In the digital age, where screens have become the dominant feature of our lives and the appeal of physical printed materials isn't diminishing. For educational purposes such as creative projects or simply adding a personal touch to your area, Income Tax Rebate On Child Education Loan are now a useful source. This article will dive in the world of "Income Tax Rebate On Child Education Loan," exploring the different types of printables, where they are available, and what they can do to improve different aspects of your lives.

Get Latest Income Tax Rebate On Child Education Loan Below

Income Tax Rebate On Child Education Loan

Income Tax Rebate On Child Education Loan - Income Tax Rebate On Child Education Loan, Tax Benefit On Child Education Loan, Can I Get Tax Benefit On Education Loan, Income Tax Benefit On Child Education, Income Tax Relief For Education Loan, Does Education Loan Comes Under 80c

Web 31 mai 2023 nbsp 0183 32 Interest paid on education loans taken for higher studies of self spouse or children including for whom you are the legal guardian can be claimed as a deduction

Web 30 mars 2023 nbsp 0183 32 Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan A

Income Tax Rebate On Child Education Loan provide a diverse variety of printable, downloadable materials available online at no cost. These resources come in many forms, like worksheets coloring pages, templates and more. The benefit of Income Tax Rebate On Child Education Loan lies in their versatility as well as accessibility.

More of Income Tax Rebate On Child Education Loan

2022 Child Tax Rebate Stratford Crier

2022 Child Tax Rebate Stratford Crier

Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is

Web 5 avr 2023 nbsp 0183 32 The tax benefits offered on children s education are as follows Childrens Education Allowance Hostel Expenditure Allowance Tax deduction on tuition fees

Income Tax Rebate On Child Education Loan have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

customization: This allows you to modify printing templates to your own specific requirements whether it's making invitations or arranging your schedule or even decorating your house.

-

Educational Value: These Income Tax Rebate On Child Education Loan offer a wide range of educational content for learners of all ages, which makes them a vital aid for parents as well as educators.

-

The convenience of Quick access to a plethora of designs and templates, which saves time as well as effort.

Where to Find more Income Tax Rebate On Child Education Loan

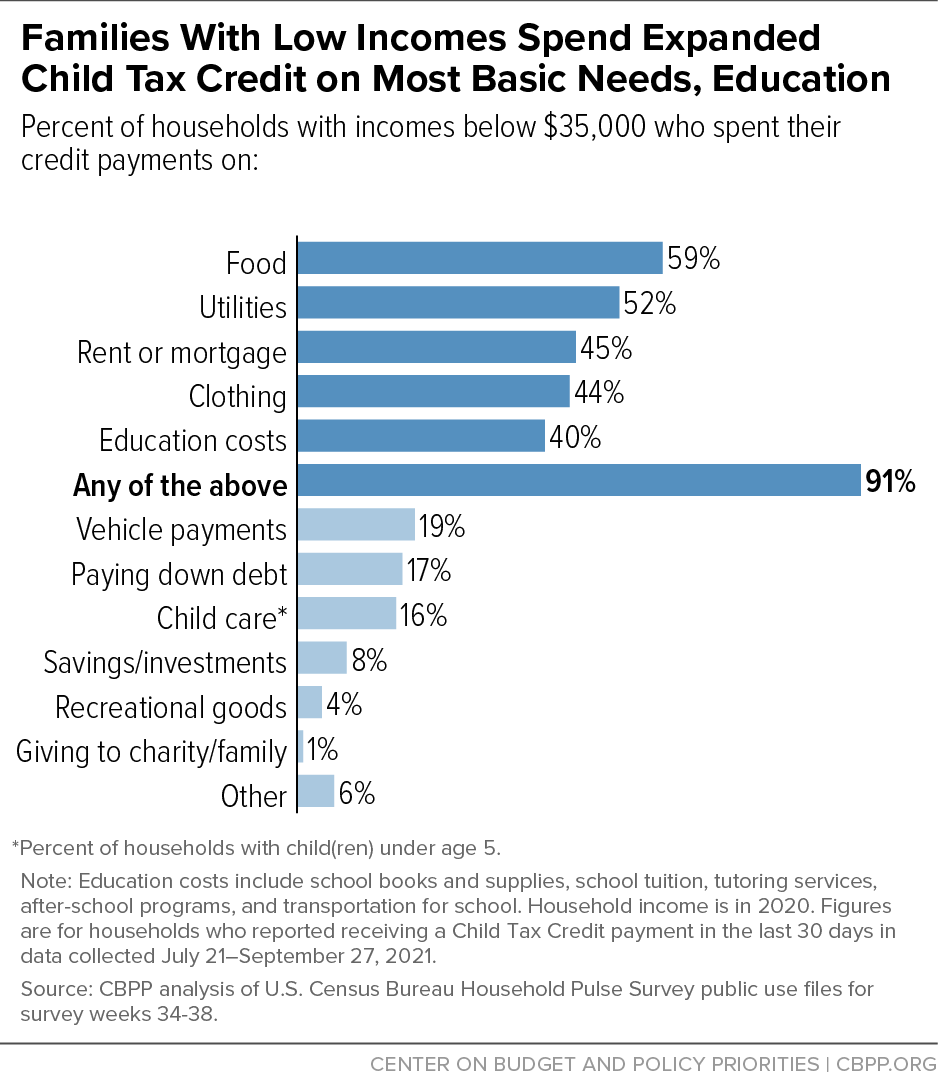

9 In 10 Families With Low Incomes Are Using Child Tax Credits To Pay

9 In 10 Families With Low Incomes Are Using Child Tax Credits To Pay

Web 23 f 233 vr 2018 nbsp 0183 32 3 The income tax deduction on education loan is only available for up to eight years or until the payment of interest in full whichever is earlier For example if you

Web 16 oct 2020 nbsp 0183 32 You can claim tax deductions on education loans as tuition fees paid to any college university or other educational institution under Section 80E of the Income Tax Act You can take education loan tax

Since we've got your interest in printables for free and other printables, let's discover where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Income Tax Rebate On Child Education Loan for various goals.

