In the digital age, in which screens are the norm but the value of tangible printed material hasn't diminished. If it's to aid in education such as creative projects or simply adding a personal touch to your space, Tax Exemption On Housing Loan Under Construction have proven to be a valuable resource. This article will dive through the vast world of "Tax Exemption On Housing Loan Under Construction," exploring the benefits of them, where to find them, and how they can be used to enhance different aspects of your lives.

Get Latest Tax Exemption On Housing Loan Under Construction Below

Tax Exemption On Housing Loan Under Construction

Tax Exemption On Housing Loan Under Construction - Tax Exemption On Housing Loan Under Construction, Tax Exemption On Housing Loan Interest Under Construction, Income Tax Exemption Housing Loan Under Construction, Tax Benefit On Home Loan Under Construction, Under Construction Home Loan Tax Benefits India, Housing Loan Tax Exemption In India

C As a general rule if the amount of deduction and exemption exceeds Rs 3 75 Lakh for any category of the taxpayers with income not exceeding Rs 5 Cr the old

To be eligible for an exemption under Section 54 the taxpayer must acquire another house within one year before or two years after the date of

Tax Exemption On Housing Loan Under Construction encompass a wide assortment of printable materials online, at no cost. These resources come in various designs, including worksheets templates, coloring pages, and more. The beauty of Tax Exemption On Housing Loan Under Construction lies in their versatility as well as accessibility.

More of Tax Exemption On Housing Loan Under Construction

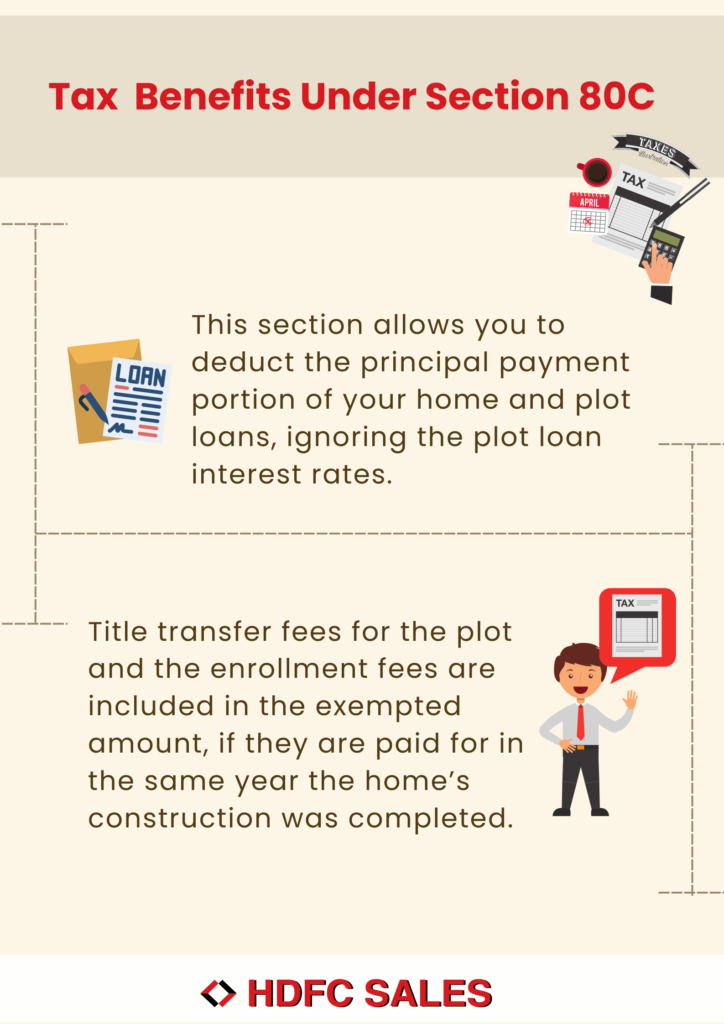

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

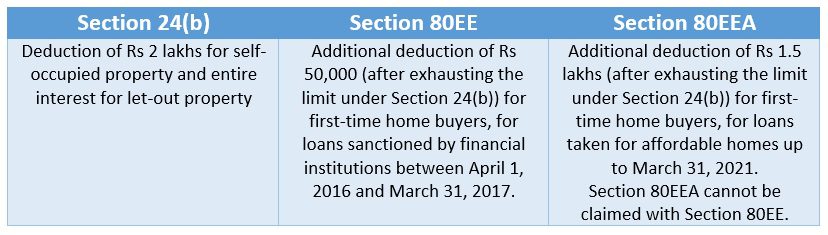

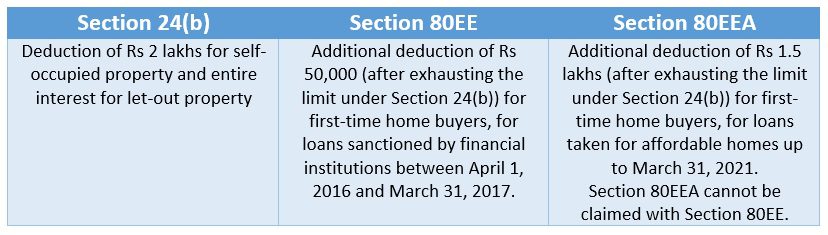

Under section 24B of the Income Tax Act 1961 homeowners can claim a tax deduction of up to Rs 2 lakh per financial year on the interest paid for a home loan

