In this digital age, when screens dominate our lives it's no wonder that the appeal of tangible printed items hasn't gone away. For educational purposes or creative projects, or simply to add some personal flair to your space, Income Tax Rebate On Education Loan In India have proven to be a valuable source. With this guide, you'll dive into the world "Income Tax Rebate On Education Loan In India," exploring their purpose, where to locate them, and how they can enrich various aspects of your daily life.

Get Latest Income Tax Rebate On Education Loan In India Below

Income Tax Rebate On Education Loan In India

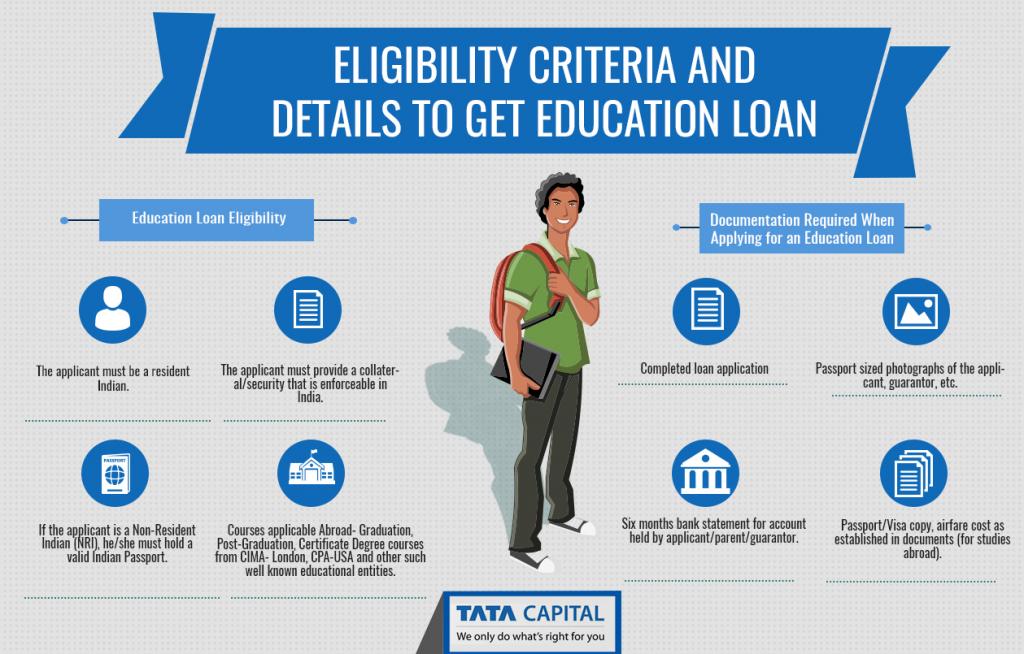

Income Tax Rebate On Education Loan In India - Income Tax Rebate On Education Loan In India, Tax Benefit On Education Loan In India, Does Education Loan Comes Under 80c, Can I Get Tax Benefit On Education Loan, Income Tax Relief For Education Loan

