Today, in which screens are the norm, the charm of tangible printed material hasn't diminished. Be it for educational use or creative projects, or simply adding a personal touch to your space, Federal Tax Credit For Electric Cars Used have become a valuable resource. For this piece, we'll take a dive in the world of "Federal Tax Credit For Electric Cars Used," exploring what they are, where to find them and the ways that they can benefit different aspects of your daily life.

Get Latest Federal Tax Credit For Electric Cars Used Below

Federal Tax Credit For Electric Cars Used

Federal Tax Credit For Electric Cars Used - Federal Tax Credit For Electric Cars Used, Federal Electric Vehicle Tax Credit For Used Cars, What Is The Federal Tax Credit For Electric Cars, Federal Tax Break For Electric Cars

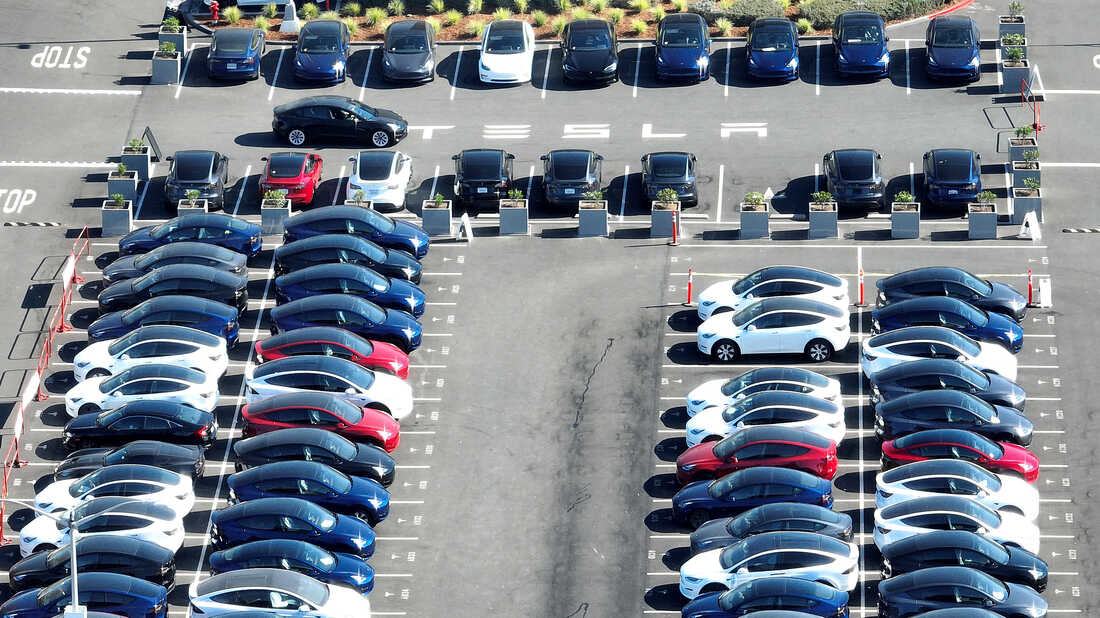

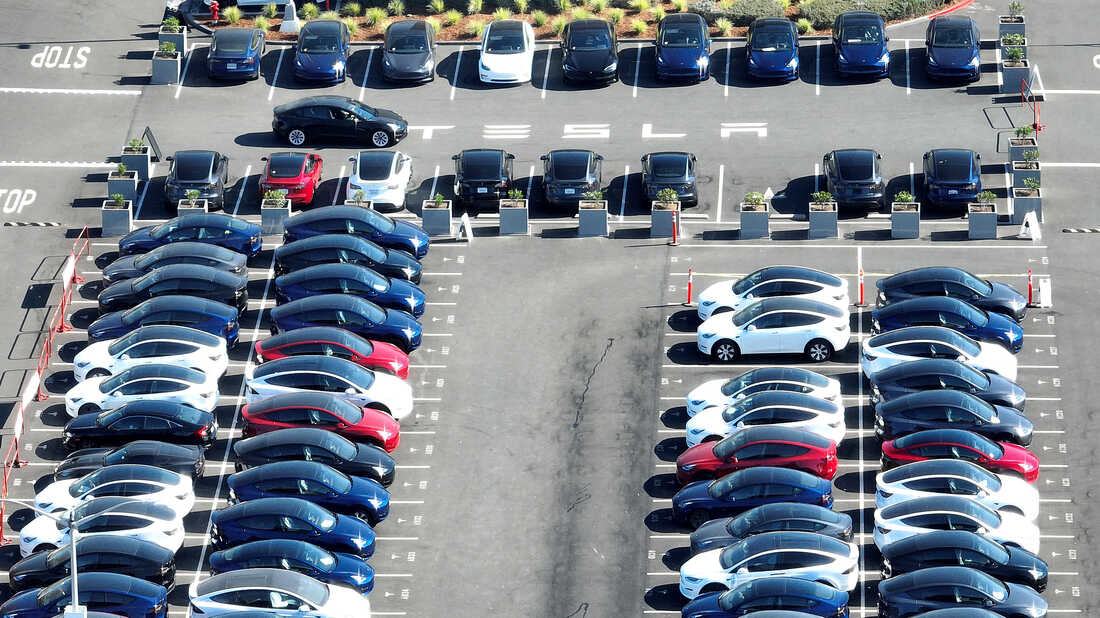

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the section 30D tax credit

As promised here is the current list of used EVs that qualify for tax credits in the US per the IRS separated by all electric BEVs and plug in hybrids PHEVs

Federal Tax Credit For Electric Cars Used offer a wide collection of printable items that are available online at no cost. These printables come in different forms, including worksheets, templates, coloring pages, and more. One of the advantages of Federal Tax Credit For Electric Cars Used lies in their versatility and accessibility.

More of Federal Tax Credit For Electric Cars Used

Federal Tax Credit For Electric Cars In 2021 Atlantic Chevrolet

Federal Tax Credit For Electric Cars In 2021 Atlantic Chevrolet

New and Used Clean Vehicle Tax Credits The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and associated equipment such as chargers

Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit equals 30 percent of the sale price up to a maximum credit of 4 000

Federal Tax Credit For Electric Cars Used have risen to immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization: There is the possibility of tailoring the design to meet your needs in designing invitations planning your schedule or even decorating your house.

-

Educational Use: Printing educational materials for no cost are designed to appeal to students of all ages. This makes them a useful instrument for parents and teachers.

-

An easy way to access HTML0: The instant accessibility to the vast array of design and templates cuts down on time and efforts.

Where to Find more Federal Tax Credit For Electric Cars Used

Electric Cars In Illinois OsVehicle

Electric Cars In Illinois OsVehicle

You could call it a tax pre fund Starting in January you ll be able to get an electric vehicle tax credit of up to 7 500 without having to wait for the IRS to process your return Instead

Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your dealership Tax credits are available for home chargers and associated energy storage each up to 1 000

Now that we've ignited your interest in Federal Tax Credit For Electric Cars Used, let's explore where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection and Federal Tax Credit For Electric Cars Used for a variety uses.

