In this day and age where screens rule our lives it's no wonder that the appeal of tangible printed products hasn't decreased. Whatever the reason, whether for education, creative projects, or simply adding an individual touch to your home, printables for free are now a vital resource. This article will take a dive deep into the realm of "Income Tax Deduction Under Section 80ccd 2," exploring their purpose, where you can find them, and how they can improve various aspects of your daily life.

Get Latest Income Tax Deduction Under Section 80ccd 2 Below

Income Tax Deduction Under Section 80ccd 2

Income Tax Deduction Under Section 80ccd 2 - Income Tax Deduction Under Section 80ccd 2, Income Tax Exemption Under Section 80ccd(2), Is 80ccd(2) Part Of 80c, Tax Deduction Under 80ccd(2), What Is Section 80ccd(2) Of Income Tax Act, How To Claim Deduction U/s 80ccd(2)

Section 80CCD of the Income Tax Act Discover the key aspects of deductions under Section 80CCD 1 and 80CCD 2 of the Income Tax Act Learn

A complete guide on Section 80CCD 2 of income tax act Also find out the deduction under Section 80CCD 2 for FY 2024 25 AY 2025 26 from Goodreturns

Income Tax Deduction Under Section 80ccd 2 encompass a wide selection of printable and downloadable materials available online at no cost. They come in many formats, such as worksheets, coloring pages, templates and more. The appealingness of Income Tax Deduction Under Section 80ccd 2 is in their versatility and accessibility.

More of Income Tax Deduction Under Section 80ccd 2

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

Understand Section 80CCD 1 and 80CCD 2 of the Income Tax Act covering tax deductions for contributions to the National Pension System NPS Learn

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY

Income Tax Deduction Under Section 80ccd 2 have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

customization Your HTML0 customization options allow you to customize the templates to meet your individual needs whether it's making invitations or arranging your schedule or decorating your home.

-

Education Value These Income Tax Deduction Under Section 80ccd 2 are designed to appeal to students of all ages, which makes these printables a powerful resource for educators and parents.

-

Convenience: The instant accessibility to an array of designs and templates cuts down on time and efforts.

Where to Find more Income Tax Deduction Under Section 80ccd 2

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Income Tax Deduction Under Section 80C To 80U FY 2022 23

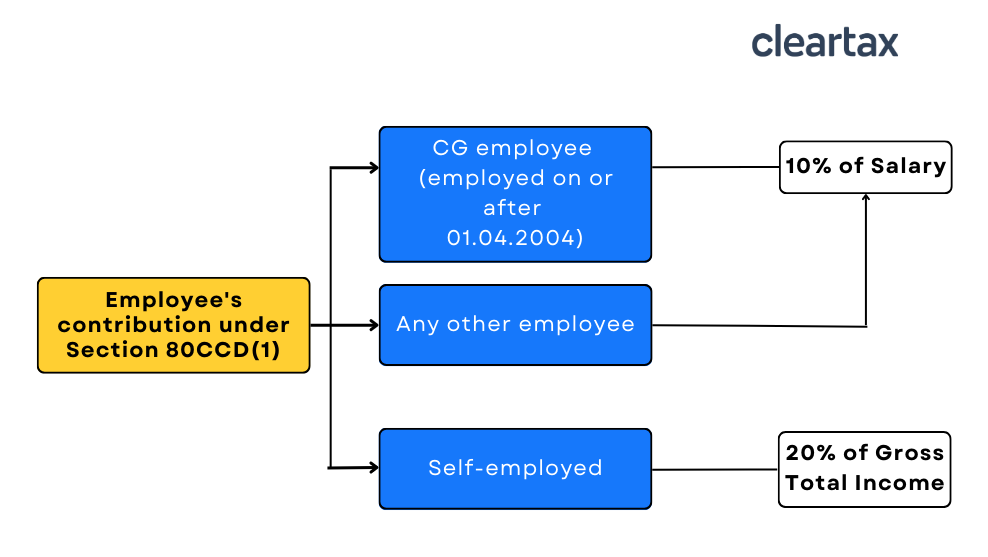

If your employer contributes to your NPS account you can claim a deduction under section 80CCD 2 There is no monetary limit on how much you can claim but it

If your employer is contributing to your NPS account then as a salaried employee you are eligible to claim a deduction for the contribution made from gross income This deduction is claimed under

We've now piqued your curiosity about Income Tax Deduction Under Section 80ccd 2 Let's see where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Income Tax Deduction Under Section 80ccd 2 suitable for many purposes.

- Explore categories like the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Great for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a broad variety of topics, that range from DIY projects to planning a party.

Maximizing Income Tax Deduction Under Section 80ccd 2

Here are some innovative ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print free worksheets to enhance learning at home (or in the learning environment).

