In a world where screens dominate our lives, the charm of tangible printed objects isn't diminished. For educational purposes or creative projects, or just adding personal touches to your space, Tax Deduction For Interest Paid On Home Loan are now a useful resource. The following article is a dive through the vast world of "Tax Deduction For Interest Paid On Home Loan," exploring what they are, where to get them, as well as how they can improve various aspects of your life.

What Are Tax Deduction For Interest Paid On Home Loan?

Printables for free include a vast collection of printable material that is available online at no cost. They are available in numerous kinds, including worksheets templates, coloring pages, and much more. The appealingness of Tax Deduction For Interest Paid On Home Loan is in their versatility and accessibility.

Tax Deduction For Interest Paid On Home Loan

Tax Deduction For Interest Paid On Home Loan

Tax Deduction For Interest Paid On Home Loan - Tax Deduction For Interest Paid On Home Loan, Tax Rebate On Interest Paid On Home Loan, Tax Relief On Interest Paid On Housing Loans, Income Tax Rebate On Interest Paid On Home Loan, Interest Paid On Home Loan Tax Deduction India, Is Interest Paid On A Home Mortgage Tax Deductible, Can You Claim Interest Paid On A Home Equity Loan On Your Taxes, Is Loan Interest Tax Deductible, Is Interest Payment On Mortgage Tax Deductible, Is Home Loan Interest Tax Deductible

[desc-5]

[desc-1]

How To Get The Interest Deduction On Your Student Loan

How To Get The Interest Deduction On Your Student Loan

[desc-4]

[desc-6]

Section 80EEA All You Need To Know About Deduction For Interest Paid

Section 80EEA All You Need To Know About Deduction For Interest Paid

[desc-9]

[desc-7]

Section 24 Of Income Tax Act Deduction For Interest On Home Loan

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Types Of Mortgages To Choose From Know The Many Options Available To You

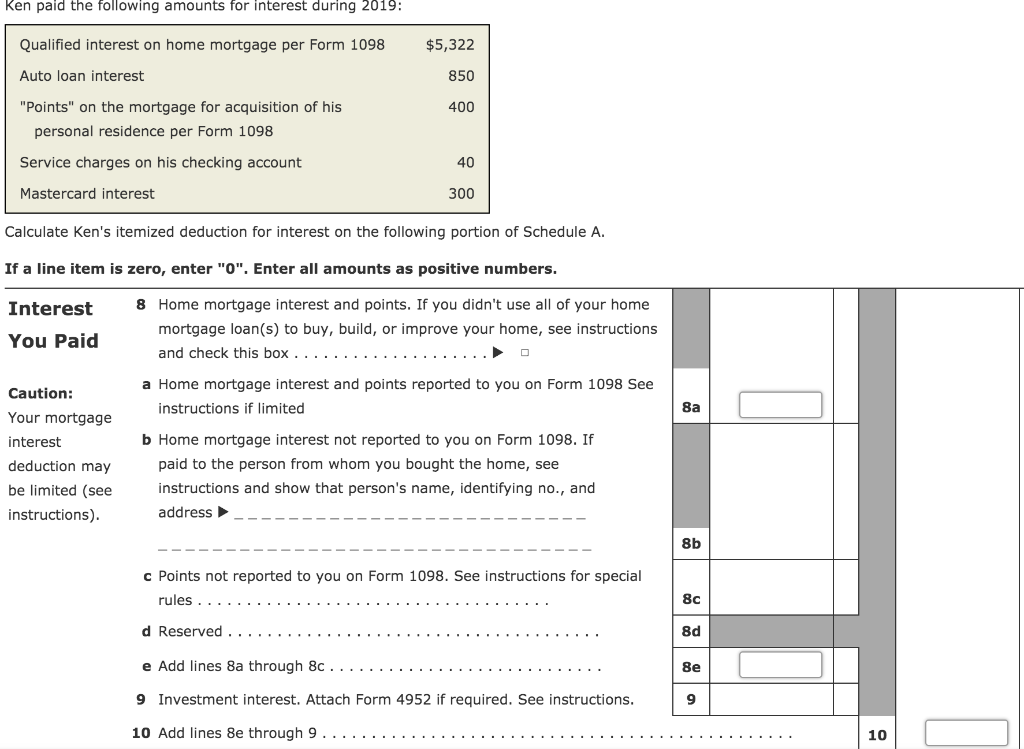

Solved Ken Paid The Following Amounts For Interest During Chegg

New Tax Law Home Equity Loan Interest Deductions Tax Help NH MA

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News