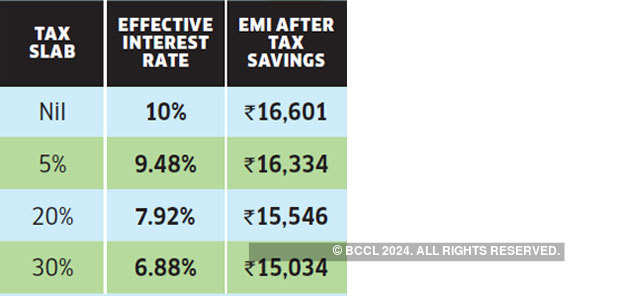

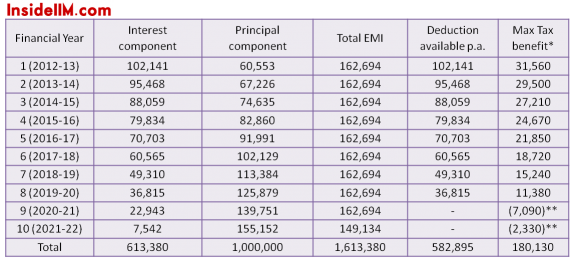

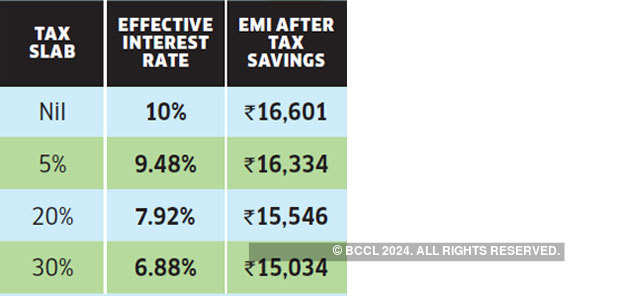

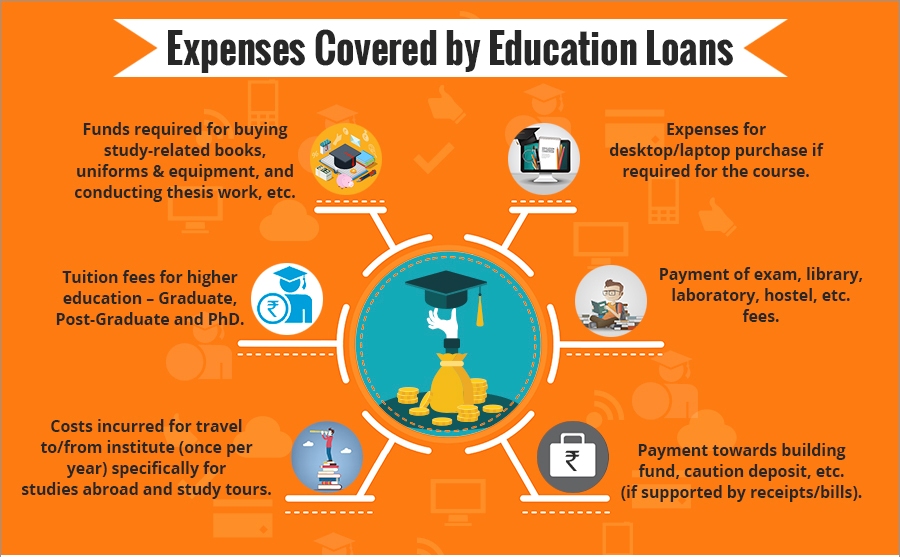

Web 25 ao 251 t 2022 nbsp 0183 32 Apart from funding your higher education costs an education loan offers excellent tax benefits No matter if you are a student or a parent you can reduce your

Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

Income Tax Rebate On Education Loan In India offer a wide range of downloadable, printable materials that are accessible online for free cost. They are available in numerous designs, including worksheets templates, coloring pages and many more. The value of Income Tax Rebate On Education Loan In India lies in their versatility as well as accessibility.

