Today, when screens dominate our lives The appeal of tangible printed products hasn't decreased. In the case of educational materials in creative or artistic projects, or simply adding an element of personalization to your space, Income Tax Deduction For Education Fees are now a useful source. Through this post, we'll dive to the depths of "Income Tax Deduction For Education Fees," exploring their purpose, where to locate them, and ways they can help you improve many aspects of your daily life.

Get Latest Income Tax Deduction For Education Fees Below

Income Tax Deduction For Education Fees

Income Tax Deduction For Education Fees - Income Tax Deduction For Education Fees, Income Tax Rebate For Education Fees, Income Tax Relief For Tuition Fees, Income Tax Benefit On Education Fees, Income Tax Exemption For Self Education Fee, Income Tax Rebate On Higher Education Fees, Income Tax Exemption On Higher Education Fees, Income Tax Rebate On Child Education Fees, Is Paying For Education Tax Deductible, 80c Education Fees Deduction

The good news is that if you re paying for school for yourself or others there are a number of education tax credits and deductions still available to you in 2023 and 2024 I ll cover each in detail The American Opportunity

How to Claim College Tuition and Fees on Your Taxes If you expect to qualify for education tax deductions or credits for yourself or your dependents you ll need to complete the correct

Income Tax Deduction For Education Fees provide a diverse assortment of printable, downloadable content that can be downloaded from the internet at no cost. These printables come in different types, such as worksheets coloring pages, templates and much more. The great thing about Income Tax Deduction For Education Fees lies in their versatility as well as accessibility.

More of Income Tax Deduction For Education Fees

Education Loan And Tax Savings PinoyStarBlog

Education Loan And Tax Savings PinoyStarBlog

Tax free income thresholds have been widened across all filing categories resulting in annual savings for individuals Increase in deduction relating to private school fees Parents having children attending independent private

Continuing education part time classes and graduate school costs can be eligible for the lifetime learning credit which can lower your tax bill by up to 2 000

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Customization: It is possible to tailor the templates to meet your individual needs, whether it's designing invitations for your guests, organizing your schedule or even decorating your home.

-

Education Value Downloads of educational content for free offer a wide range of educational content for learners of all ages, which makes them an invaluable tool for teachers and parents.

-

The convenience of You have instant access many designs and templates saves time and effort.

Where to Find more Income Tax Deduction For Education Fees

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Find out which expenses you can claim as income tax deductions and work out the amount to claim Deductions for self education conferences and training You can t claim children s

Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize your tax

We hope we've stimulated your interest in printables for free we'll explore the places they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Income Tax Deduction For Education Fees to suit a variety of motives.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free including flashcards, learning materials.

- Ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- The blogs are a vast selection of subjects, that includes DIY projects to planning a party.

Maximizing Income Tax Deduction For Education Fees

Here are some ways of making the most use of Income Tax Deduction For Education Fees:

1. Home Decor

- Print and frame gorgeous images, quotes, or festive decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to reinforce learning at home for the classroom.

3. Event Planning

- Make invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax Deduction For Education Fees are a treasure trove filled with creative and practical information that satisfy a wide range of requirements and needs and. Their accessibility and versatility make they a beneficial addition to any professional or personal life. Explore the wide world that is Income Tax Deduction For Education Fees today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes they are! You can download and print the resources for free.

-

Can I make use of free printing templates for commercial purposes?

- It's determined by the specific terms of use. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may come with restrictions on usage. Be sure to read the conditions and terms of use provided by the designer.

-

How can I print Income Tax Deduction For Education Fees?

- Print them at home using the printer, or go to an in-store print shop to get top quality prints.

-

What software do I need to run printables free of charge?

- The majority of PDF documents are provided with PDF formats, which can be opened with free software, such as Adobe Reader.

