In this day and age where screens have become the dominant feature of our lives The appeal of tangible printed products hasn't decreased. Be it for educational use as well as creative projects or just adding the personal touch to your home, printables for free have proven to be a valuable source. For this piece, we'll take a dive into the sphere of "Income Tax Deduction Under Section 80c To 80u," exploring the different types of printables, where to find them, and how they can enrich various aspects of your life.

Get Latest Income Tax Deduction Under Section 80c To 80u Below

Income Tax Deduction Under Section 80c To 80u

Income Tax Deduction Under Section 80c To 80u - Income Tax Deduction Under Section 80c To 80u, Income Tax Deduction Under Section 80c To 80u Pdf, Income Tax Deduction Under Section 80c To 80u Pdf In Hindi, Income Tax Deduction Section 80c To 80u, Section 80c To 80u Deduction, Explain Deduction Under Section 80c To 80u, 80c To 80u Deduction List, What Is Section 80c To 80u

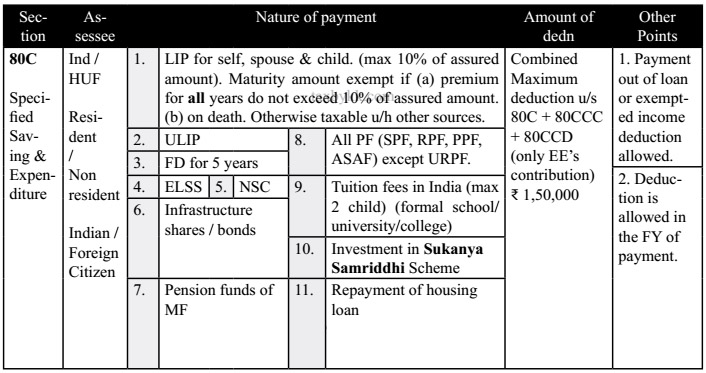

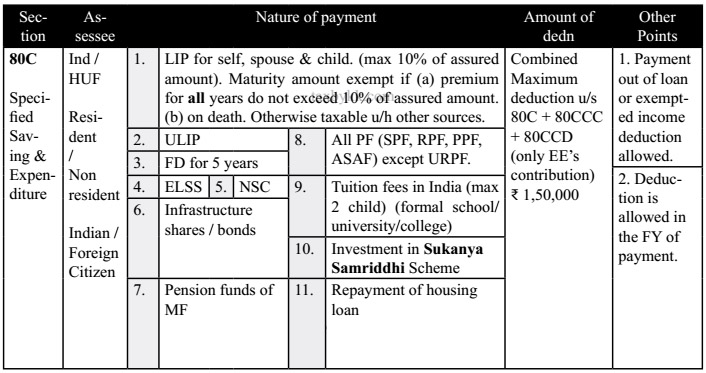

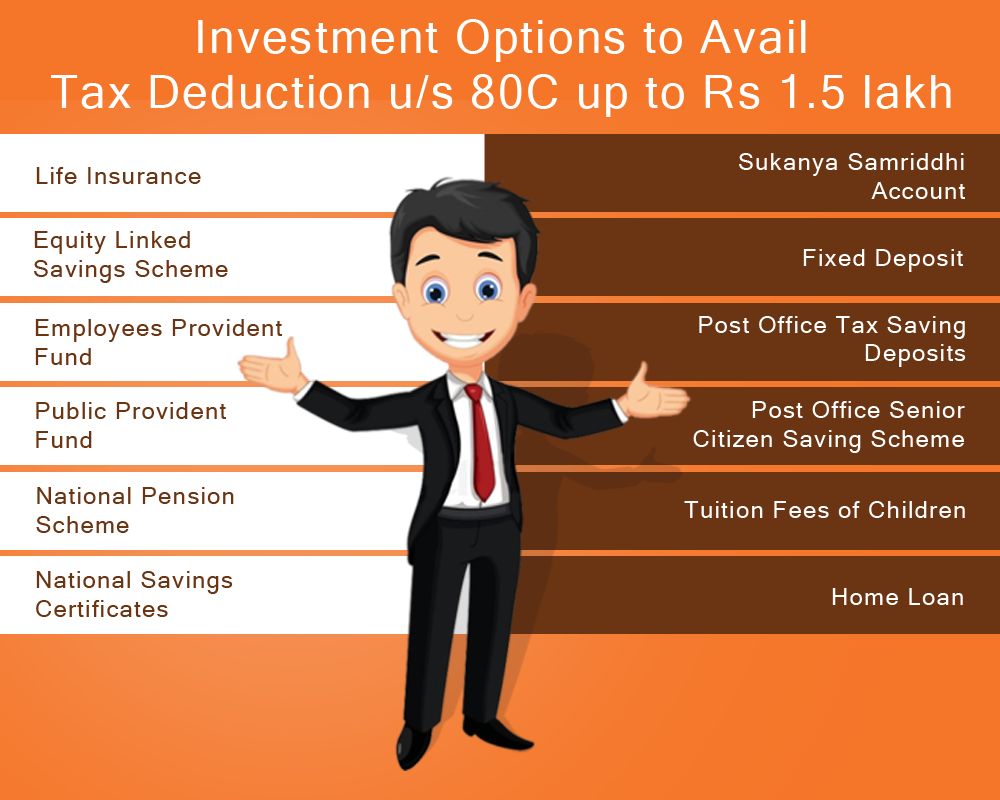

Sections 80C to 80U are provisions in the Indian Income Tax Act that offer tax deductions to individuals and businesses These sections cover a wide range of expenses investments and contributions that qualify for

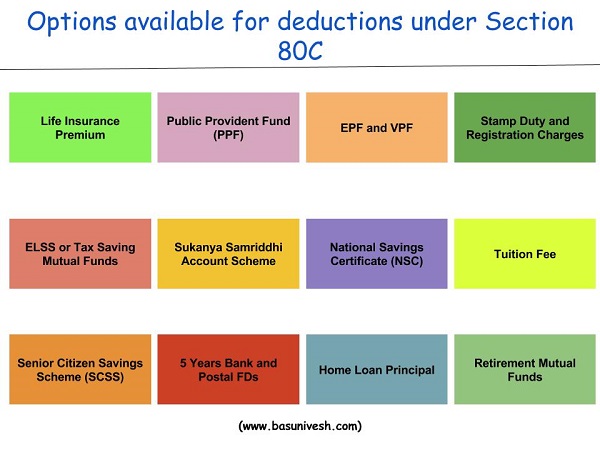

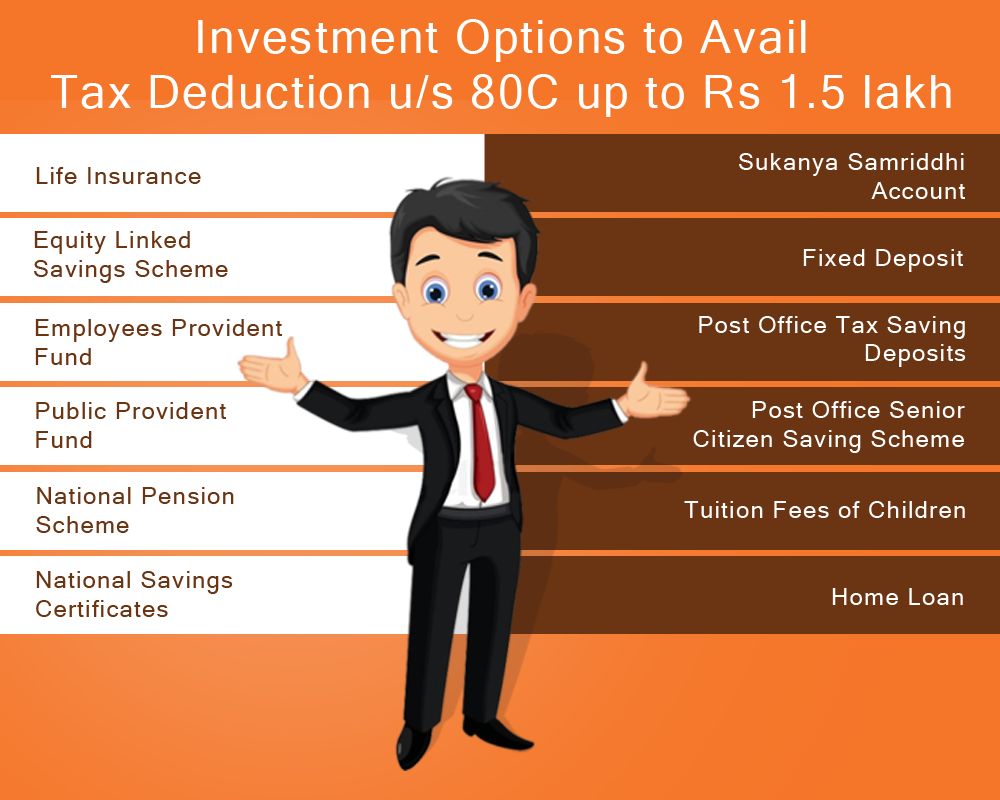

In simple terms you can reduce up to Rs 1 50 000 from your total taxable income through section 80C This deduction is allowed to an Individual or a HUF A maximum of Rs 1

The Income Tax Deduction Under Section 80c To 80u are a huge assortment of printable, downloadable materials available online at no cost. These resources come in many kinds, including worksheets coloring pages, templates and more. The appeal of printables for free is their versatility and accessibility.