More of Income Tax Rebate On Education Loan In India

Income Tax Deduction On Education Loan 80E CAGMC

Income Tax Deduction On Education Loan 80E CAGMC

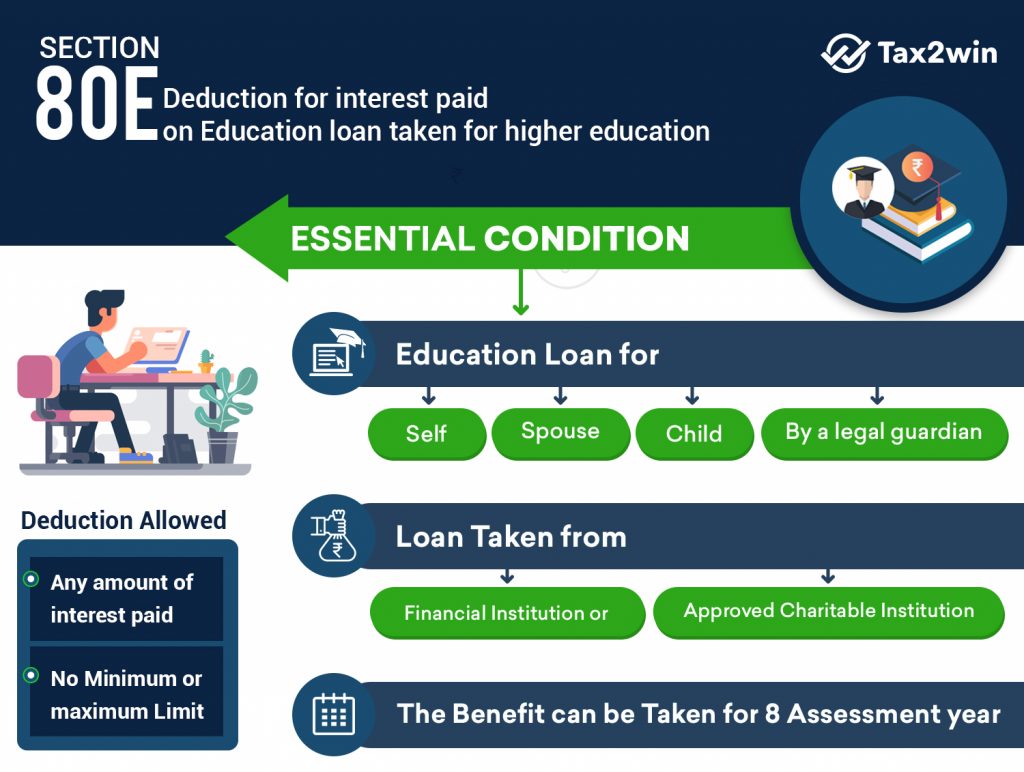

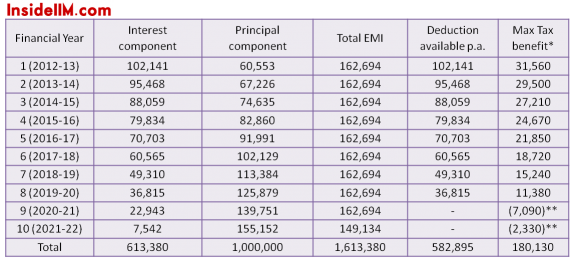

Web 16 f 233 vr 2021 nbsp 0183 32 The Income Tax Act sets no maximum limits on the tax benefits However students can only obtain tax benefits from the interest paid on the education loan

Web 5 avr 2023 nbsp 0183 32 In a financial year individuals can claim a maximum deduction of Rs 1 5 lakh for payments made towards tuition fees along with deductions for items such as

Income Tax Rebate On Education Loan In India have gained a lot of recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Individualization It is possible to tailor the templates to meet your individual needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Worth: Downloads of educational content for free are designed to appeal to students of all ages, making them a valuable resource for educators and parents.

-

Affordability: Instant access to many designs and templates is time-saving and saves effort.

