Today, with screens dominating our lives it's no wonder that the appeal of tangible printed objects isn't diminished. Whatever the reason, whether for education for creative projects, just adding a personal touch to your home, printables for free have become an invaluable resource. With this guide, you'll take a dive into the sphere of "Home Loan Interest Tax Rebate Section," exploring what they are, how they are, and how they can enrich various aspects of your daily life.

Get Latest Home Loan Interest Tax Rebate Section Below

Home Loan Interest Tax Rebate Section

Home Loan Interest Tax Rebate Section - Home Loan Interest Tax Rebate Section, Home Loan Interest Tax Benefit Section, Home Loan Interest Tax Benefit Under Which Section, Home Loan Interest Deduction Section, Home Loan Interest Deduction Section 24, Home Loan Interest Deduction Section Limit, Home Loan Interest Rebate In Income Tax Section, Is Home Loan Interest Tax Deductible, Income Tax Rebate On Second Housing Loan Interest, How To Get Rebate On Home Loan Interest

Web For home loan repayment each co borrower can claim tax benefits under Section 80C upto Rs 1 50 lakhs every year together with other eligible items So you will get the tax benefits on the home loan in the ratio in

Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Home Loan Interest Tax Rebate Section provide a diverse array of printable materials online, at no cost. These materials come in a variety of types, like worksheets, coloring pages, templates and many more. The great thing about Home Loan Interest Tax Rebate Section is in their versatility and accessibility.

More of Home Loan Interest Tax Rebate Section

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

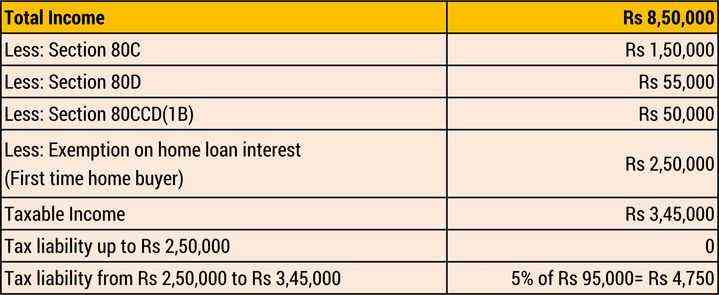

Web 24 ao 251 t 2023 nbsp 0183 32 The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Web 5 sept 2023 nbsp 0183 32 Benefits of Section 80EEA are offered to home loans sanctioned between 1 April 2019 and 31 March 2022 Borrowers whose loans were approved during this period

Home Loan Interest Tax Rebate Section have risen to immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Customization: It is possible to tailor printables to your specific needs, whether it's designing invitations to organize your schedule or even decorating your house.

-

Educational value: Downloads of educational content for free can be used by students from all ages, making them an essential tool for parents and teachers.

-

The convenience of Quick access to an array of designs and templates will save you time and effort.

Where to Find more Home Loan Interest Tax Rebate Section

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri

Web Principal repayment of home loans can net annual tax deductions of up to Rs 1 5 lakh under Section 80C of the ITA On the interest payments for a home loan you can claim

Since we've got your interest in Home Loan Interest Tax Rebate Section and other printables, let's discover where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Home Loan Interest Tax Rebate Section suitable for many reasons.

- Explore categories like furniture, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free as well as flashcards and other learning tools.

- Ideal for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- The blogs are a vast spectrum of interests, all the way from DIY projects to planning a party.

Maximizing Home Loan Interest Tax Rebate Section

Here are some fresh ways to make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets for free to enhance your learning at home also in the classes.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Home Loan Interest Tax Rebate Section are a treasure trove of practical and innovative resources that satisfy a wide range of requirements and interest. Their access and versatility makes them a wonderful addition to any professional or personal life. Explore the many options of Home Loan Interest Tax Rebate Section today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I use the free templates for commercial use?

- It is contingent on the specific usage guidelines. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Some printables may contain restrictions regarding usage. Make sure you read the conditions and terms of use provided by the author.

-

How do I print Home Loan Interest Tax Rebate Section?

- You can print them at home with either a printer or go to the local print shops for high-quality prints.

-

What program is required to open printables free of charge?

- Many printables are offered in the PDF format, and can be opened with free software, such as Adobe Reader.

