In a world with screens dominating our lives and the appeal of physical printed materials isn't diminishing. It doesn't matter if it's for educational reasons, creative projects, or simply adding an individual touch to your area, Gold Bond For Tax Exemption Under Section 80c have become an invaluable source. For this piece, we'll dive through the vast world of "Gold Bond For Tax Exemption Under Section 80c," exploring their purpose, where to get them, as well as the ways that they can benefit different aspects of your daily life.

Get Latest Gold Bond For Tax Exemption Under Section 80c Below

Gold Bond For Tax Exemption Under Section 80c

Gold Bond For Tax Exemption Under Section 80c - Gold Bond For Tax Exemption Under Section 80c, Sovereign Gold Bond Tax Exemption Under Section 80c, Sovereign Gold Bond Investment Tax Exemption Under Section 80c, Sovereign Gold Bond Income Tax Exemption Under Section 80c, Is Sovereign Gold Bond Tax Free Under Section 80c, Is Gold Bond Covered Under 80c, Is Sovereign Gold Bond Exemption Under Section 80c, Are Gold Bonds Under 80c

Key Takeaways Interest income from SGBs is taxable as per your income tax slab Long term capital gains on SGBs held till maturity are tax exempt Selling SGBs before maturity may

Tax Implications of SGBs Under Section 80C of the Income Tax Act there are no tax benefits available for the lump sum deposit of Sovereign Gold Bonds SGBs

The Gold Bond For Tax Exemption Under Section 80c are a huge array of printable materials available online at no cost. The resources are offered in a variety formats, such as worksheets, coloring pages, templates and many more. The beauty of Gold Bond For Tax Exemption Under Section 80c is their versatility and accessibility.

