In this age of technology, with screens dominating our lives, the charm of tangible printed objects hasn't waned. If it's to aid in education for creative projects, simply adding an individual touch to your space, Income Tax Exemption For Self Education Fee have proven to be a valuable resource. For this piece, we'll dive into the world "Income Tax Exemption For Self Education Fee," exploring the benefits of them, where they are, and how they can improve various aspects of your daily life.

Get Latest Income Tax Exemption For Self Education Fee Below

Income Tax Exemption For Self Education Fee

Income Tax Exemption For Self Education Fee - Income Tax Exemption For Self Education Fee, Self Education Fees Tax Exemption, Self Education Fees Deduction Income Tax, Self Tuition Fees Exemption In Income Tax, Income Tax Exemption On Education Expenses, Self Tuition Fees Exemption

Therefore if an individual opts for the new tax regime in current FY 2022 23 ending on March 31 2023 then s he will not be able to claim the commonly availed deductions and exemptions such as

TR 2024 3 Income tax deductibility of self education expenses incurred by an individual This cover sheet is provided for information only It does not form part of TR 2024 3

Income Tax Exemption For Self Education Fee offer a wide selection of printable and downloadable content that can be downloaded from the internet at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages, and more. The appeal of printables for free is their versatility and accessibility.

More of Income Tax Exemption For Self Education Fee

We Got 12A Exemption Registration Under Income Tax

We Got 12A Exemption Registration Under Income Tax

In case you take education loan for full time education in India you can claim deduction for interest for such loan under Section 80E as well as for tuition fee

Find out which education expenses qualify for claiming education credits or deductions Qualified education expenses are amounts paid for tuition fees and other

Income Tax Exemption For Self Education Fee have risen to immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

customization It is possible to tailor designs to suit your personal needs such as designing invitations making your schedule, or decorating your home.

-

Educational Benefits: These Income Tax Exemption For Self Education Fee can be used by students of all ages, making these printables a powerful resource for educators and parents.

-

Convenience: immediate access an array of designs and templates reduces time and effort.

Where to Find more Income Tax Exemption For Self Education Fee

50 Income Tax Exemption For High Earners In Cyprus

50 Income Tax Exemption For High Earners In Cyprus

If you are self employed you deduct your expenses for qualifying work related education directly from your self employment income This reduces the

As per Section 10 14 of the Income Tax Act 1961 special allowances are given to salaried individuals to cover their children s education and hostel expenses

In the event that we've stirred your interest in printables for free, let's explore where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Income Tax Exemption For Self Education Fee designed for a variety objectives.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing including flashcards, learning tools.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- These blogs cover a wide range of interests, starting from DIY projects to planning a party.

Maximizing Income Tax Exemption For Self Education Fee

Here are some ways create the maximum value of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Print free worksheets for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Income Tax Exemption For Self Education Fee are a treasure trove of practical and imaginative resources that cater to various needs and preferences. Their accessibility and versatility make them an essential part of both personal and professional life. Explore the vast world of Income Tax Exemption For Self Education Fee right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes, they are! You can download and print these items for free.

-

Can I use free templates for commercial use?

- It's based on specific usage guidelines. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download Income Tax Exemption For Self Education Fee?

- Some printables may come with restrictions in use. Make sure to read the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- Print them at home with an printer, or go to a print shop in your area for the highest quality prints.

-

What software must I use to open printables that are free?

- Most PDF-based printables are available in the PDF format, and can be opened with free software such as Adobe Reader.

