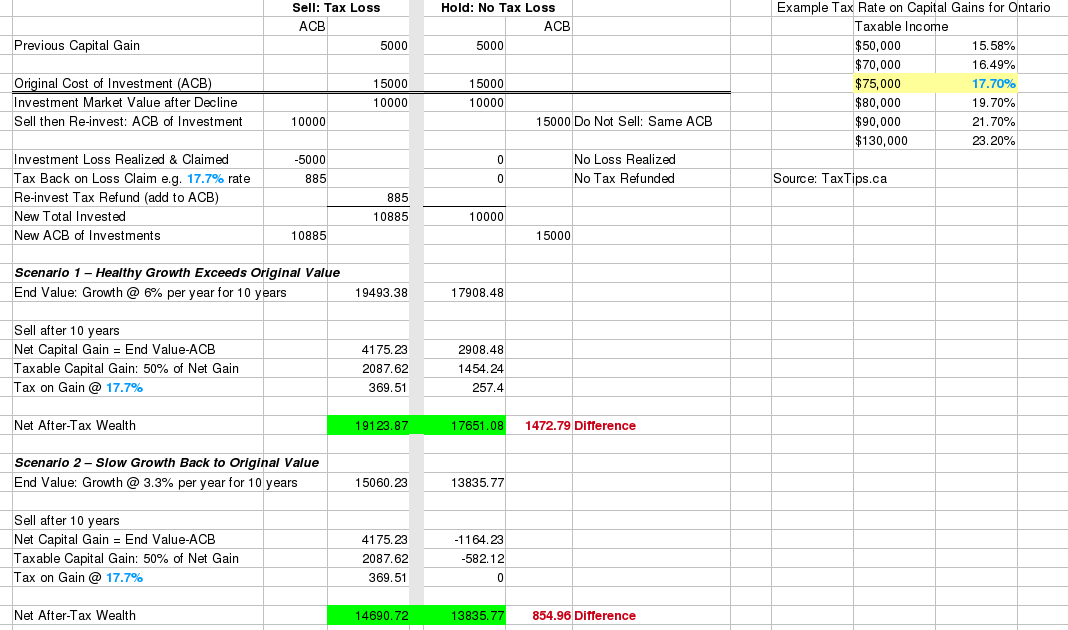

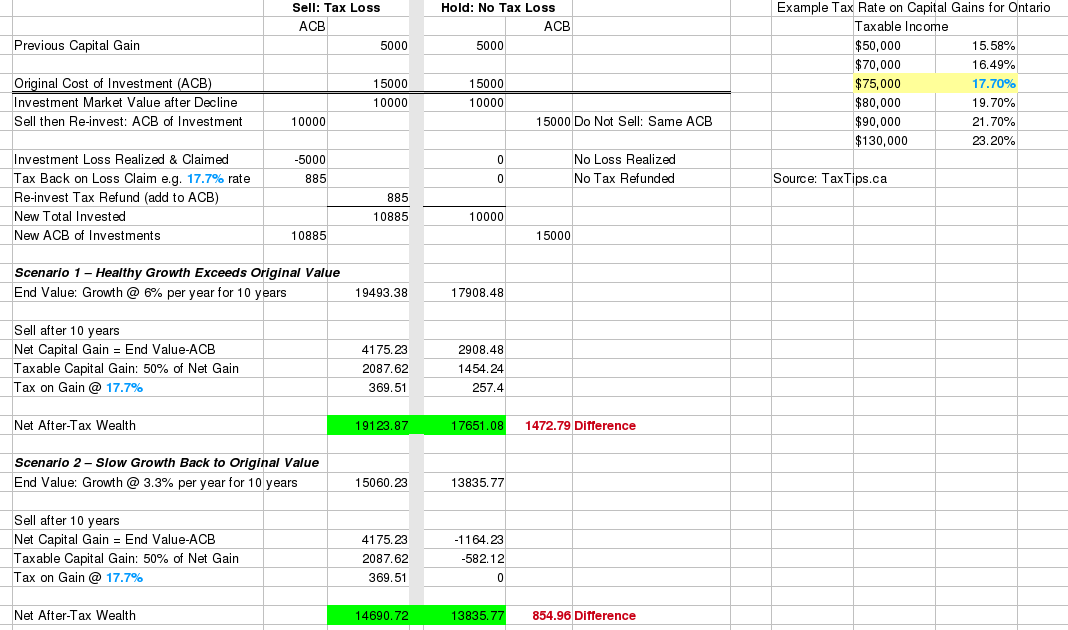

HowtoInvestOnline Tax Loss Selling Explained What Why And How

HowtoInvestOnline Tax Loss Selling Explained What Why And How

Web Marginal Relief Your company or organisation may be entitled to Marginal Relief if its taxable profits from 1 April 2023 are between 163 50 000 and 163 250 000 Previous Rates

