Today, where screens dominate our lives it's no wonder that the appeal of tangible printed objects isn't diminished. In the case of educational materials as well as creative projects or just adding personal touches to your space, Education Loan Exemption Under Income Tax are now a vital source. Through this post, we'll dive into the sphere of "Education Loan Exemption Under Income Tax," exploring their purpose, where they are, and the ways that they can benefit different aspects of your lives.

Get Latest Education Loan Exemption Under Income Tax Below

Education Loan Exemption Under Income Tax

Education Loan Exemption Under Income Tax - Education Loan Exemption Under Income Tax, Education Loan Exemption In Income Tax 2022-23, Education Loan Exemption In Income Tax, Education Loan Benefit Under Income Tax, Self Education Loan Exemption In Income Tax, Education Loan Interest Benefit In Income Tax, Whether Education Loan Is Exempt In Income Tax, Can Education Loan Be Used For Tax Exemption, Education Loan Tax Exemption Limit, Is Education Loan Tax Free

Individuals need to meet certain eligibility criteria to claim tax deductions under Section 80E of Income Tax Act Only individuals who have availed of loans under their names can claim tax exemptions

Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education loans Learn eligibility criteria benefits and how to claim the deduction

Education Loan Exemption Under Income Tax provide a diverse collection of printable material that is available online at no cost. These materials come in a variety of forms, including worksheets, templates, coloring pages, and more. The great thing about Education Loan Exemption Under Income Tax is in their versatility and accessibility.

More of Education Loan Exemption Under Income Tax

Exemptions From Income Tax Section 10 Of Income Tax Section 10

Exemptions From Income Tax Section 10 Of Income Tax Section 10

Section 80E of the Income Tax Act allows a tax deduction on the interest paid on education loans for higher studies Section 80E deduction helps to reduce the financial burden of education loans by lowering the taxable income of the borrower

The tax benefits on education loan are only valid once you start the repayment and moreover they are only available up to eight years For instance if your loan tenure exceeds eight years you cannot claim for deductions beyond eight years Hence it is better that the education loan is repaid within eight years

Education Loan Exemption Under Income Tax have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Customization: It is possible to tailor print-ready templates to your specific requirements in designing invitations planning your schedule or even decorating your house.

-

Educational value: Printables for education that are free are designed to appeal to students from all ages, making them a vital tool for parents and teachers.

-

The convenience of Quick access to many designs and templates cuts down on time and efforts.

Where to Find more Education Loan Exemption Under Income Tax

Group Insurance Scheme Exemption Under Income Tax The Enterprise World

Group Insurance Scheme Exemption Under Income Tax The Enterprise World

Understanding Section 80E Tax Exemption The 80E education loan tax benefit is for individuals who have taken out loans for higher education It applies to the loan s interest not the principal and can be claimed for a maximum of

You can save up to 10 times more tax if you take up an education loan to fund your education than using your own funds An education loan income tax exemption can be claimed either by the loan applicant or the co applicant

In the event that we've stirred your interest in printables for free we'll explore the places you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection in Education Loan Exemption Under Income Tax for different objectives.

- Explore categories like interior decor, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free as well as flashcards and other learning tools.

- Ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- These blogs cover a wide array of topics, ranging including DIY projects to party planning.

Maximizing Education Loan Exemption Under Income Tax

Here are some innovative ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print worksheets that are free to enhance learning at home or in the classroom.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Education Loan Exemption Under Income Tax are a treasure trove of fun and practical tools that cater to various needs and desires. Their availability and versatility make them an essential part of your professional and personal life. Explore the world of Education Loan Exemption Under Income Tax right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes, they are! You can print and download these tools for free.

-

Do I have the right to use free templates for commercial use?

- It's contingent upon the specific conditions of use. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Do you have any copyright rights issues with Education Loan Exemption Under Income Tax?

- Some printables may have restrictions concerning their use. Always read the terms and conditions offered by the designer.

-

How can I print Education Loan Exemption Under Income Tax?

- Print them at home with either a printer at home or in a print shop in your area for the highest quality prints.

-

What program do I require to view printables for free?

- The majority are printed in the PDF format, and can be opened using free software like Adobe Reader.

