In this age of electronic devices, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. Whatever the reason, whether for education and creative work, or simply to add an element of personalization to your home, printables for free are a great resource. In this article, we'll dive deeper into "Education Loan Tax Exemption Section," exploring the benefits of them, where to locate them, and ways they can help you improve many aspects of your daily life.

Get Latest Education Loan Tax Exemption Section Below

Education Loan Tax Exemption Section

Education Loan Tax Exemption Section - Education Loan Tax Exemption Section, Education Loan Tax Benefit Section, Education Loan Tax Exemption Limit, Education Loan Tax Exemption Example, Can Education Loan Be Used For Tax Exemption, Education Loan Interest Exemption Limit

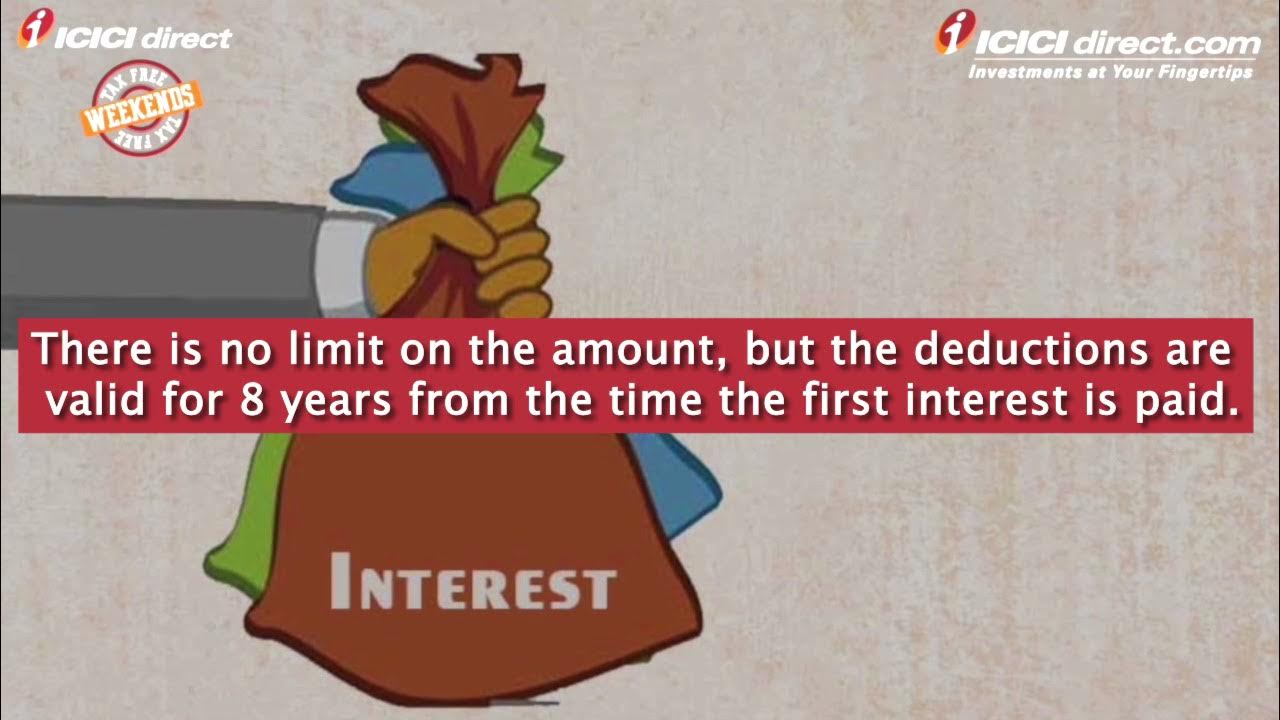

Section 80E of the Income Tax Act allows a tax deduction on the interest paid on education loans for higher studies Section 80E deduction helps to reduce the financial burden