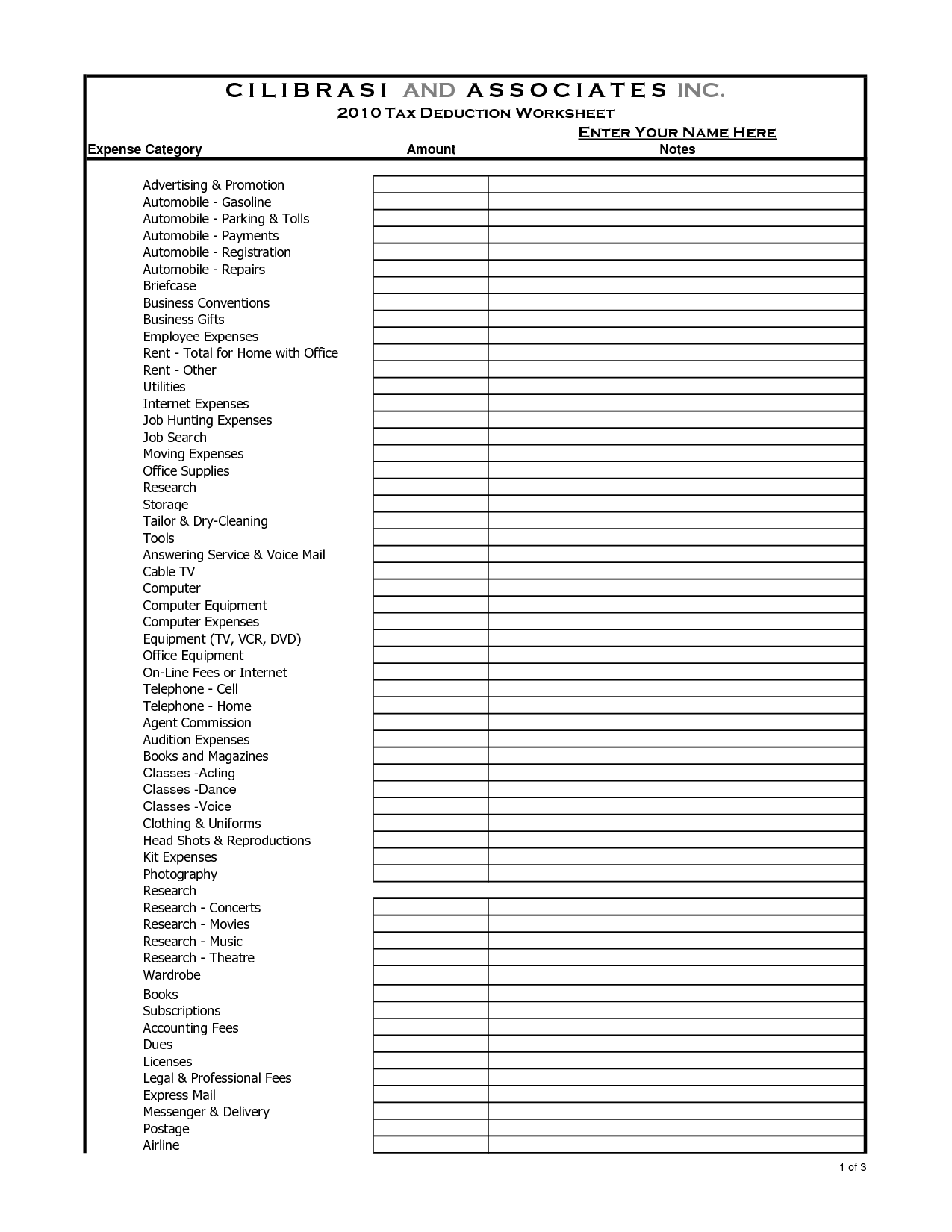

16 Tax Organizer Worksheet Worksheeto

Income Tax Deduction For Medical Treatment With Automated TDS On

Check more sample of Income Tax Deduction For Education Fees below

Tax Deductions For Teachers TPT Sellers In 2020 Teacher Tax

Section 80E Income Tax Deduction For Education Loan

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Section 80E Income Tax Deduction For Education Loan IndiaFilings

Form 1040 U S Individual Tax Return Definition

/GettyImages-184939771-10a77dd8e8b34ac7aaff499dfe09a657.jpg)

https://www.forbes.com › ... › tuition-an…

How to Claim College Tuition and Fees on Your Taxes If you expect to qualify for education tax deductions or credits for yourself or your dependents you ll need to complete the correct

https://www.irs.gov › credits-deductions › individuals › ...

In general qualified tuition and related expenses for the education tax credits include tuition and required fees for the enrollment or attendance at eligible post secondary educational

How to Claim College Tuition and Fees on Your Taxes If you expect to qualify for education tax deductions or credits for yourself or your dependents you ll need to complete the correct

In general qualified tuition and related expenses for the education tax credits include tuition and required fees for the enrollment or attendance at eligible post secondary educational

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Section 80E Income Tax Deduction For Education Loan

Section 80E Income Tax Deduction For Education Loan IndiaFilings

/GettyImages-184939771-10a77dd8e8b34ac7aaff499dfe09a657.jpg)

Form 1040 U S Individual Tax Return Definition

How To Claim The Tuition And Fees Deduction Tuition Deduction Tax

Tax Deduction For Secretarial And Tax Filing Fee

Tax Deduction For Secretarial And Tax Filing Fee

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News