Where to Find more Income Tax Rebate On Education Loan In India

Section 80E Deduction For Interest On Education Loan Tax2win

Section 80E Deduction For Interest On Education Loan Tax2win

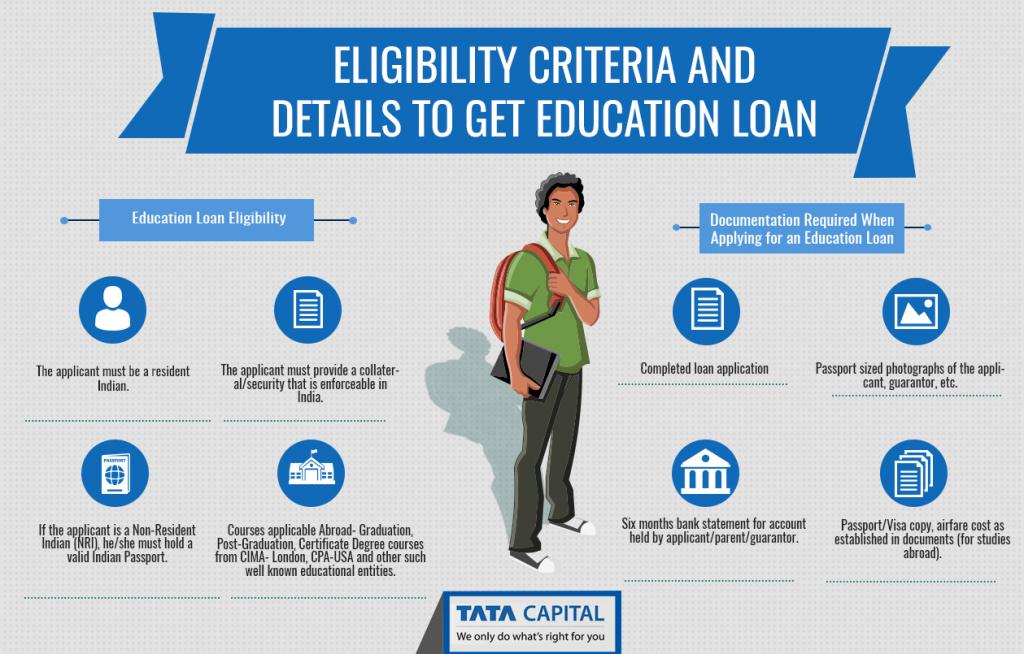

Web This article will cover all the education loan subsidy schemes in India Read the article till the end to gain a clear insight on the schemes features eligibility criteria etc Types of Education Loan Subsidy Schemes

Web If you intend to take a loan for pursuing higher studies in India or abroad you can claim a deduction under section 80E of the Income Tax Act 1961 which caters specifically to

Now that we've piqued your curiosity about Income Tax Rebate On Education Loan In India Let's see where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Income Tax Rebate On Education Loan In India designed for a variety applications.

- Explore categories like decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free including flashcards, learning materials.

- Perfect for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- These blogs cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Income Tax Rebate On Education Loan In India

Here are some unique ways ensure you get the very most use of Income Tax Rebate On Education Loan In India:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Income Tax Rebate On Education Loan In India are an abundance with useful and creative ideas which cater to a wide range of needs and desires. Their access and versatility makes them a valuable addition to both personal and professional life. Explore the wide world of Income Tax Rebate On Education Loan In India today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes you can! You can download and print these materials for free.

-

Are there any free printables to make commercial products?

- It's determined by the specific terms of use. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may have restrictions in use. Make sure you read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- You can print them at home using either a printer or go to any local print store for superior prints.

-

What software will I need to access printables free of charge?

- The majority of printed documents are in the format PDF. This can be opened with free software like Adobe Reader.

Education Rebate Income Tested

DEDUCTION UNDER SECTION 80C TO 80U PDF

Check more sample of Income Tax Rebate On Education Loan In India below

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

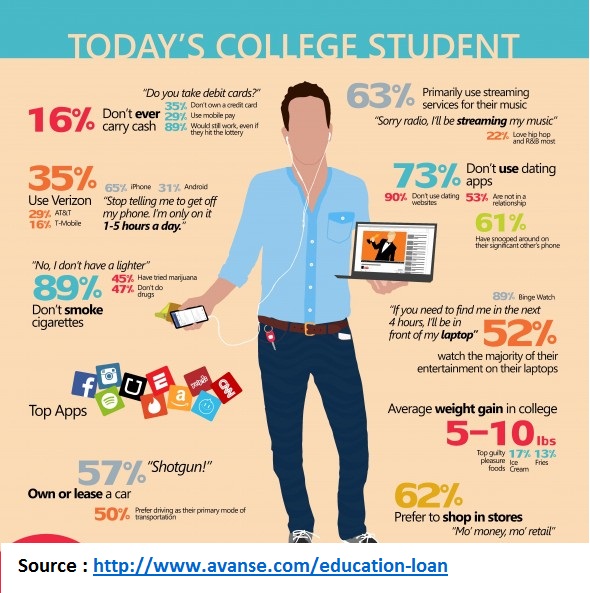

Today s College Student Education Loans In India

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

All You Need To Know About Tax Benefits On Education Loan Interest

Education Loan Tax Benefits How Education Loan Can Help Your Child

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

https://tax2win.in/guide/sec-80e-deduction-interest-on-education-loan

Web 28 juin 2019 nbsp 0183 32 Less Interest paid Deduction u s 80E Rs 1 00 000 Net Taxable Income Rs 5 00 000 The interest paid Rs 1 00 000 on education loan is deducted from the

Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

Web 28 juin 2019 nbsp 0183 32 Less Interest paid Deduction u s 80E Rs 1 00 000 Net Taxable Income Rs 5 00 000 The interest paid Rs 1 00 000 on education loan is deducted from the

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Today s College Student Education Loans In India

All You Need To Know About Tax Benefits On Education Loan Interest

Education Loan Tax Benefits How Education Loan Can Help Your Child

Bank Of India Education Loan Interest Rate 2018 Loan Walls

PPT Education Loan In India PowerPoint Presentation Free Download

PPT Education Loan In India PowerPoint Presentation Free Download

Education Loan Jain Finance