In this day and age when screens dominate our lives, the charm of tangible printed materials hasn't faded away. For educational purposes and creative work, or just adding personal touches to your home, printables for free can be an excellent resource. In this article, we'll dive deeper into "Standard Deduction For Huf," exploring their purpose, where to locate them, and how they can add value to various aspects of your lives.

Get Latest Standard Deduction For Huf Below

Standard Deduction For Huf

Standard Deduction For Huf - Standard Deduction For Huf, Is Standard Deduction Applicable For Huf, Is 80c Deduction Available To Huf, Huf Tax Benefits, Deductions Available For Huf

As HUF can own and transact in shares and securities it can avail the basic deduction of Rs one lakh in respect of long term capital gains arsing on sale of listed share and units of equity oriented units of mutual funds under Section 112A from current year

Both HUF and Mr Chopra as well as other members of the HUF can claim a deduction under section 80C Furthermore the income of the HUF can be invested by the HUF and will continue to be taxed in the hands of the HUF

Printables for free include a vast assortment of printable, downloadable documents that can be downloaded online at no cost. These resources come in various styles, from worksheets to templates, coloring pages, and much more. The benefit of Standard Deduction For Huf is in their variety and accessibility.

More of Standard Deduction For Huf

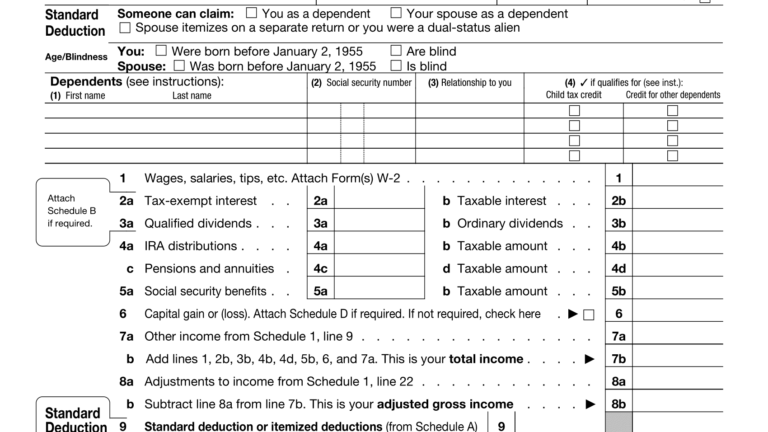

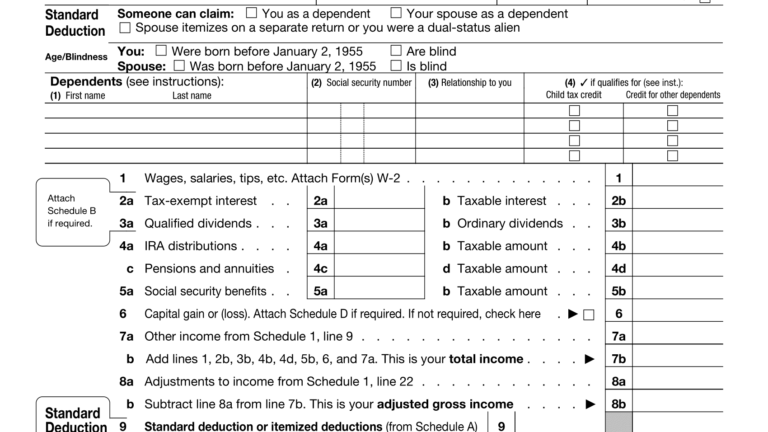

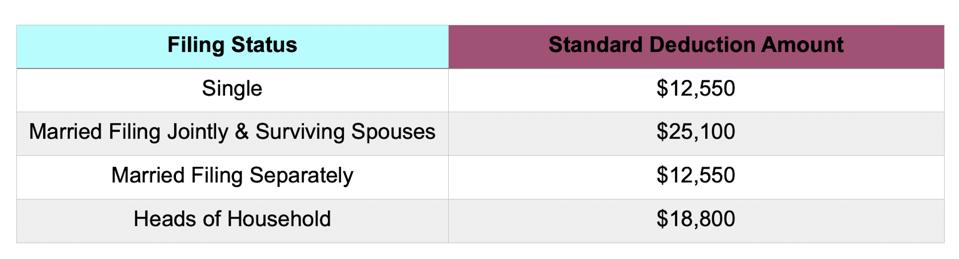

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Hindu Undivided Families HUFs have a unique tax treatment in India which plays a crucial role in financial planning This comprehensive guide will delve into the various facets of HUF taxation including residential status income computation deductions tax regimes and much more