- Explore categories such as furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching materials.

- This is a great resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a wide spectrum of interests, that includes DIY projects to party planning.

Maximizing Federal Tax Credit For Electric Cars Used

Here are some ways create the maximum value of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home for the classroom.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Federal Tax Credit For Electric Cars Used are a treasure trove of creative and practical resources that cater to various needs and desires. Their accessibility and versatility make they a beneficial addition to each day life. Explore the wide world of Federal Tax Credit For Electric Cars Used now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes you can! You can print and download these tools for free.

-

Do I have the right to use free printables for commercial purposes?

- It's contingent upon the specific rules of usage. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Are there any copyright problems with Federal Tax Credit For Electric Cars Used?

- Certain printables could be restricted in use. Check the terms and conditions offered by the creator.

-

How can I print printables for free?

- You can print them at home with printing equipment or visit a local print shop to purchase superior prints.

-

What program do I require to view printables for free?

- The majority of printables are in PDF format. These can be opened with free programs like Adobe Reader.

How To Calculate The Federal Tax Credit For Electric Cars GreenCars

Federal Tax Credit For Electric Cars OsVehicle

Check more sample of Federal Tax Credit For Electric Cars Used below

Federal Tax Credit For Electric Cars 2021 Form Wcarsj

![]()

What To Know About The 7 500 IRS EV Tax Credit For Electric Cars In

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

Federal Tax Credit For Electric Cars All You Need To Know Way Blog

BMW Electric Plug in Hybrid Vehicle Tax Credit Update For 2023

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://electrek.co/2024/03/18/here-are-all-the...

As promised here is the current list of used EVs that qualify for tax credits in the US per the IRS separated by all electric BEVs and plug in hybrids PHEVs

https://www.irs.gov/newsroom/qualifying-clean...

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

As promised here is the current list of used EVs that qualify for tax credits in the US per the IRS separated by all electric BEVs and plug in hybrids PHEVs

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

Federal Tax Credit For Electric Cars All You Need To Know Way Blog

What To Know About The 7 500 IRS EV Tax Credit For Electric Cars In

BMW Electric Plug in Hybrid Vehicle Tax Credit Update For 2023

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Ev Tax Credit 2022 Cap Clement Wesley

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

What s The Federal Tax Credit For Electric Cars In 2021