In this digital age, in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. For educational purposes as well as creative projects or simply adding the personal touch to your space, Income Tax Credit Definition have become an invaluable source. In this article, we'll take a dive through the vast world of "Income Tax Credit Definition," exploring what they are, where to find them, and how they can be used to enhance different aspects of your lives.

Get Latest Income Tax Credit Definition Below

Income Tax Credit Definition

Income Tax Credit Definition - Income Tax Credit Definition, Income Tax Deductions Definition, Income Tax Benefit Definition, Income Tax Deductions Definition Economics, Income Tax Deduction Definition Business, Income Tax Credit Meaning In Hindi, Earned Income Tax Credit Definition, Earned Income Tax Credit Definition Economics, Earned Income Tax Credit Definition Ap Gov, Federal Income Tax Credit Definition

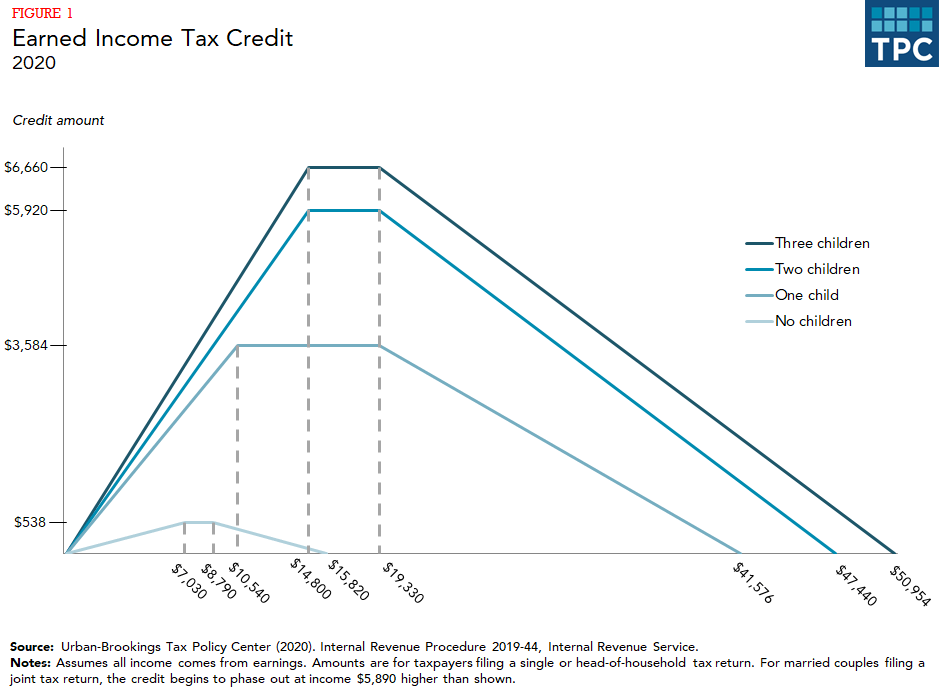

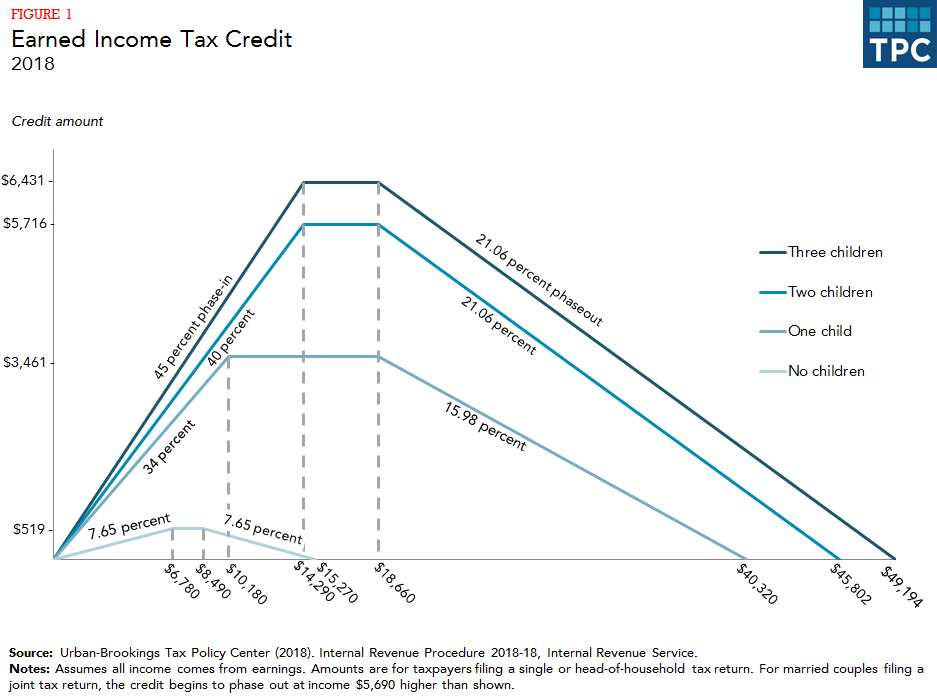

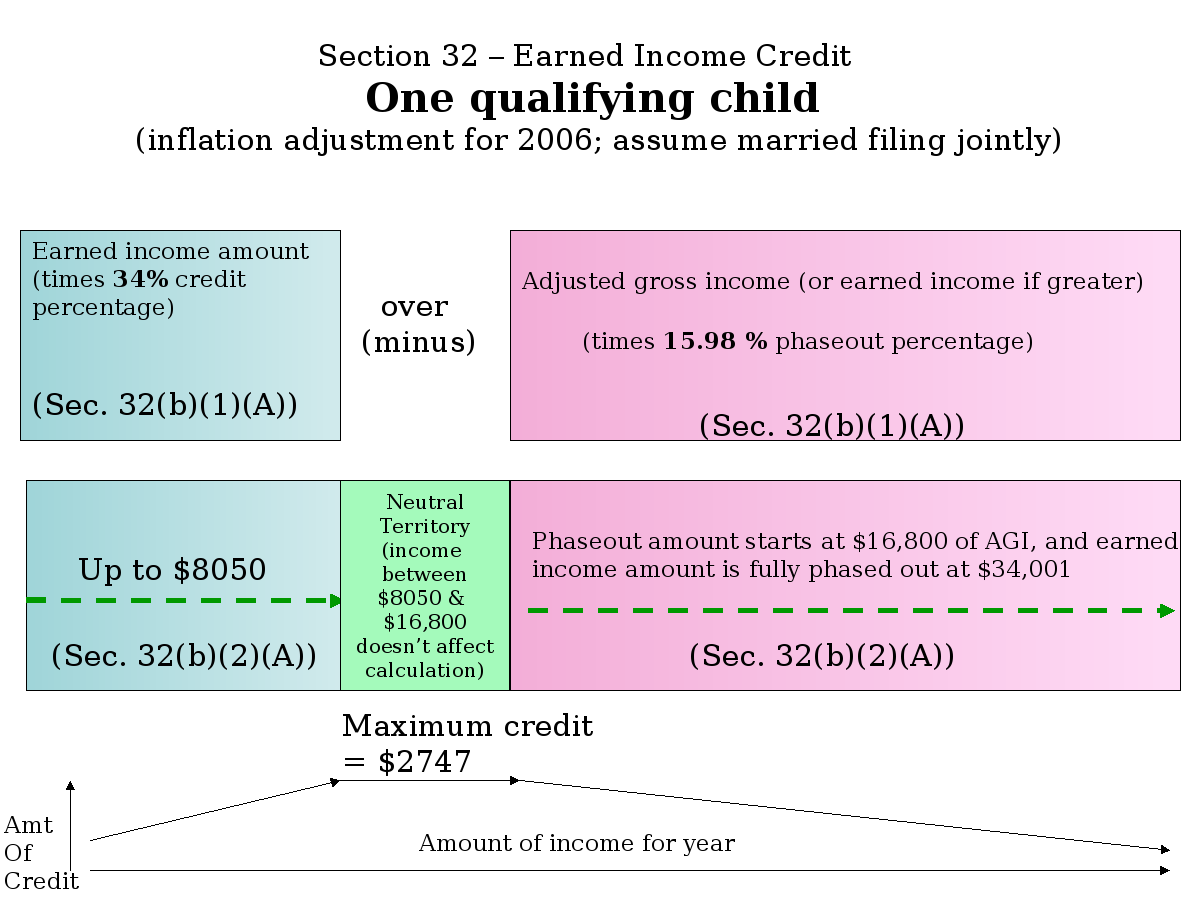

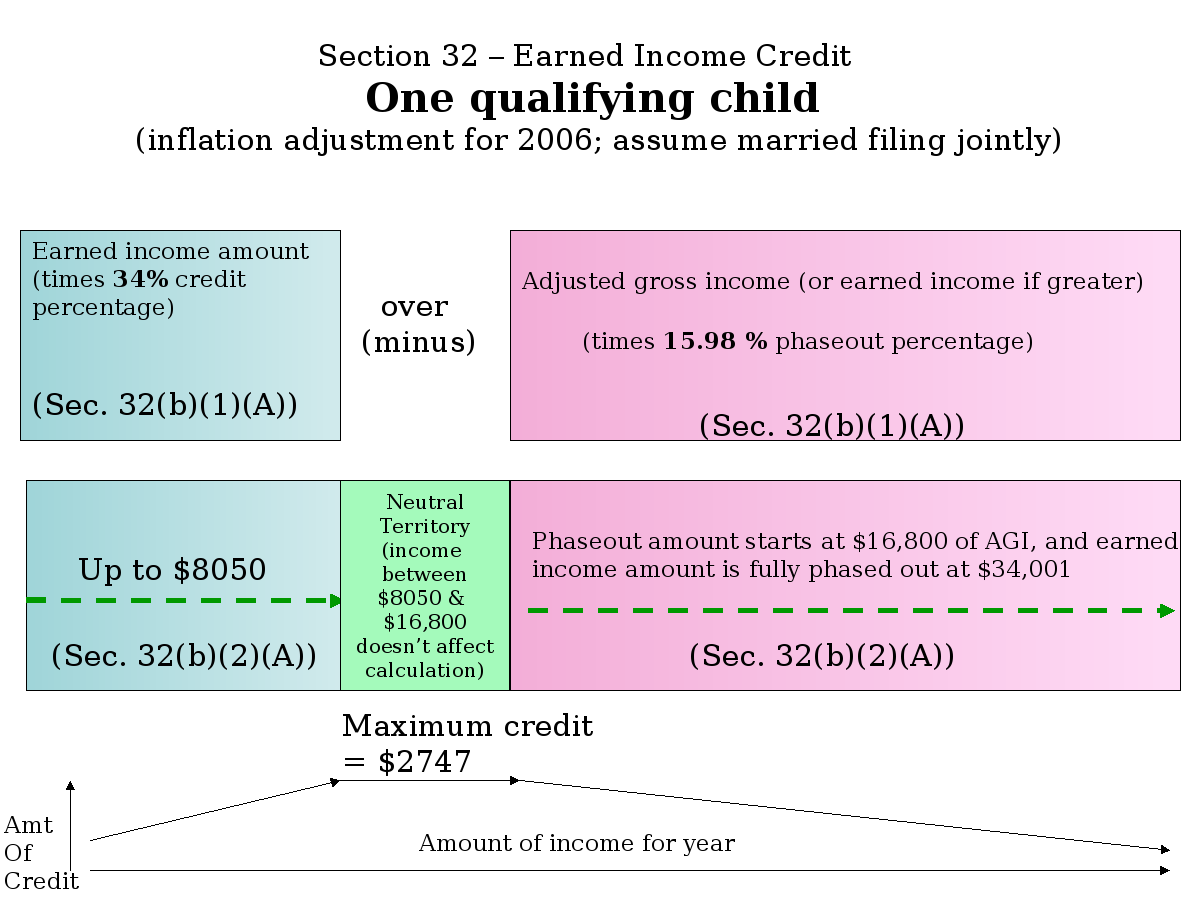

The United States federal earned income tax credit or earned income credit EITC or EIC is a refundable tax credit for low to moderate income working individuals and couples particularly those with children The amount of EITC benefit depends on a recipient s income and number of children

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund

Printables for free cover a broad range of printable, free materials online, at no cost. These resources come in many forms, including worksheets, coloring pages, templates and many more. The appeal of printables for free is in their versatility and accessibility.

