In this age of electronic devices, when screens dominate our lives it's no wonder that the appeal of tangible printed products hasn't decreased. Be it for educational use, creative projects, or simply to add a personal touch to your space, Income Tax Exemptions For Salaried Employees 2022 23 are now an essential resource. We'll dive into the world "Income Tax Exemptions For Salaried Employees 2022 23," exploring what they are, where they are available, and how they can improve various aspects of your lives.

Get Latest Income Tax Exemptions For Salaried Employees 2022 23 Below

Income Tax Exemptions For Salaried Employees 2022 23

Income Tax Exemptions For Salaried Employees 2022 23 - Income Tax Exemptions For Salaried Employees 2022-23, Income Tax Exemptions For Salaried Employees 2022-23 Pdf, Income Tax Rules For Salaried Employees 2022-23, Salary Standard Deduction For Ay 2022-23

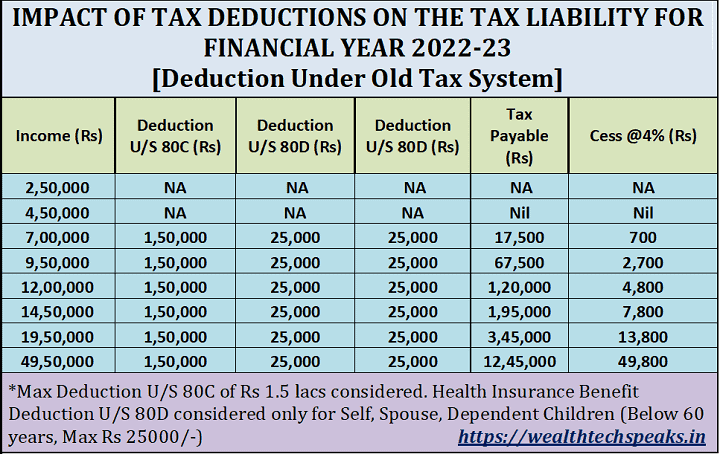

The old tax regime allows an individual to save income tax via various deductions and tax exemptions such as sections 80C 80D 80CCD 1b 80TTA HRA