Property Under Construction If your purchased property is under construction and you live in a rented house you can claim HRA However home loan

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

customization: Your HTML0 customization options allow you to customize designs to suit your personal needs in designing invitations or arranging your schedule or decorating your home.

-

Education Value These Tax Exemption On Housing Loan Under Construction are designed to appeal to students of all ages. This makes them a useful tool for parents and teachers.

-

Accessibility: Access to a variety of designs and templates, which saves time as well as effort.

Where to Find more Tax Exemption On Housing Loan Under Construction

Requirements For Pag IBIG Affordable Housing Loan Program LIST

Requirements For Pag IBIG Affordable Housing Loan Program LIST

How to claim home loan benefit on under construction property Interest on home loan Shweta TAX Solutions 155K subscribers Subscribed 517 27K views 5

Under Section 80C of the Income Tax Act a borrower can claim tax exemption on the payments made towards stamp duty registration charges and

Now that we've piqued your interest in Tax Exemption On Housing Loan Under Construction and other printables, let's discover where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Tax Exemption On Housing Loan Under Construction designed for a variety needs.

- Explore categories like design, home decor, craft, and organization.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free, flashcards, and learning materials.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a wide range of interests, all the way from DIY projects to party planning.

Maximizing Tax Exemption On Housing Loan Under Construction

Here are some ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print worksheets that are free for teaching at-home for the classroom.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Tax Exemption On Housing Loan Under Construction are a treasure trove of useful and creative resources that meet a variety of needs and needs and. Their accessibility and versatility make they a beneficial addition to both professional and personal lives. Explore the wide world of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Exemption On Housing Loan Under Construction truly for free?

- Yes, they are! You can download and print these materials for free.

-

Can I utilize free templates for commercial use?

- It's all dependent on the usage guidelines. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright issues with Tax Exemption On Housing Loan Under Construction?

- Some printables could have limitations regarding their use. Be sure to read the terms and condition of use as provided by the creator.

-

How can I print Tax Exemption On Housing Loan Under Construction?

- You can print them at home using an printer, or go to an area print shop for higher quality prints.

-

What software do I need to run printables free of charge?

- The majority of PDF documents are provided in the format of PDF, which can be opened with free programs like Adobe Reader.

Sales Tax Exemption Certificate Wisconsin

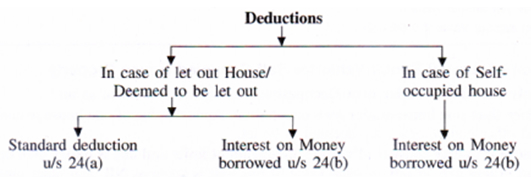

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

Check more sample of Tax Exemption On Housing Loan Under Construction below

REVISED HOME LOAN BENEFITS U S 80EEA Deduction On Interest For Housing

Maui Loan

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

Stamp Duty Exemption 2019 Warren Churchill

HOUSING LOAN UNDER GOODS And SERVICE TAX Stock Image Image Of

Section 54 54F Income Tax Act Tax Exemption On Capital Gains

https://tax2win.in/guide/under-construction-property-tax-benefit

To be eligible for an exemption under Section 54 the taxpayer must acquire another house within one year before or two years after the date of

https://www.tatacapital.com/blog/loan-for-home/can...

Tax exemption on home loan interest for under construction property You can claim a tax exemption of up to Rs 2 00 000 on the interest payments made in a

To be eligible for an exemption under Section 54 the taxpayer must acquire another house within one year before or two years after the date of

Tax exemption on home loan interest for under construction property You can claim a tax exemption of up to Rs 2 00 000 on the interest payments made in a

Stamp Duty Exemption 2019 Warren Churchill

Maui Loan

HOUSING LOAN UNDER GOODS And SERVICE TAX Stock Image Image Of

Section 54 54F Income Tax Act Tax Exemption On Capital Gains

Mortgage Home Loan Process Cuztomize

Revised Income Tax Exemption Calculator For Interest Paid On Housing

Revised Income Tax Exemption Calculator For Interest Paid On Housing

Third Housing Loan For Exceptional Cases Only HDB Property Market