More of Income Tax Credit Definition

Was Ist Die Steuergutschrift F r Verdientes Einkommen Rencana

Was Ist Die Steuergutschrift F r Verdientes Einkommen Rencana

A tax credit is a dollar amount that you can subtract from your income tax to reduce your overall tax liability So while a tax refund simply represents the difference between the taxes you paid versus the taxes you actually owe a tax credit is a benefit that directly reduces your tax burden

Tax credits are a type of financial incentive offered by the government to reduce an individual s or a company s tax liability They directly reduce the amount of tax owed dollar for dollar as opposed to tax deductions which lower the amount of taxable income

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: You can tailor printed materials to meet your requirements such as designing invitations and schedules, or even decorating your home.

-

Educational value: These Income Tax Credit Definition can be used by students of all ages, which makes them a great tool for teachers and parents.

-

Accessibility: Instant access to various designs and templates cuts down on time and efforts.

Where to Find more Income Tax Credit Definition

Income Tax Credit Definition PINCOMEQ

Income Tax Credit Definition PINCOMEQ

Find if you qualify for the Earned Income Tax Credit EITC with or without qualifying children or relatives on your tax return Low to moderate income workers with qualifying children may be eligible to claim the Earned Income Tax Credit EITC if certain qualifying rules apply to them

A tax credit is a dollar for dollar reduction of a tax bill which can reduce what a taxpayer owes or potentially increase their refund

If we've already piqued your interest in Income Tax Credit Definition Let's see where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Income Tax Credit Definition for various reasons.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- These blogs cover a wide selection of subjects, everything from DIY projects to party planning.

Maximizing Income Tax Credit Definition

Here are some fresh ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home or in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Credit Definition are an abundance of innovative and useful resources that meet a variety of needs and interest. Their access and versatility makes them a great addition to both professional and personal lives. Explore the many options of Income Tax Credit Definition today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Credit Definition truly completely free?

- Yes you can! You can print and download these tools for free.

-

Can I utilize free templates for commercial use?

- It is contingent on the specific usage guidelines. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues with Income Tax Credit Definition?

- Certain printables could be restricted on their use. Make sure you read the terms and conditions set forth by the author.

-

How can I print Income Tax Credit Definition?

- You can print them at home with either a printer or go to an area print shop for high-quality prints.

-

What program do I need to open printables free of charge?

- A majority of printed materials are with PDF formats, which can be opened using free programs like Adobe Reader.

What Is Earned Income Credit EIC Limits Eligibility ExcelDataPro

Earned Income Credit Worksheet 2023

Check more sample of Income Tax Credit Definition below

What Is The Earned Income Tax Credit Tax Policy Center

Student Loan Crisis Research Paper WriteWork

Tax Credit Definition Types Examples How Does It Work

How To Establish Credit Minimum Income For Earned Income Credit

Earned Income Tax Credit EITC Definition TaxEDU

Earned Income Tax Credit EITC Who Qualifies

https://www.irs.gov › newsroom › tax-credits-for...

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund

https://www.investopedia.com › terms › earnedincomecredit.asp

The earned income tax credit EITC is a tax break available to low and moderate income wage earners It is a refundable tax credit that reduces the amount of taxes owed on a dollar for dollar

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund

The earned income tax credit EITC is a tax break available to low and moderate income wage earners It is a refundable tax credit that reduces the amount of taxes owed on a dollar for dollar

How To Establish Credit Minimum Income For Earned Income Credit

Student Loan Crisis Research Paper WriteWork

Earned Income Tax Credit EITC Definition TaxEDU

Earned Income Tax Credit EITC Who Qualifies

Unified Tax Credit Definition InfoComm

Lifetime Learning Credit definition With Rules And Issues Rule Investing

Lifetime Learning Credit definition With Rules And Issues Rule Investing

Earned Income Tax Credit All It s Details USA Tax Credit