In the digital age, where screens rule our lives, the charm of tangible printed objects hasn't waned. For educational purposes, creative projects, or simply adding personal touches to your home, printables for free are now a vital source. This article will take a dive into the world "Home Loan Rebate In Income Tax Before Possession," exploring what they are, where to find them and how they can enhance various aspects of your life.

Get Latest Home Loan Rebate In Income Tax Before Possession Below

Home Loan Rebate In Income Tax Before Possession

Home Loan Rebate In Income Tax Before Possession - Home Loan Rebate In Income Tax Before Possession, Home Loan Benefit In Income Tax Before Possession, Tax Benefit On Home Loan Before Possession, Tax Benefit On Home Loan Interest Before Possession, Income Tax Rebate On Home Loan Rules

Web 28 janv 2023 nbsp 0183 32 Income tax return Rebate on home loan interest paid before possession can be claimed over a period of five years after getting possession says Section 24 B

Web 16 mai 2013 nbsp 0183 32 Acquiring a home loan makes an individual eligible for tax deduction under section 80C and section 24 of Income Tax Act Housing Loan taken and possession

The Home Loan Rebate In Income Tax Before Possession are a huge range of printable, free documents that can be downloaded online at no cost. These printables come in different types, such as worksheets templates, coloring pages, and many more. The appealingness of Home Loan Rebate In Income Tax Before Possession is their flexibility and accessibility.

More of Home Loan Rebate In Income Tax Before Possession

Latest Income Tax Rebate On Home Loan 2023

Latest Income Tax Rebate On Home Loan 2023

Web Can an individual claim Home Loan tax benefit before possession Yes it is possible to claim a tax rebate on Home Loan before possession However these tax rebates

Web 5 f 233 vr 2023 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

The Home Loan Rebate In Income Tax Before Possession have gained huge popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization: The Customization feature lets you tailor the design to meet your needs when it comes to designing invitations to organize your schedule or even decorating your home.

-

Educational Benefits: Educational printables that can be downloaded for free can be used by students of all ages, making them a valuable instrument for parents and teachers.

-

Accessibility: The instant accessibility to a plethora of designs and templates helps save time and effort.

Where to Find more Home Loan Rebate In Income Tax Before Possession

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Benefits On Home Loan Loanfasttrack

Web 9 sept 2023 nbsp 0183 32 In case of delayed possession over the stipulated period considering that the tax deduction limit over the first 5 years in Rs 2 lakh and the tax deductible limit after

Web 24 d 233 c 2021 nbsp 0183 32 Answer Since you have already sold the house in respect of which you were entitled to claim pre EMI interest for the next two years as no income is taxable in respect of the same house property

We've now piqued your curiosity about Home Loan Rebate In Income Tax Before Possession Let's take a look at where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Home Loan Rebate In Income Tax Before Possession designed for a variety purposes.

- Explore categories like home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Perfect for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs are a vast array of topics, ranging starting from DIY projects to planning a party.

Maximizing Home Loan Rebate In Income Tax Before Possession

Here are some fresh ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home and in class.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Home Loan Rebate In Income Tax Before Possession are a treasure trove of useful and creative resources that cater to various needs and pursuits. Their availability and versatility make these printables a useful addition to each day life. Explore the vast world of Home Loan Rebate In Income Tax Before Possession and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes you can! You can download and print these resources at no cost.

-

Are there any free printables for commercial purposes?

- It's based on the usage guidelines. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Are there any copyright concerns when using Home Loan Rebate In Income Tax Before Possession?

- Some printables could have limitations on use. Make sure you read the terms and conditions provided by the creator.

-

How do I print printables for free?

- You can print them at home using any printer or head to the local print shop for top quality prints.

-

What program is required to open printables free of charge?

- Most printables come in the format PDF. This can be opened with free software such as Adobe Reader.

A Complete Guide On Tax Rebate On Second Home Loan Derek Time

Increase In Rebate Limit Relief On Home Loan Here s What Taxpayers

Check more sample of Home Loan Rebate In Income Tax Before Possession below

Income Tax Rebate On Home Loan Fy 2019 20 A design system

SBI Credai Sign MoU For Home Loan Rebate For Budget Housing

Latest Income Tax Rebate On Home Loan 2023

Income Tax Rebate Under Section 87A

LHDN IRB Personal Income Tax Rebate 2022

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

https://taxmantra.com/tax-benefit-on-home-loan-in-case-of-pre-and-post...

