In this age of electronic devices, when screens dominate our lives yet the appeal of tangible printed material hasn't diminished. Be it for educational use such as creative projects or just adding personal touches to your area, Federal Tax Credit Home Energy Efficiency Improvement are now a vital source. The following article is a take a dive to the depths of "Federal Tax Credit Home Energy Efficiency Improvement," exploring what they are, where they are, and how they can enhance various aspects of your life.

Get Latest Federal Tax Credit Home Energy Efficiency Improvement Below

Federal Tax Credit Home Energy Efficiency Improvement

Federal Tax Credit Home Energy Efficiency Improvement - Federal Tax Credit Home Energy Efficiency Improvement, Federal Tax Credits For Residential Energy Efficient Improvements, What Is A Federal Tax Credit For Energy Efficiency, Federal Tax Credits For Renewable Energy

A More information on the energy efficient home improvement credit and residential clean energy property credit is available for tax professionals building contractors

You can claim either the Energy Efficient Home Improvement Credit or the Residential Energy Clean Property Credit for the year when you make qualifying

Federal Tax Credit Home Energy Efficiency Improvement offer a wide selection of printable and downloadable items that are available online at no cost. They come in many styles, from worksheets to templates, coloring pages, and many more. The appealingness of Federal Tax Credit Home Energy Efficiency Improvement is in their versatility and accessibility.

More of Federal Tax Credit Home Energy Efficiency Improvement

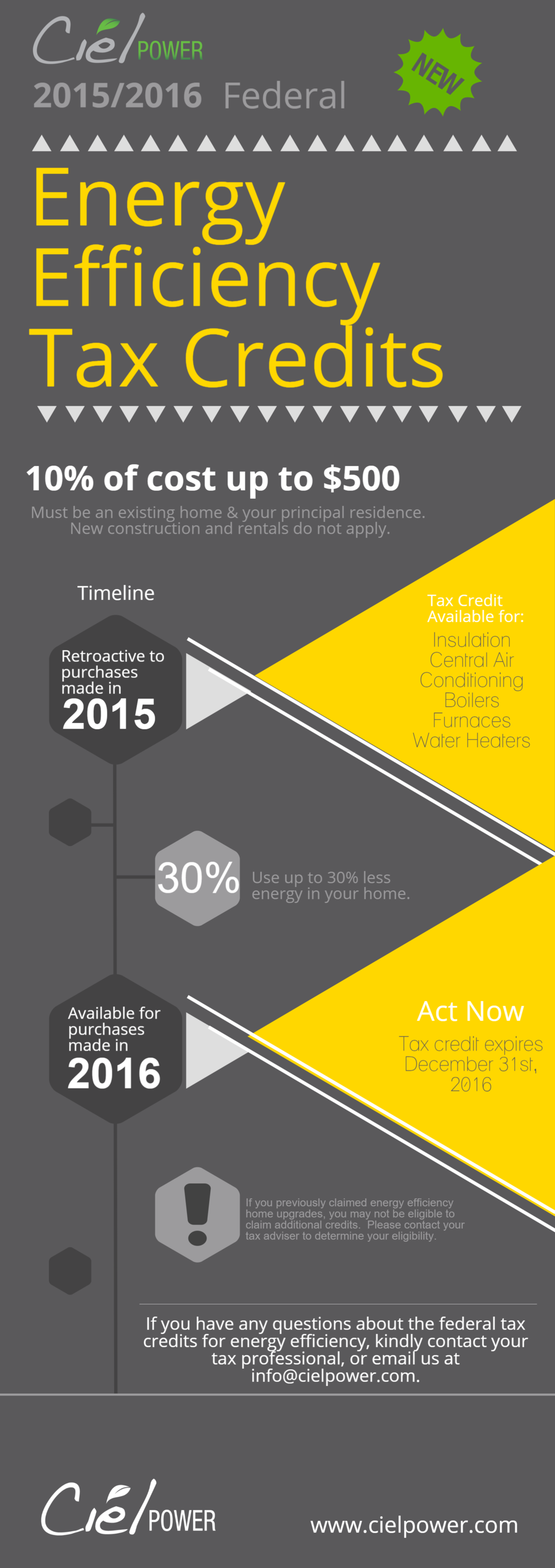

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

The energy efficient home improvement credit is subject to the following limitations Sec 25C b as amended by the act Annual overall limitation The credit

Federal Tax Credit Home Energy Efficiency Improvement have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Modifications: This allows you to modify designs to suit your personal needs when it comes to designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value: Downloads of educational content for free can be used by students from all ages, making these printables a powerful source for educators and parents.

-

Affordability: You have instant access many designs and templates will save you time and effort.

