In the age of digital, when screens dominate our lives it's no wonder that the appeal of tangible printed products hasn't decreased. Whatever the reason, whether for education as well as creative projects or simply adding personal touches to your home, printables for free have proven to be a valuable resource. Through this post, we'll take a dive into the world "House Rent Allowance Deduction In Income Tax Section," exploring the benefits of them, where to locate them, and what they can do to improve different aspects of your daily life.

Get Latest House Rent Allowance Deduction In Income Tax Section Below

House Rent Allowance Deduction In Income Tax Section

House Rent Allowance Deduction In Income Tax Section - House Rent Allowance Deduction In Income Tax Section, House Rent Exemption In Income Tax Section, House Rent Allowance Deduction Under Section, House Rent Deduction In Income Tax Section, House Rent Deduction In Income Tax Section Limit, House Rent Allowance Deduction In Income Tax

Calculate Please enter email to continue You can claim HRA while tax filing even if you have not submitted rent receipts to your HR clearTax will help you claim this while e filing If you don t receive HRA you can now claim upto Rs 60 000 deduction under Section 80GG Click here to calculate your tax as per Budget 2024

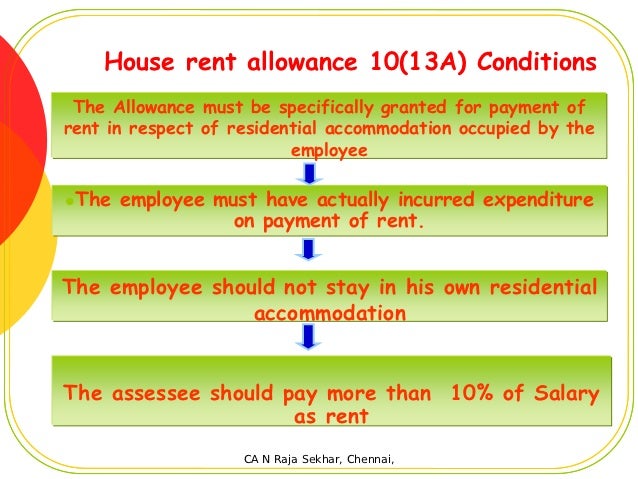

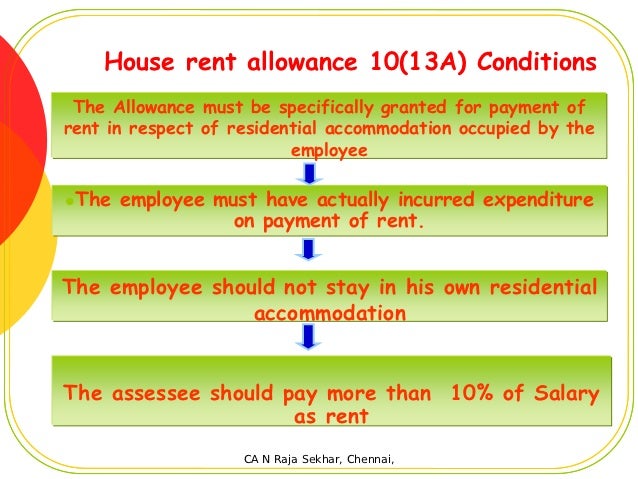

05 May 2020 72 144 Views 5 comments HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA

House Rent Allowance Deduction In Income Tax Section encompass a wide assortment of printable, downloadable material that is available online at no cost. They are available in numerous types, such as worksheets coloring pages, templates and many more. One of the advantages of House Rent Allowance Deduction In Income Tax Section is their versatility and accessibility.

More of House Rent Allowance Deduction In Income Tax Section

CALCULATION OF HOUSE RENT ALLOWANCE Allowance Kids Education Excel

CALCULATION OF HOUSE RENT ALLOWANCE Allowance Kids Education Excel

Under Section 80GG the deduction is allowed to an individual who pays rent without receiving any House Rent Allowance from an employer Hence check the Salary Slip to see if there is any House Rent Allowance component in the salary break up

The best part Salaried individuals who live in a rented house can claim tax exemption on HRA under Section 10 13A of the Income Tax Act HRA is subject to full or partial tax deductions An employee has to submit Form 12BB to the employer to claim the exemptions like HRA LTA etc and Income Tax deductions under Chapter VI A

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Personalization Your HTML0 customization options allow you to customize printing templates to your own specific requirements for invitations, whether that's creating them planning your schedule or even decorating your house.

-

Educational Value: Printing educational materials for no cost can be used by students of all ages, making them a useful instrument for parents and teachers.

-

An easy way to access HTML0: Quick access to many designs and templates, which saves time as well as effort.

Where to Find more House Rent Allowance Deduction In Income Tax Section

Material Requirement Form House Rent Deduction In Income Tax Section

Material Requirement Form House Rent Deduction In Income Tax Section

HRA Tax Deduction Under Section 80GG To claim a deduction under Section 80GG of the Income Tax Act individuals need to consider the following and select the lowest amount among them Individuals can claim a deduction of Rs 5 000 per month towards rent paid Calculate 25 of the adjusted total income

House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the employee However Income Tax Act provides a deduction of hra under section 10 13A subject to certain limits

After we've peaked your interest in House Rent Allowance Deduction In Income Tax Section, let's explore where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of House Rent Allowance Deduction In Income Tax Section designed for a variety uses.

- Explore categories like furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free as well as flashcards and other learning materials.

- It is ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs are a vast selection of subjects, that includes DIY projects to party planning.

Maximizing House Rent Allowance Deduction In Income Tax Section

Here are some creative ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home also in the classes.

3. Event Planning

- Invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

House Rent Allowance Deduction In Income Tax Section are an abundance of useful and creative resources designed to meet a range of needs and pursuits. Their availability and versatility make them a wonderful addition to both personal and professional life. Explore the vast world that is House Rent Allowance Deduction In Income Tax Section today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes you can! You can print and download these documents for free.

-

Can I make use of free templates for commercial use?

- It's based on the conditions of use. Always check the creator's guidelines before using any printables on commercial projects.

-

Do you have any copyright concerns with House Rent Allowance Deduction In Income Tax Section?

- Certain printables may be subject to restrictions in their usage. Be sure to review these terms and conditions as set out by the designer.

-

How can I print printables for free?

- You can print them at home with an printer, or go to the local print shops for top quality prints.

-

What program is required to open printables that are free?

- The majority are printed in the format PDF. This is open with no cost software such as Adobe Reader.

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Section 24 Deduction Income From House Property

Check more sample of House Rent Allowance Deduction In Income Tax Section below

Income Tax Savings HRA

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube

House Rent Allowance Deduction Calculation YouTube

HRA Or House Rent Allowance Deduction Calculation

Incometax Slide shankar Bose iit

https://taxguru.in/income-tax/house-rent-allowance...

05 May 2020 72 144 Views 5 comments HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA

https://cleartax.in/s/claim-deduction-under-section-80gg-for-rent-paid

In case you own any residential property at any place for which your income from house property is calculated under applicable sections as a self occupied property no deduction under section 80GG is allowed You will be required to file Form 10BA with details of the payment of rent

05 May 2020 72 144 Views 5 comments HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA

In case you own any residential property at any place for which your income from house property is calculated under applicable sections as a self occupied property no deduction under section 80GG is allowed You will be required to file Form 10BA with details of the payment of rent

House Rent Allowance Deduction Calculation YouTube

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

HRA Or House Rent Allowance Deduction Calculation

Incometax Slide shankar Bose iit

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

HRA Tax Exemption Calculator House Rent Deduction In Income Tax