In this age of technology, in which screens are the norm it's no wonder that the appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses as well as creative projects or just adding a personal touch to your home, printables for free have become an invaluable source. With this guide, you'll take a dive into the sphere of "Student Loan Interest Tax Credit Calculator Canada," exploring their purpose, where you can find them, and how they can add value to various aspects of your lives.

Get Latest Student Loan Interest Tax Credit Calculator Canada Below

Student Loan Interest Tax Credit Calculator Canada

Student Loan Interest Tax Credit Calculator Canada - Student Loan Interest Tax Credit Calculator Canada, How Much Tax Credit For Student Loan Interest, Can You Claim Interest On Student Loans Canada, Is Student Loan Interest Tax Deductible Canada, Do You Get A Tax Credit For Student Loan Interest

There are both federal and provincial non refundable tax credits for student loan interest The tax credit is calculated by multiplying the lowest federal provincial territorial tax

Key Takeaways Receive a 15 tax credit based on the interest you paid on your student loans in 2022 and the preceding five years To qualify for the student loan tax credit

Printables for free cover a broad selection of printable and downloadable materials that are accessible online for free cost. They are available in numerous kinds, including worksheets templates, coloring pages and much more. The appealingness of Student Loan Interest Tax Credit Calculator Canada is in their versatility and accessibility.