Web 3 mars 2021 nbsp 0183 32 This measure introduces a temporary extension to the period over which businesses may carry trading losses back for relief against profits of earlier years to get

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Customization: We can customize designs to suit your personal needs for invitations, whether that's creating them as well as organizing your calendar, or even decorating your house.

-

Educational Value Education-related printables at no charge are designed to appeal to students of all ages, making the perfect source for educators and parents.

-

Accessibility: instant access a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Corporation Tax Rebate Losses

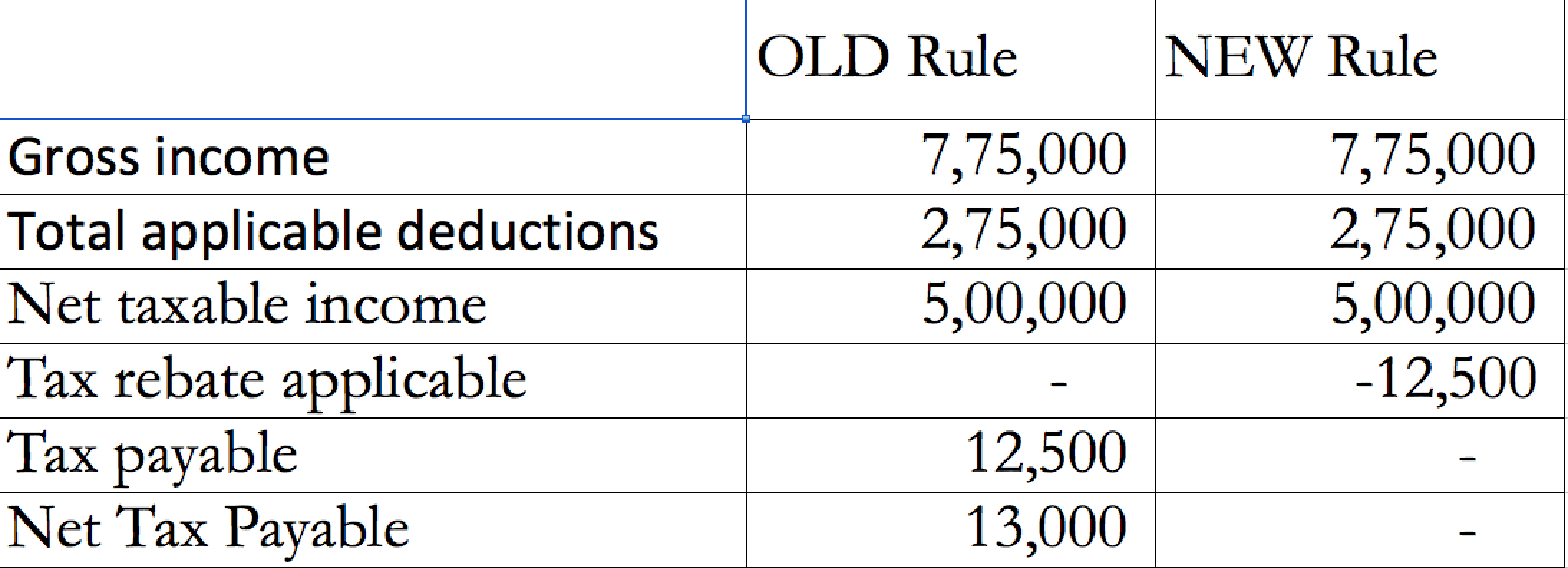

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Web Recent data on corporate tax losses present a puzzle this paper attempts to ex plain theratiooflossestopositiveincomewasmuchhigheraroundtherecession of 2001 than

Web Part 5 of Corporation Tax Act 2010 CTA 2010 allows a company to surrender losses and other amounts and enables in certain cases involving groups or consortiums of

Now that we've piqued your interest in printables for free and other printables, let's discover where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Corporation Tax Rebate Losses for various applications.

- Explore categories such as decorations for the home, education and the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs are a vast variety of topics, including DIY projects to planning a party.

Maximizing Corporation Tax Rebate Losses

Here are some creative ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living areas.