- Explore categories like design, home decor, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free, flashcards, and learning materials.

- It is ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- These blogs cover a wide selection of subjects, that range from DIY projects to planning a party.

Maximizing Income Tax Rebate On Child Education Loan

Here are some ideas create the maximum value of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets for free for teaching at-home, or even in the classroom.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Rebate On Child Education Loan are a treasure trove of practical and innovative resources that cater to various needs and preferences. Their accessibility and versatility make them an invaluable addition to any professional or personal life. Explore the wide world that is Income Tax Rebate On Child Education Loan today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Rebate On Child Education Loan really for free?

- Yes you can! You can download and print these materials for free.

-

Does it allow me to use free printables for commercial uses?

- It's based on specific rules of usage. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may come with restrictions in their usage. Make sure you read the terms of service and conditions provided by the author.

-

How can I print Income Tax Rebate On Child Education Loan?

- Print them at home using either a printer at home or in any local print store for superior prints.

-

What software do I need to open Income Tax Rebate On Child Education Loan?

- The majority of PDF documents are provided in PDF format. They can be opened with free software, such as Adobe Reader.

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

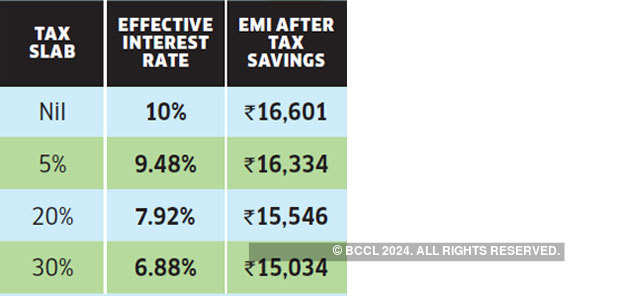

Education Loan Tax Benefits How Education Loan Can Help Your Child

Check more sample of Income Tax Rebate On Child Education Loan below

Here s How You Calculate Your Adjusted Gross Income AGI

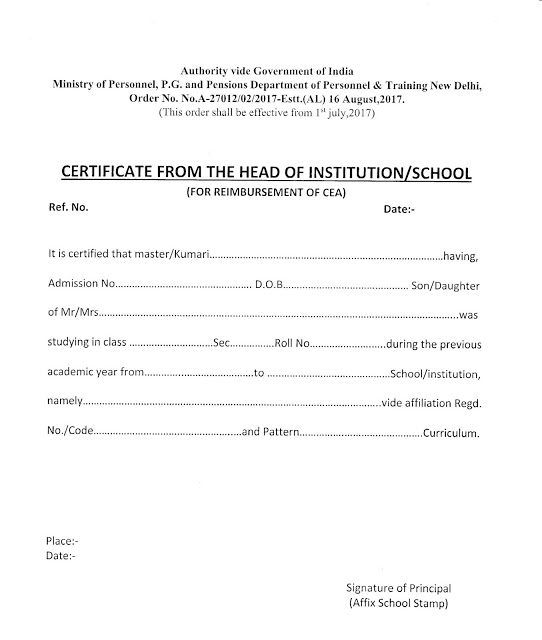

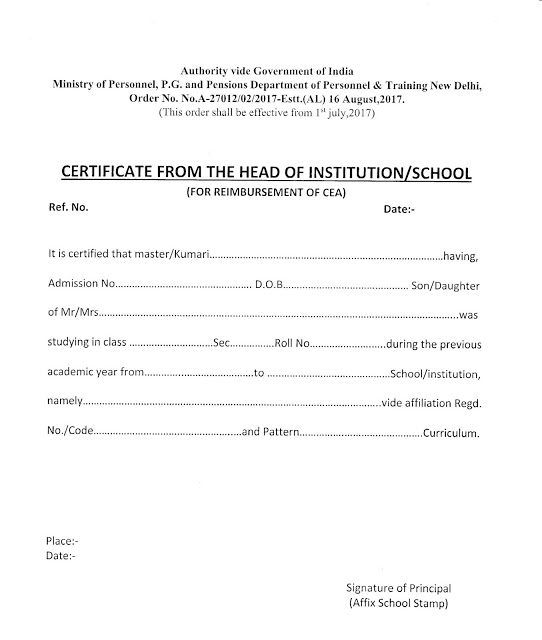

Children Education Allowance CEA Approved Format CEA

Section 87A Tax Rebate Under Section 87A

Education Rebate Income Tested

What Does Rebate Lost Mean On Student Loans

Child Care Rebate Income Tax Return 2022 Carrebate

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan A

https://www.irs.gov/publications/p970

Web If any tax free educational assistance for the qualified education expenses paid in 2022 or any refund of your qualified education expenses paid in 2022 is received after you

Web 30 mars 2023 nbsp 0183 32 Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan A

Web If any tax free educational assistance for the qualified education expenses paid in 2022 or any refund of your qualified education expenses paid in 2022 is received after you

Education Rebate Income Tested

Children Education Allowance CEA Approved Format CEA

What Does Rebate Lost Mean On Student Loans

Child Care Rebate Income Tax Return 2022 Carrebate

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

DEDUCTION UNDER SECTION 80C TO 80U PDF

DEDUCTION UNDER SECTION 80C TO 80U PDF

Income Tax Rebate Under Section 87A