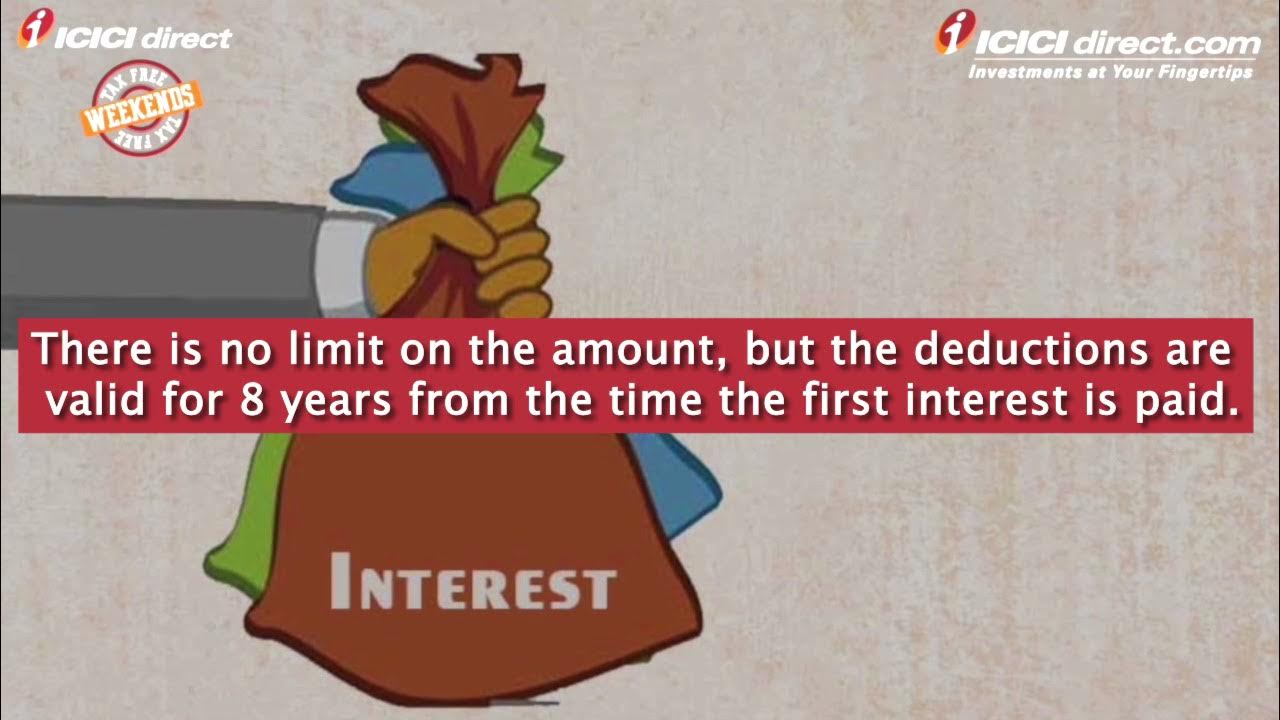

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

Education Loan Tax Exemption Section provide a diverse range of downloadable, printable materials that are accessible online for free cost. The resources are offered in a variety types, such as worksheets templates, coloring pages and more. The value of Education Loan Tax Exemption Section lies in their versatility as well as accessibility.

More of Education Loan Tax Exemption Section

Home Loan 5 Tax Exemption Tax Planning

Home Loan 5 Tax Exemption Tax Planning

An education loan tax benefit is a provision that allows individuals to claim a tax deduction on the interest paid on a loan taken for higher education This tax benefit is available in many

Section 80E caters to tax deductions on educational loans Learn about the eligibility criteria period of deduction and associated tax benefits

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Flexible: It is possible to tailor the design to meet your needs in designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value: Printables for education that are free can be used by students from all ages, making them a valuable tool for parents and teachers.

-

Accessibility: instant access the vast array of design and templates cuts down on time and efforts.

Where to Find more Education Loan Tax Exemption Section

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Under Section 80E of the Income Tax Act 1961 a person who has received an education loan option for higher studies for themselves their kids or spouse or if they re the

Understanding Section 80E Tax Exemption The 80E education loan tax benefit is for individuals who have taken out loans for higher education It applies to the loan s interest

Now that we've piqued your curiosity about Education Loan Tax Exemption Section Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Education Loan Tax Exemption Section suitable for many uses.

