In a world where screens rule our lives, the charm of tangible printed products hasn't decreased. For educational purposes in creative or artistic projects, or simply adding the personal touch to your space, Income Tax Benefit On House Rent are now a vital resource. Here, we'll dive through the vast world of "Income Tax Benefit On House Rent," exploring what they are, how to get them, as well as how they can be used to enhance different aspects of your daily life.

Get Latest Income Tax Benefit On House Rent Below

Income Tax Benefit On House Rent

Income Tax Benefit On House Rent - Income Tax Benefit On House Rent, Income Tax Exemption On House Rent, House Rent Rebate In Income Tax Calculator, Income Tax Rebate On House Rent Paid, Income Tax Deduction On House Rent Paid, Income Tax Rebate On House Rent Allowance, Income Tax Exemption On House Rent Paid, Income Tax Rebate On House Rent Received, Income Tax Relief On House Rent Paid, Income Tax Rebate House Rent Receipt

In this article we delve into the nuances of House Rent Allowance exploring its tax implications and elucidating the considerations that individuals need to know about to use this financial benefit effectively What is

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals

Income Tax Benefit On House Rent cover a large range of printable, free materials online, at no cost. These printables come in different formats, such as worksheets, coloring pages, templates and more. The appealingness of Income Tax Benefit On House Rent lies in their versatility as well as accessibility.

More of Income Tax Benefit On House Rent

Lease Car Calculator Uk CALCULATORSA

Lease Car Calculator Uk CALCULATORSA

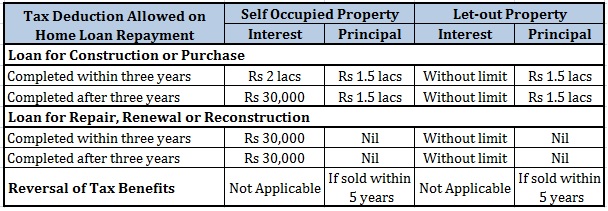

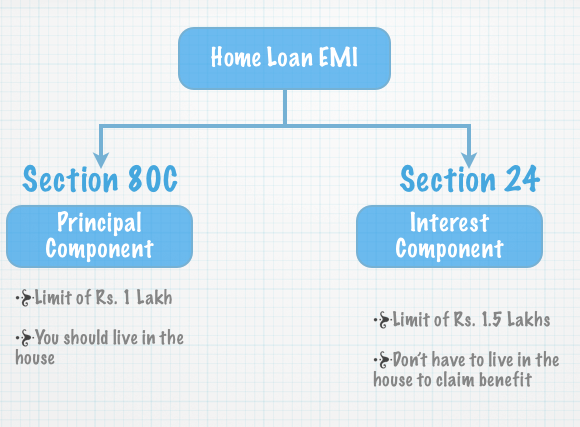

For most employees House Rent Allowance HRA is a part of their salary structure Although it is a part of your salary HRA unlike basic salary is not fully taxable Subject to certain conditions a part of HRA is exempted

To qualify for tax benefit on HRA the individual should be a salaried employee should reside in a rented accommodation and pay rent Here are the key considerations and provisions with respect to HRA and the

Income Tax Benefit On House Rent have garnered immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

customization We can customize print-ready templates to your specific requirements for invitations, whether that's creating them as well as organizing your calendar, or even decorating your home.

-

Education Value Printables for education that are free cater to learners from all ages, making them a valuable resource for educators and parents.

-

It's easy: Instant access to the vast array of design and templates is time-saving and saves effort.