More of Student Loan Interest Tax Credit Calculator Canada

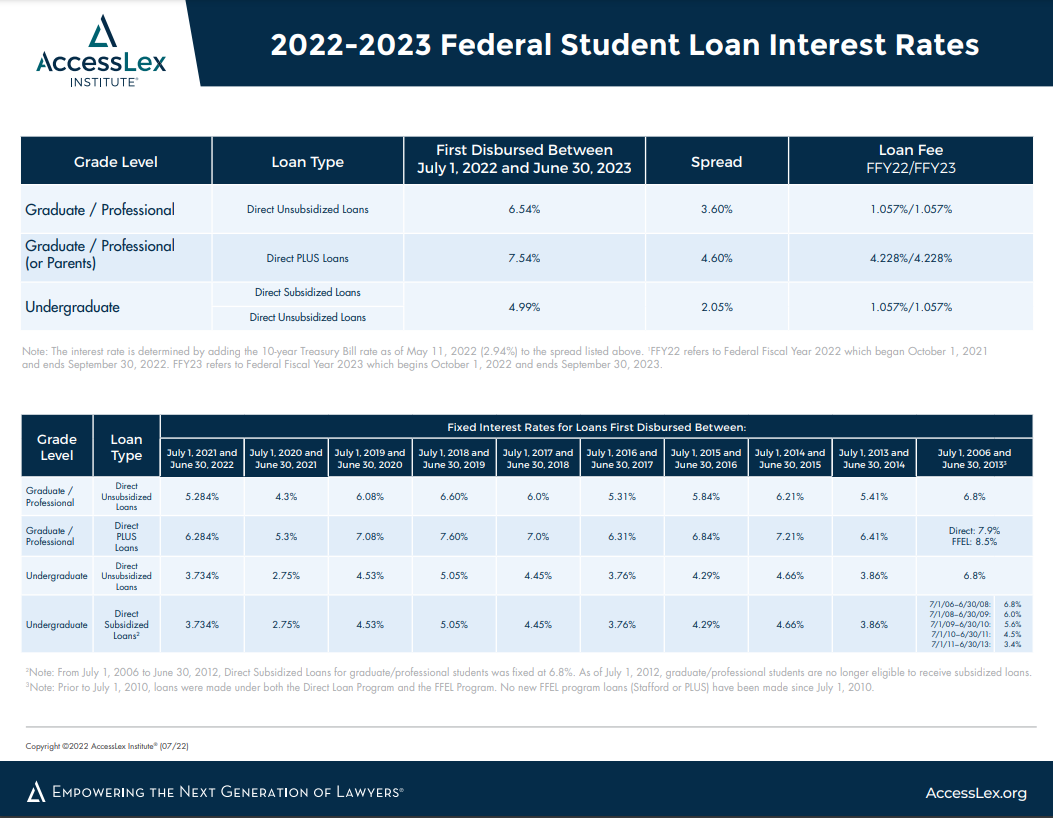

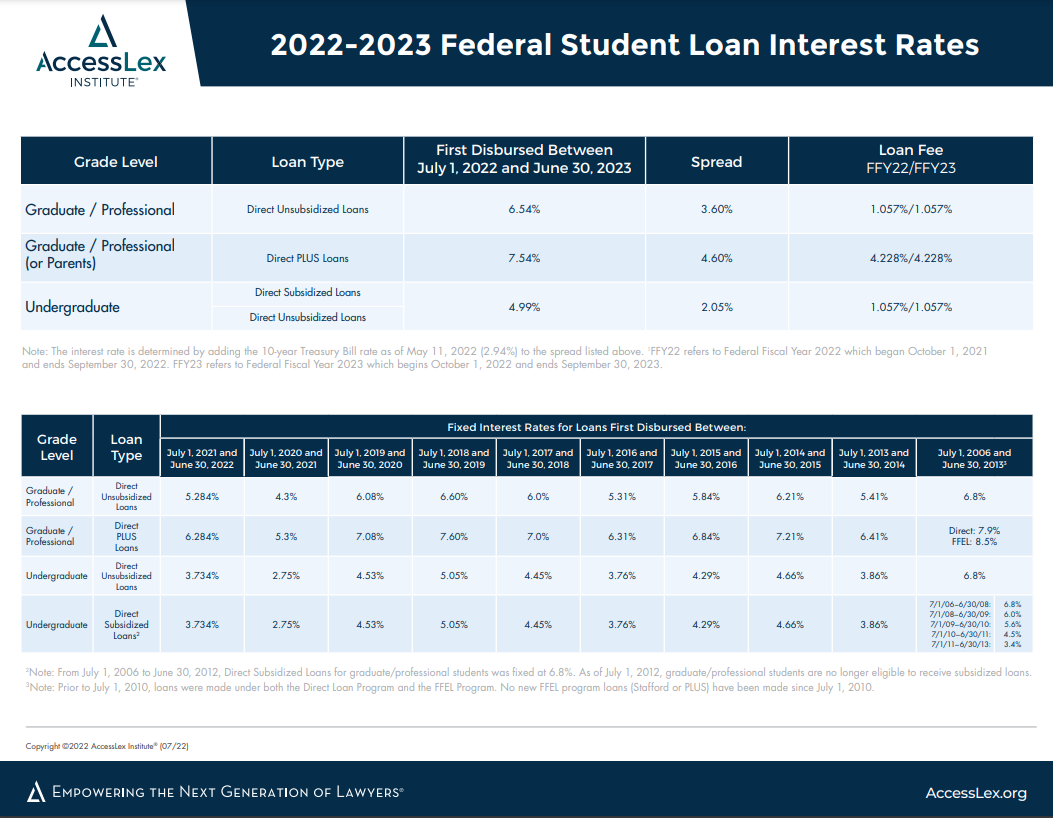

Federal Student Loan Interest Rates AccessLex

Federal Student Loan Interest Rates AccessLex

You ll receive 15 of your interest paid back as a tax credit Are student loans tax deductible in Canada Your student loan is not tax deductible but you can claim any

The student loan interest tax credit estimate provided through the Repayment Calculator is only an estimate of the annual tax credit amount that may be available

Student Loan Interest Tax Credit Calculator Canada have risen to immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

The ability to customize: You can tailor the design to meet your needs whether it's making invitations making your schedule, or decorating your home.

-

Educational Use: Downloads of educational content for free offer a wide range of educational content for learners of all ages, which makes them a great device for teachers and parents.

-

Simple: Fast access the vast array of design and templates, which saves time as well as effort.

