In this age of technology, where screens dominate our lives and the appeal of physical printed items hasn't gone away. In the case of educational materials in creative or artistic projects, or simply to add an extra personal touch to your home, printables for free are now a vital resource. This article will take a dive into the world of "Income Tax Rebate On Joint Home Loan," exploring what they are, how to find them and how they can enrich various aspects of your life.

Get Latest Income Tax Rebate On Joint Home Loan Below

Income Tax Rebate On Joint Home Loan

Income Tax Rebate On Joint Home Loan - Income Tax Rebate On Joint Home Loan, Joint Home Loan Tax Benefits, Income Tax Rules For Joint Home Loan, Income Tax Rebate On Home Loan Rules, How To Claim Joint Home Loan In Income Tax

Web 22 janv 2020 nbsp 0183 32 In case of joint home loans both members listed as co owners become eligible for tax deductions of a maximum of 150 000 on the principal amount component You can avail an additional

Web 26 juil 2019 nbsp 0183 32 1 Income Tax benefits on a joint home loan can be claimed by all the joint owners 2 Ownership is required for joint owners i e Co owner 3 Joint owners have

Income Tax Rebate On Joint Home Loan provide a diverse array of printable documents that can be downloaded online at no cost. The resources are offered in a variety types, like worksheets, coloring pages, templates and many more. The benefit of Income Tax Rebate On Joint Home Loan is in their versatility and accessibility.

More of Income Tax Rebate On Joint Home Loan

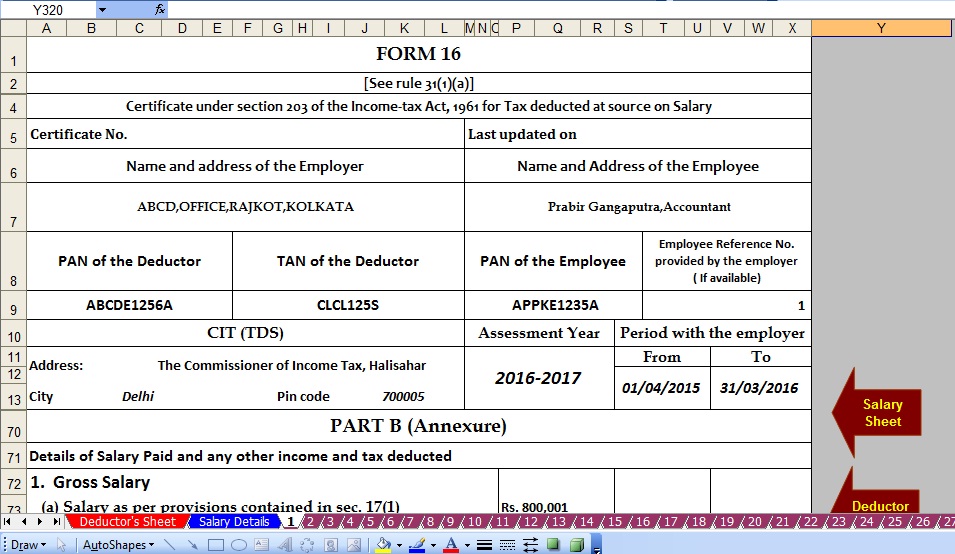

Joint Home Loan Declaration Form For Income Tax Savings And Non

Joint Home Loan Declaration Form For Income Tax Savings And Non

Web 7 avr 2022 nbsp 0183 32 If you obtain a home loan you also become subject to tax benefits under the Income Tax Act Section 24 and Section 80C 1961 Here taking a joint home loan also

Web Having a joint home loan is advantageous when both the co borrowers are tax payers But do keep in mind that to claim income tax benefits in joint home loan all the co borrowers

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization Your HTML0 customization options allow you to customize printed materials to meet your requirements, whether it's designing invitations to organize your schedule or even decorating your house.

-

Educational Value: Printing educational materials for no cost cater to learners of all ages. This makes them an invaluable tool for parents and educators.

-

Affordability: Instant access to various designs and templates will save you time and effort.

Where to Find more Income Tax Rebate On Joint Home Loan

PPT 3 Ways To Get A Tax Benefits On Joint Home Loan PowerPoint

PPT 3 Ways To Get A Tax Benefits On Joint Home Loan PowerPoint

Web Income Tax Benefits on Home Loans The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a

Web if you have taken a home loan but continue to reside in a rented property you can claim tax benefits against HRA as well in the case of a joint home loan both borrowers can claim

Since we've got your interest in printables for free and other printables, let's discover where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Income Tax Rebate On Joint Home Loan to suit a variety of objectives.

- Explore categories such as interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free with flashcards and other teaching tools.

- Perfect for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- The blogs covered cover a wide range of interests, that includes DIY projects to planning a party.