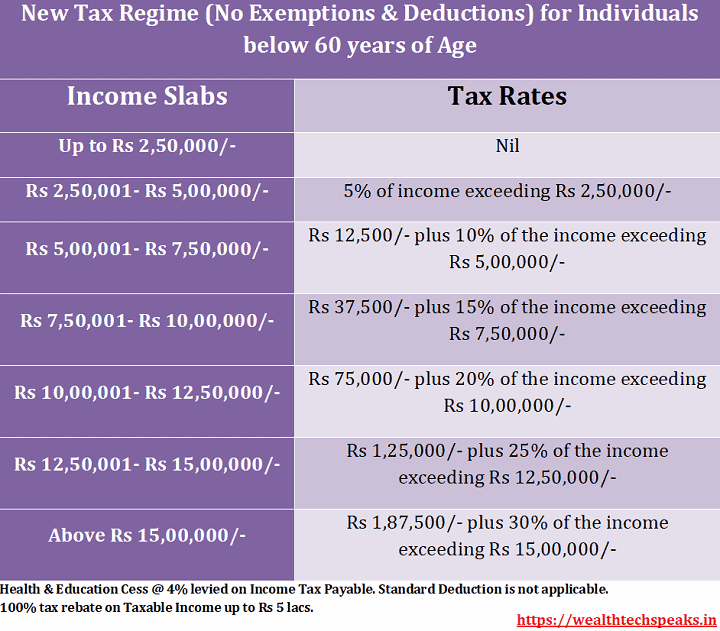

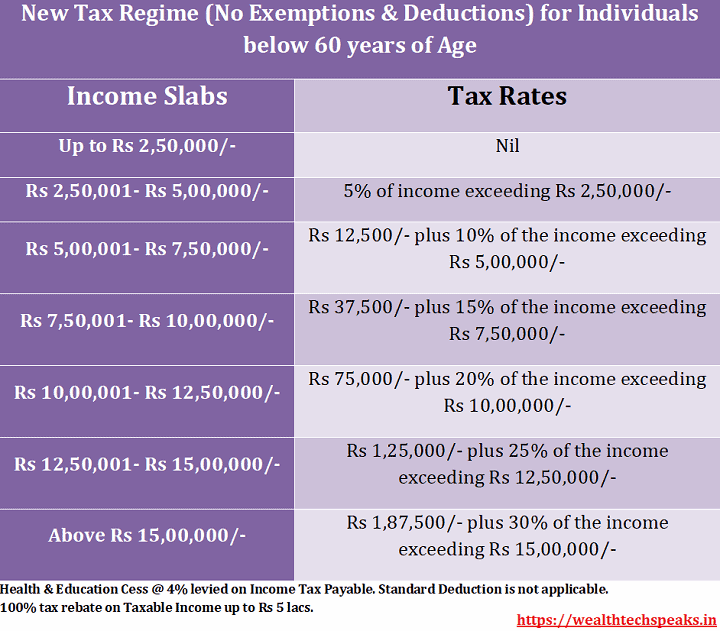

The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old

Income Tax Exemptions For Salaried Employees 2022 23 cover a large assortment of printable, downloadable resources available online for download at no cost. These printables come in different types, such as worksheets coloring pages, templates and much more. The great thing about Income Tax Exemptions For Salaried Employees 2022 23 is their flexibility and accessibility.

More of Income Tax Exemptions For Salaried Employees 2022 23

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Income Tax Return filing salaried employees AY 2022 23 Section 80C deductions on which benefits apply Income Tax News The Financial Express Nifty

The bottom line Income tax exemptions for salaried employees 2021 22 The Income Tax Act 1961 mandates certain income tax allowances exemptions for the salaried class These exemptions

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Individualization They can make designs to suit your personal needs such as designing invitations, organizing your schedule, or decorating your home.

-

Educational Worth: Printables for education that are free offer a wide range of educational content for learners of all ages, which makes them a useful resource for educators and parents.

-

Affordability: Access to numerous designs and templates saves time and effort.

Where to Find more Income Tax Exemptions For Salaried Employees 2022 23

How To File Income Tax Return Online For Salaried Employees 2022 2023

How To File Income Tax Return Online For Salaried Employees 2022 2023

Finance Minister Nirmala Sitharaman presented Union Budget 2022 23 in Parliament today February 1 2021 The Finance Minister announced no change in personal income tax slabs and rates Thus

This rebate allows individuals earning an income below 7 lakhs to pay a marginally lower tax amount under the new tax regime It means that if your total tax payable is up to

We've now piqued your curiosity about Income Tax Exemptions For Salaried Employees 2022 23 Let's take a look at where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of applications.

- Explore categories such as home decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- These blogs cover a wide variety of topics, ranging from DIY projects to planning a party.

Maximizing Income Tax Exemptions For Salaried Employees 2022 23

Here are some ideas ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Exemptions For Salaried Employees 2022 23 are an abundance of practical and imaginative resources catering to different needs and needs and. Their accessibility and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the wide world of Income Tax Exemptions For Salaried Employees 2022 23 to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes, they are! You can print and download these documents for free.

-

Can I download free templates for commercial use?

- It's based on specific conditions of use. Always read the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may come with restrictions on usage. Make sure to read the conditions and terms of use provided by the creator.

-

How can I print Income Tax Exemptions For Salaried Employees 2022 23?

- Print them at home using the printer, or go to a print shop in your area for high-quality prints.

-

What program do I require to view printables free of charge?

- The majority of printed documents are in PDF format. They can be opened using free software like Adobe Reader.