2. Education

- Print worksheets that are free to enhance your learning at home for the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Corporation Tax Rebate Losses are a treasure trove of innovative and useful resources which cater to a wide range of needs and needs and. Their accessibility and flexibility make them an invaluable addition to both professional and personal life. Explore the plethora of Corporation Tax Rebate Losses and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I utilize free printables for commercial uses?

- It depends on the specific terms of use. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with Corporation Tax Rebate Losses?

- Some printables may have restrictions in use. Always read the terms and regulations provided by the designer.

-

How do I print printables for free?

- Print them at home with a printer or visit a local print shop for premium prints.

-

What program will I need to access printables at no cost?

- Most PDF-based printables are available as PDF files, which can be opened with free software such as Adobe Reader.

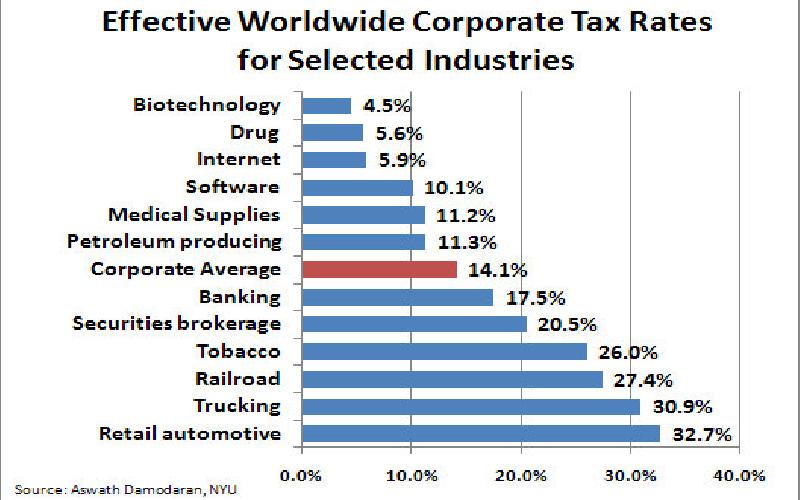

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

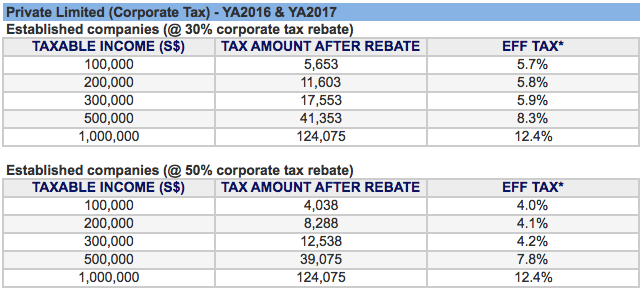

Tax Rebates As Economic Stimulus Can They Work Businessandfinance Blog

