Today, where screens dominate our lives and the appeal of physical printed material hasn't diminished. Whatever the reason, whether for education project ideas, artistic or simply adding the personal touch to your space, Recovery Rebate Credit Married Filing Separately are now an essential source. Here, we'll dive into the world "Recovery Rebate Credit Married Filing Separately," exploring the different types of printables, where to locate them, and how they can be used to enhance different aspects of your life.

Get Latest Recovery Rebate Credit Married Filing Separately Below

Recovery Rebate Credit Married Filing Separately

Recovery Rebate Credit Married Filing Separately - Recovery Rebate Credit Married Filing Separately

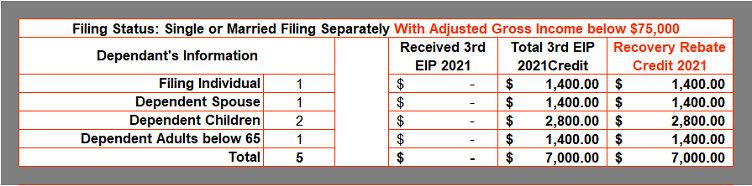

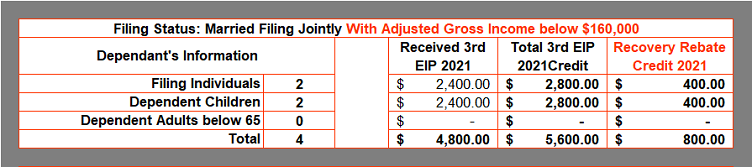

Web 14 janv 2022 nbsp 0183 32 The 2021 EIP recovery rebate credit has the same income phaseout thresholds as for 2020 75 000 for single filers and 150 000 for married couples filing

Web 10 d 233 c 2021 nbsp 0183 32 75 000 if filing as a single or as married filing separately Your payment will be reduced by 5 of the amount by which your AGI exceeds the applicable threshold

Printables for free include a vast selection of printable and downloadable materials available online at no cost. They come in many forms, including worksheets, templates, coloring pages and more. The appeal of printables for free is in their versatility and accessibility.

More of Recovery Rebate Credit Married Filing Separately

Filled Out Amended Return To Claim Recovery Rebate Recovery Rebate

Filled Out Amended Return To Claim Recovery Rebate Recovery Rebate

Web 1 juil 2020 nbsp 0183 32 Married filing separately may be an option In most situations it is better for a married couple to file a joint return rather than file

Web 18 janv 2022 nbsp 0183 32 At first glance it looks like filing Married Filing Separately will result in an additional 877 in taxes for the couple However Michelle s return will also contain an Recovery Rebate Credit of 4 200 meaning

Recovery Rebate Credit Married Filing Separately have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

The ability to customize: Your HTML0 customization options allow you to customize the templates to meet your individual needs, whether it's designing invitations or arranging your schedule or even decorating your home.

-

Educational Benefits: Educational printables that can be downloaded for free are designed to appeal to students of all ages, which makes them an essential tool for teachers and parents.

-

Simple: You have instant access a plethora of designs and templates, which saves time as well as effort.

Where to Find more Recovery Rebate Credit Married Filing Separately

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Web 3 mars 2022 nbsp 0183 32 Your first Economic Impact Payment was 1 200 2 400 if married filing jointly for 2020 plus 500 for each qualifying child you had in 2020 Your second

Web 12 oct 2022 nbsp 0183 32 Image credit Getty Images By Rocky Mengle last updated October 12 2022 If you didn t get a third stimulus check or you only got a partial check then you

We've now piqued your interest in Recovery Rebate Credit Married Filing Separately Let's see where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection with Recovery Rebate Credit Married Filing Separately for all applications.

- Explore categories such as decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets along with flashcards, as well as other learning tools.

- Ideal for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- The blogs are a vast range of topics, that includes DIY projects to planning a party.

Maximizing Recovery Rebate Credit Married Filing Separately

Here are some creative ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Recovery Rebate Credit Married Filing Separately are a treasure trove of fun and practical tools which cater to a wide range of needs and needs and. Their accessibility and flexibility make them a valuable addition to both professional and personal lives. Explore the plethora of Recovery Rebate Credit Married Filing Separately today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I utilize free printables for commercial uses?

- It's dependent on the particular rules of usage. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Certain printables might have limitations in their usage. Make sure to read the conditions and terms of use provided by the creator.

-

How do I print Recovery Rebate Credit Married Filing Separately?

- Print them at home with any printer or head to a print shop in your area for higher quality prints.

-

What software is required to open printables free of charge?

- Most PDF-based printables are available in the format PDF. This can be opened with free software like Adobe Reader.

Recovery Rebate Credit Married In 2023 Recovery Rebate

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Check more sample of Recovery Rebate Credit Married Filing Separately below

The Recovery Rebate Credit Calculator ShauntelRaya

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Recovery Credit Printable Rebate Form

Cares Act Recovery Rebate Credit Recovery Rebate

Fillable Online Claiming The Recovery Rebate Credit If Your Filing

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-b...

Web 10 d 233 c 2021 nbsp 0183 32 75 000 if filing as a single or as married filing separately Your payment will be reduced by 5 of the amount by which your AGI exceeds the applicable threshold

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-g...

Web 17 f 233 vr 2022 nbsp 0183 32 You were issued the full amount of the Recovery Rebate Credit if your third Economic Impact Payment was 1 400 2 800 if married filing jointly for 2021 plus

Web 10 d 233 c 2021 nbsp 0183 32 75 000 if filing as a single or as married filing separately Your payment will be reduced by 5 of the amount by which your AGI exceeds the applicable threshold

Web 17 f 233 vr 2022 nbsp 0183 32 You were issued the full amount of the Recovery Rebate Credit if your third Economic Impact Payment was 1 400 2 800 if married filing jointly for 2021 plus

Recovery Credit Printable Rebate Form

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Cares Act Recovery Rebate Credit Recovery Rebate

Fillable Online Claiming The Recovery Rebate Credit If Your Filing

Recovery Rebate Credit Form Printable Rebate Form

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Mastering The Recovery Rebate Credit Free Printable Worksheet Style