More of Gold Bond For Tax Exemption Under Section 80c

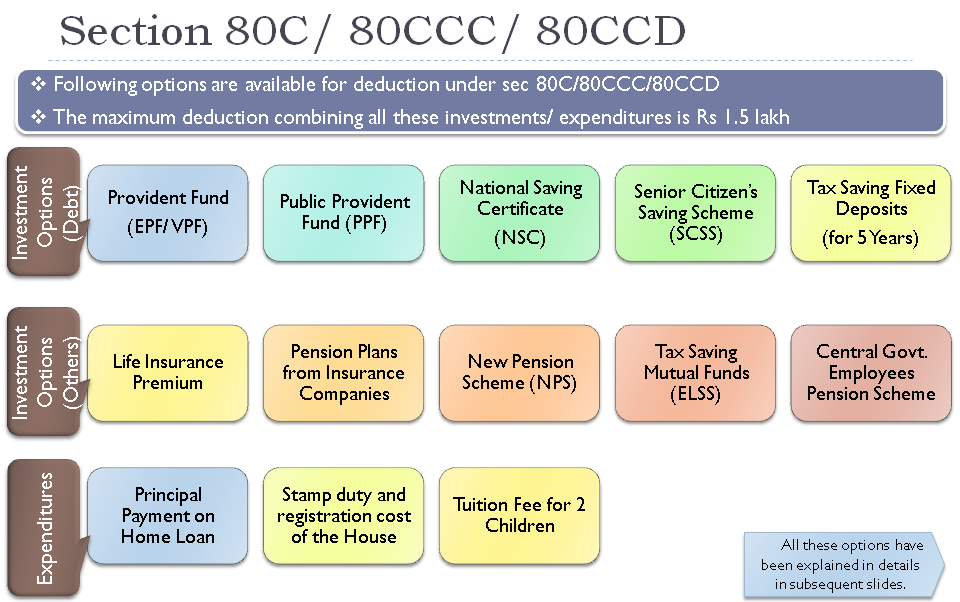

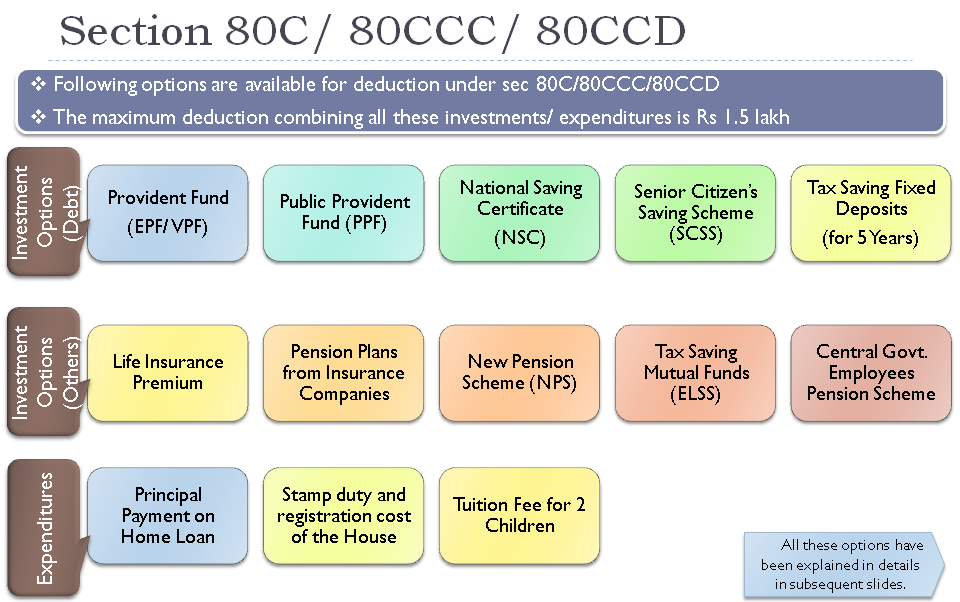

Tax Planning Through Deductions Under Section 80C

Tax Planning Through Deductions Under Section 80C

Sovereign Gold Bond Tax Exemption Under Section 80C SGB investments do not qualify for tax deduction benefits under Section 80C of the Income Tax Act The interest earned on SGB deposits is also not tax exempt

Sovereign gold bond tax exemption under section 80C No D duction und r S ction 80C Unlik oth r inv stm nts th r s no tax d duction und r S ction 80C for th initial inv stm nt amount in SGBs

The Gold Bond For Tax Exemption Under Section 80c have gained huge recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Individualization We can customize designs to suit your personal needs in designing invitations and schedules, or decorating your home.

-

Educational Worth: Education-related printables at no charge offer a wide range of educational content for learners of all ages. This makes them an essential aid for parents as well as educators.

-

The convenience of immediate access numerous designs and templates helps save time and effort.

Where to Find more Gold Bond For Tax Exemption Under Section 80c

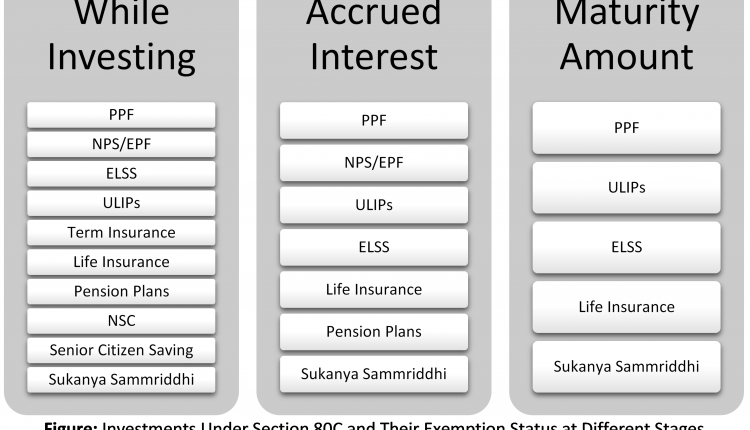

Section 80C Deductions List To Save Income Tax FinCalC Blog

Section 80C Deductions List To Save Income Tax FinCalC Blog

Income tax rules on sovereign gold bonds 1 The interest received on your gold bond holdings is taxable The interest income is clubbed with your income and taxed

Explore the tax benefits of investing in sovereign gold bonds Find out how holding gold bonds can reduce your tax liability and provide a secure investment option

Now that we've ignited your interest in Gold Bond For Tax Exemption Under Section 80c Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Gold Bond For Tax Exemption Under Section 80c for various applications.

