In this age of electronic devices, when screens dominate our lives and the appeal of physical printed items hasn't gone away. Be it for educational use such as creative projects or just adding some personal flair to your space, Income Tax Deduction Under Section 80ccg can be an excellent source. We'll take a dive through the vast world of "Income Tax Deduction Under Section 80ccg," exploring what they are, how to find them, and how they can be used to enhance different aspects of your life.

Get Latest Income Tax Deduction Under Section 80ccg Below

Income Tax Deduction Under Section 80ccg

Income Tax Deduction Under Section 80ccg - Income Tax Deduction Under Section 80ccg, Income Tax Deduction Under Section 80d, Income Tax Rebate Under Section 80d, Income Tax Relief Under Section 80d, Income Tax Exemption Limit Under Section 80d, Income Tax Medical Bills Exemption Under Section 80d, Deduction Under Section 80ccg Of Income Tax Act, Is 80ccg Part Of 80c, What Is 80ccg Deduction

Deduction under Section 80CCG Tax deductions under Section 80CCG of the Income Tax Act are can be availed only by first time investors in the equity market Individuals with a

The deduction under section 80 CCG was enacted in 2012 The broad provisions of the Scheme and the income tax benefits under it have already been

The Income Tax Deduction Under Section 80ccg are a huge assortment of printable, downloadable items that are available online at no cost. They come in many formats, such as worksheets, templates, coloring pages and much more. The beauty of Income Tax Deduction Under Section 80ccg is their versatility and accessibility.

More of Income Tax Deduction Under Section 80ccg

Deduction Under Section 80D Ultimate Guide

Deduction Under Section 80D Ultimate Guide

Discover the benefits of the section 80CCG deduction under the Rajiv Gandhi Equity Savings Scheme RGESS Learn about the eligibility criteria investment

List of all share mutual fund and ETF investments eligible for deduction under Section 80CCG of the Income Tax Act or Rajiv Gandhi Equity Savings Scheme

The Income Tax Deduction Under Section 80ccg have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

customization You can tailor the design to meet your needs whether you're designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Worth: These Income Tax Deduction Under Section 80ccg are designed to appeal to students of all ages, which makes them a valuable instrument for parents and teachers.

-

Convenience: Fast access a plethora of designs and templates saves time and effort.

Where to Find more Income Tax Deduction Under Section 80ccg

Income Tax Deduction Under Section 80U For Disabled Persons I e Autism

Income Tax Deduction Under Section 80U For Disabled Persons I e Autism

While the 80CCG income tax section offers tax saving benefits for first time investors it s being phased out due to lack of adoption A new investor starting from the

Section 80CCG of IT Act 1961 2023 provides for deduction in respect of investment made under an equity savings scheme Recently we have discussed in

Since we've got your interest in Income Tax Deduction Under Section 80ccg Let's look into where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Income Tax Deduction Under Section 80ccg for various purposes.

- Explore categories like the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free including flashcards, learning tools.

- It is ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs are a vast array of topics, ranging ranging from DIY projects to planning a party.

Maximizing Income Tax Deduction Under Section 80ccg

Here are some new ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Print worksheets that are free to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Income Tax Deduction Under Section 80ccg are an abundance of practical and imaginative resources which cater to a wide range of needs and desires. Their accessibility and flexibility make these printables a useful addition to the professional and personal lives of both. Explore the many options of Income Tax Deduction Under Section 80ccg to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Deduction Under Section 80ccg really cost-free?

- Yes you can! You can print and download these materials for free.

-

Can I utilize free printables to make commercial products?

- It's based on specific conditions of use. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Do you have any copyright issues with Income Tax Deduction Under Section 80ccg?

- Some printables may have restrictions regarding usage. Be sure to review the terms and conditions set forth by the creator.

-

How do I print Income Tax Deduction Under Section 80ccg?

- Print them at home using a printer or visit an area print shop for higher quality prints.

-

What program do I need to run printables at no cost?

- Many printables are offered in the format of PDF, which can be opened with free programs like Adobe Reader.

Income Tax Deduction Under Section 80C Empowering The Society

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Check more sample of Income Tax Deduction Under Section 80ccg below

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

80CCD Income Tax Deduction Under Section 80CCD FY 20 21

Top 5 Post Office Tax Saving Schemes Offering Income Tax Deduction

INCOME TAX A To Z

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://taxguru.in/income-tax/deduction-section-80ccg.html

The deduction under section 80 CCG was enacted in 2012 The broad provisions of the Scheme and the income tax benefits under it have already been

https://cleartax.in/s/phasing-out-of-section-80ccg

The deduction under section 80CCG i e Rajiv Gandhi Equity Savings Scheme RGESS available under Chapter 6A has been discontinued starting from 1st

The deduction under section 80 CCG was enacted in 2012 The broad provisions of the Scheme and the income tax benefits under it have already been

The deduction under section 80CCG i e Rajiv Gandhi Equity Savings Scheme RGESS available under Chapter 6A has been discontinued starting from 1st

Top 5 Post Office Tax Saving Schemes Offering Income Tax Deduction

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

INCOME TAX A To Z

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

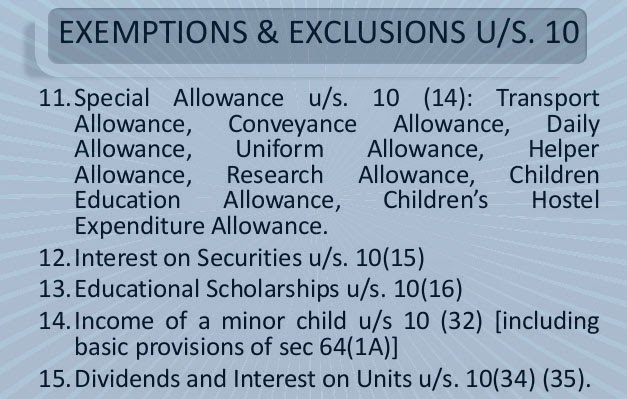

Deduction Under Section 10 14

Deductions From Gross Total Income Under Section 80C To 80 U Of Income

Deductions From Gross Total Income Under Section 80C To 80 U Of Income

Deduction Under Section 80G Income Tax Act Company Suggestion