Check more sample of Corporation Tax Rebate Losses below

EU Loses Over 27 Billion In Corporate Tax A Year To UK Switzerland

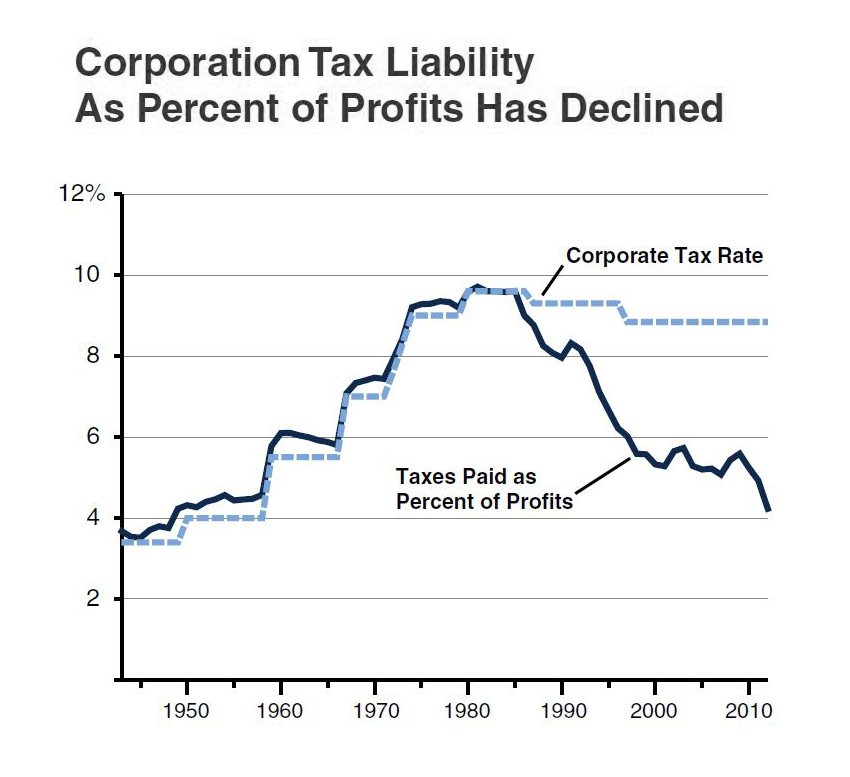

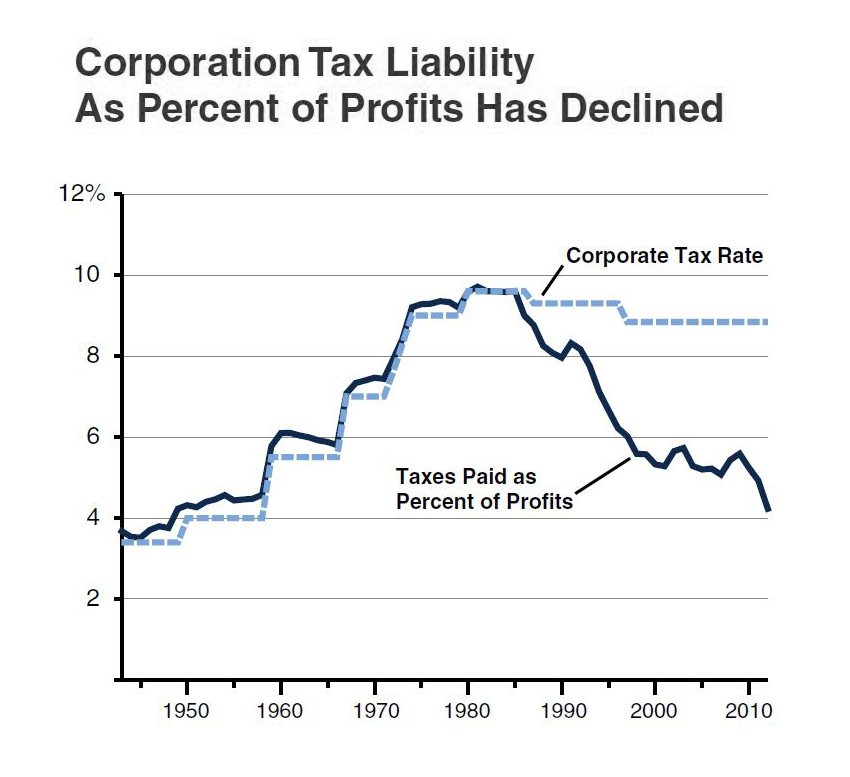

Corporation Tax Liability As Percent Of Profits Has Declined EconTax Blog

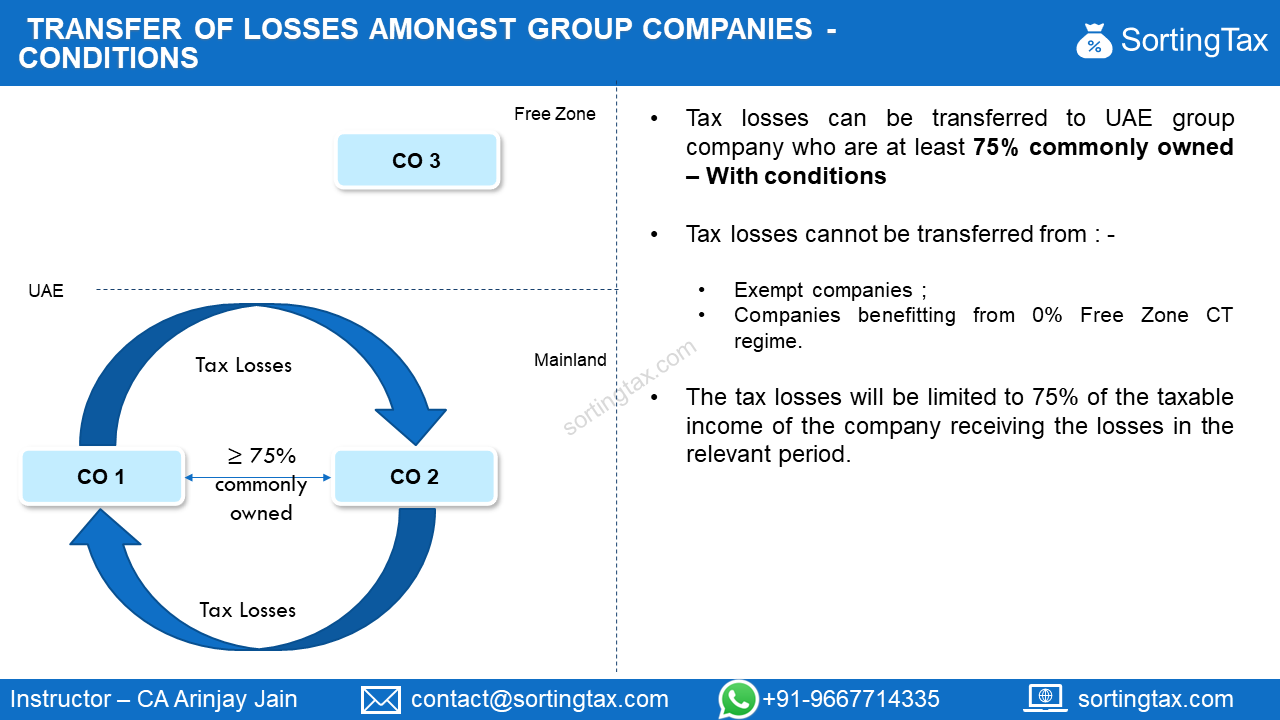

Group Transfer Of Losses Under UAE Corporate Tax Sorting Tax

Corporation Tax And Trading Losses Debitam

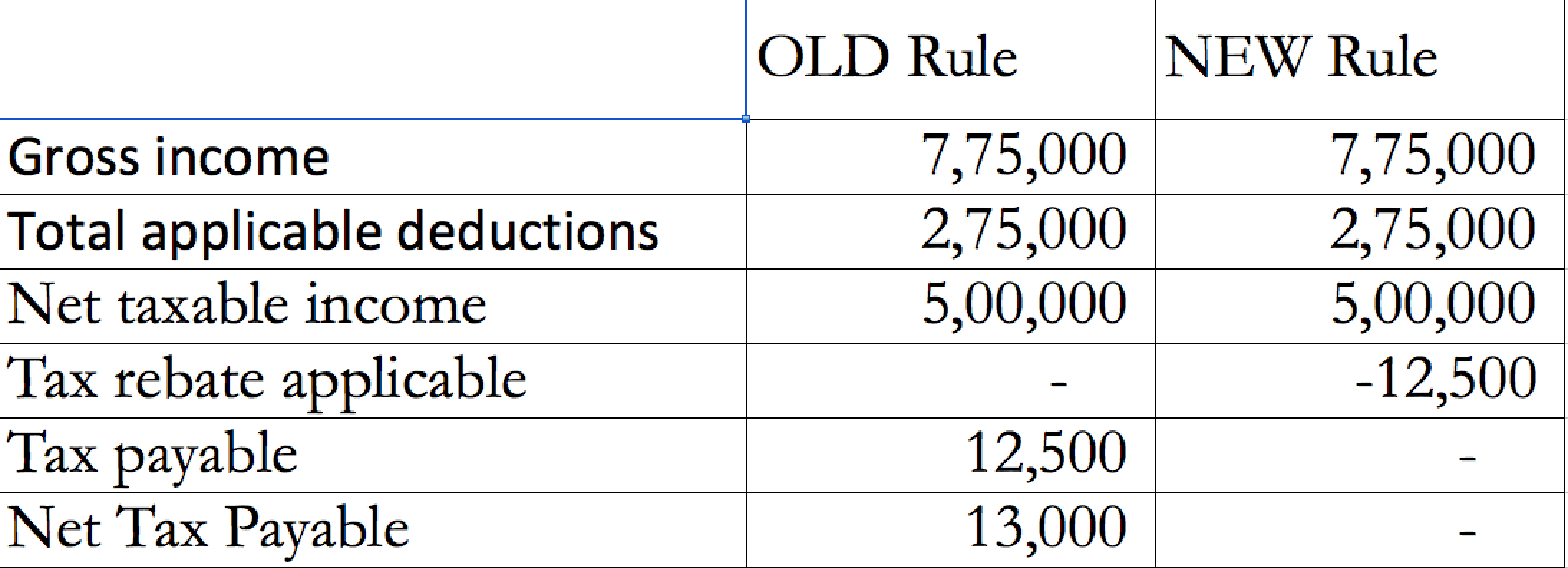

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Deferred Tax And Temporary Differences The Footnotes Analyst

https://www.gov.uk/government/publications/extended-loss-carry-back...