Where to Find more Income Tax Benefit On House Rent

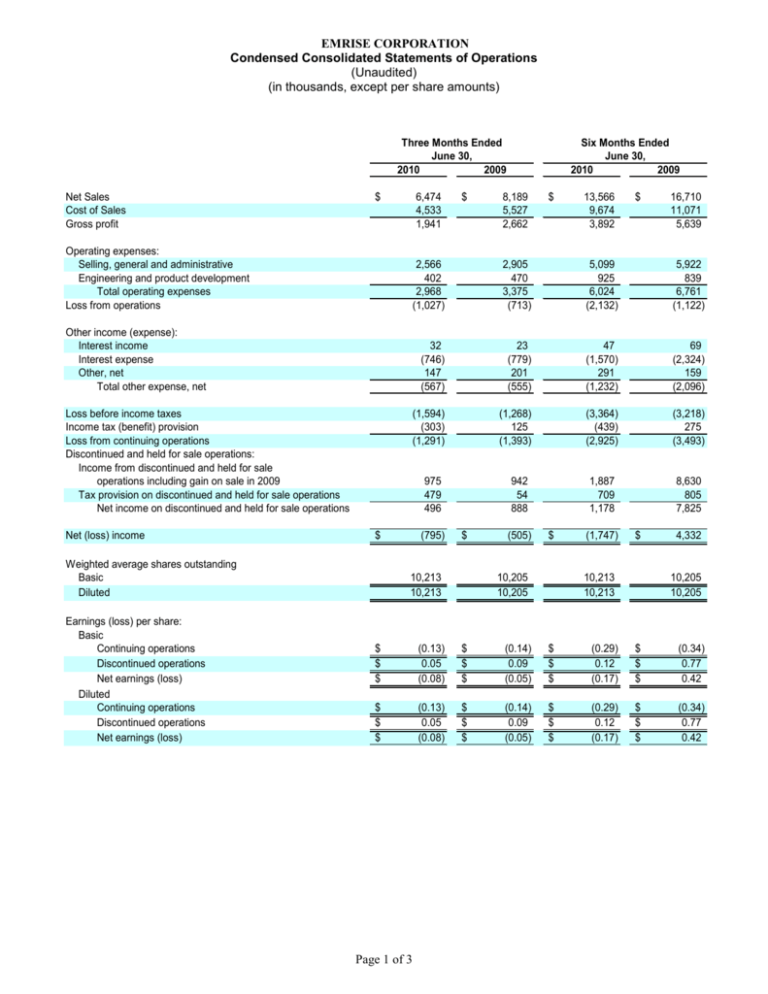

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

If you own rental real estate you should be aware of your federal tax responsibilities All rental income must be reported on your tax return and in general the associated expenses can be

House Rent Allowance Key Points Salaried people residing in rental housing are eligible to claim the HRA tax exemption HRA exemption is calculated based on multiple things like the actual rent paid the base pay or

We hope we've stimulated your curiosity about Income Tax Benefit On House Rent and other printables, let's discover where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Income Tax Benefit On House Rent to suit a variety of reasons.

- Explore categories such as the home, decor, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs are a vast range of interests, starting from DIY projects to party planning.

Maximizing Income Tax Benefit On House Rent

Here are some unique ways for you to get the best use of Income Tax Benefit On House Rent:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use free printable worksheets to help reinforce your learning at home also in the classes.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Benefit On House Rent are an abundance filled with creative and practical information for a variety of needs and pursuits. Their availability and versatility make they a beneficial addition to each day life. Explore the world of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes they are! You can print and download these tools for free.

-

Can I make use of free printables for commercial uses?

- It's all dependent on the terms of use. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues in Income Tax Benefit On House Rent?

- Some printables may have restrictions in their usage. Be sure to read the terms and conditions set forth by the author.

-

How can I print printables for free?

- You can print them at home using your printer or visit the local print shops for top quality prints.

-

What software must I use to open printables for free?

- A majority of printed materials are with PDF formats, which can be opened with free software, such as Adobe Reader.