- Explore categories like decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- Great for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- These blogs cover a broad variety of topics, from DIY projects to planning a party.

Maximizing Education Loan Tax Exemption Section

Here are some fresh ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to enhance your learning at home, or even in the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Education Loan Tax Exemption Section are an abundance with useful and creative ideas that satisfy a wide range of requirements and desires. Their access and versatility makes them a great addition to both professional and personal life. Explore the vast array of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Education Loan Tax Exemption Section really free?

- Yes you can! You can download and print these items for free.

-

Are there any free printouts for commercial usage?

- It depends on the specific usage guidelines. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables could be restricted regarding usage. Be sure to review the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- Print them at home with any printer or head to the local print shop for better quality prints.

-

What program will I need to access Education Loan Tax Exemption Section?

- Most printables come in the PDF format, and can be opened with free software, such as Adobe Reader.

Tax Benefits Of Education Loan 80E Education Loan Tax Exemption

Tax Exemption On Education Loan Section 80E Explained

Check more sample of Education Loan Tax Exemption Section below

Education Loan Tax Deduction Under Section 80E YouTube

Education Loan Tax Benefit Education Loan Tax Exemption ICICI

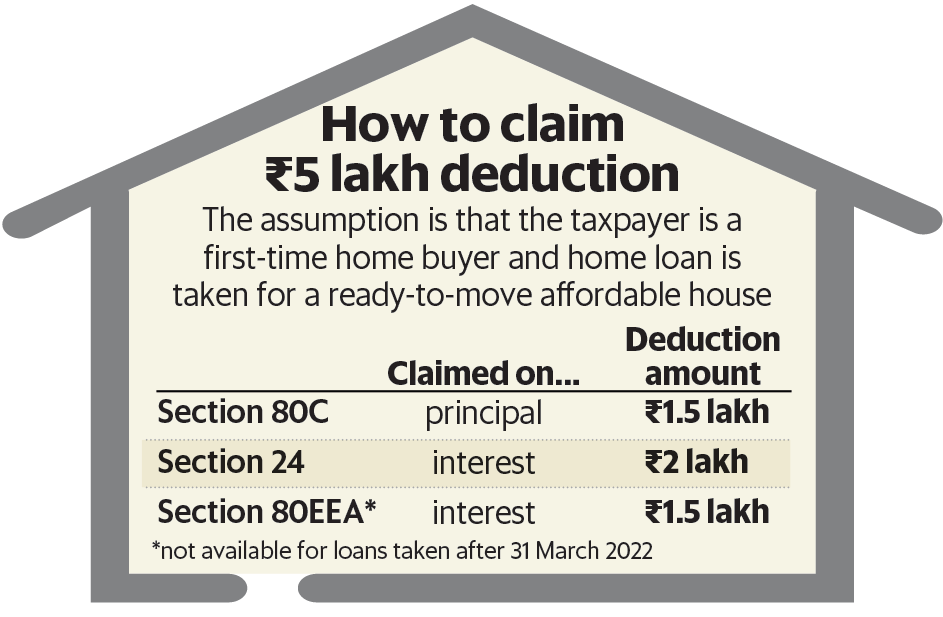

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Section 10 Of Income Tax Act Exemptions Deductions How To Claim

