In the digital age, in which screens are the norm The appeal of tangible printed materials isn't diminishing. If it's to aid in education in creative or artistic projects, or simply adding some personal flair to your space, Home Loan Interest Deduction Section have become a valuable resource. The following article is a take a dive into the sphere of "Home Loan Interest Deduction Section," exploring their purpose, where to get them, as well as ways they can help you improve many aspects of your daily life.

Get Latest Home Loan Interest Deduction Section Below

Home Loan Interest Deduction Section

Home Loan Interest Deduction Section - Home Loan Interest Deduction Section, Home Loan Interest Deduction Section 24, Home Loan Interest Deduction Section In Income Tax, Home Loan Interest Deduction Section In Itr, Home Loan Interest Deduction Section India, Home Loan Interest Deduction Section In Itr2, Home Loan Interest Deduction Section Limit, Home Loan Interest Deduction Section In Itr 1, Home Loan Interest Deduction Section In Hindi, Home Loan Interest Exemption Under Section

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution or a housing finance company You can claim a deduction of up to Rs 50 000 per financial year as per this section

If you have borrowed money to buy residential property in order to rent it out you can deduct all the related interest expenses This is considered a loan for the production of income i e you receive taxable income from the investment you made with the borrowed funds

Printables for free cover a broad assortment of printable content that can be downloaded from the internet at no cost. They are available in numerous forms, including worksheets, templates, coloring pages and many more. The great thing about Home Loan Interest Deduction Section is in their variety and accessibility.

More of Home Loan Interest Deduction Section

Budget 2023 Home Loan Interest Deduction Cannot Be Part Of Acquisition

Budget 2023 Home Loan Interest Deduction Cannot Be Part Of Acquisition

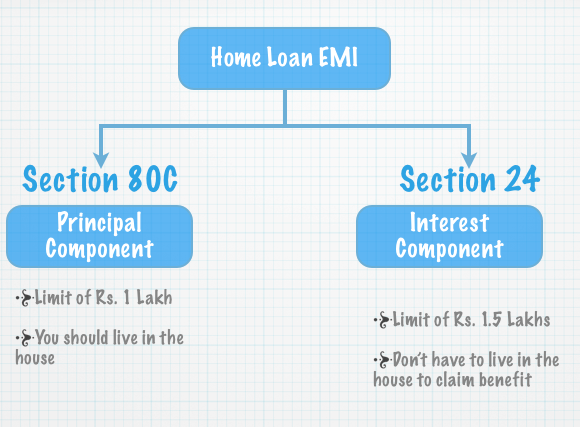

Deductions allowed on home loan interest Deductions for home loan interest repayment are offered under various sections of the income tax law Deductions under Section 24 B Available for Property construction property purchase Can be claimed for Self occupied rented deemed to be rented properties

This publication discusses the rules for deduct ing home mortgage interest Part I contains general information on home mortgage interest including points It also ex plains how to report deductible interest on your tax return Part II explains how your deduction for home mortgage interest may be limited It contains Ta

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Flexible: We can customize printables to your specific needs be it designing invitations to organize your schedule or decorating your home.

-

Educational Use: Educational printables that can be downloaded for free cater to learners of all ages, which makes them a vital tool for parents and teachers.

-

Affordability: Access to a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Home Loan Interest Deduction Section

How To Get The Interest Deduction On Your Student Loan

How To Get The Interest Deduction On Your Student Loan

To provide interest deduction on home loans section 80EEA has been introduced The older provision of Section 80EE allowed a deduction of up to Rs 50 000 for interest paid to first time home buyers for loans sanctioned from a financial institution between 1 April 2016 and 31 March 2017

Section 80EE of the Income Tax Act allows first time home buyers to deduct interest payments on their mortgages For home loans taken out during 1 April 2016 to 31 March 2017 a tax deduction of up to Rs 50 000 is available Only first time home buyers are eligible for deductions on home loan interest payments under Section 80EE

Since we've got your curiosity about Home Loan Interest Deduction Section Let's see where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Home Loan Interest Deduction Section to suit a variety of uses.

- Explore categories like design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- This is a great resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- These blogs cover a wide range of interests, everything from DIY projects to party planning.

Maximizing Home Loan Interest Deduction Section

Here are some ideas create the maximum value use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Home Loan Interest Deduction Section are a treasure trove of creative and practical resources designed to meet a range of needs and desires. Their availability and versatility make these printables a useful addition to any professional or personal life. Explore the plethora of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I make use of free printables for commercial uses?

- It's contingent upon the specific rules of usage. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Are there any copyright problems with Home Loan Interest Deduction Section?

- Some printables may come with restrictions in use. Be sure to read the terms and conditions set forth by the author.

-

How do I print printables for free?

- Print them at home with your printer or visit a local print shop for the highest quality prints.

-

What software do I need to open printables at no cost?

- The majority are printed in the format PDF. This is open with no cost software such as Adobe Reader.

Home Loan Interest Deduction Procedure To Claim HomeCapital

Home Loan Interest Home Loan Interest Deduction Under Which Section

Check more sample of Home Loan Interest Deduction Section below

Student Loan Interest Deduction Worksheet

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

HOME LOAN BUDGET 2019 HOME LOAN TAX BENEFIT HOUSE LOAN INTEREST

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

All About Section 80EEA For Deduction On Home Loan Interest

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

https://www.vero.fi › en › individuals › deductions › what...

If you have borrowed money to buy residential property in order to rent it out you can deduct all the related interest expenses This is considered a loan for the production of income i e you receive taxable income from the investment you made with the borrowed funds

https://cleartax.in

Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The deduction is only available to individuals who meet specific criteria and have taken a

If you have borrowed money to buy residential property in order to rent it out you can deduct all the related interest expenses This is considered a loan for the production of income i e you receive taxable income from the investment you made with the borrowed funds

Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The deduction is only available to individuals who meet specific criteria and have taken a

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

All About Section 80EEA For Deduction On Home Loan Interest

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

Tax Deduction On Home Loan Interest Under Section 80EE Wishfin

Can You Claim Both HRA And Home Loan Interest Deduction In Income Tax

Can You Claim Both HRA And Home Loan Interest Deduction In Income Tax

TAXATION OF HOME LOAN INTEREST DEDUCTION UNDER SECTION 80EE OF IT ACT