In the age of digital, where screens dominate our lives, the charm of tangible printed objects hasn't waned. Be it for educational use and creative work, or simply adding personal touches to your space, Tax Benefit On Home Loan Under Construction are a great resource. For this piece, we'll take a dive deep into the realm of "Tax Benefit On Home Loan Under Construction," exploring the benefits of them, where they can be found, and how they can enrich various aspects of your lives.

Get Latest Tax Benefit On Home Loan Under Construction Below

Tax Benefit On Home Loan Under Construction

Tax Benefit On Home Loan Under Construction - Tax Benefit On Home Loan Under Construction, Tax Exemption On Home Loan Under Construction, Tax Benefit On Home Loan Interest Under Construction, Tax Benefit On Second Home Loan Under Construction, Tax Exemption On Housing Loan Under Construction, Income Tax Benefit On Second Home Loan Under Construction, Income Tax Benefit On Home Loan Under New Tax Regime, Can I Get Tax Benefit On Home Loan For Under Construction Property, Under Construction Home Loan Tax Benefits India, Home Loan Tax Benefit On Under Construction Property

As per Section 24 b of the Income Tax Act you can avail of a tax benefit of up to 2 Lakh per financial year on your home loan interest payments This includes the interest

For under construction property tax deductions on home loan interest can be claimed only after the construction is complete Interest payments made towards the loan during pre construction are eligible for a claim in five equal

Tax Benefit On Home Loan Under Construction cover a large collection of printable documents that can be downloaded online at no cost. These resources come in many types, such as worksheets templates, coloring pages and many more. The benefit of Tax Benefit On Home Loan Under Construction is in their variety and accessibility.

More of Tax Benefit On Home Loan Under Construction

How To Claim Tax Benefits On Home Loan Bleu Finance

How To Claim Tax Benefits On Home Loan Bleu Finance

Total pre construction interest on home loan Rs 90 000 for FY 2021 22 and Rs 1 20 000 for FY 2022 23 sums up to Rs 2 10 000 Rs 2 10 000 is the pre construction interest that can be claimed in five equal installments of

You can claim tax benefits on a Home Loan availed of to purchase an under construction property Familiarising yourself with the tax exemptions available under Section

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Customization: It is possible to tailor printables to your specific needs be it designing invitations making your schedule, or even decorating your home.

-

Educational Value Free educational printables provide for students from all ages, making the perfect instrument for parents and teachers.

-

Affordability: Access to a plethora of designs and templates will save you time and effort.

Where to Find more Tax Benefit On Home Loan Under Construction

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Tax exemption on home loan interest for under construction property You can claim a tax exemption of up to Rs 2 00 000 on the interest payments made in a year and deductions of up to Rs 1 50 000 on the

Learn how to claim tax deduction on interest and principal paid for an under construction property with a home loan Find out the eligibility conditions and sections for pre construction stage home loan tax benefits

We've now piqued your interest in printables for free, let's explore where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of reasons.

- Explore categories like design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- Ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a wide range of topics, all the way from DIY projects to planning a party.

Maximizing Tax Benefit On Home Loan Under Construction

Here are some inventive ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets from the internet to build your knowledge at home or in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Benefit On Home Loan Under Construction are an abundance of practical and imaginative resources for a variety of needs and needs and. Their availability and versatility make them a wonderful addition to any professional or personal life. Explore the wide world of Tax Benefit On Home Loan Under Construction right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes, they are! You can download and print these tools for free.

-

Are there any free printables in commercial projects?

- It's based on specific rules of usage. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may have restrictions on their use. Make sure you read these terms and conditions as set out by the author.

-

How can I print Tax Benefit On Home Loan Under Construction?

- Print them at home using a printer or visit a print shop in your area for high-quality prints.

-

What program do I need in order to open printables at no cost?

- A majority of printed materials are in the format PDF. This can be opened with free software such as Adobe Reader.