The Budget 2020 introduces a new regime under Section 115BAC giving individuals and HUF taxpayers an option to pay income tax at lower rates with fewer exemptions and deductions to claim Keep reading to learn more about Section 115BAC of the Income tax Act 1961

Standard Deduction For Huf have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Customization: Your HTML0 customization options allow you to customize printed materials to meet your requirements when it comes to designing invitations making your schedule, or decorating your home.

-

Educational Benefits: Printing educational materials for no cost cater to learners of all ages, which makes them a great aid for parents as well as educators.

-

An easy way to access HTML0: Instant access to an array of designs and templates will save you time and effort.

Where to Find more Standard Deduction For Huf

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

As discussed earlier HUF is a separate legal entity and it also enjoys the basic exemption limit of Rs 2 50 000 and deductions that are available to an individual Here are some of section 80 deduction which is available to HUF

HUFs benefit from various tax deductions under Sections 80C 80D and more Governed by Hindu law but available to Jains Sikhs and Buddhists an HUF requires legal setup and careful management It allows pooling income from various sources but closing an HUF is difficult and requires unanimous agreement among members

Now that we've piqued your curiosity about Standard Deduction For Huf, let's explore where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection in Standard Deduction For Huf for different objectives.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing including flashcards, learning materials.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- These blogs cover a wide variety of topics, that range from DIY projects to planning a party.

Maximizing Standard Deduction For Huf

Here are some creative ways of making the most use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home and in class.

3. Event Planning

- Make invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

Standard Deduction For Huf are a treasure trove filled with creative and practical information that meet a variety of needs and interest. Their accessibility and flexibility make them a valuable addition to every aspect of your life, both professional and personal. Explore the vast collection of Standard Deduction For Huf today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes you can! You can download and print these files for free.

-

Can I make use of free printables for commercial purposes?

- It's based on the conditions of use. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Are there any copyright issues in Standard Deduction For Huf?

- Certain printables might have limitations regarding their use. You should read the terms and conditions set forth by the designer.

-

How can I print Standard Deduction For Huf?

- You can print them at home using printing equipment or visit the local print shops for more high-quality prints.

-

What program do I need to run printables for free?

- Most printables come as PDF files, which is open with no cost software like Adobe Reader.

Standard Deduction Every Filing Status 2023 2024

What s The Standard Deduction For 2020 Vs 2021 Kiplinger

Check more sample of Standard Deduction For Huf below

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction 2023 Over 65 W2023A

Standard Deduction For 2021 22 Standard Deduction 2021 Www vrogue co

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Irs Standard Deduction For Seniors 2020 Standard Deduction 2021

2022 Tax Brackets Irs Calculator

https://cleartax.in/s/huf-hindu-undivided-family

Both HUF and Mr Chopra as well as other members of the HUF can claim a deduction under section 80C Furthermore the income of the HUF can be invested by the HUF and will continue to be taxed in the hands of the HUF

https://taxguru.in/income-tax/income-tax-benefits-individuals-hufs.html

In this comprehensive guide we will explore the key provisions and changes that affect individual taxpayers and HUFs for the Assessment Year 2024 25 enabling you to make informed financial decisions and take full advantage of the tax benefits provided by the government

Both HUF and Mr Chopra as well as other members of the HUF can claim a deduction under section 80C Furthermore the income of the HUF can be invested by the HUF and will continue to be taxed in the hands of the HUF

In this comprehensive guide we will explore the key provisions and changes that affect individual taxpayers and HUFs for the Assessment Year 2024 25 enabling you to make informed financial decisions and take full advantage of the tax benefits provided by the government

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Standard Deduction 2023 Over 65 W2023A

Irs Standard Deduction For Seniors 2020 Standard Deduction 2021

2022 Tax Brackets Irs Calculator

Everything You Need To Know About The Standard Deduction For 2021 2022

Standard Deduction Worksheet For Dependents

Standard Deduction Worksheet For Dependents

Your First Look At 2021 Tax Rates Projected Brackets Standard