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Deduction Under Section 80ccd 2 are a treasure trove of creative and practical resources which cater to a wide range of needs and hobbies. Their availability and versatility make them an essential part of both professional and personal life. Explore the endless world of Income Tax Deduction Under Section 80ccd 2 today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes they are! You can print and download these tools for free.

-

Can I make use of free printables in commercial projects?

- It's contingent upon the specific conditions of use. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues in Income Tax Deduction Under Section 80ccd 2?

- Certain printables could be restricted concerning their use. Be sure to read the terms and conditions offered by the designer.

-

How do I print Income Tax Deduction Under Section 80ccd 2?

- You can print them at home using any printer or head to an in-store print shop to get superior prints.

-

What software must I use to open printables that are free?

- Most PDF-based printables are available in the PDF format, and is open with no cost programs like Adobe Reader.

80CCD Income Tax Deduction Under Section 80CCD FY 20 21

Section 80CCC Tax Deductions On Pension Fund Contributions Tax2win

Check more sample of Income Tax Deduction Under Section 80ccd 2 below

Section 80 Eligibility Limit Investments For Which Deduction Is Claimed

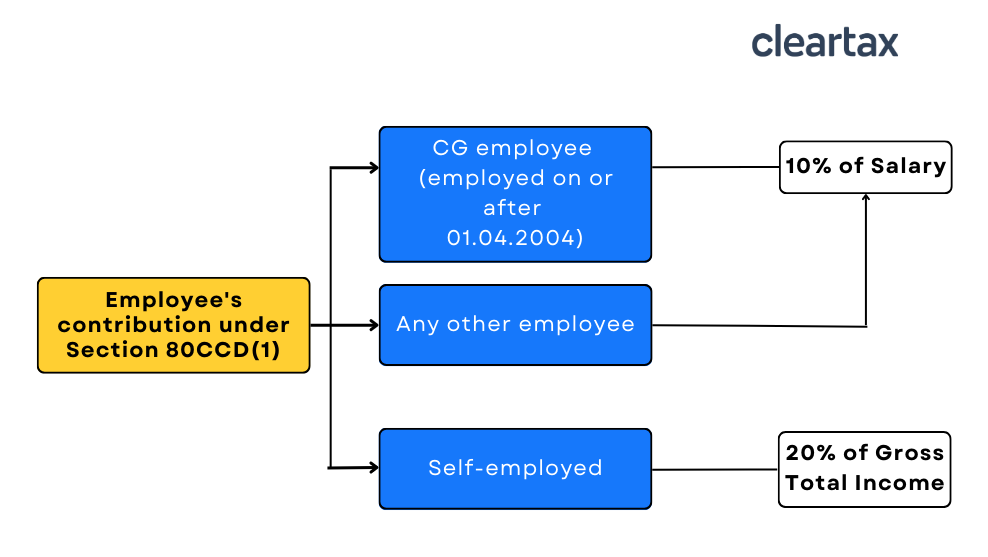

80CCD Income Tax Deduction Under Section 80CCD 1 2