Maximizing Income Tax Rebate On Joint Home Loan

Here are some innovative ways that you can make use use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home also in the classes.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Income Tax Rebate On Joint Home Loan are a treasure trove with useful and creative ideas for a variety of needs and preferences. Their accessibility and flexibility make them a valuable addition to both professional and personal life. Explore the world of Income Tax Rebate On Joint Home Loan and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually are they free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I use the free printables for commercial use?

- It's based on the terms of use. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables might have limitations concerning their use. Check the terms and conditions set forth by the author.

-

How can I print printables for free?

- Print them at home with your printer or visit an in-store print shop to get more high-quality prints.

-

What program do I need in order to open printables at no cost?

- A majority of printed materials are in PDF format. They can be opened using free software, such as Adobe Reader.

Housing Loans Joint Declaration Form For Housing Loan

PPT How To Avail Tax Benefit On Joint Home Loan PowerPoint

Check more sample of Income Tax Rebate On Joint Home Loan below

Tax Benefits On Joint Home Loans What You Should Know U

PPT How To Avail Tax Benefit On Joint Home Loan PowerPoint

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

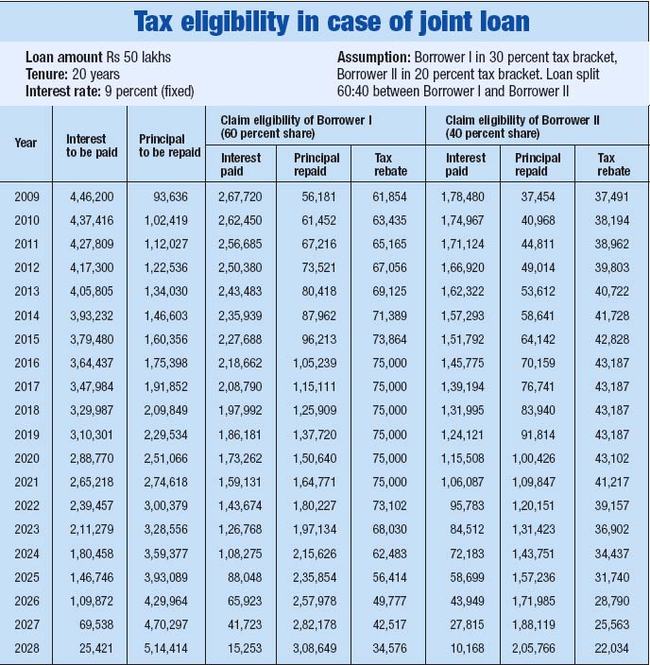

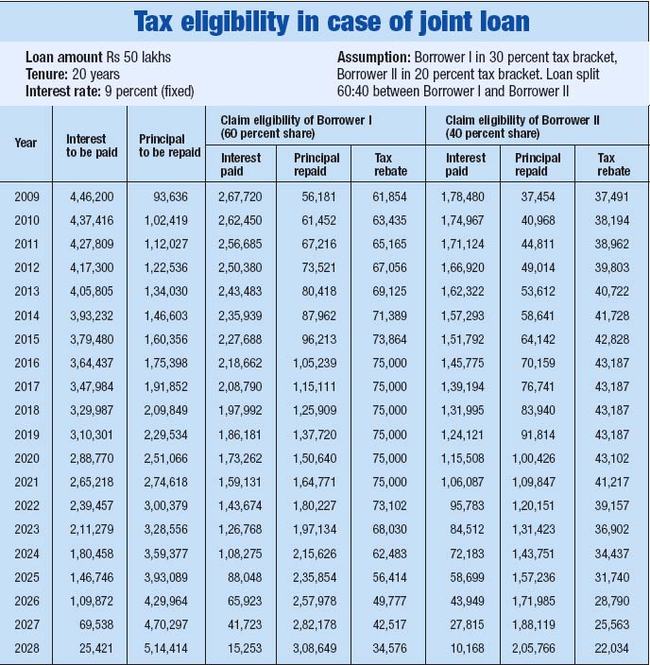

Tax Benefits Of A Joint Home Loan To Co borrowers The Economic Times

https://taxguru.in/income-tax/tax-benefits-home-loan-joint-owners.html

Web 26 juil 2019 nbsp 0183 32 1 Income Tax benefits on a joint home loan can be claimed by all the joint owners 2 Ownership is required for joint owners i e Co owner 3 Joint owners have

https://housing.com/news/claim-tax-benefits-joint-home-loans

Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

Web 26 juil 2019 nbsp 0183 32 1 Income Tax benefits on a joint home loan can be claimed by all the joint owners 2 Ownership is required for joint owners i e Co owner 3 Joint owners have

Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

PPT How To Avail Tax Benefit On Joint Home Loan PowerPoint

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Tax Benefits Of A Joint Home Loan To Co borrowers The Economic Times

How To Calculate Tax Rebate On Home Loan Grizzbye

Georgia Income Tax Rebate 2023 Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live