We Got 12A Exemption Registration Under Income Tax

House Of Representatives Files Bill Of Tax Exemption For Senior

Check more sample of Income Tax Exemption For Self Education Fee below

Life Insurance Income Tax Exemption IndiaFilings

Income Tax Calculation Example For Salary Employees 2023 24 Govtempdiary

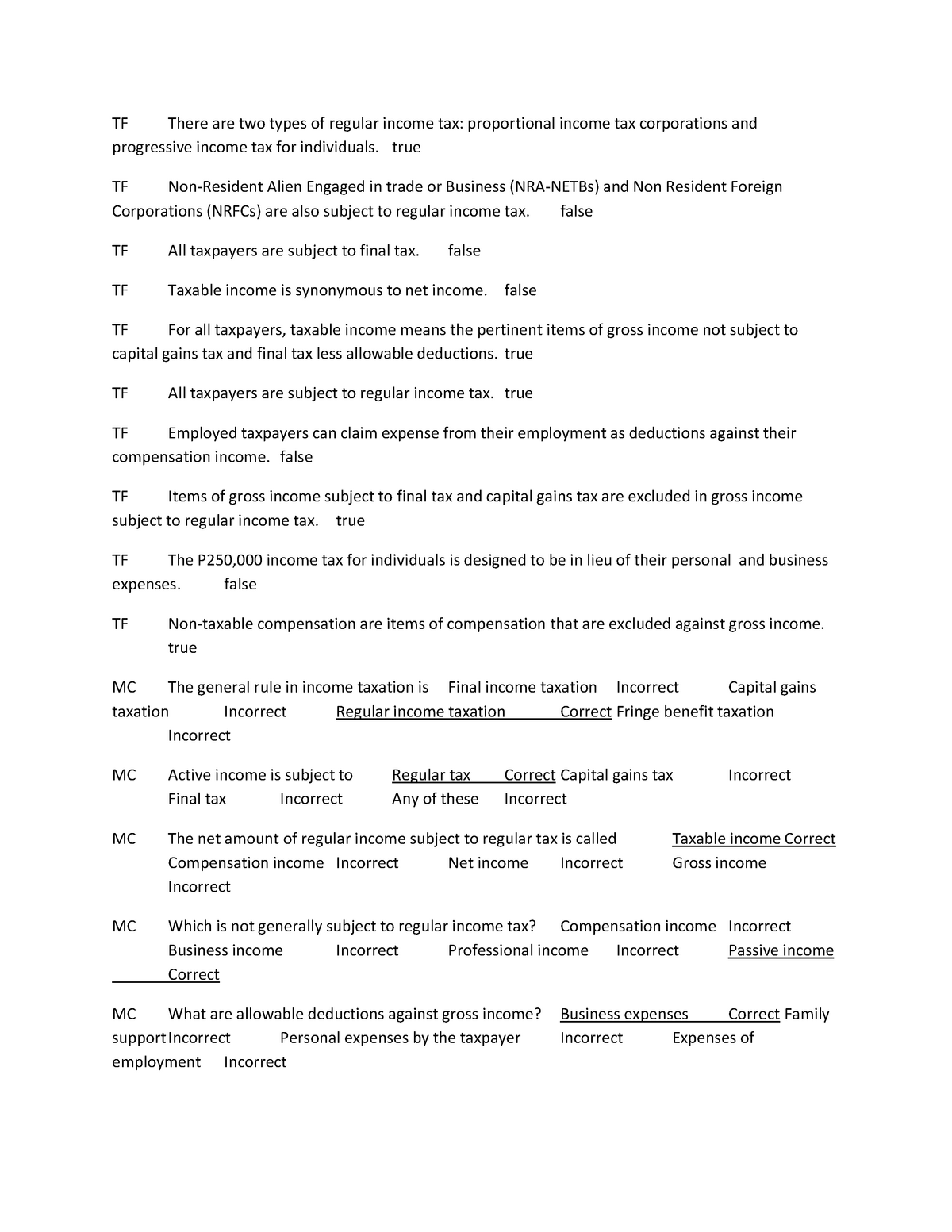

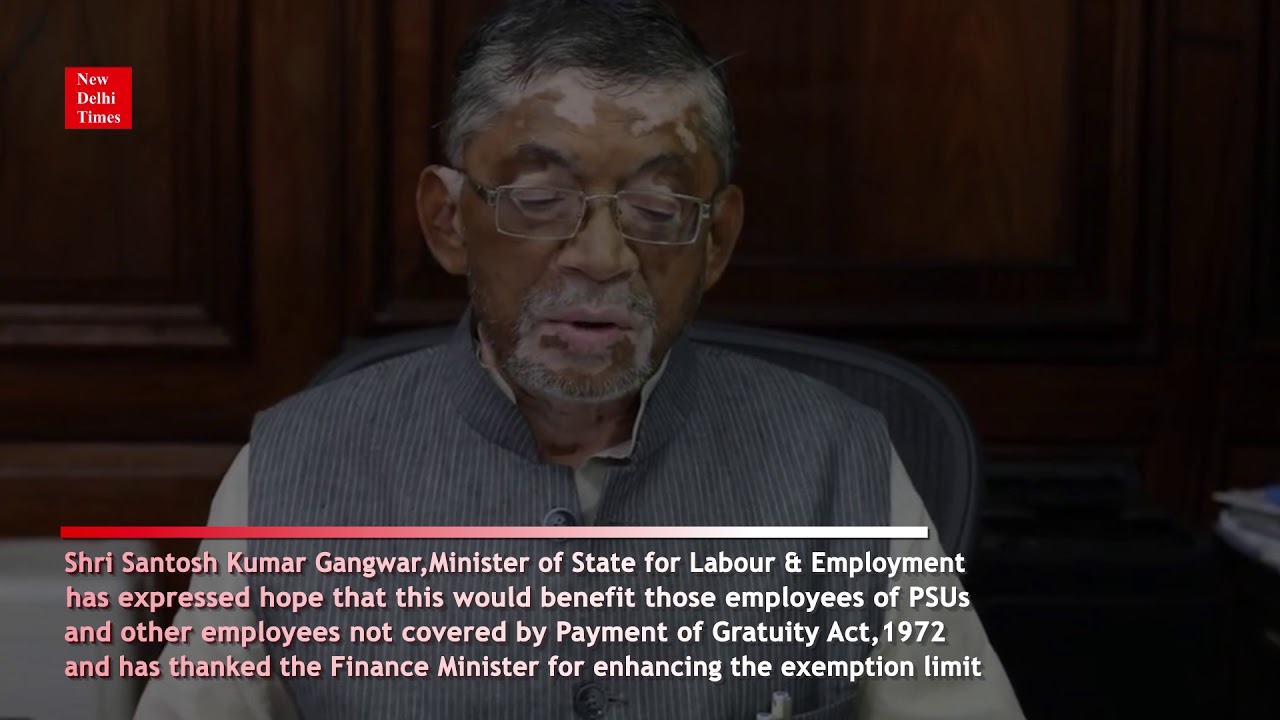

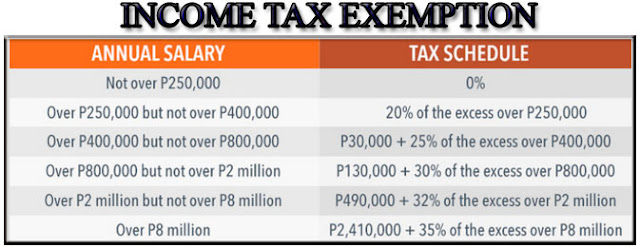

Introduction Of Income Taxation TF There Are Two Types Of Regular

Income Tax Exemption For Cancer Patients CancerWalls

The Take home Pay Is Bigger As Senate Approved Higher Personal Income

Forms For Income Tax Exemption word

https://www.ato.gov.au/law/view/pdf?DocId=TXR...

TR 2024 3 Income tax deductibility of self education expenses incurred by an individual This cover sheet is provided for information only It does not form part of TR 2024 3

https://taxguru.in/income-tax/deduction-us-80…

Expenditure paid for self education not allowable Fees paid for spouse Maximum Limit for Section 80C Deduction Deduction

TR 2024 3 Income tax deductibility of self education expenses incurred by an individual This cover sheet is provided for information only It does not form part of TR 2024 3

Expenditure paid for self education not allowable Fees paid for spouse Maximum Limit for Section 80C Deduction Deduction

Income Tax Exemption For Cancer Patients CancerWalls

Income Tax Calculation Example For Salary Employees 2023 24 Govtempdiary

The Take home Pay Is Bigger As Senate Approved Higher Personal Income

Forms For Income Tax Exemption word

Lymphoedema Management Seed Physio

Government Doubles Income Tax Exemption For Gratuity Updated You

Government Doubles Income Tax Exemption For Gratuity Updated You

BOI Approves Additional Incentives For Target Industries MPG