In this age of technology, where screens rule our lives, the charm of tangible printed objects hasn't waned. For educational purposes for creative projects, simply to add an individual touch to your home, printables for free are now a useful resource. Through this post, we'll take a dive deep into the realm of "Income Tax Deduction Under Section 80c To 80u Pdf," exploring the different types of printables, where to get them, as well as how they can enhance various aspects of your daily life.

Get Latest Income Tax Deduction Under Section 80c To 80u Pdf Below

Income Tax Deduction Under Section 80c To 80u Pdf

Income Tax Deduction Under Section 80c To 80u Pdf - Income Tax Deduction Under Section 80c To 80u Pdf, Income Tax Deduction Under Section 80c To 80u Pdf In Hindi, Explain Deduction Under Section 80c To 80u, Section 80c To 80u Deduction, 80c To 80u Deduction List

Article explains Income Tax Deduction Available to Individual and HUF under Section 80C Section 80CCG Section 80D Section 80DD Section 80DDB Section 80E Section 80EE Section 80G Section 80GG Section 80GGB Section 80RRB Section 80TTA Section 80TTB and Section 80U of Income Tax Act 1961 Deduction Under Sections 80C to 80U

The Indian Income Tax Act provides for various deductions under sections 80C to 80U which can be claimed by an individual or a business entity while calculating their taxable income Let us take an example of tax saving for individuals with yearly salaries up to 20 lakhs

Income Tax Deduction Under Section 80c To 80u Pdf include a broad array of printable documents that can be downloaded online at no cost. They come in many forms, like worksheets coloring pages, templates and much more. The beauty of Income Tax Deduction Under Section 80c To 80u Pdf lies in their versatility as well as accessibility.

More of Income Tax Deduction Under Section 80c To 80u Pdf

Income Tax Deduction Under Section 80C To 80U Salary Employees YouTube

Income Tax Deduction Under Section 80C To 80U Salary Employees YouTube

Sec 80AB Deductions to be made with reference to the income included in the gross total income Sec 80AC Deduction not to be allowed unless return furnished Important Points 1 Deduction u s 80C to 80U can never exceed Gross Total Income 2 Deduction u s 80C to 80U shall not be allowed from STCG u s 111A STCG u s 111A is taxable 15

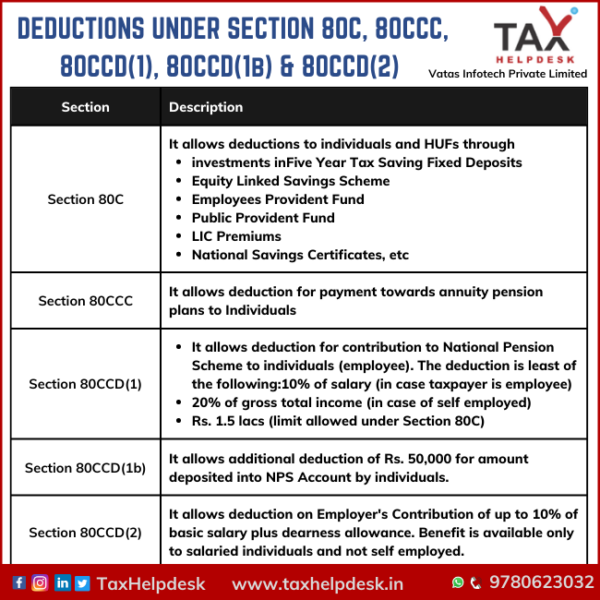

Deductions 80CCD Deduction for contribution in pension scheme notified by the Government to the extent of 10 of salary in case of employees and 10 of total income in case of others Maximum Deduction of Rs 50 000 for contribution in National Pension Scheme The deduction is in addition to the maximum

The Income Tax Deduction Under Section 80c To 80u Pdf have gained huge popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization: They can make printables to fit your particular needs whether you're designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value Downloads of educational content for free cater to learners from all ages, making these printables a powerful tool for parents and teachers.

-

Affordability: immediate access a variety of designs and templates helps save time and effort.

Where to Find more Income Tax Deduction Under Section 80c To 80u Pdf

Deduction Under Section 80C To 80U YouTube

Deduction Under Section 80C To 80U YouTube

Tax deductions specified under Chapter VIA of the Income Tax Act These Deductions will not be available to a taxpayer opting for the New Tax Regime u s 115 BAC except for deduction u s 80CCD 2 which will be applicable for New Tax Regime as well

In simple terms you can reduce up to Rs 1 50 000 from your total taxable income through section 80C This deduction is allowed to an Individual or a HUF A maximum of Rs 1 50 000 can be claimed for the FY 2021 22 2020 21 and FY 2019 20 each

We hope we've stimulated your interest in printables for free Let's take a look at where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection in Income Tax Deduction Under Section 80c To 80u Pdf for different applications.

- Explore categories like home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a broad range of topics, that range from DIY projects to planning a party.

Maximizing Income Tax Deduction Under Section 80c To 80u Pdf

Here are some innovative ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Print free worksheets to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Income Tax Deduction Under Section 80c To 80u Pdf are an abundance with useful and creative ideas that meet a variety of needs and needs and. Their availability and versatility make them a great addition to both personal and professional life. Explore the world of Income Tax Deduction Under Section 80c To 80u Pdf and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes you can! You can print and download these tools for free.

-

Can I download free printables for commercial uses?

- It's based on the usage guidelines. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables could be restricted regarding usage. Make sure to read the terms and conditions set forth by the creator.

-

How can I print printables for free?

- You can print them at home with the printer, or go to an in-store print shop to get higher quality prints.

-

What program will I need to access Income Tax Deduction Under Section 80c To 80u Pdf?

- A majority of printed materials are in the PDF format, and can be opened with free software such as Adobe Reader.

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Deduction Under Section 80C A Complete List BasuNivesh

Check more sample of Income Tax Deduction Under Section 80c To 80u Pdf below

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Deductions From Gross Total Income Under Section 80C To 80 U Of Income

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Deduction Under Section 80C

Tax Deduction Section 80C How To Claim Deductions Under Section 80C

https://tax2win.in/guide/deductions

The Indian Income Tax Act provides for various deductions under sections 80C to 80U which can be claimed by an individual or a business entity while calculating their taxable income Let us take an example of tax saving for individuals with yearly salaries up to 20 lakhs

https://cleartax.in/s/80c-80-deductions

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25

The Indian Income Tax Act provides for various deductions under sections 80C to 80U which can be claimed by an individual or a business entity while calculating their taxable income Let us take an example of tax saving for individuals with yearly salaries up to 20 lakhs

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Deduction Under Section 80C

Tax Deduction Section 80C How To Claim Deductions Under Section 80C

Section 80U Tax Deductions For Disabled Individuals Tax2win

What Is Income Tax Deduction Section 80C To 80U

What Is Income Tax Deduction Section 80C To 80U

A Quick Look At Deductions Under Section 80C To Section 80U