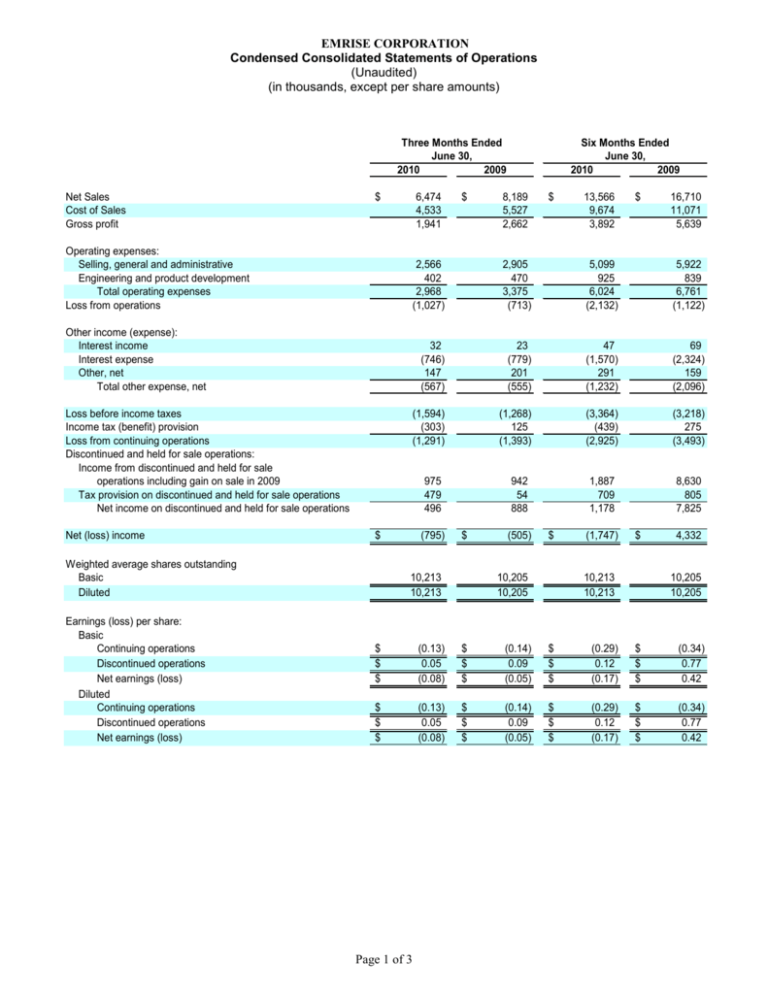

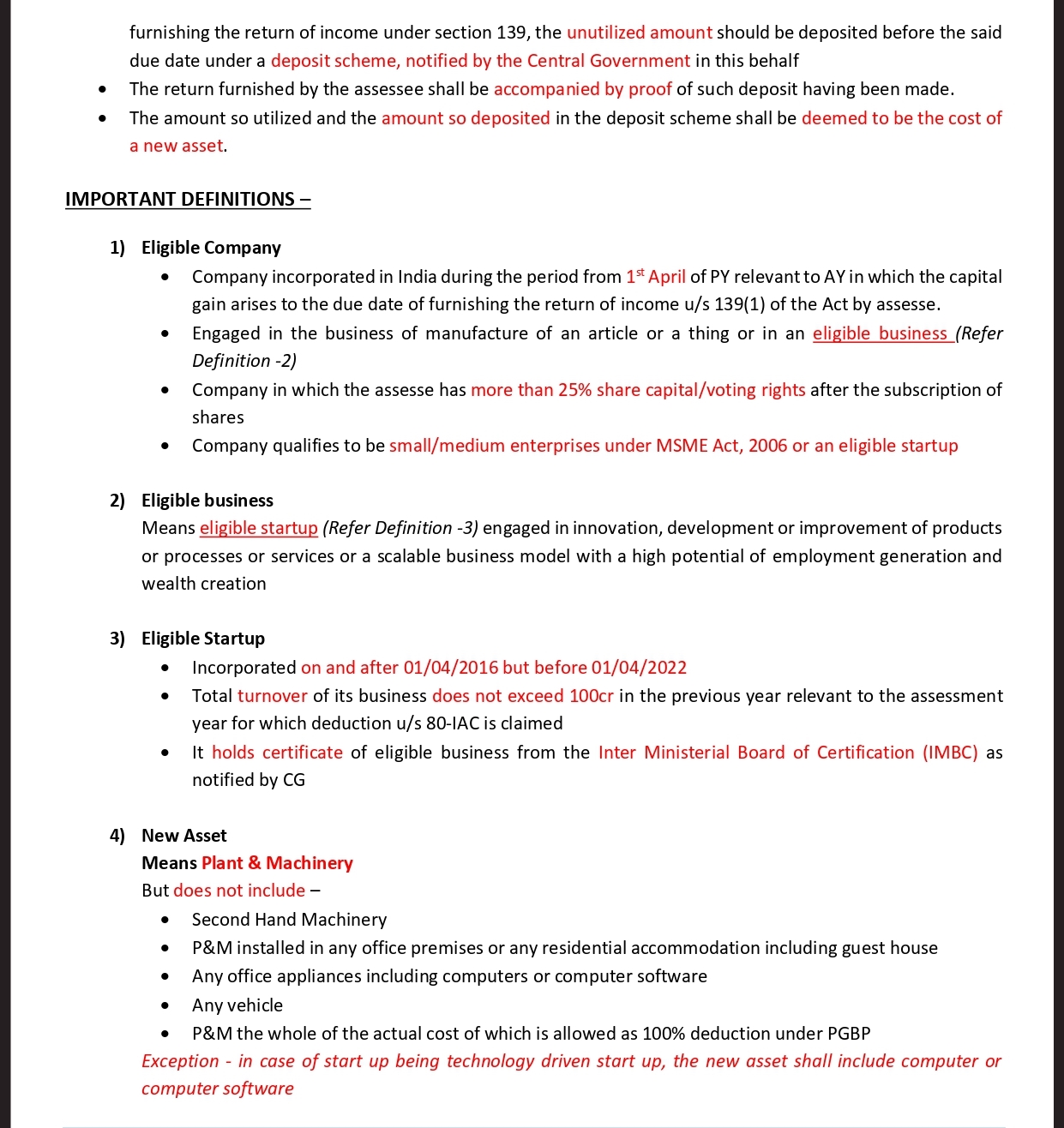

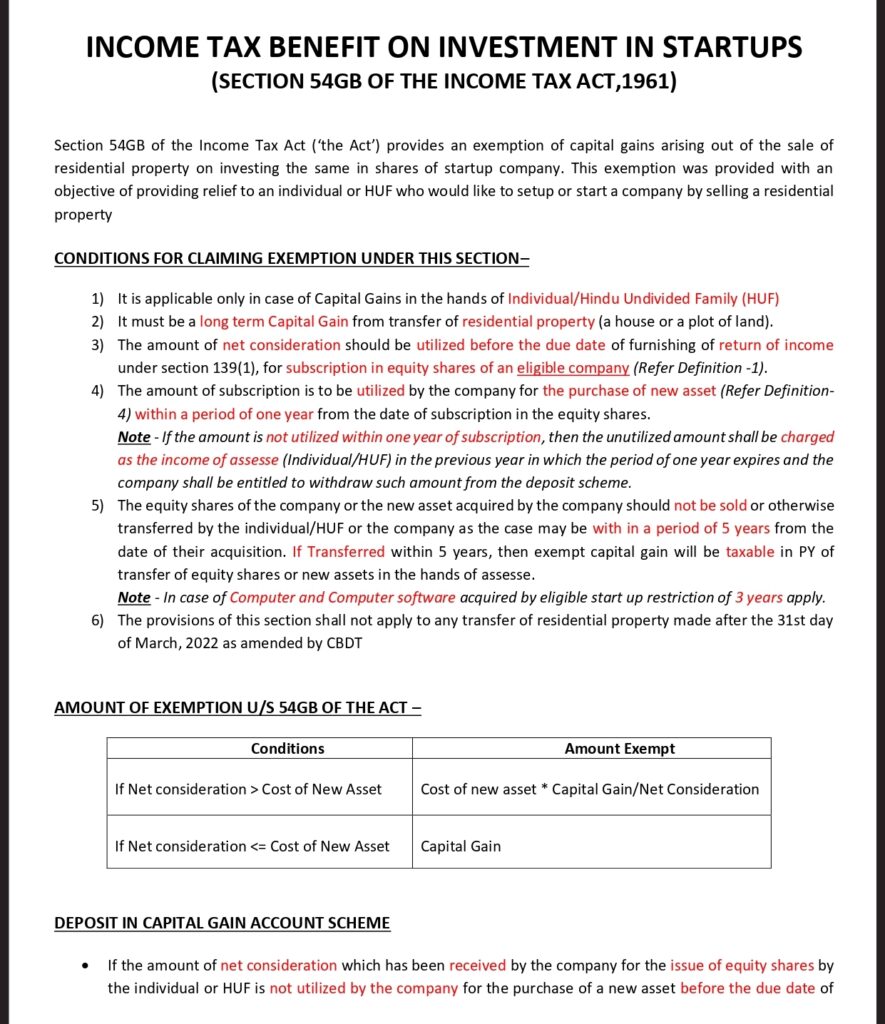

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Check more sample of Income Tax Benefit On House Rent below

Income Tax Benefits On Housing Loan In India

You Can Claim Income Tax Benefit On Interest For Home Loan Taken From

What Are The Tax Benefits On Top Up Loan HomeFirst

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

Tax Benefit On Electric Vehicles Inside Narrative

Mere Securing A House On Rent In USA Is Not Conclusive Fact That

https://tax2win.in › guide › hra-house-re…

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals

https://cleartax.in

In case you own any residential property at any place for which your income from house property is calculated under applicable sections as a self occupied property no deduction under section 80GG is allowed You will

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals

In case you own any residential property at any place for which your income from house property is calculated under applicable sections as a self occupied property no deduction under section 80GG is allowed You will

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

You Can Claim Income Tax Benefit On Interest For Home Loan Taken From

Tax Benefit On Electric Vehicles Inside Narrative

Mere Securing A House On Rent In USA Is Not Conclusive Fact That

20151209 Tax Benefits On A Home Loan Personal Finance Plan

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

How Will Your Home Loan Save Income Tax By Vinita Solanki Medium