Where to Find more Student Loan Interest Tax Credit Calculator Canada

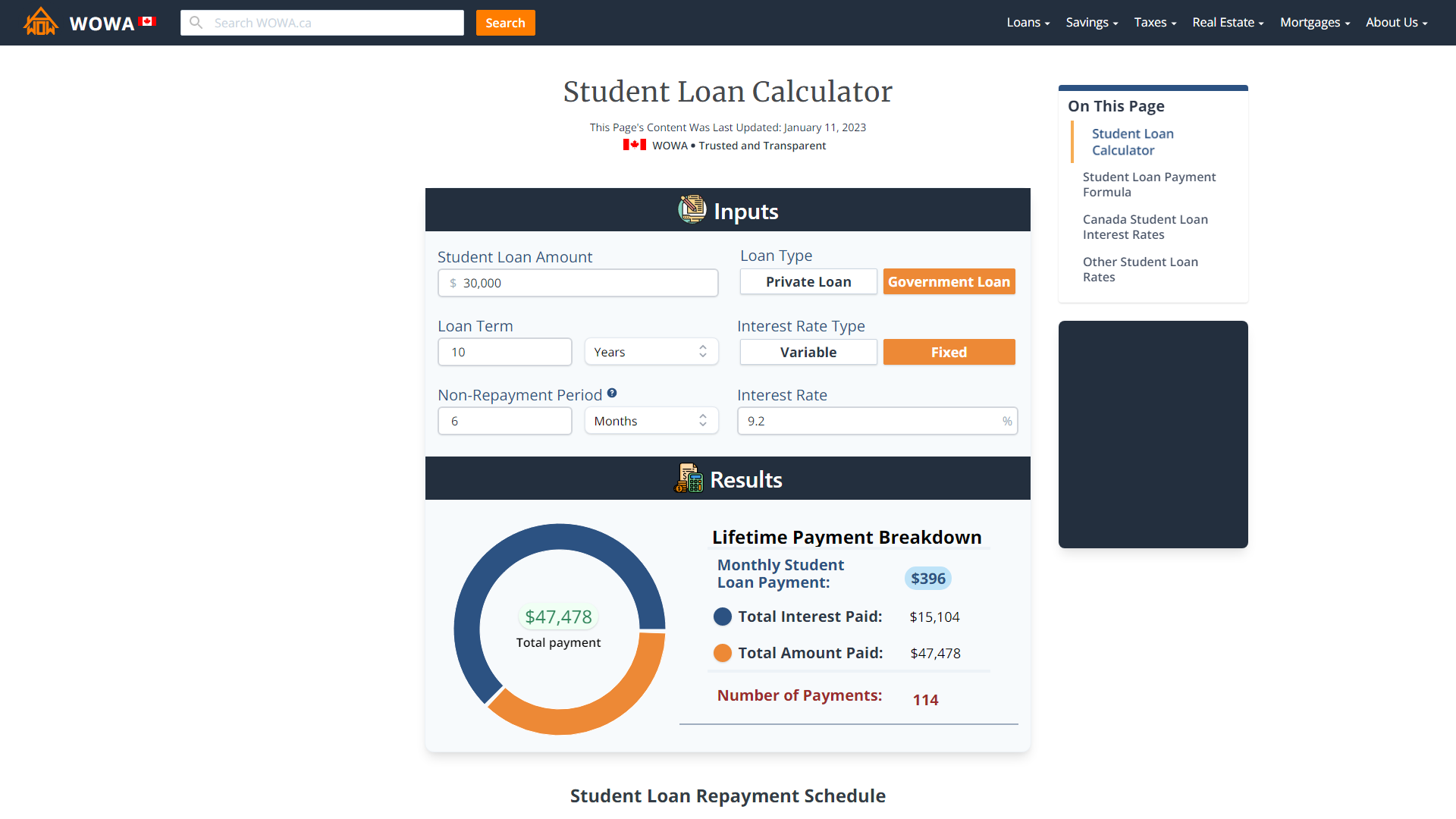

Student Loan Calculator Canada WOWA ca

Student Loan Calculator Canada WOWA ca

Tax Season If you paid interest on your student loan in 2023 your Tax Receipt and annual statement will be available in your secure inbox as of January 12th 2024 T4A

Student Loan Interest Tax Credits Forgiveness Calculator This calculator allows you to select your province and enter the interest rate fixed or variable for you

We've now piqued your interest in Student Loan Interest Tax Credit Calculator Canada Let's find out where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Student Loan Interest Tax Credit Calculator Canada for various goals.

- Explore categories like furniture, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- These blogs cover a broad spectrum of interests, that range from DIY projects to planning a party.

Maximizing Student Loan Interest Tax Credit Calculator Canada

Here are some innovative ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Student Loan Interest Tax Credit Calculator Canada are a treasure trove with useful and creative ideas that can meet the needs of a variety of people and interests. Their availability and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the endless world that is Student Loan Interest Tax Credit Calculator Canada today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes they are! You can print and download the resources for free.

-

Can I use free printables to make commercial products?

- It's based on the usage guidelines. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may have restrictions regarding usage. Always read the terms and conditions provided by the author.

-

How do I print printables for free?

- Print them at home with your printer or visit an area print shop for high-quality prints.

-

What software is required to open printables at no cost?

- The majority of PDF documents are provided in the PDF format, and is open with no cost software, such as Adobe Reader.

Account Suspended Student Loan Debt Student Loans Best Student Loans

What Credit Score Is Needed For A Student Loan Student Loan Planner

Check more sample of Student Loan Interest Tax Credit Calculator Canada below

The Federal Student Loan Interest Deduction

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

Certificate Courses Student Loans Higher Education Expand Goo

Student Loan Interest Tax Deduction Milliken Perkins Brunelle

Student Loan Interest Deduction 2013 PriorTax Blog

Student Loan Interest Tax Deduction YouTube

Lower Your Student Loan Interest Rate NOW

https://turbotax.intuit.ca/tips/claiming-student...

Key Takeaways Receive a 15 tax credit based on the interest you paid on your student loans in 2022 and the preceding five years To qualify for the student loan tax credit

https://www.debt101.ca/taxcredit

Canadians all get the same federal tax credit on eligible student loan interest At writing this is 15 percent But the provinces vary in their tax credit rates This means you get a

Key Takeaways Receive a 15 tax credit based on the interest you paid on your student loans in 2022 and the preceding five years To qualify for the student loan tax credit

Canadians all get the same federal tax credit on eligible student loan interest At writing this is 15 percent But the provinces vary in their tax credit rates This means you get a

Student Loan Interest Deduction 2013 PriorTax Blog

Certificate Courses Student Loans Higher Education Expand Goo

Student Loan Interest Tax Deduction YouTube

Lower Your Student Loan Interest Rate NOW

Treasury Sets Student Loan Interest Rates Near Historic Lows

6 Best Tax Tips For Student Loan Borrowers Student Loan Planner

6 Best Tax Tips For Student Loan Borrowers Student Loan Planner

Learn How The Student Loan Interest Deduction Works