- Explore categories like design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- The blogs are a vast variety of topics, that range from DIY projects to planning a party.

Maximizing Gold Bond For Tax Exemption Under Section 80c

Here are some ways to make the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Print free worksheets to build your knowledge at home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings and birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Gold Bond For Tax Exemption Under Section 80c are an abundance of fun and practical tools designed to meet a range of needs and needs and. Their accessibility and flexibility make them a fantastic addition to any professional or personal life. Explore the wide world of Gold Bond For Tax Exemption Under Section 80c to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes you can! You can download and print these free resources for no cost.

-

Does it allow me to use free templates for commercial use?

- It's dependent on the particular rules of usage. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright rights issues with Gold Bond For Tax Exemption Under Section 80c?

- Some printables could have limitations on their use. Make sure to read the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- You can print them at home using the printer, or go to an in-store print shop to get superior prints.

-

What program do I require to open printables at no cost?

- Most PDF-based printables are available in PDF format. These can be opened using free software, such as Adobe Reader.

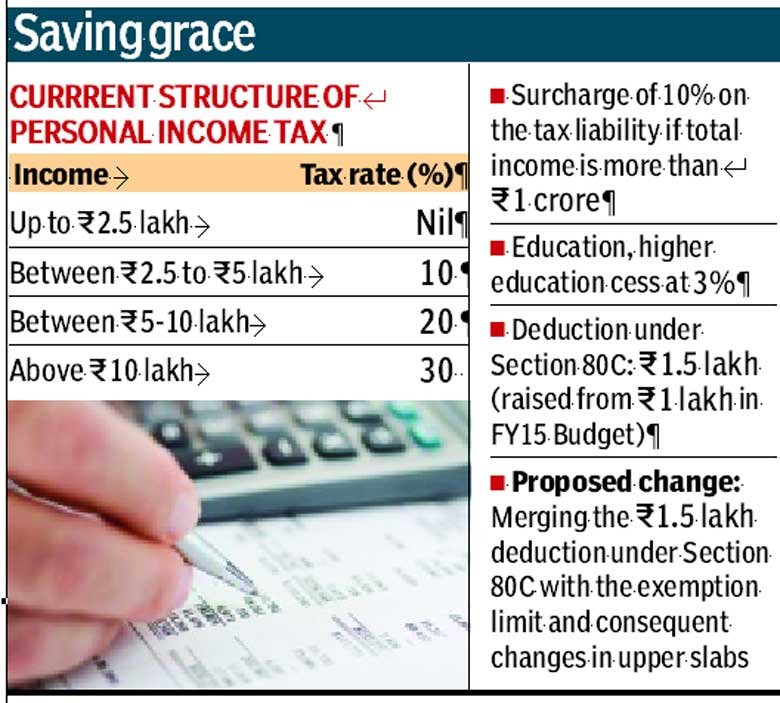

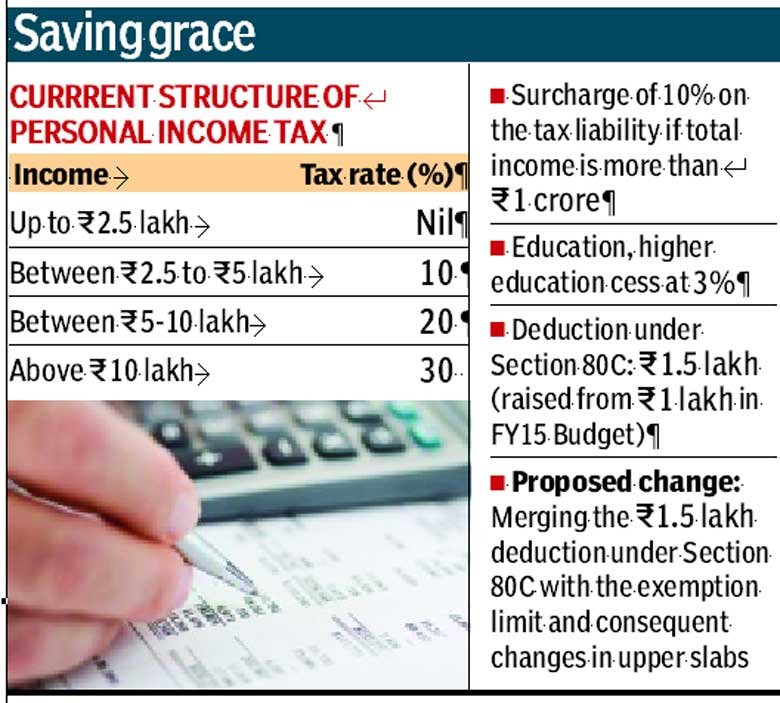