What Are Reuluations About Getting A Home Loan On A Forclosed Home

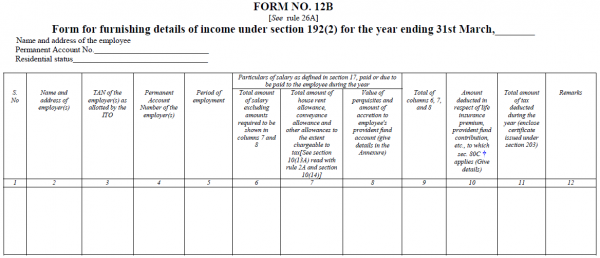

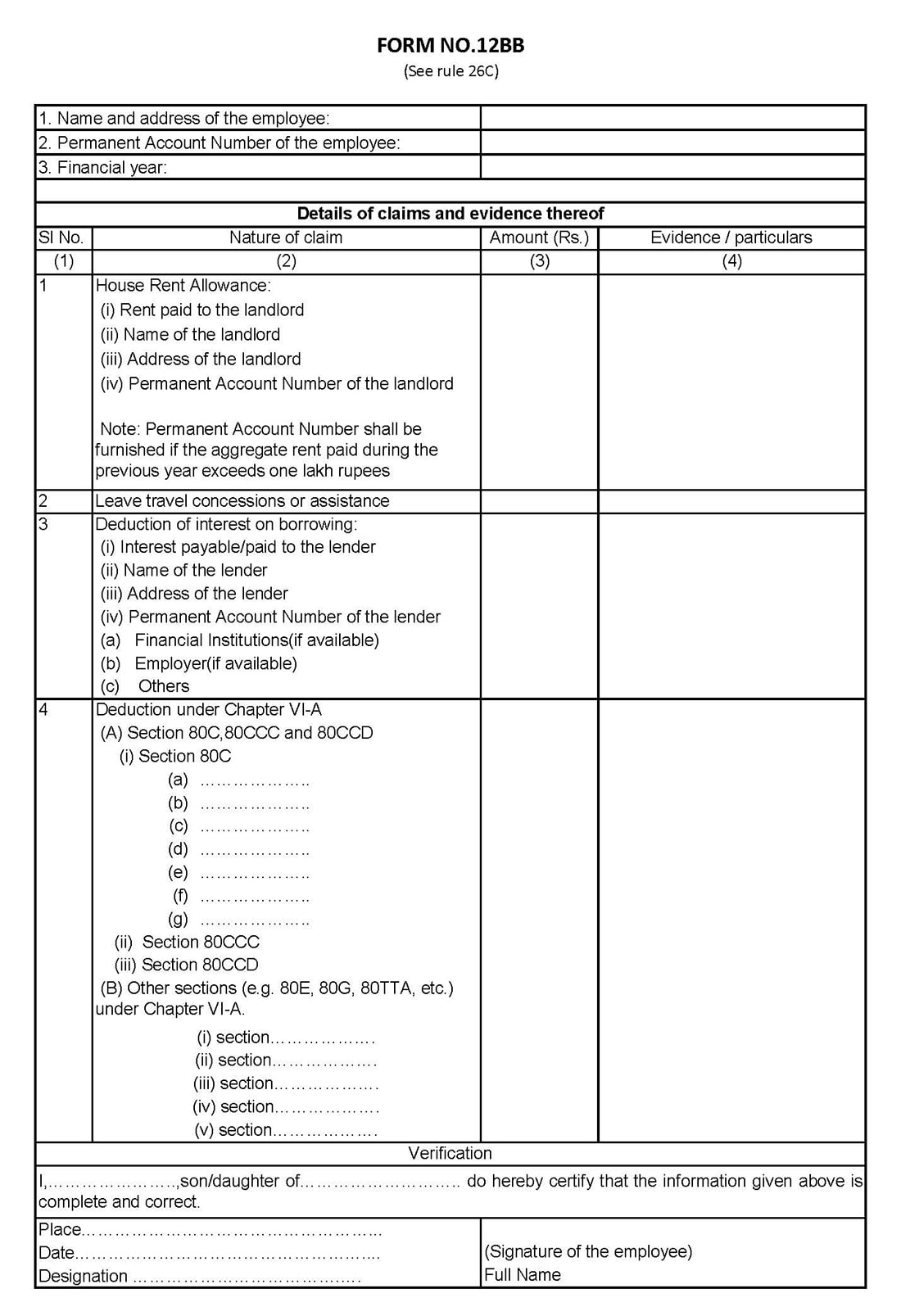

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Check more sample of Home Loan Interest Tax Rebate Section below

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

DEDUCTION UNDER SECTION 80C TO 80U PDF

Essential Design Smartphone Apps

How To Lower Loan Interest Rates

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

DEDUCTION UNDER SECTION 80C TO 80U PDF

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

Essential Design Smartphone Apps

How To Lower Loan Interest Rates

Home Loan Interest Exemption In Income Tax Home Sweet Home

Rising Home Loan Interests Have Begun To Impact Homebuyers

Rising Home Loan Interests Have Begun To Impact Homebuyers

Home Loan Interest Tax Benefit 2019 20 Home Sweet Home Insurance