Web 4 avr 2022 nbsp 0183 32 The government introduced legislation in Finance Act 2021 that provides a temporary extension to the loss carry back rules for trading losses of both corporate

https://www.impots.gouv.fr/international-professionnel/tax-incentives

Web Tax benefits New businesses with innovative start up status are entitled to exemptions from Personal income tax or corporate income tax Total exemption for the first

Web 4 avr 2022 nbsp 0183 32 The government introduced legislation in Finance Act 2021 that provides a temporary extension to the loss carry back rules for trading losses of both corporate

Web Tax benefits New businesses with innovative start up status are entitled to exemptions from Personal income tax or corporate income tax Total exemption for the first

Corporation Tax And Trading Losses Debitam

Corporation Tax Liability As Percent Of Profits Has Declined EconTax Blog

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Deferred Tax And Temporary Differences The Footnotes Analyst

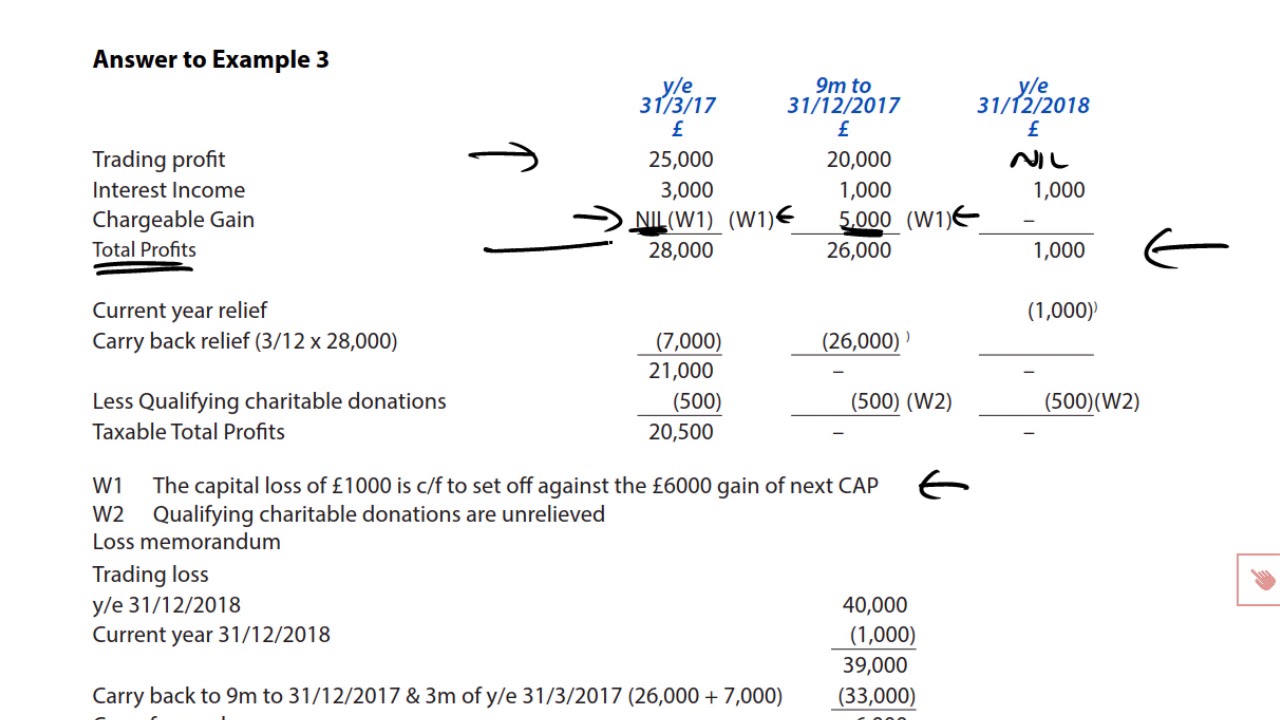

Tax Adjusted Trading Losses Carry Forward Relief ACCA Taxation TX

Corporation Tax And Trading Losses Debitam

Corporation Tax And Trading Losses Debitam

Happy Bright Day Quotes