How Much Amount Can Be Claimed For Tax Exemption Under Section 80C

Tax Saving Options Under Section 80C For Salaried Others TheSWO

Check more sample of Gold Bond For Tax Exemption Under Section 80c below

Raising The Limit Under Section 80C What Budget Can Do To Reduce Your

Section 80C And 80D Exemption Apart From Section 80C And 80D How Many

Stamp Duty And Registration Charges Deduction U s 80C

Budget 2014 Impact On Money Taxes And Savings

Exemption In Lieu Of 80C Tax Benefits

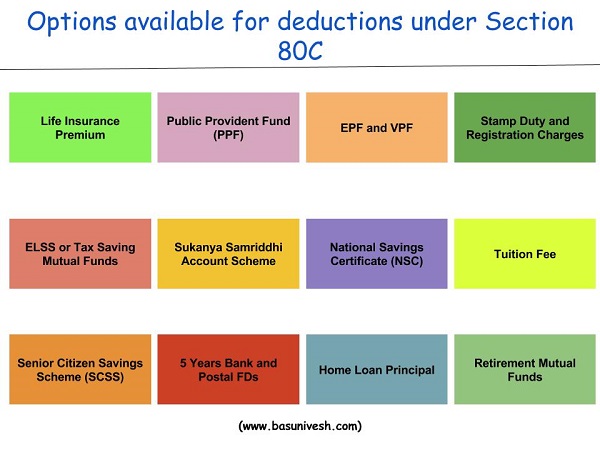

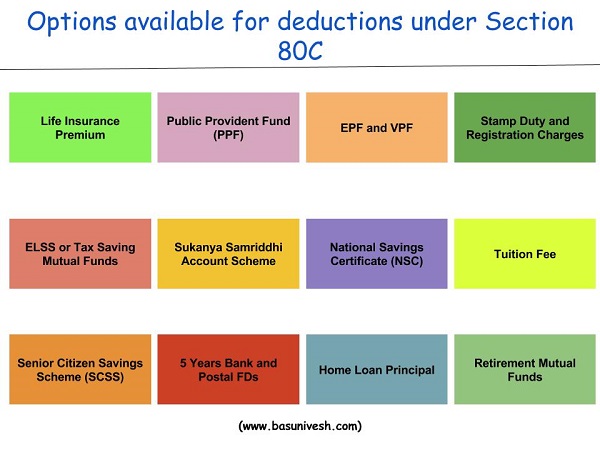

Deduction Under Section 80C A Complete List BasuNivesh

https://economictimes.indiatimes.com › wealth › web...

Tax Implications of SGBs Under Section 80C of the Income Tax Act there are no tax benefits available for the lump sum deposit of Sovereign Gold Bonds SGBs

https://www.businesstoday.in › personal …

There are no tax deduction benefits for the lump sum deposit of SGBs under Section 80C of the Income Tax Act The interest given on SGB deposits is also not tax free

Tax Implications of SGBs Under Section 80C of the Income Tax Act there are no tax benefits available for the lump sum deposit of Sovereign Gold Bonds SGBs

There are no tax deduction benefits for the lump sum deposit of SGBs under Section 80C of the Income Tax Act The interest given on SGB deposits is also not tax free

Budget 2014 Impact On Money Taxes And Savings

Section 80C And 80D Exemption Apart From Section 80C And 80D How Many

Exemption In Lieu Of 80C Tax Benefits

Deduction Under Section 80C A Complete List BasuNivesh

Arts Projects Charitable Or Not Nonprofit Law Blog

80C 5

80C 5

Tax Benefits Under Section 80C For Government Employees And Pensioners