More of Income Tax Deduction Under Section 80c To 80u

Income Tax Deduction Under Section 80C To 80U Salary Employees YouTube

Income Tax Deduction Under Section 80C To 80U Salary Employees YouTube

The repayment of the principal of a loan taken to buy or construct a residential property is eligible for tax deductions under Section 80C This deduction is also applicable on stamp duty registration fees and transfer

Section 80C of the Income Tax Act is the most popular income tax deduction for tax saving 80C deduction limit for the current FY 2023 24 AY 2024 25 is Rs 1 50 000 However ITR filing is mandatory in order to claim

Income Tax Deduction Under Section 80c To 80u have gained a lot of popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization: The Customization feature lets you tailor designs to suit your personal needs when it comes to designing invitations or arranging your schedule or even decorating your house.

-

Educational value: These Income Tax Deduction Under Section 80c To 80u offer a wide range of educational content for learners of all ages, which makes these printables a powerful tool for teachers and parents.

-

It's easy: You have instant access many designs and templates can save you time and energy.

Where to Find more Income Tax Deduction Under Section 80c To 80u

Deduction Under Section 80C To 80U YouTube

Deduction Under Section 80C To 80U YouTube

Donations made to specified funds and or institutions notified by the income tax department are eligible for deductions under section 80G Remember the amount of deduction that can be claimed by you will depend

Taxpayers with less than 80 but more than 40 disability get a deduction of Rs 75 000 and taxpayers with severe disabilities which is 80 or more get a deduction of Rs 1 25 000 The deduction is a fixed amount that is

In the event that we've stirred your interest in printables for free, let's explore where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection and Income Tax Deduction Under Section 80c To 80u for a variety goals.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets or flashcards as well as learning tools.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs covered cover a wide array of topics, ranging ranging from DIY projects to planning a party.

Maximizing Income Tax Deduction Under Section 80c To 80u

Here are some creative ways create the maximum value of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home for the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Income Tax Deduction Under Section 80c To 80u are a treasure trove of practical and innovative resources catering to different needs and hobbies. Their availability and versatility make they a beneficial addition to both professional and personal life. Explore the vast collection of Income Tax Deduction Under Section 80c To 80u and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes they are! You can download and print the resources for free.

-

Can I use free printables in commercial projects?

- It's determined by the specific terms of use. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables could be restricted in use. Be sure to review the terms and conditions provided by the creator.

-

How do I print Income Tax Deduction Under Section 80c To 80u?

- You can print them at home using your printer or visit the local print shop for more high-quality prints.

-

What program do I need in order to open printables that are free?

- The majority of PDF documents are provided in the format PDF. This can be opened with free programs like Adobe Reader.

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Deduction Under Section 80C A Complete List BasuNivesh

Check more sample of Income Tax Deduction Under Section 80c To 80u below

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Income Tax 80c Deduction Fy 2021 22 TAX

Section 80U Tax Deductions For Disabled Individuals Tax2win

Deduction Under Section 80C

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

https://cleartax.in/s/80c-80-deductions-amp

In simple terms you can reduce up to Rs 1 50 000 from your total taxable income through section 80C This deduction is allowed to an Individual or a HUF A maximum of Rs 1

https://taxguru.in/income-tax/income-t…

Deductions are the exemptions on the amount taxable as per Income Tax Act They are the Investments made by the persons for them their Family their parents Article explains Income Tax Deduction Available to

In simple terms you can reduce up to Rs 1 50 000 from your total taxable income through section 80C This deduction is allowed to an Individual or a HUF A maximum of Rs 1

Deductions are the exemptions on the amount taxable as per Income Tax Act They are the Investments made by the persons for them their Family their parents Article explains Income Tax Deduction Available to

Deduction Under Section 80C

Income Tax 80c Deduction Fy 2021 22 TAX

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

Deductions From Gross Total Income Under Section 80C To 80 U Of Income

Investment Options To Avail Tax Deduction Under Section 80C

Investment Options To Avail Tax Deduction Under Section 80C

Tax Deduction Section 80C How To Claim Deductions Under Section 80C