Personal Loan Tax Exemptions Eligibility Criteria Limitations Tax

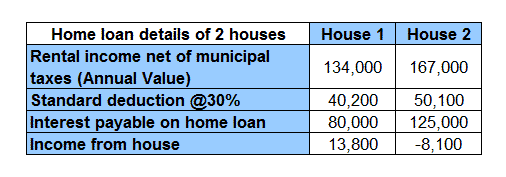

What Are The Income Tax Benefits On Mortgage Loan Loanfasttrack

https://cleartax.in/s/section-80e-deducti…

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

https://www.etmoney.com/learn/income …

Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a tax deduction for the

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a tax deduction for the

Section 10 Of Income Tax Act Exemptions Deductions How To Claim

Education Loan Tax Benefit Education Loan Tax Exemption ICICI

Personal Loan Tax Exemptions Eligibility Criteria Limitations Tax

What Are The Income Tax Benefits On Mortgage Loan Loanfasttrack

Education Loan A Student s Guide To Taking And Repaying An Education

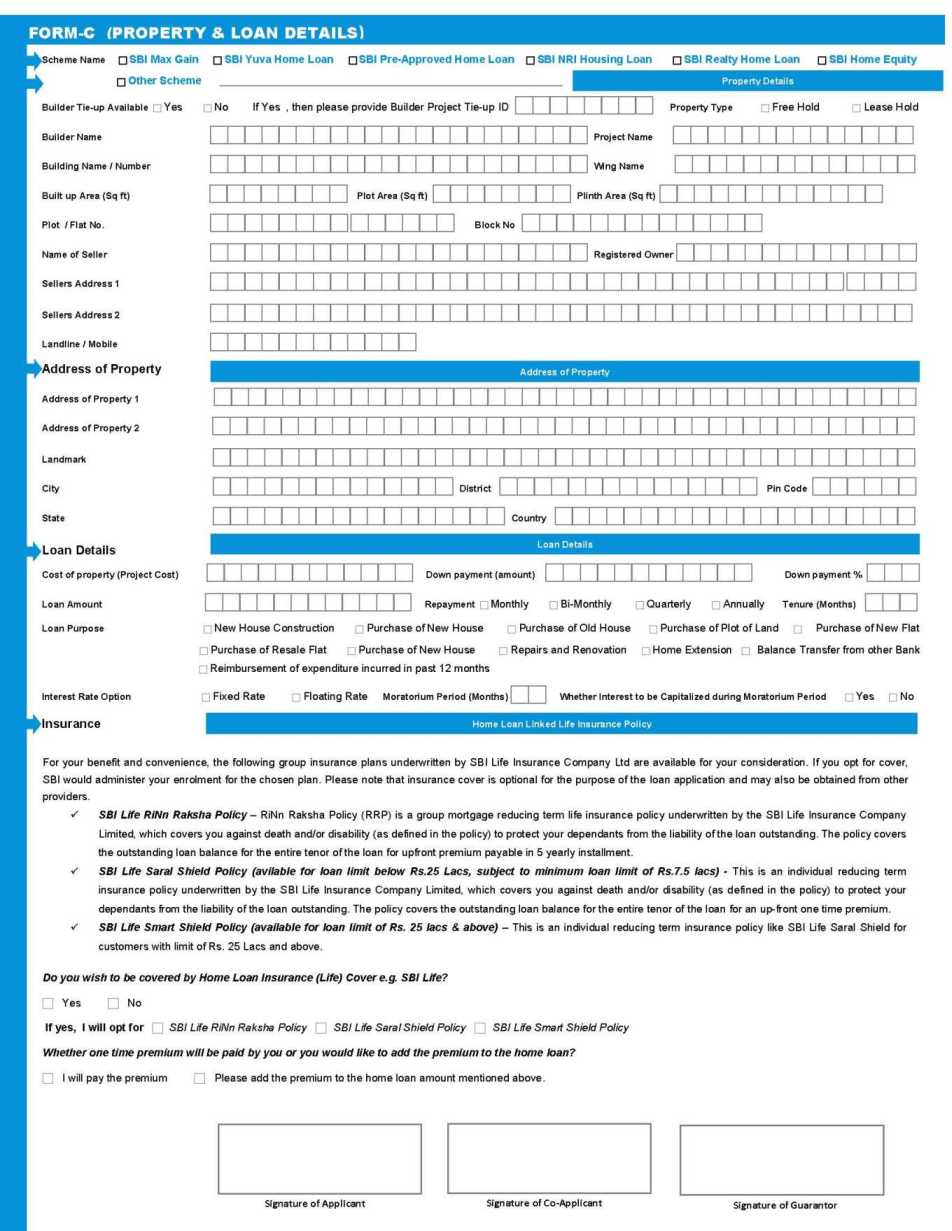

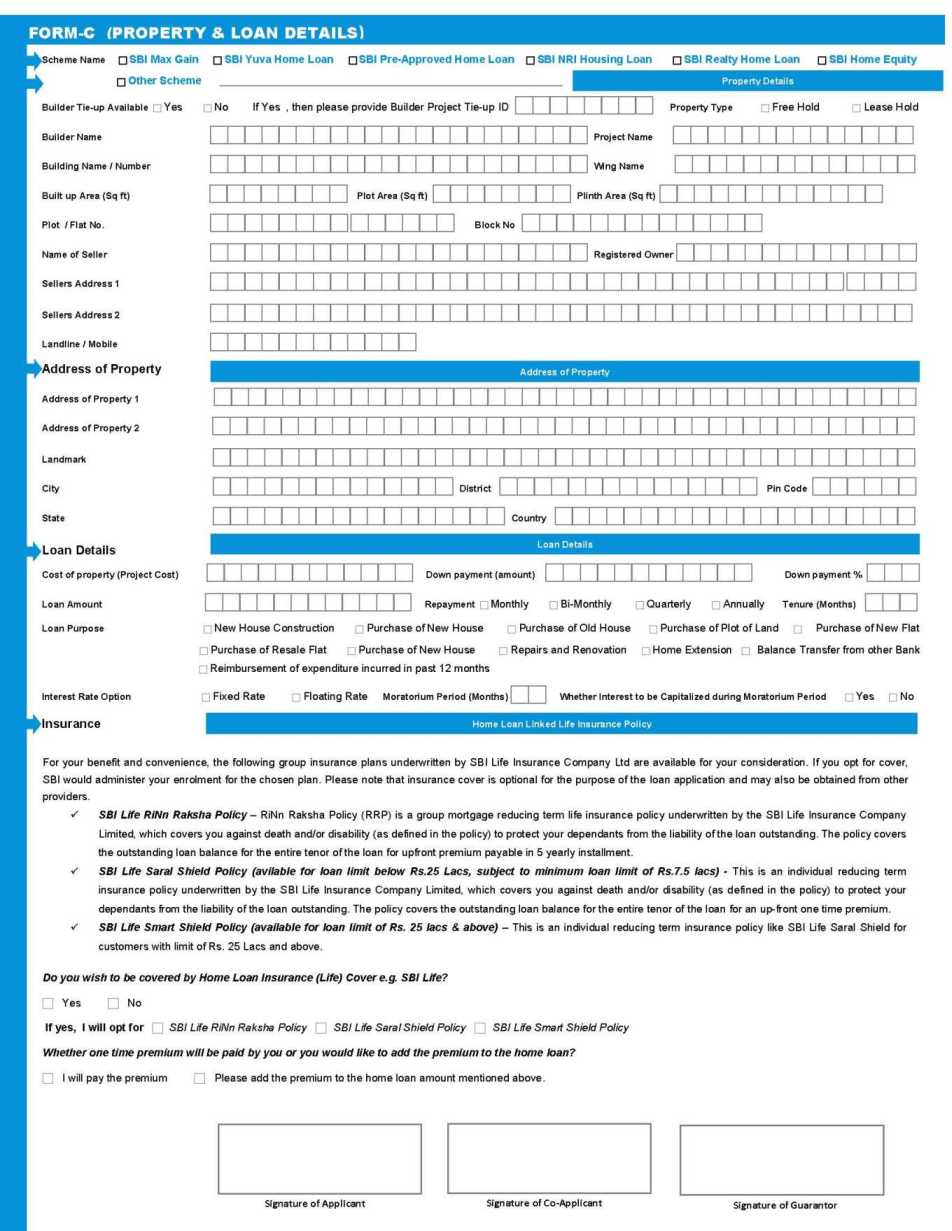

ECS Form SBI Home Loan 2023 2024 EduVark

ECS Form SBI Home Loan 2023 2024 EduVark

Site Loan Tax Exemption COOKING WITH THE PROS