In this digital age, where screens have become the dominant feature of our lives, the charm of tangible printed objects hasn't waned. For educational purposes project ideas, artistic or simply to add an element of personalization to your space, Tax Benefit On Education Loans can be an excellent resource. With this guide, you'll take a dive deep into the realm of "Tax Benefit On Education Loans," exploring what they are, how they are available, and how they can be used to enhance different aspects of your daily life.

Get Latest Tax Benefit On Education Loans Below

Tax Benefit On Education Loans

Tax Benefit On Education Loans - Tax Benefit On Education Loans, Tax Benefit On Home Loans, Tax Benefit On Education Loan In India, Tax Benefit On Education Loan Interest, Tax Deduction On Student Loans, Tax Benefit On Home Loan Calculator, Tax Benefit On Home Loan For Joint Owners, Tax Benefit On Home Loan Under Construction, Tax Benefit On Home Loan Interest Under Construction, Can I Get Tax Benefit On Education Loan

The IRS only requires federal loan servicers to report payments on IRS Form 1098 E if the interest received from the borrower in the tax year was 600 or more although some federal loan servicers still send 1098 E s to borrowers

An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero you

Tax Benefit On Education Loans provide a diverse range of downloadable, printable content that can be downloaded from the internet at no cost. These resources come in many forms, including worksheets, templates, coloring pages and much more. The appeal of printables for free is their flexibility and accessibility.

More of Tax Benefit On Education Loans

How To Take Tax Benefit On Education Loan YouTube

How To Take Tax Benefit On Education Loan YouTube

The tax benefit on education loans is given under Section 80E of the Income Tax Act It allows taxpayers to claim deductions on the interest paid towards education loans for themselves their spouse their children or a

Find out which education expenses qualify for claiming education credits or deductions Qualified education expenses are amounts paid for tuition fees and other related expenses for

Tax Benefit On Education Loans have garnered immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Customization: They can make the templates to meet your individual needs when it comes to designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value: These Tax Benefit On Education Loans are designed to appeal to students from all ages, making them a great aid for parents as well as educators.

-

The convenience of Instant access to a myriad of designs as well as templates helps save time and effort.

Where to Find more Tax Benefit On Education Loans

4 Different Types Of Loans That Have Tax Benefits

4 Different Types Of Loans That Have Tax Benefits

When you use student loan funds to finance your education if you are eligible the IRS allows you to claim qualifying expenses that you pay with those funds towards educational tax credits

Several tax breaks can help you cover the high costs of education future college expenses and interest you pay on student loans

After we've peaked your interest in printables for free Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection and Tax Benefit On Education Loans for a variety motives.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- It is ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- These blogs cover a broad selection of subjects, that includes DIY projects to planning a party.

Maximizing Tax Benefit On Education Loans

Here are some ideas in order to maximize the use use of Tax Benefit On Education Loans:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets for free to build your knowledge at home and in class.

3. Event Planning

- Design invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Benefit On Education Loans are an abundance filled with creative and practical information for a variety of needs and desires. Their accessibility and flexibility make these printables a useful addition to the professional and personal lives of both. Explore the vast world of Tax Benefit On Education Loans today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes they are! You can print and download these items for free.

-

Can I download free printables for commercial purposes?

- It's contingent upon the specific usage guidelines. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables might have limitations concerning their use. Be sure to check the terms and condition of use as provided by the designer.

-

How can I print Tax Benefit On Education Loans?

- You can print them at home using either a printer at home or in the local print shops for more high-quality prints.

-

What software must I use to open printables for free?

- The majority of printables are with PDF formats, which can be opened using free software such as Adobe Reader.

Income Tax Benefit On Second Home Loan Complete Guide

Some Student Loan Borrowers Are Going To Be Taxed On Their Forgiveness

Check more sample of Tax Benefit On Education Loans below

The Effects Of Changes In Foreign Exchange Rates Accounting Tax

Guide To Student Loan Interest Rates And How Much You Will Pay

Benefits Of Education Loans In India

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Benefits On Housing Loan In India

https://www.irs.gov/newsroom/tax-benefits-for...