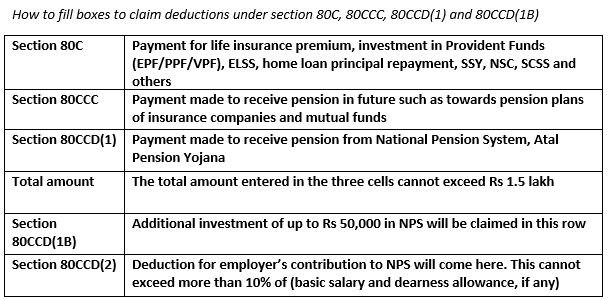

Deduction Under Section 80C 80CCC 80CCD 1 And 80CCE Under Chapter VI

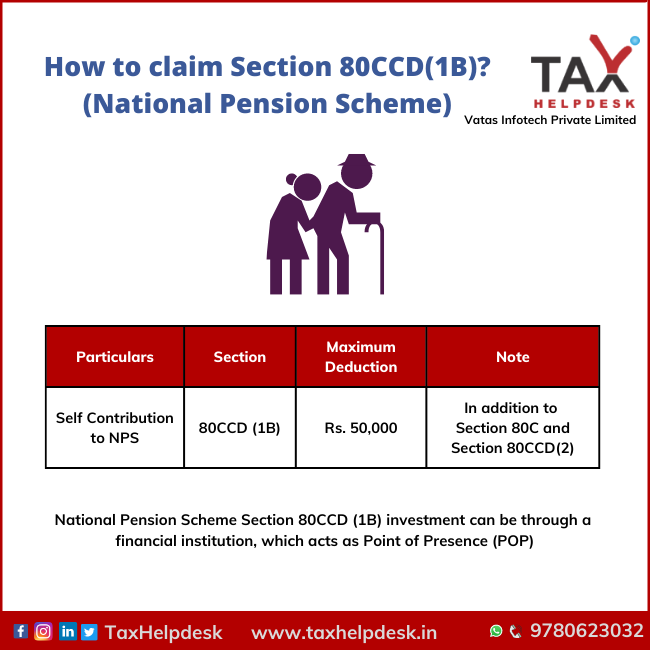

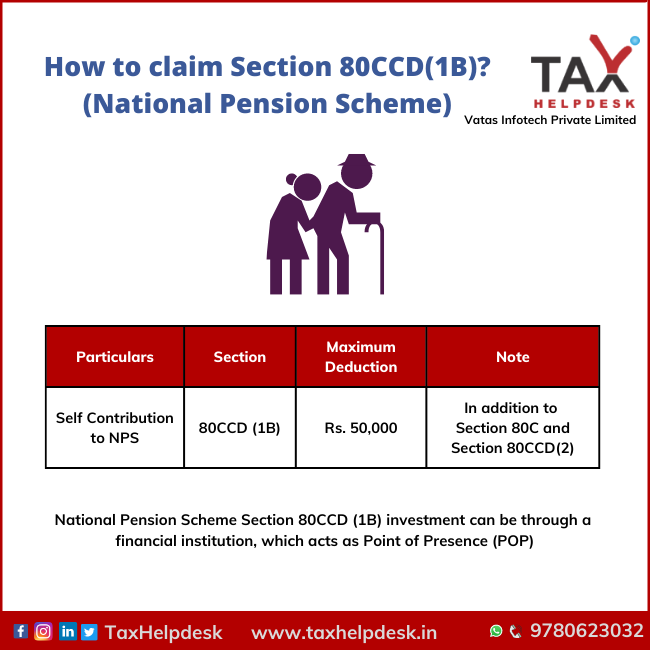

How To Claim Section 80CCD 1B TaxHelpdesk

Deductions Under Section 80CCD Of Income Tax

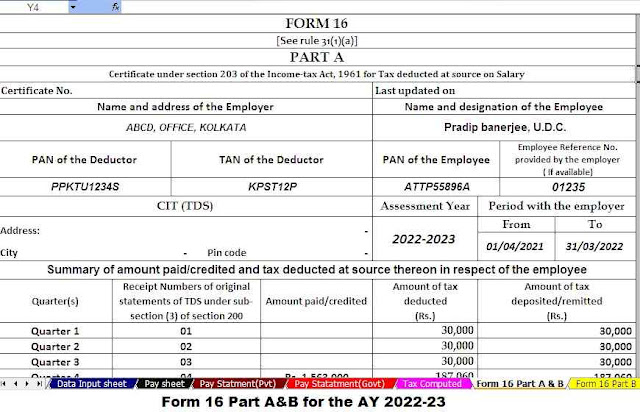

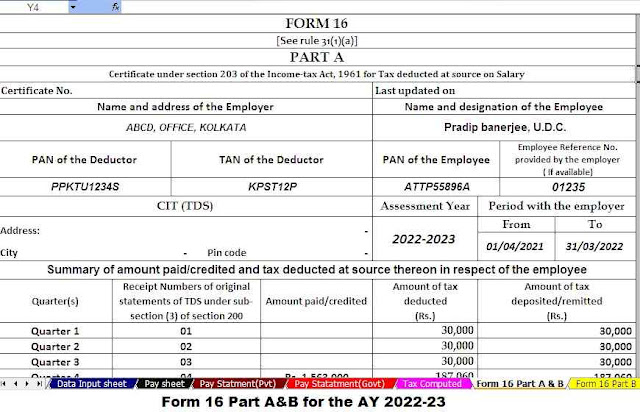

Income Tax Section 80CCD With Auto Fill Income Tax Form 16 For The F Y

https://www.goodreturns.in/section-80ccd-2-of...

A complete guide on Section 80CCD 2 of income tax act Also find out the deduction under Section 80CCD 2 for FY 2024 25 AY 2025 26 from Goodreturns

https://www.etmoney.com/learn/income-tax/section...

When filing your income tax returns as a salaried or self employed individual you can claim up to 1 50 000 jointly under Section 80CCD 1 for

A complete guide on Section 80CCD 2 of income tax act Also find out the deduction under Section 80CCD 2 for FY 2024 25 AY 2025 26 from Goodreturns

When filing your income tax returns as a salaried or self employed individual you can claim up to 1 50 000 jointly under Section 80CCD 1 for

How To Claim Section 80CCD 1B TaxHelpdesk

80CCD Income Tax Deduction Under Section 80CCD 1 2

Deductions Under Section 80CCD Of Income Tax

Income Tax Section 80CCD With Auto Fill Income Tax Form 16 For The F Y

Deduction Under Section 80C 80CCC 80CCD 80D For AY 2019 20

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Section 80ccd Of Income Tax deduction In Income Tax Section 80ccd 1b