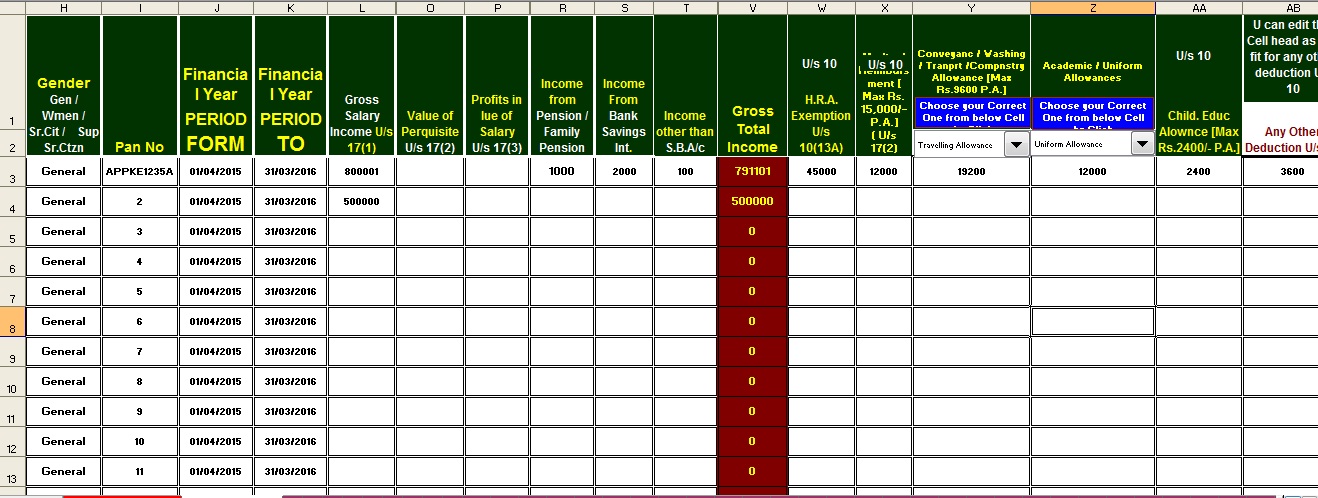

Income Tax Allowances For Salaried Employees For F Y 2021 22 A Y 2022 23

Income Tax Exemptions For Salaried Employees F Y 2022 23

Check more sample of Income Tax Exemptions For Salaried Employees 2022 23 below

Govt Announced Seven Slabs For Salaried Class In Budget 2022 23

Income Tax Return Filing For Salaried Employees AY 2022 23 Section 80C

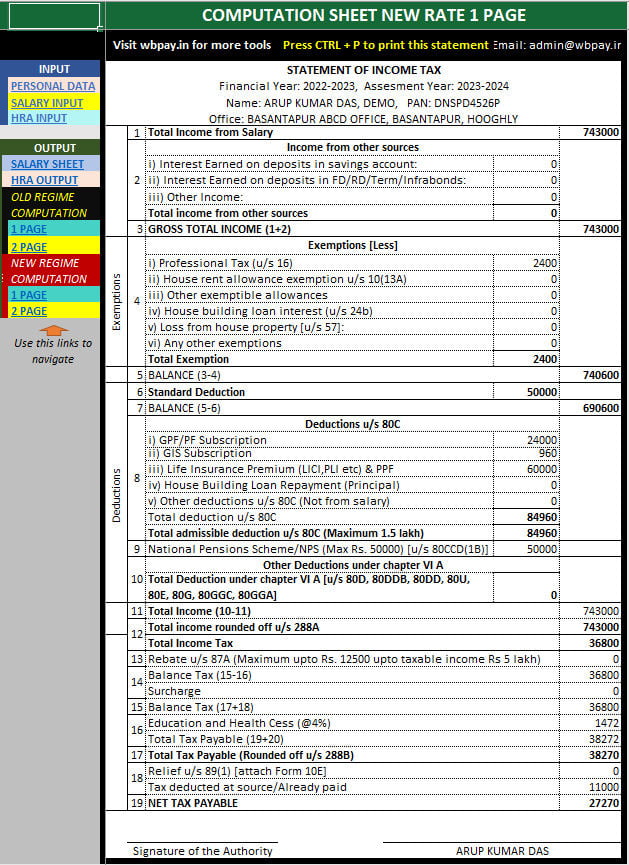

All In One Income Tax Calculator For The FY 2022 23

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Income Tax Calculator FY 2021 22 AY 2022 23 Excel Download 2023

Income Tax Exemptions And Deductions Allowed For Salaried Individuals

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old

https://cleartax.in/s/income-tax-slabs

Individuals with Net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A i e tax liability will be NIL in both New and old existing

The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old

Individuals with Net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A i e tax liability will be NIL in both New and old existing

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Income Tax Return Filing For Salaried Employees AY 2022 23 Section 80C

Income Tax Calculator FY 2021 22 AY 2022 23 Excel Download 2023

Income Tax Exemptions And Deductions Allowed For Salaried Individuals

FY 2022 23 Income Tax Calculation On Salaried Employee CTC

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

Income Tax Calculation Financial Year 2022 23 WealthTech Speaks