In this age of electronic devices, where screens dominate our lives The appeal of tangible printed objects hasn't waned. In the case of educational materials project ideas, artistic or simply to add a personal touch to your area, Income Tax Benefit Definition are now a useful resource. This article will take a dive into the sphere of "Income Tax Benefit Definition," exploring the benefits of them, where to locate them, and ways they can help you improve many aspects of your lives.

Get Latest Income Tax Benefit Definition Below

Income Tax Benefit Definition

Income Tax Benefit Definition - Income Tax Benefit Definition, Income Tax Deductions Definition, Income Tax Credit Definition, Income Tax Rebate Definition, Income Tax Deductions Definition Economics, Income Tax Deduction Definition Business, Deferred Income Tax Benefit Definition, Income Tax Deduction Def, A Tax Benefit Meaning, Earned Income Tax Credit Definition

The term tax credit refers to an amount of money that taxpayers can subtract directly from the taxes they owe This is different from tax deductions which lower the amount of an

A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit Tax benefits include tax credits tax deductions and tax deferrals Some tax benefits can show up directly on your paycheck whereas others have to

The Income Tax Benefit Definition are a huge collection of printable materials available online at no cost. They come in many forms, including worksheets, templates, coloring pages and much more. The beauty of Income Tax Benefit Definition is in their variety and accessibility.

More of Income Tax Benefit Definition

Income Tax Benefits On Housing Loan In India

Income Tax Benefits On Housing Loan In India

A tax benefit is interpreted broadly and includes any exclusion deduction or credit which reduced federal income tax due in a prior year A tax benefit also includes increases in unexpired carryover losses for which the taxpayer has not yet utilized

Income tax A percentage of generated income that is relinquished to the state or federal government Payroll tax A percentage withheld from an employee s pay by an

Income Tax Benefit Definition have risen to immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization We can customize the templates to meet your individual needs, whether it's designing invitations or arranging your schedule or even decorating your house.

-

Educational Benefits: The free educational worksheets cater to learners of all ages, which makes them an essential instrument for parents and teachers.

-

An easy way to access HTML0: The instant accessibility to a myriad of designs as well as templates can save you time and energy.

Where to Find more Income Tax Benefit Definition

Benefit Definition Stock Photo Download Image Now 2015 Allowance

Benefit Definition Stock Photo Download Image Now 2015 Allowance

What is a Tax Benefit A tax benefit is any tax advantage given by the IRS to a taxpayer that reduces his or her tax burden It s also the name of an IRS rule requiring companies to pay taxes on income that was previously written off

Provisions relating to the Income Tax annual bonus relief and other provisions relevant to Employee Ownership Trusts are set out at sections 312A to 312I of the Income Tax Earnings and Pensions

We've now piqued your interest in Income Tax Benefit Definition and other printables, let's discover where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection in Income Tax Benefit Definition for different needs.

- Explore categories such as furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets as well as flashcards and other learning tools.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- The blogs covered cover a wide variety of topics, that includes DIY projects to party planning.

Maximizing Income Tax Benefit Definition

Here are some ideas create the maximum value use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print out free worksheets and activities to reinforce learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Benefit Definition are a treasure trove of useful and creative resources that meet a variety of needs and interests. Their accessibility and versatility make them a great addition to both professional and personal lives. Explore the vast collection of Income Tax Benefit Definition to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes you can! You can download and print the resources for free.

-

Are there any free printables for commercial purposes?

- It's contingent upon the specific rules of usage. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables may be subject to restrictions regarding usage. Be sure to read the terms and regulations provided by the designer.

-

How do I print printables for free?

- Print them at home using the printer, or go to the local print shop for high-quality prints.

-

What software do I need to run Income Tax Benefit Definition?

- A majority of printed materials are in PDF format, which is open with no cost programs like Adobe Reader.