Where to Find more Federal Tax Credit Home Energy Efficiency Improvement

Download 10 Steps To Energy Efficiency Improvement Simulate Live

Download 10 Steps To Energy Efficiency Improvement Simulate Live

Home Improvement Air Conditioners energy efficient More Info on Air Conditioners Clothes Dryers ENERGY STAR heat pump More Info on Clothes Dryers Electric Stove

Energy Efficient Upgrades That Qualify for Federal Tax Credits Looking for the ENERGY STAR label makes it easy to identify products for your home that save energy save money and help protect the climate Here

After we've peaked your interest in Federal Tax Credit Home Energy Efficiency Improvement Let's see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with Federal Tax Credit Home Energy Efficiency Improvement for all needs.

- Explore categories like the home, decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- Perfect for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs are a vast variety of topics, that includes DIY projects to planning a party.

Maximizing Federal Tax Credit Home Energy Efficiency Improvement

Here are some creative ways ensure you get the very most of Federal Tax Credit Home Energy Efficiency Improvement:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use free printable worksheets for teaching at-home (or in the learning environment).

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Federal Tax Credit Home Energy Efficiency Improvement are a treasure trove of fun and practical tools that can meet the needs of a variety of people and passions. Their accessibility and flexibility make them an invaluable addition to any professional or personal life. Explore the plethora of Federal Tax Credit Home Energy Efficiency Improvement and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes you can! You can print and download these documents for free.

-

Can I make use of free printing templates for commercial purposes?

- It's contingent upon the specific usage guidelines. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables might have limitations in their usage. Be sure to check these terms and conditions as set out by the creator.

-

How do I print Federal Tax Credit Home Energy Efficiency Improvement?

- You can print them at home using the printer, or go to a print shop in your area for higher quality prints.

-

What program will I need to access printables free of charge?

- Most printables come in PDF format. These can be opened using free software, such as Adobe Reader.

Home Energy Efficiency Tips Steve Clark Clarkliving

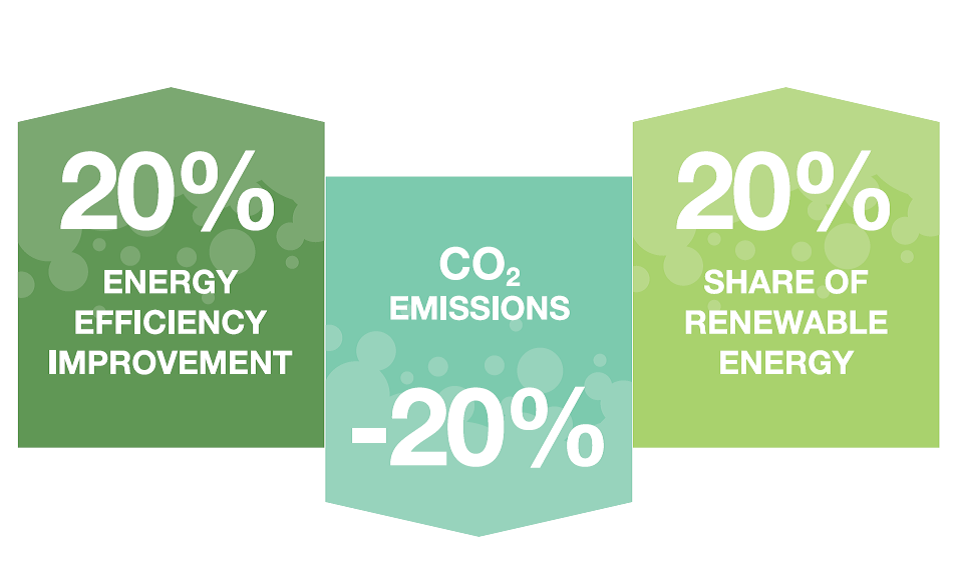

European Ecodesign And Energy Labeling Regulations

Check more sample of Federal Tax Credit Home Energy Efficiency Improvement below

For Energy Efficiency Day Here Are Tips To Cut Your Consumption The

Energy Efficiency Improvement Act Of 2015 Alliance To Save Energy

Claim Energy Efficiency Tax Credit For Homeowners Before It s Gone Inman

The Top Reasons To Use A Credit Union And How To Join One Stone

Review Of Energy Efficiency Improvement Scheme

Residential Energy Efficiency Poole s Plumbing Raleigh NC

https://www.irs.gov/credits-deductions/home-energy-tax-credits

You can claim either the Energy Efficient Home Improvement Credit or the Residential Energy Clean Property Credit for the year when you make qualifying

https://turbotax.intuit.com/tax-tips/home...

Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE

You can claim either the Energy Efficient Home Improvement Credit or the Residential Energy Clean Property Credit for the year when you make qualifying

Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE

The Top Reasons To Use A Credit Union And How To Join One Stone

Energy Efficiency Improvement Act Of 2015 Alliance To Save Energy

Review Of Energy Efficiency Improvement Scheme

Residential Energy Efficiency Poole s Plumbing Raleigh NC

Federal Tax Credit On Tesla Models Set To Ratchet Down Again July 1

500 Federal Tax Credit Announced For Energy Saving Window Film Home

500 Federal Tax Credit Announced For Energy Saving Window Film Home

Infographic How To Make Your Home More Energy Efficient GenStone