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Home Loan 5 Tax Exemption Tax Planning

Check more sample of Education Loan Exemption Under Income Tax below

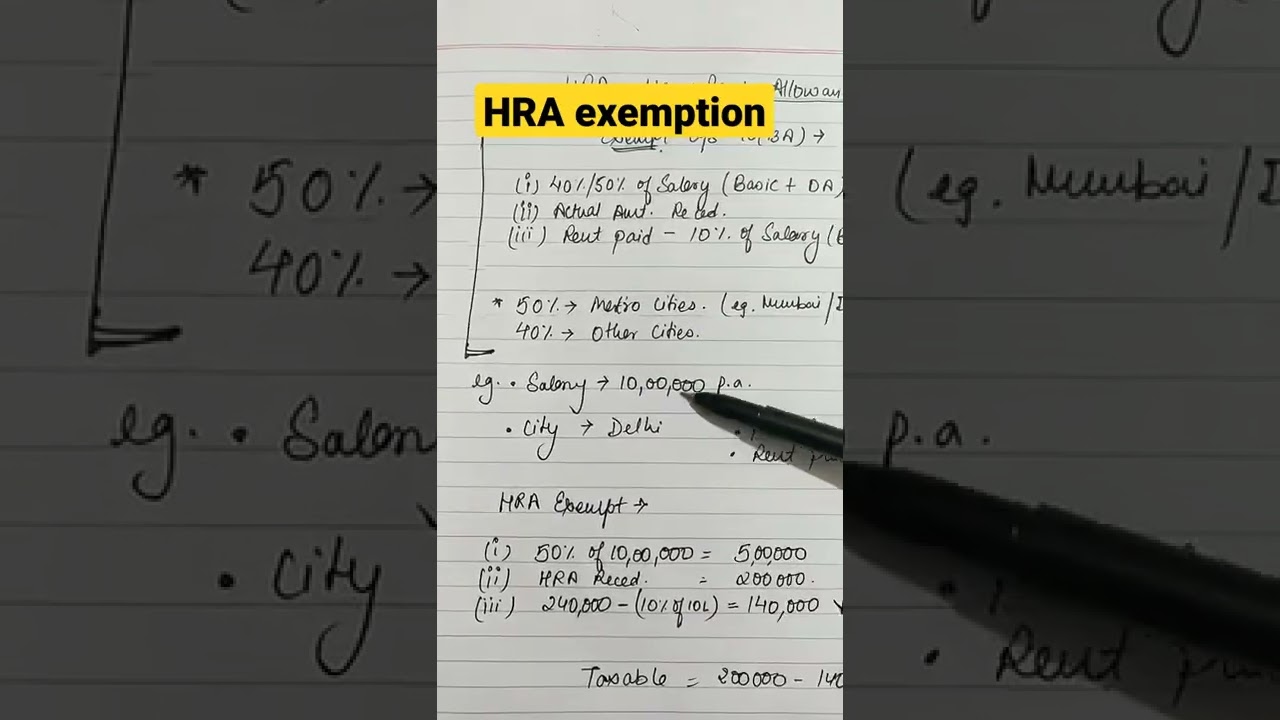

HRA Exemption Under Income Tax HRA Calculation Sec 10 13A Itr For

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Income Tax Exemption On Interest Of Education Loan YouTube

How To Apply For PTPTN Loan Repayment Exemption Pengecualian

A Guide To Group Insurance Scheme Exemption Under Income Tax

We Got 12A Exemption Registration Under Income Tax

https://tax2win.in › guide

Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education loans Learn eligibility criteria benefits and how to claim the deduction

https://cleartax.in

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available only in old tax regime

Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education loans Learn eligibility criteria benefits and how to claim the deduction

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available only in old tax regime

How To Apply For PTPTN Loan Repayment Exemption Pengecualian

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

A Guide To Group Insurance Scheme Exemption Under Income Tax

We Got 12A Exemption Registration Under Income Tax

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

Sharing On PTPTN Loan Payment Exemption 2022

Sharing On PTPTN Loan Payment Exemption 2022

Quality Assurance Hot selling Products 1 NIP BAY DE NOC LURE CO THE