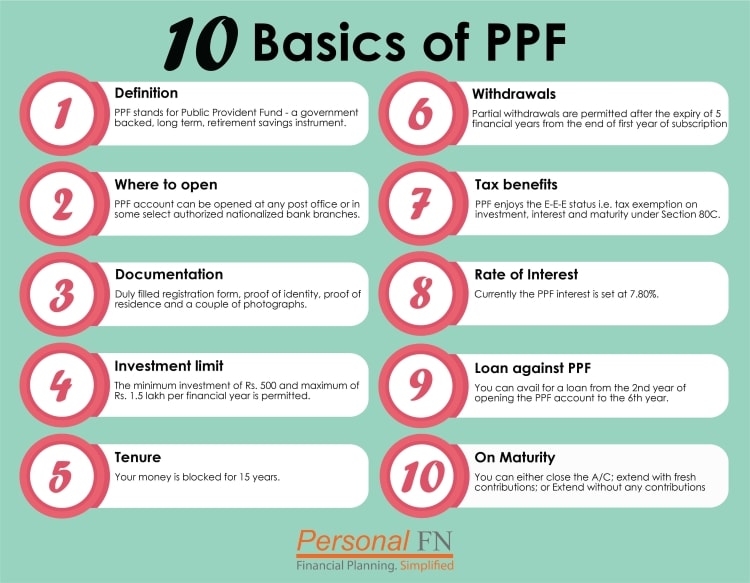

PUBLIC PROVIDENT FUND PPF SCHEME INCOME TAX BENEFIT INVESTMENT LIMIT

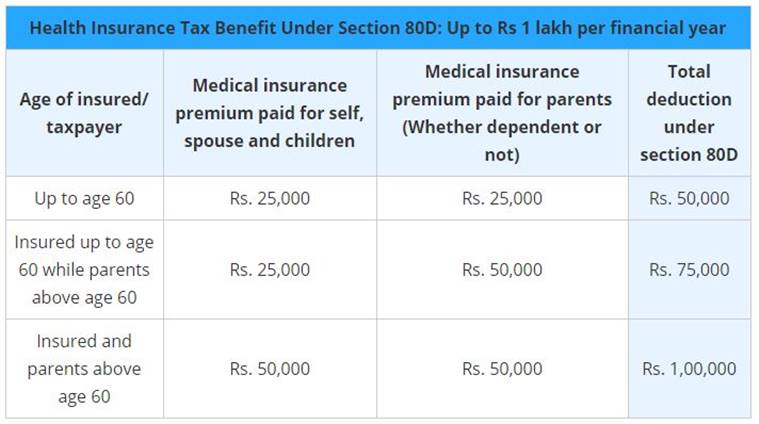

Income Tax Benefit Up To Rs 1 Lakh In Health Insurance Plans How Much

Check more sample of Income Tax Benefit Definition below

Section 80EE Income Tax Benefit On Home Loan Interest

Working Income Tax Benefit

Apa Itu Income Tax Benefit Dotedu id

Seniors Income Tax Benefit Applications Archway Community Services

INCOME TAX BENEFIT TO OWN A HOUSE SIMPLE TAX INDIA

2020 Income Tax Benefit Return For Individual KCWA

https://www.thebalancemoney.com/what-is-a-tax-benefit-5215181

A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit Tax benefits include tax credits tax deductions and tax deferrals Some tax benefits can show up directly on your paycheck whereas others have to

https://cleartax.in/glossary/income-tax-benefit

What is Income Tax Benefit In India tax benefits are different based on the status of the taxpayer i e individual HUF company etc The tax benefit can be a tax rebate or deduction Tax rebate means a specific amount will be deducted from the tax payable Deduction means deducting an eligible amount from the taxable income Who is eligible

A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit Tax benefits include tax credits tax deductions and tax deferrals Some tax benefits can show up directly on your paycheck whereas others have to

What is Income Tax Benefit In India tax benefits are different based on the status of the taxpayer i e individual HUF company etc The tax benefit can be a tax rebate or deduction Tax rebate means a specific amount will be deducted from the tax payable Deduction means deducting an eligible amount from the taxable income Who is eligible

Seniors Income Tax Benefit Applications Archway Community Services

Working Income Tax Benefit

INCOME TAX BENEFIT TO OWN A HOUSE SIMPLE TAX INDIA

2020 Income Tax Benefit Return For Individual KCWA

Sentences With Benefit Definition And Example Sentences Example

Tax Benefit Business Concept Of The Day

Tax Benefit Business Concept Of The Day

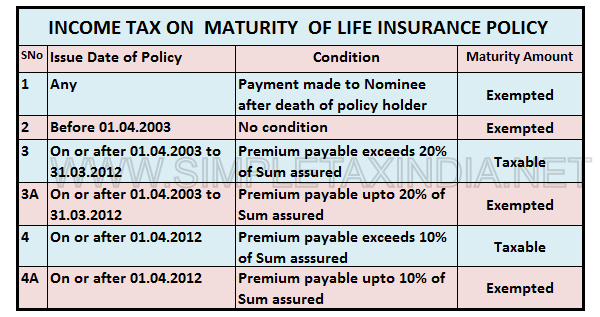

INCOME TAX BENEFIT ON LIFE INSURANCE SIMPLE TAX INDIA