An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero you

https://www.forbes.com/advisor/taxes/…

How Much Student Loan Interest Is Tax Deductible You can deduct either 2 500 in student loan interest or the actual amount of loan interest you paid during the year whichever is less

An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero you

How Much Student Loan Interest Is Tax Deductible You can deduct either 2 500 in student loan interest or the actual amount of loan interest you paid during the year whichever is less

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Guide To Student Loan Interest Rates And How Much You Will Pay

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Benefits On Housing Loan In India

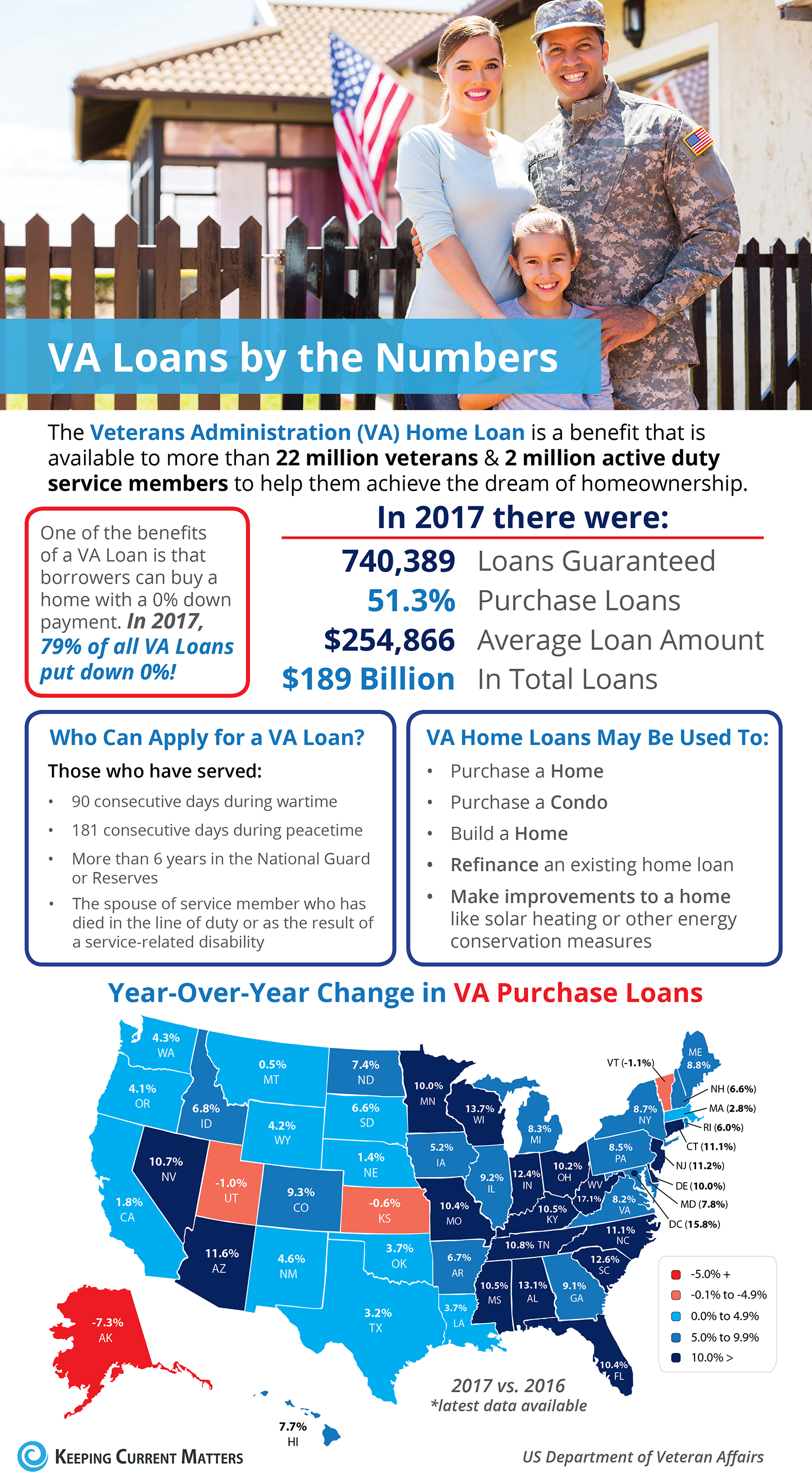

VA Home Loans By The Numbers INFOGRAPHIC Blog

Income Tax Benefit On Home Loan Repayment IDFC FIRST Bank

Income Tax Benefit On Home Loan Repayment IDFC FIRST Bank

Here Is The Tax Benefit On Personal Loans That You Can Avail