Web 16 mai 2013 nbsp 0183 32 Acquiring a home loan makes an individual eligible for tax deduction under section 80C and section 24 of Income Tax Act Housing Loan taken and possession

https://www.tatacapital.com/blog/loan-for-home/home-loan-tax-benefits...

Web 12 janv 2022 nbsp 0183 32 You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the

Web 16 mai 2013 nbsp 0183 32 Acquiring a home loan makes an individual eligible for tax deduction under section 80C and section 24 of Income Tax Act Housing Loan taken and possession

Web 12 janv 2022 nbsp 0183 32 You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the

Income Tax Rebate Under Section 87A

SBI Credai Sign MoU For Home Loan Rebate For Budget Housing

LHDN IRB Personal Income Tax Rebate 2022

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

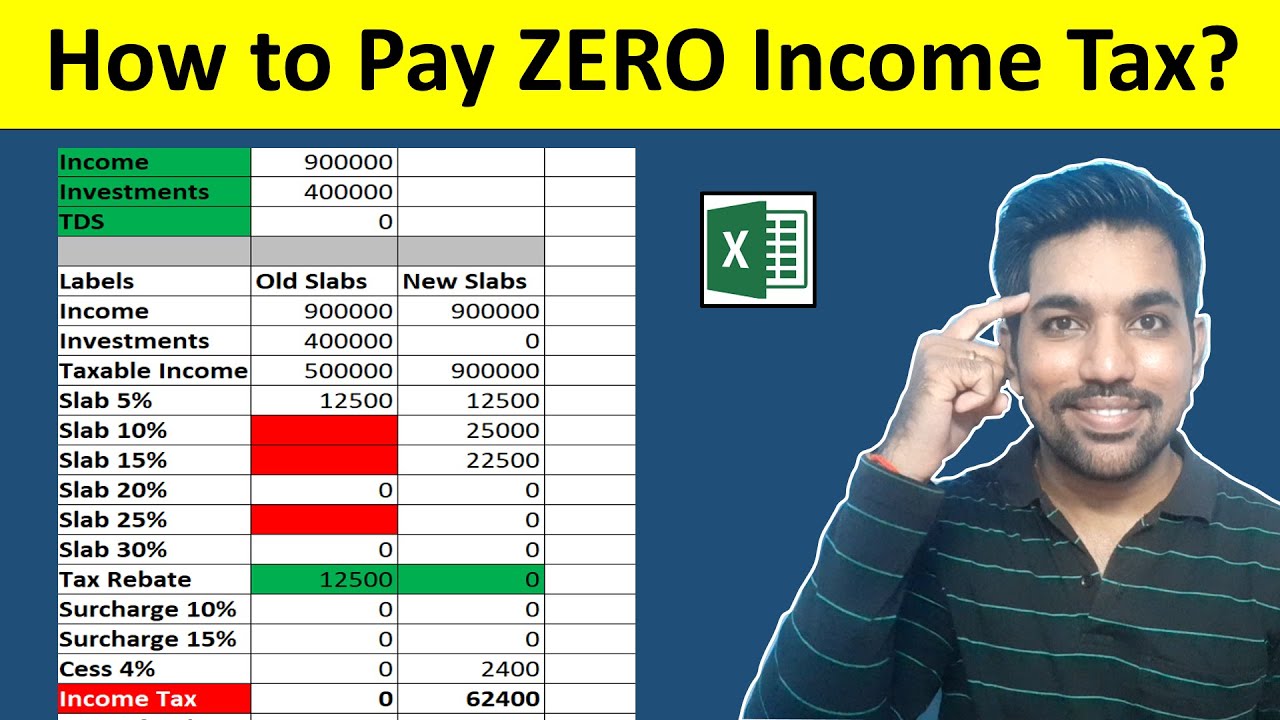

How To Pay ZERO Income Tax With Tax Rebate Income Tax Calculation

All You Need To Know About 87a Tax Rebate For Annual Year 2017 18

All You Need To Know About 87a Tax Rebate For Annual Year 2017 18

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And