Tax Benefits How To Use Home Loan Interest To Benefit Of Tax

The Deduction Of Interest On Mortgages Is More Delicate With The New

Check more sample of Tax Benefit On Home Loan Under Construction below

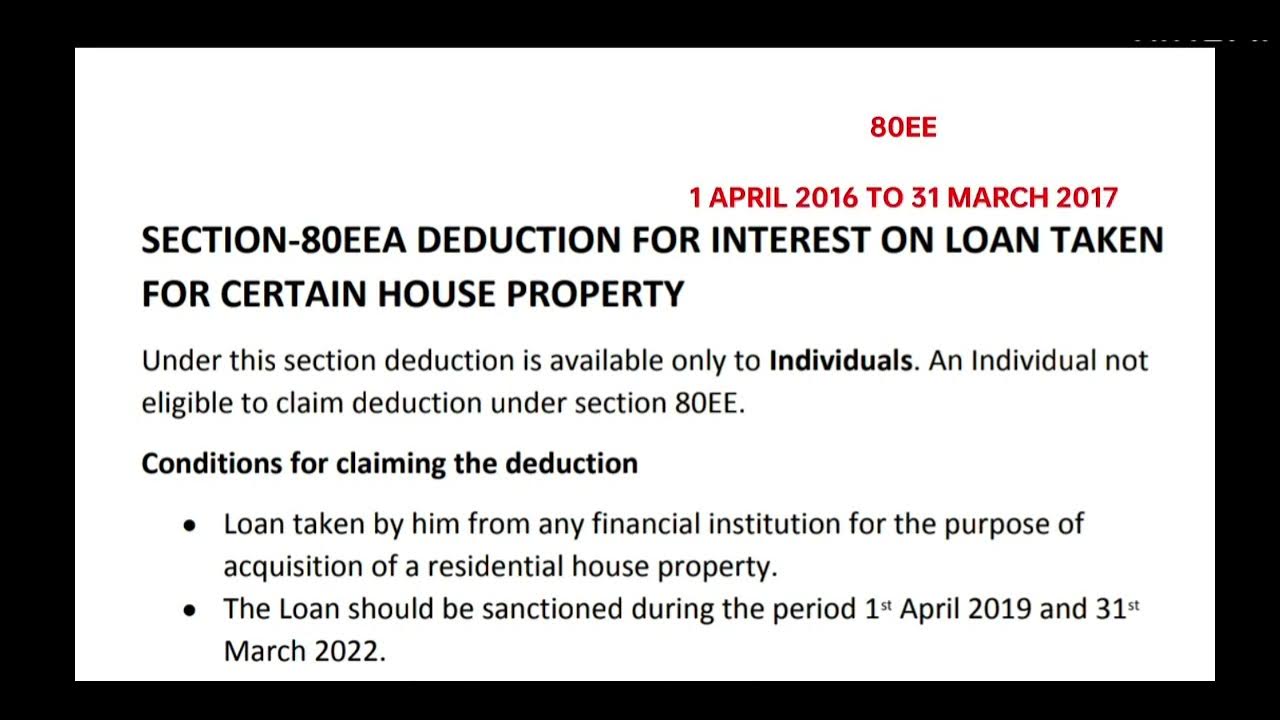

SECTION 80EEA ADDITIONAL BENEFIT ON HOME LOAN RBGCONSULTANTS

Tax Benefit For Interest On Home Loan Under Income Tax Section 24

Maui Loan

Home Loan Tax Benefits As Per Union Budget 2020

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

How To Avail Max Home Loan Tax Benefit In India In 2022 Crazyhoja

https://www.tatacapital.com › blog › loa…

For under construction property tax deductions on home loan interest can be claimed only after the construction is complete Interest payments made towards the loan during pre construction are eligible for a claim in five equal

https://cleartax.in › home-loan-tax-benefit

Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions for interest portion till the construction

For under construction property tax deductions on home loan interest can be claimed only after the construction is complete Interest payments made towards the loan during pre construction are eligible for a claim in five equal

Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions for interest portion till the construction

Home Loan Tax Benefits As Per Union Budget 2020

Tax Benefit For Interest On Home Loan Under Income Tax Section 24

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

How To Avail Max Home Loan Tax Benefit In India In 2022 Crazyhoja

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

Income Tax Benefit On Home Construction Loan HomeFirst

Income Tax Benefit On Home Construction Loan HomeFirst

Know How You Can Get Tax Benefits On Home Loan